In the ever-evolving landscape of cryptocurrency, two main types of exchanges have emerged as the primary platforms for trading digital assets: centralized exchanges (CEXs) and decentralized exchanges (DEXs). Both serve the fundamental purpose of facilitating the buying and selling of cryptocurrencies, but they operate on vastly different principles and infrastructures.

These exchanges are essential to the buying and selling of crypto coins and tokens, such as Bitcoin.

Centralized Exchanges (CEXs)

Centralized exchanges are platforms that act as intermediaries between buyers and sellers, much like traditional stock exchanges. These platforms are operated by specific companies or organizations that maintain full control over the exchange operations. Some of the most well-known centralized exchanges include Coinbase, Binance, and Kraken.

Advantages of CEXs

- User-Friendly Interfaces: CEXs often provide more user-friendly interfaces, making it easier for newcomers to navigate the complexities of cryptocurrency trading.

- High Liquidity: Due to their centralized nature, these exchanges can offer higher liquidity, facilitating quicker trades and better prices for users.

- Fiat-to-Crypto Transactions: Many centralized exchanges allow users to buy cryptocurrencies directly with fiat currencies, providing a critical entry point for new users into the crypto ecosystem.

- Customer Support: CEXs usually offer customer support services to assist users with any issues, adding an extra layer of user assurance.

Disadvantages of CEXs

- Security Risks: Centralized platforms can be prime targets for hackers, as they hold a significant amount of user funds and data.

- Regulatory Oversight: Being centralized entities, these exchanges are subject to regulatory scrutiny, which can lead to sudden changes in operations or even shutdowns.

- Limited Anonymity: CEXs often require users to undergo KYC (Know Your Customer) procedures, which can deter users seeking anonymity.

Decentralized Exchanges (DEXs)

Decentralized exchanges operate without a central authority, facilitating direct peer-to-peer transactions on a blockchain. DEXs are built on the principle of eliminating intermediaries, thereby promoting a more open and unrestricted environment for trading. Examples of decentralized exchanges include Uniswap, Sushiswap, and PancakeSwap.

Advantages of DEXs

- Enhanced Security: Without a central point of failure, DEXs are less susceptible to large-scale hacks that plague centralized platforms.

- Anonymity: Users can trade directly from their wallets without needing to provide personal information, thus preserving their privacy.

- Censorship Resistance: DEXs operate on a global scale without central oversight, making them resistant to censorship and regulatory interference.

Disadvantages of DEXs

- Complex User Experience: The lack of a centralized entity means users must navigate more complex interfaces and manage their own security, such as private keys.

- Lower Liquidity: DEXs typically have lower liquidity than their centralized counterparts, which can lead to higher slippage and less favorable trade prices.

- Limited Features: Compared to CEXs, DEXs often offer fewer features, such as advanced trading tools and customer support.

Security Aspects

Security is a paramount concern in the world of cryptocurrency trading. Centralized exchanges, despite their efforts to bolster security through measures like cold storage and two-factor authentication, have suffered from significant breaches. Decentralized exchanges, by design, mitigate some of these risks by allowing users to retain control of their private keys. However, they are not entirely immune to risks, such as smart contract vulnerabilities.

User Experience

The user experience between CEXs,, like Binance or Coinbase, and DEXs can differ greatly. Centralized exchanges offer a more curated experience, with user-friendly platforms, customer support, and additional services like staking and lending. Decentralized exchanges prioritize autonomy and privacy but require a higher level of technical knowledge from their users.

Impact on the Cryptocurrency Market

Both CEXs and DEXs play critical roles in the cryptocurrency market. Centralized exchanges have been instrumental in introducing and providing access to cryptocurrencies for a broader audience. They have facilitated the growth of the crypto market by providing liquidity, fiat gateways, and a sense of security for new entrants. On the other hand, decentralized exchanges embody the decentralized ethos of cryptocurrency, offering alternatives that prioritize security, privacy, and resistance to censorship. DEXs have also spurred innovation in the space, particularly in the realm of DeFi (Decentralized Finance), pushing the boundaries of what is possible within decentralized ecosystems.

Summary

The choice between centralized and decentralized exchanges depends on individual preferences, trading needs, and priorities such as security, privacy, ease of use, and access to specific cryptocurrencies. Centralized exchanges offer a more straightforward entry point for newcomers, with higher liquidity and customer support, but at the cost of privacy and central point of failure risks. Decentralized exchanges, while catering to users seeking privacy and control over their funds, come with their own set of challenges, including lower liquidity and a steeper learning curve.

As the cryptocurrency market continues to mature, we may see further innovations and improvements in both CEXs and DEXs, potentially leading to hybrid models that combine the best aspects of both worlds. The ongoing development of these platforms will play a crucial role in shaping the future of cryptocurrency trading and the broader adoption of blockchain technology.

A bankruptcy adjudicator has granted Genesis Global Holdco permission to liquidate approximately £1.3 billion worth of Grayscale Bitcoin Trust (GBTC) shares as part of endeavours to reimburse investors.

During a hearing on 14th February at the United States District Court for the Southern District of New York, conducted via Zoom, Judge Sean Lane endorsed an order allowing Genesis to divest a portion of its investments from Grayscale.

Documents filed in February indicated that Genesis held about £1.6 billion worth of shares in GBTC, Grayscale Ethereum Trust (ETHE), and Grayscale Ethereum Classic Trust (ETCG).

According to Genesis’s bankruptcy filings, it claimed to possess around 35 million GBTC shares and 11 million ETHE and ETCG shares.

Grayscale lodged a restricted objection to the proposal for the company to liquidate the trust assets on 9th February, asserting that the sales were “subject to written approval” by the investment firm but did not aim to “delay, impede, or obstruct the Debtors’ sale or transfer of Trust Assets.”

READ MORE: SOL Token Surges, Overtakes BNB to Claim Fourth Spot in Cryptocurrency Rankings

On 10th January, the U.S. Securities and Exchange Commission (SEC) sanctioned the conversion of Grayscale’s GBTC to a spot Bitcoin exchange-traded fund for listing and trading on U.S. exchanges, alongside offerings from 10 other asset managers.

Genesis remarked that the SEC’s approval would ease the redemption of shares in cash.

Genesis disclosed a £21 million settlement with the SEC on 31st January over its purported involvement in offering and vending unregistered securities through the Gemini Earn program.

The company operates independently from Genesis Global Trading, which encountered enforcement proceedings initiated by the New York Department of Financial Services in January.

The Uniswap Foundation, backers of the decentralised finance (DeFi) protocol Uniswap, have revealed the launch date for the protocol’s v4 subsequent to the forthcoming Dencun upgrade on Ethereum.

In a statement on X, the foundation shared a roadmap outlining its intentions for the forthcoming rollout.

The organisation emphasised that it is presently in the “Code Freeze” phase, where it is finalising core code, conducting testing, optimising gas, enhancing security, and completing peripheral tasks.

The launch of Uniswap v4 is provisionally scheduled for Q3 2024.

Following this, the Uniswap Foundation team will engage audit firms and hold a community audit contest to review v4’s code.

The team is confident that Uniswap v4 will feature the “most rigorously audited code ever deployed on Ethereum.” Concurrently, the decentralised exchange will be deployed to the testnet as final adjustments are made.

As per the Uniswap Foundation, the third phase will see Uniswap v4 go live on the Ethereum mainnet in the third quarter of 2024.

READ MORE: Ledger and Coinbase Join Forces to Simplify Crypto Transactions and Enhance Self-Custody Options

The organisation noted that this is a tentative date, contingent upon the status of the impending Dencun upgrade on Ethereum.

As previously reported by Cointelegraph, the Ethereum network’s Dencun upgrade was activated on the Goerli testnet on Jan. 17.

The upgrade introduces various Ethereum Improvement Proposals (EIPs), including EIP-4844, which enables proto-danksharding, a feature aimed at reducing layer2 transaction fees.

The Goerli deployment for the Dencun upgrade experienced a four-hour delay. Nonetheless, the upgrade’s deployment on the Sepolia testnet — the second of three Ethereum testnets — was completed without incident on Jan. 31.

Subsequent to the second testnet, the Dencun upgrade concluded the third phase of testing following its deployment to the Holesky testnet on Feb. 7.

On Feb. 8, Ethereum developer Tim Beiko announced that the upgrade is scheduled for the mainnet at “slot 8626176.” Blockchain research firm Nethermind noted that this will occur on March 13, 2024, at 1:55:35 pm UTC.

The date was established by Ethereum developers in a call on Feb. 8, subsequent to the successful deployment to the Holesky testnet.

Shares in cryptocurrency exchange Coinbase have surged by 37% in the past week, riding the wave of a recent upswing in Bitcoin prices.

Analysts anticipate robust performance as the company prepares to unveil its fourth-quarter results on Thursday.

MarketWatch and FactSet’s aggregated data reveals a consensus among analysts, foreseeing a substantial revenue increase for Coinbase in Q4.

Projections suggest a rise of approximately 22% from Q3, reaching $825 million.

The surge in revenue is expected to be fuelled by heightened trading volumes.

Analysts estimate a near doubling from $76 billion in Q3 to $142.7 billion in Q4.

Coinbase is also expected to report a fourth-quarter earnings-per-share of $0.02, marking a turnaround from the $0.01 loss per share reported in the preceding quarter.

This surge coincides with Bitcoin’s price rise of 16.3% over the past week, as reported by Coinmarketcap.

On February 13, competitor Robinhood announced a 24% year-on-year increase in Q4 revenue, driven in part by a surge in cryptocurrency trading revenue, which amounted to $43 million, up 10% year-on-year.

READ MORE: SOL Token Surges, Overtakes BNB to Claim Fourth Spot in Cryptocurrency Rankings

Despite these positive indicators, some remain cautious about Coinbase’s future performance in 2024.

JPMorgan analysts, in a note to investors on January 22, predicted a decline in Coinbase’s share price, citing concerns about the lacklustre performance of spot Bitcoin ETFs trading.

However, recent data indicates an uptick in Bitcoin ETF flows, with BlackRock’s IBIT alone generating $493 million in inflows on February 13.

Coinbase, serving as custodian for eight of the top 10 spot Bitcoin ETF providers, including BlackRock and iShares, stands to benefit from this resurgence.

The ongoing lawsuit with the United States Securities and Exchange Commission (SEC) poses another challenge for Coinbase.

Nevertheless, crypto lawyer James Murphy, also known as “MetaLawMan,” remains optimistic about Coinbase’s prospects, expressing confidence that the SEC will lose the case.

Coinbase shares are currently up 14% for the day, buoyed by a broader rally in the cryptocurrency sector, highlighted by Bitcoin’s surge above $50,000 on February 13.

Bitcoin surged to new two-year highs on February 14, delighting enthusiasts with a Valentine’s Day surprise.

Data from Cointelegraph Markets Pro and TradingView revealed a robust rebound in BTC prices from the previous day’s lows of $48,400.

During the Asian trading session, Bitcoin not only recovered from a sudden 4% decline but also soared to long-term highs, aiming for $52,000 at the time of writing.

Typical bullish behaviour saw BTC/USD gaining $1,000 within a single hourly candle, while the overall crypto market capitalisation approached the $2 trillion mark with Bitcoin’s surpassing $1 trillion.

Analysing the short-term setup, renowned trader Skew identified an ongoing reversal of resistance/support levels on the four-hour chart.

He highlighted key trendlines involving exponential moving averages (EMAs) and the relative strength index (RSI) score.

“I think so far this trend is fairly straightforward as long as the market sustains current bullish momentum,” he stated in part of his latest post on X (formerly Twitter).

“4H EMAs will provide nice & concise trend confirmations along with RSI for momentum with current trend, as well when its clear current momentum is lost.

READ MORE: Ledger and Coinbase Join Forces to Simplify Crypto Transactions and Enhance Self-Custody Options

Key closes often with these trends are daily open & weekly open.”

On Binance, Skew additionally observed that spot buyer interest had anticipated institutional inflows via the United States spot Bitcoin exchange-traded funds (ETFs).

As reported by Cointelegraph, these ETFs continue to gain traction, with nine providers acquiring more BTC daily.

Taking a broader perspective, popular trader and analyst Rekt Capital suggested that events were unfolding in accordance with the classic bull markets for Bitcoin.

The timing of the BTC price resurgence towards all-time highs was “right on schedule,” he informed X followers this week.

Drawing parallels to 2020, Rekt Capital highlighted the cathartic impact of the block subsidy halving, with BTC/USD typically commencing a “pre-halving rally” two months in advance.

The next halving is anticipated in mid-April.

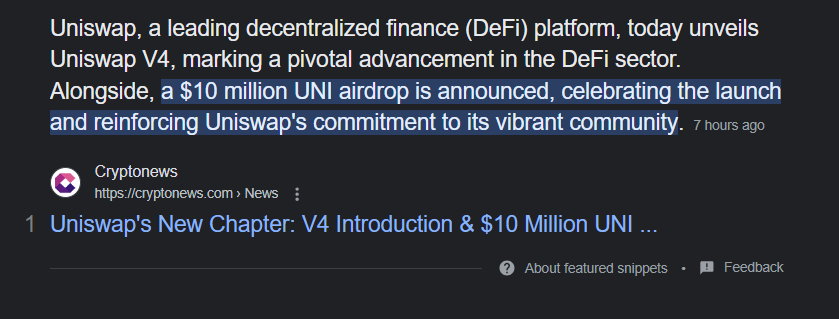

Numerous crypto news sites, including CryptoNews.com – one of the largest crypto news sites in the world – have unknowingly promoted a fake Uniswap website that will drain users’ wallets once connected.

The scammers, going by the name Draek Chavva, reached out to several news sites, including CryptoIntelligence.co.uk, to enquire about publishing a press release.

The press release is titled Uniswap V4 Launch Paired with Generous $10 Million UNI Airdrop (2024), and it links to a fake Uniswap website – https://unisweoips.com/ – where users can allegedly take part in the $10 million airdrop.

However, instead of receiving tokens as part of the airdrop, the scammers will drain the wallets of anyone who connects to this spoof “Uniswap” website.

Over a dozen crypto news sites published this press release, with links to the fake Uniswap website.

Some sites, such as CryptoNews.com, have deleted the press releases that they published, but many PRs remain live on a multitude of websites as of the time of publishing this article.

Crypto holders are advised to be extremely careful about connecting their wallets to any website, even if it appears legitimate at first glance, as there are many spoof websites.

Hardware wallet provider Ledger and cryptocurrency exchange Coinbase have announced a partnership aimed at simplifying crypto purchases and facilitating the transfer of assets from exchanges to self-custody.

In a statement to Cointelegraph, the Ledger team emphasised that Coinbase’s on-ramp solution, Coinbase Pay, will be seamlessly integrated into the Ledger Live application.

This integration enables users to transfer their existing crypto holdings and conduct transactions directly from their desktop or mobile devices, with the added convenience of receiving crypto purchases directly on their Ledger devices.

Describing the previous process of moving crypto from an exchange to self-custody as “a cumbersome process that left users vulnerable to potential errors,” Ian Rogers, Chief Experience Officer at Ledger, remarked that before the collaboration, buying and transferring crypto was “a tedious process.”

However, Rogers expressed confidence that the integration has significantly simplified the process, likening it to the way travel agency Skyscanner simplified travel bookings.

READ MORE: Google Launches £21.4 Million AI Training Fund to Empower European Workforce

He elaborated, stating, “This integration makes it much easier for crypto users to buy through Coinbase and have the funds directly deposited to the secure self-custody of their Ledger.”

Addressing potential changes in the demand for self-custody, Rogers suggested that, similar to different bank accounts, there will be various wallet options.

He indicated that the collaboration with Coinbase demonstrates to consumers that they have a choice. Rogers further noted that the integration makes the experience more straightforward for newcomers to self-custody, affirming, “At the end of the day, you have the option to choose digital ownership through self-custody.”

According to the Ledger team, the crypto industry is entering a new phase driven by the recent introduction of spot Bitcoin exchange-traded funds (ETFs). Ledger anticipates that this development will attract new users to the crypto space.

While these users may initially engage with ETFs, Ledger hopes they will eventually opt for self-custody, which the wallet provider identifies as “the true use case for crypto.”

A novel Ethereum token standard, ERC-404, has swiftly garnered attention within the blockchain community, eliciting both admiration and critique from seasoned industry figures.

Termed ERC-404, this standard amalgamates the functionalities of ERC-20 tokens with those of ERC-721, commonly utilised in crafting non-fungible tokens (NFTs).

Notably, ERC-404 facilitates the fractional ownership of NFTs, exemplified by the subdivision of assets like the Bored Ape Yacht Club among numerous wallet holders.

Introduced earlier this year by anonymous developers under the alias “ctrl” and “Acme” within the Pandora project, ERC-404 has already seen notable success, with the inaugural ERC-404 token witnessing a remarkable surge, returning 530% since its issuance on Feb. 6.

Presently, Pandora ERC-404 tokens command a trading price of $23,484 and boast a market cap of $235 million.

Plans for the protocol’s future entail a reduction in protocol gas fees by 28% to 50%.

Nonetheless, not all share an optimistic outlook on ERC-404’s potential.

READ MORE: Institutional Investors Increasingly Embrace AI in Trading, JPMorgan Survey Finds

“The negative feedback centres on [ERC-404] deviating from standard ERC procedures, technically rendering it a non-ERC token,” remarked Miguel Prada, co-founder and tech lead at Diva Staking.

He further cautioned, “The absence of standardisation poses a significant constraint, potentially limiting independent integration and adoption by DeFi projects or exchanges.”

Echoing similar sentiments, Ryan Lee, chief analyst of Bitget Research, emphasised the experimental nature of ERC-404, cautioning against premature optimism.

“While ERC-404 presents an innovative prospect, its longevity and widespread acceptance remain uncertain,” Lee remarked.

Conversely, Akash Mahendra, head of developer relations at layer-1 blockchain Haven1, hailed ERC-404 as a “game changer.”

Mahendra lauded its capacity to transform Ethereum into a frontrunner in real-world asset tokenisation, opening avenues for novel utility.

However, despite growing momentum, ERC-404 awaits official endorsement from the Ethereum Foundation, with its status pending review as an Ethereum Improvement Protocol.

Mahendra, acknowledging the associated risks, urged cautious consideration from investors, citing potential vulnerabilities in unaudited projects.

As the blockchain community awaits the verdict on ERC-404’s fate, Mahendra advises vigilance amidst the excitement surrounding this pioneering innovation.

United States President Joe Biden has inadvertently assumed the role of a Bitcoin ambassador following the posting of a picture adorned with laser eyes on his Twitter and Instagram profiles.

Accompanied by the caption “just like we drew it up,” the post was in reference to the Kansas City Chiefs’ victory over the San Francisco 49ers in the 2024 Super Bowl.

Initially interpreted by many crypto enthusiasts as a direct nod to or endorsement of Bitcoin, Biden’s new profile picture with laser eyes utilises the “Dark Brandon” meme.

This meme alludes to the conspiracy theory suggesting that the Super Bowl was manipulated to ensure the victory of Taylor Swift’s partner, Travis Kelce’s team, thus enabling the pop sensation to subsequently endorse Biden for president.

The president’s social media team has previously embraced the Dark Brandon meme to cultivate a perception of Biden as trendy and daring.

The post from Biden’s account playfully suggests his involvement in plotting the team’s victory.

READ MORE: UN Probes North Korea-linked Cyberattacks on Crypto Firms, Profits Totaling $3 Billion

The crypto community swiftly reacted to the meme. Bankless speculated on the implications for the ETH/BTC chart, while the pseudonymous user WhalePanda indirectly accused Biden of “cultural appropriation.”

However, it is important to note that the president has not endorsed any policies favouring Bitcoin or cryptocurrencies in general, making it highly improbable for Biden to explicitly endorse a specific crypto asset.

According to Coinbase’s non-profit advocacy group Stand with Crypto, Biden is categorised as “anti-crypto,” based on five public statements displaying a negative stance towards digital assets.

The phenomenon of laser eyes, often employed as a symbol of optimism regarding Bitcoin’s prospects, originated as part of a social media movement aiming to drive Bitcoin’s price to $100,000 by the end of 2021, a goal that remained unfulfilled.

Prominent figures adopting the laser-eyed profile picture included NFL star Tom Brady, Paris Hilton, and Elon Musk.

While Biden unintentionally acknowledged Bitcoin, Jack Dorsey, CEO of Block (formerly Square), made a more overt reference to the digital asset during the Super Bowl.

Dorsey was spotted in the stands sporting a Satoshi T-shirt, modelled after the design of popular Nirvana tees, featuring a smiley face reminiscent of the band’s 1991 album Nevermind.

As blockchain technology gains greater traction, students and the forthcoming cohort of young entrepreneurs demonstrate a burgeoning familiarity with the technology.

In an interview with Cointelegraph, Greg Siourounis, managing director of the Sui Foundation, discussed the foundation’s endeavour to establish a blockchain academy in partnership with the American University of Sharjah, based in the United Arab Emirates.

Siourounis articulated the initiative’s objective as heightening awareness among students regarding blockchain and its potential for crafting applications and platforms to tackle various issues.

He conveyed plans to conduct seminars and workshops aimed at educating youths about the capabilities and limitations of blockchain.

Upon initial interaction with university students, Siourounis was taken aback to discover a considerable degree of awareness concerning blockchain technology. Reflecting on this encounter, he disclosed to Cointelegraph:

“We walked into the amphitheatre where students from high schools and also from universities were presenting ideas, and surprisingly enough, seven out of 10 ideas had blockchain as one part of their solution.”

Siourounis elucidated that this indicates a growing understanding among students and young entrepreneurs of the utility of blockchain technology.

Consequently, he stressed the necessity of furnishing young individuals with the requisite tools to enhance their comprehension of blockchain’s potential and limitations.

Moreover, Siourounis underscored the importance of shielding students from misinformation, stating:

READ MORE: UN Probes North Korea-linked Cyberattacks on Crypto Firms, Profits Totaling $3 Billion

“So, it’s twofold. One is to educate them on the usability, but at the same time give them the right tools and filters to filter the information that is coming from outside about this technology.”

The establishment of the blockchain academy aligns with Sharjah’s aspiration to emerge as a hub for blockchain research and education.

Tod Laursen, chancellor of the American University of Sharjah, asserted that the academy seeks to provide students with insights into “future-oriented topics,” enabling them to engage with trending subjects and acquire skills essential for “thriving in the evolving landscape of tomorrow.”

Meanwhile, the Governor of Bangko Sentral ng Pilipinas (BSP), Eli Remolona, disclosed the central bank’s intention to introduce a wholesale central bank digital currency (CBDC) in the forthcoming years.

Speaking to Inquirer.net, Remolona elaborated on the BSP’s plan to develop a CBDC, affirming the central bank’s decision not to employ blockchain technology due to previous unsuccessful attempts by other central banks.