Australia’s Bendigo Bank has joined the ranks of major banks in the country by announcing blocks on “high-risk crypto payments” in an effort to safeguard its 2.3 million customers from investment scams.

The move, disclosed on July 31 by Jason Gordon, the bank’s head of fraud, entails implementing new rules on instant payments to crypto exchanges to add “friction to certain genuine payments.”

While the bank has stated its intentions to combat fraudulent transactions and enhance customer protections, it has not disclosed specific details about the high-risk transactions being targeted or the exchanges that may be affected.

This comes after similar actions were taken in recent months by three of Australia’s major banks—Commonwealth Bank, National Australia Bank (NAB), and Westpac.

Chainalysis APAC Policy Head Chengyi Ong warned in an earlier interview that such actions could force Australia’s crypto community to resort to offshore exchanges for their transactions.

Ong argued that blocking exchanges alone would not deter criminal actors, as they could simply shift to other platforms—crypto or otherwise.

READ MORE:Pro-XRP Lawyer Alleges SEC’s Actions Driven by Safeguarding Corporate Capitalism

Moreover, uncertainty over banking access might push crypto exchanges and users beyond the reach of regulatory authorities.

Ong proposed a more holistic approach, calling for cooperation between banks, regulators, telecommunication providers, and social media platforms to tackle every potential point of interaction between scam victims and perpetrators.

Dr. Aaron Lane, a senior lecturer with the RMIT Blockchain Innovation Hub, echoed this sentiment, suggesting that banks should work constructively with exchanges rather than taking a blanket approach of debanking the entire industry or asset class.

He recommended reserving debanking as a risk tool for individual cases of serious and unacceptable risk.

Australia has been considering crypto-specific laws for over three years, prompting Dr. Lane to call on lawmakers to move crypto law reform “out of the too-hard basket.”

The Department of the Treasury also issued a statement in June expressing similar concerns, highlighting that inaction on debanking could impede financial services competition and innovation, potentially driving businesses to operate solely in cash.

In conclusion, Bendigo Bank’s decision to block high-risk crypto payments aligns with actions taken by other major Australian banks.

While the move is intended to protect customers from investment scams, experts argue that a more comprehensive approach involving cooperation between various stakeholders is needed to address the issue effectively.

Other Stories:

Kyrgyzstan Expands Cryptocurrency Mining with Government Backing at Hydro Power Plant

French Data Protection Agency Investigates Worldcoin

Worldcoin’s Iris Scanning Project Raises Privacy and Sovereignty Concern

Bitcoin (BTC) experienced reduced volatility as it approached the July 30 weekly close, leaving traders anticipating a significant long-term bullish signal.

Over the weekend, BTC/USD exhibited sideways movement, trading within a narrow $150 range.

Despite several macroeconomic data events throughout the week, the market remained calm, leading to speculations of an imminent breakdown.

Pseudonymous trader Daan Crypto Trades highlighted that the compression in price action had not been seen since the beginning of 2023, suggesting that a substantial move might be on the horizon.

Comparisons were drawn to earlier in the year when Bitcoin’s Bollinger Bands resembled the current conditions before the price surged 70% in the first quarter.

Analysis of the Binance BTC/USD order book by monitoring resource Material Indicators revealed that whales’ buying pressure coincided with increased resistance near $30,000.

However, they expected significant support to remain until the weekly and monthly candle closes on July 29.

READ MORE: Pro-XRP Lawyer Alleges SEC’s Actions Driven by Safeguarding Corporate Capitalism

The potential bullish cross on Bitcoin’s monthly moving average convergence/divergence (MACD) indicator drew significant attention as market observers noted its proximity to confirmation.

Historical patterns indicated that this could lead to upside gains in the future.

Although the cross held positive implications, Trading resource Stockmoney Lizards cautioned that Bitcoin might still be in its summer correction mode.

A chart presented by Stockmoney Lizards displayed a prior monthly MACD cross in late 2015, which preceded Bitcoin’s surge two years later, resulting in the previous cycle’s all-time high of $20,000.

The cross signaled preparations for the significant price movement that followed.

While lower-timeframe MACD crosses can sometimes be false alarms, the significance of a weekly cross in August 2021 was evident as it preceded the move to Bitcoin’s current all-time highs in November of that year.

As the weekly close approached, traders kept a close eye on Bitcoin’s price action, hoping to witness the potential bull signal and foreseeing the implications it might have on the future trajectory of the cryptocurrency.

Other Stories:

Worldcoin’s Iris Scanning Project Raises Privacy and Sovereignty Concern

Kyrgyzstan Expands Cryptocurrency Mining with Government Backing at Hydro Power Plant

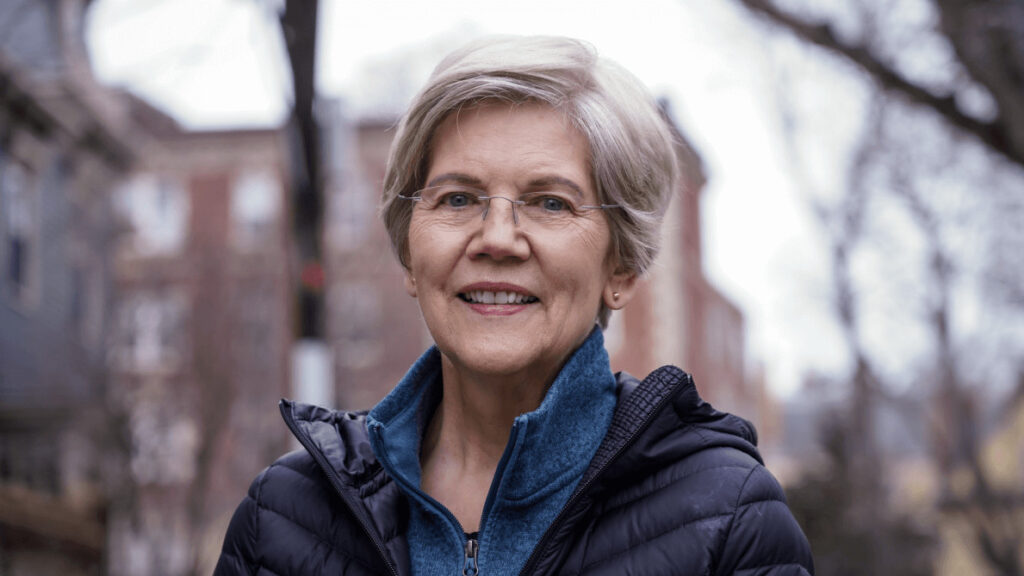

The Bank Policy Institute (BPI), a pro-banking organization in the US, has come out in support of Senator Elizabeth Warren’s efforts to strengthen cryptocurrency regulations.

Senator Warren, along with three other senators, recently reintroduced the Digital Asset Anti-Money Laundering Act, which aims to impose stricter rules to combat money laundering and terrorism financing within the crypto industry.

Despite past criticism from Senator Warren, the BPI expressed its endorsement of the bipartisan legislation.

In a statement, the BPI emphasized the need for the existing anti-money laundering and Bank Secrecy Act framework to encompass digital assets, in order to safeguard the nation’s financial system against illicit finance.

The proposed seven-page bill, if enacted, would require digital asset wallet providers, miners, and blockchain validators to maintain records of customer identities.

Additionally, financial institutions would be prohibited from using digital asset mixers, such as Tornado Cash, which are designed to obscure blockchain data.

Senator Warren and her co-sponsors, Senator Joe Manchin, Senator Roger Marshall, and Senator Lindsey Graham, announced the reintroduction of the bill.

In addition to customer identity tracking, the legislation would prompt relevant government bodies, including the Treasury Department, Securities and Exchange Commission, and Commodity Futures Trading Commission, to establish new examination processes to ensure compliance with anti-money laundering and terrorism financing requirements.

Several organizations, including the Massachusetts Bankers Association, AARP, the National Consumer Law Center, and the National Consumers League, have expressed their support for the bill.

READ MORE: Why Didn’t Bitcoin (BTC) Enter a New Rally?

However, not everyone in the crypto community agrees with the proposed legislation.

Tyler Winklevoss, co-founder of the Gemini crypto exchange, criticized the bill in a tweet, suggesting that those opposing it are making the right decision.

Senator Warren originally introduced the bill in December 2022, arguing that current anti-money laundering laws do not adequately cover the crypto industry.

She has consistently called for cryptocurrencies to be subjected to the same regulations as traditional banking institutions to prevent money laundering and illegal activities.

Gary Gensler, Chairman of the US Securities and Exchange Commission (SEC), has also been vocal about his concerns regarding the crypto market.

He highlighted the prevalence of fraud in the sector and pointed out that many crypto investors do not receive the same level of protection as investors in traditional securities markets.

In conclusion, the Digital Asset Anti-Money Laundering Act seeks to tighten regulations on cryptocurrencies to combat illicit financial activities.

While Senator Warren and the BPI back the bill, some members of the crypto community, including Tyler Winklevoss, have expressed reservations. Gary Gensler, the SEC Chairman, also shares concerns about fraudulent activities in the crypto market and advocates for better investor protection.

Other Stories:

Revealed: The Best Crypto Marketing & PR Agency

3 Best Crypto Projects That Will Boom In 2023 & The Next Bull Run

SEC and Binance Oppose Eeon’s Intervention in Crypto Exchange Lawsuit

Blockchain technology is predicted to save financial institutions nearly $10 billion in cross-border payment expenses by 2030, says a report by Ripple and the U.S.

Faster Payments Council (FPC). Conducted among 300 finance professionals from 45 countries, the report revealed that 97% see blockchain as critical for improving payment systems over the next three years.

Over half the respondents believe the primary benefit of cryptocurrency lies in its ability to reduce costs.

As per Juniper Research, the use of blockchain in global transactions could result in significant cost savings for banks in the upcoming six years, potentially around $10 billion by 2030.

The report underscores that as the e-commerce market grows and businesses target international markets, cross-border payments will likely surge.

Predictions indicate that global cross-border payment flows could hit $156 trillion by 2030, driven by a 5% annual growth rate.

However, opinions diverged regarding the timeline for wide-scale merchant adoption of digital currency payments.

READ MORE: SEC and Binance Oppose Eeon’s Intervention in Crypto Exchange Lawsuit

Half of the participants were optimistic about most merchants embracing crypto payments within three years, but confidence levels varied regarding adoption within the next year.

Notably, participants from the Middle East and Africa showed the highest confidence (27%) in widespread merchant acceptance of crypto within the next year.

Conversely, respondents from the Asia-Pacific region were less optimistic, with just 13% predicting a similar adoption timeframe.

These findings follow a report from the Bank of International Settlements (BIS), indicating that up to 24 central bank digital currencies (CBDCs) might be in circulation in the next six years.

The BIS survey, which covered 86 central banks, revealed that 93% of them are exploring CBDCs, forecasting the circulation of up to 15 retail and nine wholesale CBDCs by 2030.

Other Stories:

3 Best Crypto Projects That Will Boom In 2023 & The Next Bull Run

The French National Commission on Informatics and Liberty (CNIL), which serves as France’s data protection agency, is raising concerns about the data collection practices employed by Worldcoin, as per a Reuters report.

In an email sent to Reuters on July 28, CNIL expressed doubt regarding the legality of the data collection process and the conditions under which biometric data is being stored by Worldcoin.

The commission further revealed that it had already launched investigations into the matter and was cooperating with the Bavarian state authority in Germany, which is also looking into the issue.

Additionally, it was reported by Reuters on July 25 that Worldcoin might face inquiries from data regulators in the United Kingdom after its launch.

Worldcoin, the brainchild of OpenAI, the company behind the popular AI chatbot ChatGPT, was officially launched on June 24.

The project requires users to submit a scan of their iris in exchange for a digital ID and free cryptocurrency.

READ MORE: Former Twitter Product Director Exposes Peculiarities of Working Under Elon Musk

The initiative has seen considerable interest, with approximately 2.1 million people signing up during the trial period over the past two years, according to the company’s website.

Since its official launch, Worldcoin boasted on Twitter (which is undergoing rebranding to X) that a new World ID is being verified every 7.6 seconds by a unique human, and new records are being set daily.

Pictures of Worldcoin orbs in different cities worldwide, including Seoul, Mexico City, and Paris, have been posted on Twitter since the launch on July 24.

The reception within the crypto community has been mixed. While some users believe that Worldcoin’s centralization could lead to potential failures, others argue that proof-of-personhood is crucial, especially with the increasing presence of AI.

Reports have emerged indicating that Worldcoin has struggled to attract new sign-ups since its launch.

The three designated locations in Hong Kong reportedly only saw around 200 sign-ups on the first day, with a total of 600 sign-ups overall.

However, co-founder Sam Altman disputed these claims by posting a video of a long line of people in Japan waiting to complete iris scans on the following day.

In conclusion, Worldcoin’s data collection methods have come under scrutiny from data protection authorities, with questions raised about the legality of the process and the storage of biometric data.

Despite significant interest and participation, the initiative has faced both praise and criticism within the crypto community.

Other Stories:

Crypto.com Receives Approval from Dutch Central Bank

Crypto Mining Firm Explores Initial Public Offering (IPO) in UAE

The launch of the memecoin Pond0x has resulted in significant financial losses for investors, with reports on social media indicating that millions of dollars were at stake on July 28.

According to data from the Maestro trading app, the Pond0x (PNDX) token experienced a price surge, reaching $0.36, only to swiftly plummet to nearly zero within just five minutes.

Jeremy Cahen, better known as “Pauly” on Twitter and the founder of Not Larva Labs, announced the Pond0x launch on July 28.

Not Larva Labs is the developer of a nonfungible token trading app for CryptoPunks and a separate parody collection called CryptoPhunks, unaffiliated with Larva Labs, the creators of CryptoPunks.

In the announcement, Cahen shared the contract address for PNDX and the URL for its official web app.

The web app featured a Pepe meme graphic, similar to the successful memecoin Pepecoin (PEPE), which gained popularity with a ticker price of $0.000001.

The app allowed users to mint new PNDX tokens by exchanging them for a fixed amount of Ether (ETH), akin to a presale or fundraiser.

However, confusion arose as some users expected the fundraiser to occur on Uniswap, and the inclusion of both the website and contract address in the same post added to the ambiguity, as per social media reports.

READ MORE: Crypto Mining Firm Explores Initial Public Offering (IPO) in UAE

Several users purchased PNDX tokens on Uniswap using bot trading apps, such as Maestro or Unibot, causing its price to rise. Meanwhile, others minted tokens through the web app and sold them at a profit.

Numerous investors reported losing thousands or even millions of dollars. Complaints flooded Cahen’s initial post, with users expressing their significant losses.

One disillusioned Pepecoin enthusiast lamented losing 4 ETH (worth $7,484) for nearly worthless tokens.

Another user claimed their $50,000 investment was now valued at a mere $10, and yet another revealed losing a staggering $2.5 million.

A report by memecoin holder Rune estimated that investors collectively lost over $2.2 million during the Pond0x launch.

In addition to financial woes, a user discovered a flawed transfer function in PNDX, enabling users to transfer coins from any other account.

The transfer function exhibited an unusual behavior, calling a separate “brutalized_” function instead of updating the user’s balance.

The impact of this “brutalized_” function was not determined by Cointelegraph at the time of publication.

Rune later provided an updated report, indicating that the person responsible for draining funds from investors was now creating a new version of PNDX.

This new project aimed to offer a “dashboard” to compensate victims through a “community coin.”

Memecoins, tied to viral internet images or videos, gained prominence with the launch of Dogecoin in 2013 and remain popular today.

Notably, memecoins experienced price surges in connection with events such as the U.S. Securities and Exchange Commission suing crypto exchanges Coinbase and Binance, as well as during a U.S. House of Representatives hearing on unidentified flying objects when several alien-themed memecoins emerged and gained attention on social media.

Other Stories:

Former Twitter Product Director Exposes Peculiarities of Working Under Elon Musk

The German Federal Financial Supervisory Authority, BaFin, has reportedly recommended that cryptocurrency exchange Binance withdraw its licensing application due to concerns regarding its CEO Changpeng Zhao (also known as “CZ”) and the company’s structure.

According to a report from The Wall Street Journal on July 28, BaFin expressed reservations about CZ passing the “fit and proper” test as per their regulatory guidelines.

The test ensures that managing directors, like CZ, possess the necessary professional qualifications, a good reputation, and can dedicate enough time to effectively manage the institution.

Additionally, BaFin raised concerns about the regulatory supervision of Binance due to the company’s complex structure.

In response, Binance announced on July 26 that it had voluntarily withdrawn its license application in Germany.

The decision was partly attributed to the company’s focus on aligning with the European Union’s Markets in Crypto-Assets (MiCA) framework.

In contradiction to The Wall Street Journal’s report, a Binance spokesperson told Cointelegraph that the story was inaccurate.

However, specific details about CZ were not provided in their response.

Meanwhile, Binance is facing legal actions in the United States brought forth by the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) for alleged violations of securities laws and trading guidelines, respectively.

READ MORE: Former Twitter Product Director Exposes Peculiarities of Working Under Elon Musk

In an attempt to dismiss the CFTC lawsuit, Binance’s lawyers filed a court motion on July 27, arguing that the commission had overstepped its authority.

Although no criminal charges have been filed at the time of publication, there have been reports of the U.S. Department of Justice (DoJ) investigating Binance for potentially violating U.S. sanctions on Russian entities.

In response to the DoJ probe, Binance’s chief strategy officer, Patrick Hillmann, announced his departure from the firm on July 6.

Despite being one of the world’s largest crypto exchanges, Binance does not have a physical headquarters.

CZ has reportedly resided in Dubai since 2021, making it challenging for the SEC to serve him a legal summons in June.

In conclusion, BaFin’s recommendation to withdraw the licensing application adds to the growing regulatory scrutiny faced by Binance, both in Germany and the United States.

These developments may have implications for the exchange’s operations and compliance efforts in the crypto market.

Other Stories:

Crypto.com Receives Approval from Dutch Central Bank

Crypto Mining Firm Explores Initial Public Offering (IPO) in UAE

SEC Commissioner Hester Pierce has voiced concerns over a recent statement by the agency advising accountants to refrain from non-audit work for cryptocurrency firms.

Pierce countered the suggestion made by the SEC’s chief accountant, Paul Munter, that accountants should adopt a binary approach when dealing with crypto companies.

Pierce fears that Munter’s proposal could deter crypto businesses from making sincere efforts to be transparent.

While she supports transparency, particularly regarding proof of reserves, Pierce is skeptical about why accounting firms should be wary of assuring crypto firms.

Pierce took to Twitter, questioning, “Why would we want to discourage good-faith efforts to provide more transparency?”

She raised her concerns about the potential chilling effect this may have on the transparency initiatives of crypto firms.

Munter argued that fractional engagements could lead crypto firms to selectively disclose certain business aspects as a complete audit to clients.

This practice, according to him, would lack transparency for investors.

READ MORE: Crypto Mining Firm Explores Initial Public Offering (IPO) in UAE

In Munter’s view, some crypto firms misleadingly market their retention of third-party reviewers, sometimes accounting firms, as conducting an “audit.”

He suggested that if an accounting firm finds its client making false statements about non-audit work, it should consider making a public statement or reporting the client to the SEC, a process he termed a “noisy withdrawal.”

Reacting to Munter’s statement, Mike Shaub, an auditing and accounting ethics professor at Texas A&M University, underscored the difficulty for auditors to make public statements given their confidentiality obligations.

He also raised concerns about some accounting firms leveraging their crypto expertise to enhance their reputations, yet becoming unresponsive when issues surface.

As this debate continues, the delicate balance between crypto firm transparency, the role of accounting firms, and investor protection remains a critical issue for the SEC and the broader industry.

Other Stories:

Former Twitter Product Director Exposes Peculiarities of Working Under Elon Musk

New cybersecurity regulations have been adopted by the United States Securities and Exchange Commission (SEC), mandating all public companies, including listed crypto firms, to promptly disclose any significant cybersecurity incidents within a strict four-day time frame.

The rules, effective as of July 26, will require disclosure when the incident is deemed “material,” except in cases where national security or public safety might be compromised.

The SEC’s initiative aims to strengthen cybersecurity risk management measures and safeguard the interests of investors.

To achieve this, the new regulations necessitate periodic reporting of a registrant’s policies and procedures for identifying and managing cybersecurity risks, along with regular updates about previously reported incidents.

SEC Chair Gary Gensler emphasized that these rules play a crucial role in benefiting investors, companies, and the overall market by ensuring that companies share material cybersecurity information transparently.

READ MORE; Best Crypto Projects to Invest in For The Next Bull Run

The scope of these regulations encompasses all publicly listed companies in the United States, including prominent players in the crypto industry such as Coinbase (COIN), Marathon Digital (MARA), Riot Blockchain (RIOT), and Hive Digital Technologies (HIVE).

The SEC outlined the rationale behind these new rules, citing the growing prevalence of digital payments and digitized operations within the workforce.

This, coupled with cybercriminals’ ability to monetize cybersecurity incidents, necessitated the implementation of stricter regulations to safeguard investors from potential threats.

Cryptocurrencies have notably been targeted by various cybercriminals, including the North Korean state-backed Lazarus Group, which has executed high-value exploits on cryptocurrency platforms, amassing over $850 million in ill-gotten gains.

It’s worth noting that the cybersecurity rules were initially proposed by the SEC in March 2022 but have now been fully adopted to enhance cybersecurity protection for investors and bolster overall market integrity.

The rules are set to be effective within 30 days following their publication in the Federal Register.

Other Stories:

Tennessee Realtor Couple Charged in $6M ‘Blessings of God Thru Crypto’ Investment Fraud

Ripple’s Chief Legal Officer Dismisses Concerns of SEC Appeal, Predicts Further Victory

Argentinian police have made a grisly discovery in the case of a missing cryptocurrency millionaire and Instagram influencer, Fernando Pérez Algaba.

The crypto trader was reported missing on July 18 after failing to return the keys to a rented apartment and not responding to phone calls.

Tragically, his remains were found dismembered in a suitcase less than a week later, on July 23, by children in Ingeniero Budge, a province near Buenos Aires.

Authorities found amputated legs and forearms in the suitcase and later discovered a torso on July 24 after draining the nearby stream.

On July 25, they found his head in a backpack. Fingerprints and tattoos confirmed the identity of the victim, and an autopsy indicated that Algaba had been shot three times before being dismembered.

Investigators believe that the murder may have been carried out by a professional group, and they suspect the motive could be debt-related.

Already, one suspect has been arrested in connection to the case.

READ MORE: KuCoin Denies Layoff Rumors Amidst Crypto Industry Stabilization

Fernando Pérez Algaba was well-known in the crypto trading community in Buenos Aires, where he ran an office with 25 other traders.

Additionally, he had gained considerable fame on Instagram, boasting over 917,000 followers. His posts typically featured luxury cars and his beloved dog.

Reports suggest that Algaba had significant debts, including 900,000 Argentine pesos ($3,300) in bounced checks, 1.2 million Argentine pesos ($4,400) owed to banks, and another debt of $70,000 related to a bounced check.

This tragedy occurred amidst a series of mysterious and sudden deaths of other crypto billionaires between October and December 2022.

Individuals such as MakerDAO co-founder Nikolai Mushegian, crypto broker Javier Biosca, Amber Group co-founder Tiantian Kullander,

Russian crypto billionaire Vyacheslav Taran, and major Bithumb shareholder Park Mo all suffered untimely demises during this period, sparking wild theories within the crypto community.

As the investigation into Algaba’s death continues, his friends, family, and followers mourn the loss of a prominent figure in the crypto and social media world.

The incident serves as a grim reminder of the potential dangers and risks that can accompany wealth and fame in the digital age.

Other Stories:

Best Crypto Projects to Invest in For The Next Bull Run

Ripple’s Chief Legal Officer Dismisses Concerns of SEC Appeal, Predicts Further Victory

Tennessee Realtor Couple Charged in $6M ‘Blessings of God Thru Crypto’ Investment Fraud