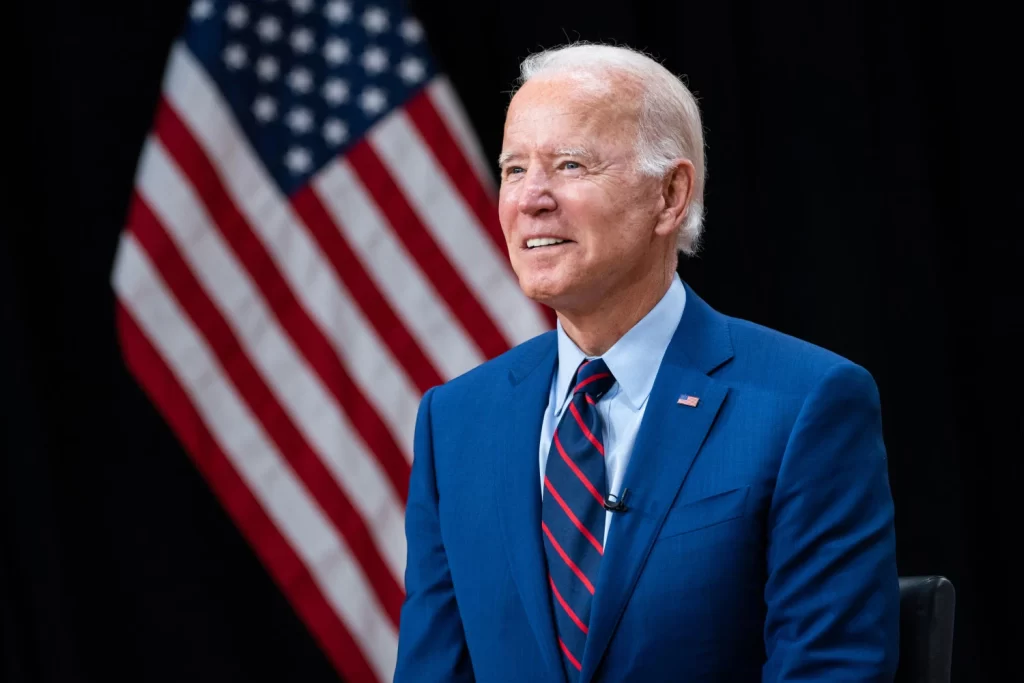

A Kamala Harris-themed memecoin surged nearly 250% on Thursday amid mounting pressure on President Joe Biden to exit the presidential race following a lackluster debate against Donald Trump.

Kamala Horris (KAMA), a deliberately misspelled Solana token featuring a poorly drawn cartoon of the U.S. vice president, saw its market cap rise from $3.5 million at the time of the June 27 debate to nearly $11.9 million, according to Dex Screener.

However, it has since dropped from its peak of $22.2 million on July 3.

Reuters reported on July 3 that Harris is the top choice to replace Biden if he decides not to seek reelection, citing seven senior sources from the Biden campaign, the White House, and the Democratic National Committee.

In contrast, Jeo Boden (BODEN), another misspelled memecoin for President Biden, has seen a 22% decline in the past 24 hours and a 73.4% decrease over the past week, according to CoinGecko.

KAMA’s rise and BODEN’s fall follow the June 27 debate, where political analysts widely criticized Biden’s performance, noting that he sounded raspy and occasionally lost his train of thought.

Biden, at 81, is the oldest person to run for president and has attributed his performance to a cold, over-preparation, and jet lag, despite being in the same time zone the week before the Atlanta-hosted debate.

Pressure is growing for Biden to drop out as his poll numbers decline. FiveThirtyEight polls show Trump leading by 2.3 percentage points.

A July 3 New York Times and Siena College poll also shows Trump ahead, with three-quarters of voters believing Biden is too old for the presidency, a five-point increase since the debate.

READ MORE: Bitcoin Drops Below $60,000 Amid Potential $9 Billion Mt. Gox Payout and Whale Activity

Similarly, a July 2 CNN poll found that three-quarters of U.S. voters think Democrats would have a better chance with a different candidate, and a July 1 CBS News poll revealed that nearly half of Democratic voters think Biden should not be the nominee.

Gamblers on the crypto prediction platform Polymarket now place Biden’s odds of dropping out at 64%, up from 19% before the debate.

Four House Democrats told Axios on July 3 that Biden should step down, with one stating that a “very large majority of the caucus shares this sentiment.”

Former House Speaker Nancy Pelosi told MSNBC it is “completely legitimate” to question if Biden’s debate performance was due to a “condition” or just “an episode.”

On July 3, the Boston Globe editorial board joined other major publications in calling for Biden to step down.

Despite this, Biden remains steadfast. “I am running,” he said on a July 3 Zoom call with campaign staff, according to Politico.

“No one’s pushing me out. I’m not leaving. I’m in this race to the end.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Fuk MT Gox could turn early investors into multi-millionaires, like Shiba Inu (SHIB) and Dogecoin (DOGE) did.

Fuk MT Gox (FUKMTGOX), a new Solana memecoin that was launched today, is poised to explode over 17,000% in price in the coming days.

This is because FUKMTGOX has announced its first centralized exchange listing, which will be on KuCoin.

This will give the Solana memecoin exposure to millions of additional investors, who will pour funds into the coin and drive its price up.

Currently, Fuk MT Gox can only be purchased via Solana decentralized exchanges, like Jupiter and Raydium, and early investors stand to make huge returns in the coming days.

Early investors in SHIB and DOGE made astronomical returns, and Fuk MT Gox could become the next viral memecoin.

Fuk MT Gox launched with over $3,000 of locked liquidity, giving it a unique advantage over the majority of other new memecoins, and early investors could make huge gains.

To buy Fuk MT Gox on Raydium or Jupiter ahead of the KuCoin listing, users need to connect their Solflare, MetaMask or Phantom wallet, and swap Solana for Fuk MT Gox by entering its contract address – 73kjJZo5jnH7ia5Tuu8pz8B327ZPX7mcLPbMbQqu7tTf – in the receiving field.

In fact, early investors could make returns similar to those who invested in Shiba Inu (SHIB) and Dogecoin (DOGE) before these memecoins went viral and exploded in price.

If this happens, a new wave of memecoin millionaires could be created in a matter of weeks – or potentially even sooner.

The Solana memecoin craze continues amid larger memecoins, like Shiba Inu (SHIB), Dogecoin (DOGE) and DogWifHat (WIF) trading sideways in recent weeks and losing momentum.

This is why many SHIB, DOGE and WIF investors are instead investing in new Solana memecoins, like FUKMTGOX.

On July 3, Bittensor had to halt its network operations following a series of wallet drains that resulted in the theft of at least $8 million worth of digital assets.

Ala Shaabana, Bittensor’s co-founder, announced the network outage on the same day in a post on X, stating:

“By way of an update, we have contained the attack and put the chain into safe mode (blocks producing but no transactions are permitted).

“We’re still mid-investigation and are considering all possibilities.”

Hacks and exploits continue to be a major concern in the crypto space, hindering its widespread adoption.

Over the past 13 years, the industry has lost nearly $19 billion to thefts, with 785 reported crypto hacks.

The recent theft was first identified by pseudonymous onchain investigator ZachXBT, who posted in a Telegram message on July 3:

“Bittensor was halted due to additional thefts earlier today potentially as a result of private key leakage.”

An unknown address, “5FbW,” was used to steal 32,000 Bittensor (TAO) tokens, worth approximately $8 million.

READ MORE: Fetch AI Price Prediction: Major Surge Anticipated Amid AI Crypto Merger and Market Optimism

This incident followed another attack on June 1, where a different wallet was drained of $11.2 million worth of TAO tokens, as noted by ZachXBT.

While smart contract vulnerabilities used to account for most of the hacked funds, private key leaks have now become more prevalent.

According to the “2024 Crypto HackHub Report” by Merkle Science, over 55% of the hacked digital assets in 2023 were lost due to private key leaks.

Mriganka Pattnaik, co-founder and CEO of Merkle Science, explained the trend:

“While smart contract vulnerabilities remain a concern, hackers increasingly target areas outside smart contracts, like private key leaks.

“These leaks, often due to phishing attacks or insecure storage practices, have led to significant losses.”

In contrast, losses from smart contract vulnerabilities significantly decreased, with hacked funds dropping 92% to $179 million in 2023, compared to a staggering $2.6 billion in 2022.

This shift highlights the changing landscape of crypto security, emphasizing the need for stronger protection against private key leaks and other non-contract-related vulnerabilities.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

India’s largest cryptocurrency exchange, CoinDCX, has acquired BitOasis, a prominent virtual asset trading platform in the Middle East and North Africa (MENA) region.

This acquisition marks CoinDCX’s entry into the MENA market, reflecting the company’s ambition to expand globally.

BitOasis is known for its high trading volumes in Emirati dirhams, making this acquisition a strategic move for CoinDCX to establish a strong presence in the region.

BitOasis recently secured a Virtual Assets Regulatory Authority (VARA)-issued minimum viable product (MVP) operational license from the Central Bank of Bahrain (CBB).

This license allows BitOasis to operate as a broker-dealer under strict regulatory conditions, ensuring that its operations comply with legal requirements.

Sumit Gupta, co-founder of CoinDCX, explained to Cointelegraph that BitOasis would continue to operate independently under its existing licenses, supervised by the relevant regulatory authorities.

“Users’ personal data will remain protected in line with BitOasis’ privacy policy and applicable law and regulation.

“Users’ assets and funds will remain fully segregated and kept safe in line with applicable regulatory requirements.”

READ MORE: Chromia Reveals 16 July As Launch Date For Its MVP Mainnet

The acquisition is expected to enhance the user experience on both platforms by offering a broader range of products and increased trading and token options.

Despite the acquisition, user accounts will not be migrated or linked between BitOasis and CoinDCX, maintaining the autonomy and privacy of each platform’s users.

In January, Gupta spoke with Cointelegraph about a $1 million fund to help investors transfer their assets from non-compliant platforms to CoinDCX.

With an estimated $4 billion invested in cryptocurrency on offshore exchanges by Indian investors, recent regulatory changes have raised significant concerns.

CoinDCX is actively supporting users by establishing secure deposit routes and offering a 1% bonus to those moving to the regulated exchange.

This strategic acquisition and CoinDCX’s initiatives underscore the company’s commitment to providing a secure and regulated environment for cryptocurrency trading, while also expanding its global footprint in the burgeoning crypto market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Marathon Digital Holdings, the world’s largest Bitcoin mining company, has not sold any of its Bitcoin holdings over the past month despite a prolonged downtrend in Bitcoin prices.

According to the company’s operations report published on July 3, Marathon held 18,536 BTC worth over $1.1 billion as of June.

Marathon aims to strengthen its Bitcoin reserves through market purchases and other strategies to boost its Bitcoin yield. However, the firm noted that it might sell some of its Bitcoin in the future:

“MARA opted not to sell any bitcoin in June.

“The Company still intends to sell a portion of its bitcoin holdings in future periods to support monthly operations, manage its treasury, and for general corporate purposes.”

The selling patterns of major Bitcoin holders, including mining firms, can significantly impact Bitcoin’s price.

The upcoming 2024 Bitcoin halving, which will reduce block rewards by half, might compel miners to sell more Bitcoin.

Marathon Digital, valued at over $6.25 billion, surpasses CleanSpark, the second-largest Bitcoin mining firm with a market capitalization of $3.85 billion, by 62%.

Marathon Digital has doubled its operational hashrate to 26.3 exahashes (EH/s) in June, thanks primarily to improvements at its Ellendale facility, which became fully operational in early July.

CEO and chairman Fred Thiel stated:

“Our proprietary mining pool outperformed, capturing 158 blocks during the month, a 10% increase over last year.”

Marathon’s goal is to achieve a hashrate of 50 EH/s by the end of 2024.

READ MORE: Fetch AI Price Prediction: Major Surge Anticipated Amid AI Crypto Merger and Market Optimism

Thiel highlighted the optimization of new sites with immersion cooling technology and the latest hardware, affirming the company’s path to meet this target:

“Domestically, our team continues to optimize our recently acquired sites with immersion cooling technology and the latest generation hardware.

“With these advancements and the expansion of our fleet, we remain on track to reach our target of 50 EH/s by the end of this year.”

Marathon is also pioneering the use of Bitcoin mining for renewable heating. In Finland’s Satakunta region, Marathon launched a 2-megawatt pilot project utilizing “district heating” to warm a town of 11,000 residents.

This method leverages the excess heat produced by mining rigs, offering a sustainable and cost-effective heating solution.

Thiel emphasized the benefits of integrating digital asset compute with district heating, which could reduce carbon emissions, lower costs, and minimize waste heat.

Marathon aims to expand its global presence and support the energy transformation through such innovative projects:

“Integrating digital asset compute with district heating can reduce carbon emissions, lower costs, and minimize waste heat, leading to enhanced sustainability and economic savings for both industries and end-users.

“We look forward to expanding our global presence as a leader in leveraging digital asset compute to support the energy transformation.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

RedStone Oracles has successfully completed a $15 million Series A funding round to advance its modular blockchain oracle solution, which has already garnered 100 clients.

RedStone, branding itself as the “fastest-growing modular oracle,” plans to utilize the new funds to enhance its oracle products.

These products are designed to provide gas fee-optimized price feeds for all Ethereum Virtual Machine (EVM) and rollup-as-a-service (RaaS) networks.

The funding round was led by Arrington Capital and included contributions from other prominent investment firms such as Spartan, IOSG Ventures, SevenX, Amber, HTX Ventures, and angel investors including the founders of EtherFi and Berachain.

Michael Arrington, the founder of Arrington Capital, highlighted RedStone’s infrastructure as a key reason for their investment.

He stated, “We have been impressed by RedStone’s ability to push ahead web3 infrastructure in technical achievement, go-to-market, and security.

This is a team of builders who we believe will continue to lead in the oracle space.”

Founded in 2021 during the Arweave incubation program, RedStone has seen significant progress since its mainnet launch in January 2023.

READ MORE: Fetch AI Price Prediction: Major Surge Anticipated Amid AI Crypto Merger and Market Optimism

It has acquired over 100 clients and secured $4 billion in value.

The chain-agnostic solution supports over 60 blockchains, making it an appealing choice for projects on emerging networks like zkSync Era, Linea, Mantle, and Scroll.

RedStone aims to offer lower transaction costs (gas fees) compared to other oracle solutions, aiding decentralized applications (DApps) in reducing unnecessary data and price feed-related expenses.

It achieves this by avoiding redundant gas fees associated with pushing the same data to multiple chains.

Blockchain oracles represent a swiftly growing sector within decentralized finance (DeFi).

According to CoinMarketCap data, the total market capitalization of all oracle-related cryptocurrencies was $13.1 billion as of June 3.

Chainlink leads the market with over $24.3 billion in total value secured (TVS) across nearly 400 protocols, followed by WinkLink with a $7.35 billion TVS across two protocols, as per DefiLlama data.

Currently, RedStone ranks as the sixth-largest oracle solution tracked by DefiLlama, with a $1.32 billion TVS across 38 protocols.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The latest CertiK Web3 Security Report reveals that onchain security incidents resulted in $1.19 billion in losses during the first half of 2024, highlighting the urgent need for enhanced security measures.

The report indicates that phishing attacks and private key compromises were the primary causes, with phishing attacks alone causing nearly $498 million in losses.

In a written Q&A with Cointelegraph, CertiK co-founder Ronghu Gu emphasized the importance of multifactor authentication, such as two-factor authentication (2FA) and “security keys.”

He stated, “All wallets with significant funds should be interacted with using a hardware wallet or similarly secure and well-designed key management solution.”

The second quarter of 2024 witnessed the most significant security breach with the DMM Bitcoin attack, resulting in a loss of $304 million.

This incident is now among the most significant hacks in history. The Japanese crypto exchange was compromised, leading to the theft of 4,502.9 Bitcoin and prompting the platform to enhance its security measures to prevent future thefts.

Another notable incident involved the Turkish crypto exchange BtcTurk, which suffered a cyberattack targeting hot wallets and resulting in a $90 million loss.

Gu informed Cointelegraph that these breaches demonstrate that “attackers are still out there” testing the defenses of major crypto custodians.

He stressed the necessity of proactive measures and a reactive response team to handle incidents.

In response to the significant losses in the first half of 2024, the United States introduced and passed the FIT21 regulatory framework bill.

This bill aims to enhance consumer protections and support innovation in the crypto sector through a comprehensive digital asset regulatory framework.

READ MORE: Chromia Reveals 16 July As Launch Date For Its MVP Mainnet

It received bipartisan support and is expected to create a safer, better-regulated environment for digital assets in the United States.

Gu noted that the FIT21 bill “will likely attract more institutional investors and drive greater compliance efforts and requirements across the industry.”

Despite the concerning findings of CertiK’s report, Gu explained that “the trend is not pointing downward.”

Although crypto hacks caused nearly $385 million in losses in May, exploits and hacks decreased by 54.2% in June.

PeckShield data indicates that $176.2 million was lost to crypto hacks in June, showing a significant reduction from May.

Gu advised that while these losses might be a part of the industry for now, users can take “simple measures” to protect themselves, such as implementing 2FA.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On July 3, Bitcoin‘s price dipped below the significant $60,000 mark, sparking concerns of extended price consolidation as the potential release of $9 billion in BTC from Mt. Gox looms.

Bitcoin dropped 4.2% in the 24 hours preceding 10:33 am UTC on July 3, reaching a low of $59,600. According to CoinMarketCap, the cryptocurrency is down 1.8% over the week.

Since June, Bitcoin has been in a downtrend, marking an almost 18% decline in the second quarter of 2024.

Investors have been eagerly awaiting a breakout above $70,000 to trigger new all-time highs, but falling below $60,000 could signal a prolonged price correction.

The potential start of repayments to Mt. Gox creditors might be contributing to Bitcoin’s decline.

The defunct exchange may have begun repaying creditors, as suggested by a Bitcoin transfer volume chart for tokens last moved between seven to ten years ago, shared by Charles Edwards, founder of Capriole Investments. Edwards noted in a July 2 X post:

“The entire history of this chart has disappeared because an enormous sum of Bitcoin moved on-chain, 10X more than the previous highs. $9B.

“But by who? Mt. Gox. It looks like those distributions really are coming.”

Mt. Gox owes over $9.4 billion in Bitcoin to about 127,000 creditors who have waited for over a decade to recover their funds. Many investors might cash out after years of untouched profits.

READ MORE: Fetch AI Price Prediction: Major Surge Anticipated Amid AI Crypto Merger and Market Optimism

However, the $9 billion from Mt. Gox could be offset by institutional inflows to U.S.-based spot Bitcoin exchange-traded funds (ETFs).

Since their January launch, these ETFs have amassed over $52.5 billion in BTC, according to Dune.

Questions arise about whether Bitcoin whales influenced the price drop below $60,000.

One large Bitcoin holder sold $180 million worth of Bitcoin within three minutes, an unusually high amount for such a brief period. Popular industry watcher Zaheer highlighted this large sale in a July 3 X post.

Further contributing to the decline, another unknown whale transferred 1,723 BTC worth over $168 million to Binance within the past 24 hours, according to Lookonchain. This transfer suggests the whale might be looking to sell and lock in profits.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Bitcoin traded at $61,000 on July 3 following a worsening United States inflation outlook.

Data from Cointelegraph Markets Pro and TradingView indicated BTC price strength slowly recovering from a 2% dip at the daily close.

This downturn led to local lows of $60,561 on Bitstamp, erasing gains from the weekend.

The mood deteriorated further as Jerome Powell, chair of the U.S. Federal Reserve, spoke about the economy and monetary policy at an event in Portugal.

Powell explained that the Fed needed more convincing that conditions were right to lower interest rates, a key move being closely watched by crypto and risk asset bulls.

“We just want to understand that the levels that we’re seeing are a true reading on what is actually happening with underlying inflation,” Powell said, quoted by Reuters and others.

Markets slightly reduced the odds of a rate cut coming at the September meeting of the Fed’s Federal Open Market Committee (FOMC), with the likelihood standing at around 65% at the time of writing, according to CME Group’s FedWatch Tool.

“It’s clear that the Fed will continue their ‘meeting by meeting’ approach,” trading resource The Kobeissi Letter wrote on X.

“While markets are expecting 2 rate cuts this year, the Fed’s latest guidance says 1 cut is coming. The next few months are crucial.”

Bitcoin market participants watched with frustration as BTC/USD returned to the bottom of a familiar range.

READ MORE: Web2 Apps Will Enter A Brave New World In Web3, But How Can They Do It?

Popular trader Skew noted manipulative liquidity moves on exchanges via order “spoofing,” where overhead resistance was added and removed multiple times.

Spot demand on Binance, the largest global exchange, was at $60,000 “and lower,” he added.

Others noted that Bitcoin had filled the latest “gap” in CME futures, created by the weekend’s upside.

Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, expressed concern over the latest BTC price action.

Markets, he argued, had not yet reconciled with the ongoing capitulation phase among miners, a phenomenon recently reported by Cointelegraph.

“Price has not yet reflected the onchain obliteration,” he warned X followers. “It doesn’t have to happen, time also heals all wounds, but Bitcoin is not patient.

Either we’re lucky, and price just consolidates between $60-70K for up to 2 months, or we puke and get a healthy overdue correction.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Web3 is spreading like wildfire, and more businesses are becoming convinced that the future of digital interactions will find a home in decentralized, blockchain-based networks.

The blockchain is impacting everything from the way business operations are executed, to how financial transactions are handled, how startups raise money and how art and real estate are bought and sold. Businesses are seeing this, and more of them have decided that it’s time to take the plunge and embrace the vision of a permissionless and decentralized internet.

Advocates of Web3 say it’s the future of the internet, built on a foundation of new-age technologies like blockchains, cryptocurrencies and NFTs. By building on Web3, businesses can tap next-generation capabilities such as ownership of digital assets, data immutability, censorship resistance and complete data privacy.

Decentralized applications or dApps enable powerful new business models, such as revenue-sharing and a creator-focused economy, with enhanced security and a more equitable economy in which everyone can participate, free from the influence of traditional intermediaries. That’s why businesses are looking for ways to migrate their Web2 applications to Web3, or build new dApps from scratch.

What Goes Into Web2-To-Web3 Migrations?

Migrating a Web2 app requires a firm understanding of the different application architecture that supports Web3 dApps.

Whereas Web2 apps have three main components, the backend, frontend and database, Web3 dApps are based on a backend that lives on the blockchain, supported by blockchain nodes. The Web3 dApp’s frontend connects with those nodes to access the blockchain platform it’s built on. Furthermore, the backend leverages IPFS and data indexing protocols to store files and retrieve data hosted on the blockchain. To interact with a Web3 dApp, users must have a digital wallet with integrated authentication.

Understanding this, it’s clear that Web3 application architectures are more complex than their Web2 counterparts, but the process of migrating an app to Web3 can be broken down into various steps.

1. Infrastructure migration

The first step is to migrate the app from its centralized infrastructure, such as a database hosted on a server, to a decentralized blockchain. These blockchain infrastructures consist of numerous distributed nodes that make up a network, working with one another to verify and add “blocks” to the blockchain. By migrating to a blockchain such as Ethereum, Web2 apps will be able to support smart contracts, which can execute transactions based on predefined conditions, without any intermediary.

2. Code migration

When moving an app from a traditional server to a blockchain, it’s necessary to translate its codebase to a specialist language that understands how decentralized networks operate. If your Web2 app is written in a programming language such as Javascript, it will need to be rewritten in Solidity if, for example, you wish to migrate it to Ethereum.

3. Oracle integration

Most applications require access to offchain data. In a Web2 environment, this is done through the use of APIs. But in Web3, there is a requirement that off-chain data comes from decentralized sources so it cannot be manipulated. This means tapping into data oracles such as Pyth Network.

4. Data storage

One thing that doesn’t have to change is the underlying storage resource. Because blockchains are extremely inefficient at storing data such as content and user information, Web3 dApps use the same kinds of storage services as their Web2 cousins, such as AWS, Microsoft Azure, Google Cloud or DigitalOcean.

5. Payment gateways

Embracing Web3 means also embracing crypto, which is the currency of the decentralized world. In that case, it’s important to either build a Web3 wallet into your app, or else enable users to connect to it using a third-party wallet such as MetaMask or Trust Wallet. With this Web3 wallet, app users have a way to store, manage and transact with crypto assets such as cryptocurrencies and NFTs.

Most dApps will also want to incorporate what’s known as a crypto on-ramp, which makes it easy for their users to exchange fiat money into cryptocurrencies. It’s essential to integrate this with the dApp, because if users are forced to exit the dApp and go to a cryptocurrency exchange, there’s a big risk that they’ll never come back to use your dApp again.

Developers can integrate crypto on-ramps and off-ramps using an API-based service such as Transak. All they have to do is paste in a couple of lines of code, and the Transak widget will appear within their dApp, giving users an easy way to buy and sell digital tokens from within the app in just a few clicks. What’s more, by integrating with Transak, dApps also don’t need to worry about the KYC process to onboard new users, as this is streamlined as part of the process of purchasing crypto.

6. User flows

The actual user experience won’t likely be impacted too much. The trend these days is to abstract away as much of the complexity of blockchain as possible, so users won’t even know they’re interacting with it. The main difference is that users will have ownership of their content, data and assets, free of any censorship or control.

How To Perform A Web2-To-Web3 App Migration?

Now we understand what needs to be done, we can set about doing it step-by-step.

A. Consider your use case

First off, the task begins with understanding the requirements of your app migration and the new use cases you want to introduce with Web3. This involves making a list of the blockchain features and functions you desire. For instance, if you’re migrating a video game from Web2 to Web3, you’ll probably want to introduce crypto and NFTs that support specific features.

Developers should also consider the existing use cases of their Web2 apps and see if these can be improved with Web3. By moving to the blockchain, it’s possible to introduce more secure transactions, enhance data integrity, increase transparency and decentralize identity management.

B. Choose a blockchain

The choice of blockchain is an important one, and includes deciding whether to go with a public or private chain. Some of the best public blockchains include Ethereum, Solana, Polygon, Polkadot, TON and Avalanche, while private chain options include Corda, Cosmos, Hyperledger and Hyperledger Fabric. You’ll want to consider the various functions and capabilities of the blockchain, as well as its level of performance, transaction fees, the type of smart contracts it uses, and so on.

C. Create your smart contracts

The nature of your smart contracts will be determined by the features and functionalities you want to bring to your migrated Web2 application. Smart contracts are what power everything that goes on behind the scenes in Web3 dApps, and enable code to be executed automatically when specified conditions are met.

D. Integrate your app

Once you have everything set up, you’ll need to make your dApp composable by integrating with various Web3 APIs, libraries, node endpoints, frameworks, SDKs and other developer tools that might be relevant. It’s these integrations that make it possible for users to interact with your dApp, fetch and query data, enable smart contract logic and so on.

E. Test, upgrade and deploy

You’re now ready for the testing process, which should be rigorous and conducted on an ongoing basis to ensure everything works smoothly and no vulnerabilities are introduced. The final step is to deploy your Web3 app on the mainnet. Be sure to perform best practices to optimize the performance of your new dApp, to streamline transaction speeds and lower costs.

You’re now blockchain-ready

Web2-to-Web3 application migration is a tricky and time-consuming process. It requires careful planning, a significant degree of expertise with blockchain platforms and smart contracts, and a strong commitment to the cause of decentralization.

That said, migrating to Web3 is a no-brainer for any business that understands where the future of the internet is headed, enabling them and their users to take advantage of the numerous benefits and opportunities to be found in a world where every app will eventually run on a decentralized network.