Crypto PR distribution involves strategic dissemination of information related to cryptocurrency projects, products, or services to a broad audience through various channels, including traditional media, digital platforms, and social networks. The aim is to build brand awareness, establish credibility, and engage potential users or investors.

Effective PR distribution in the crypto space is crucial due to the industry’s fast-paced nature and the need to stand out among countless projects vying for attention.

Publish Your PR in Cointelegraph and Reuters

Crypto Intelligence’s PR distribution service allows crypto and blockchain projects to publish press releases in leading sites, such as Cointelegraph and Reuters.

To enquire about pricing and other details, you can send an email to sales@cryptointelligence.co.uk, or reach out via Telegram.

Importance of Crypto PR Distribution

The cryptocurrency market is known for its volatility, innovation, and rapid growth. As new technologies and projects emerge, companies must effectively communicate their value propositions to stay ahead. PR distribution plays a vital role in achieving these objectives by ensuring that the right message reaches the right audience at the right time.

A well-executed PR strategy can help crypto projects:

- Increase Visibility: By leveraging various media outlets and platforms, projects can reach a wider audience, including potential investors, users, and enthusiasts.

- Build Trust and Credibility: In a sector plagued by scams and regulatory scrutiny, establishing trust is paramount. Effective PR can highlight a project’s legitimacy, team expertise, and technological advancements.

- Educate the Market: Given the complexity of blockchain technology and cryptocurrency, there’s a significant need for education. PR can demystify concepts for the general public, fostering greater understanding and adoption.

- Support Community Building: Engaging with the crypto community through social media, forums, and events can strengthen relationships with existing supporters and attract new ones.

Channels for Crypto PR Distribution

The choice of channels for PR distribution is critical to ensure the message is effectively conveyed. These channels can be broadly categorized into:

- Traditional Media: Includes press releases distributed to news outlets, interviews on television and radio, and articles in print and online publications. These platforms offer credibility and can reach a broad audience.

- Digital Media: Encompasses cryptocurrency news websites, blogs, and online publications that specialize in blockchain technology and financial innovation. These platforms are crucial for reaching a targeted audience already interested in cryptocurrency.

- Social Media and Forums: Platforms like Twitter, Reddit, Telegram, and LinkedIn are vital for real-time engagement with the community. These channels allow for direct interaction with followers, Q&A sessions, and updates on project developments.

- Influencer Partnerships: Collaborating with influencers and thought leaders in the crypto space can amplify a project’s message. Influencers can provide endorsements, reviews, and tutorials to their followers.

- Email Marketing: Sending newsletters and updates directly to subscribers’ inboxes can keep the community informed about the latest news, events, and milestones.

Best Practices for Effective Crypto PR Distribution

For a crypto PR campaign to be successful, it must be strategic, well-planned, and executed. Here are some best practices:

- Craft Compelling Messages: The message should be clear, concise, and tailored to the target audience. It should highlight what sets the project apart and why it matters.

- Timing is Key: Given the fast-paced nature of the crypto market, timing the release of information can significantly impact its effectiveness. Aligning PR efforts with market trends, project milestones, or significant events can enhance visibility.

- Leverage Multimedia: Incorporating images, videos, and infographics can make the PR content more engaging and shareable across platforms.

- Monitor and Measure: Tracking the reach and impact of PR efforts is essential for understanding what works and refining future strategies. Metrics such as website traffic, social media engagement, and media mentions can provide valuable insights.

- Ethical Considerations: Transparency and honesty are critical in all communications. Avoid making unfounded claims or promises that can’t be delivered, as this can damage credibility and trust.

Challenges in Crypto PR Distribution

Despite its potential benefits, crypto PR distribution faces several challenges. The rapidly changing regulatory environment can make messaging complex, requiring careful navigation to avoid legal pitfalls. Additionally, the crowded market means that projects must work harder to differentiate themselves and capture the audience’s attention.

Moreover, skepticism and misinformation about cryptocurrency can lead to resistance from traditional media outlets and the public. Overcoming these obstacles requires a focused, adaptable approach and a commitment to educating and engaging with the audience.

Final Thoughts

Crypto PR distribution is a dynamic and essential component of a comprehensive marketing strategy for any cryptocurrency project. By effectively leveraging various channels and adhering to best practices, projects can enhance their visibility, build trust with their audience, and foster a supportive community. However, navigating the challenges of the crypto landscape requires expertise, creativity, and a commitment to ethical communication.

The Shiba Inu community is abuzz with the introduction of SHIB Names, a novel service enabling fans to establish a unique presence within its burgeoning ecosystem.

Developed by Shiba Inu’s domain name ally, D3 Global, this initiative allows individuals to obtain custom SHIB-branded domain names at a reduced price through an exclusive promotional code.

Marking a pivotal moment for Shiba Inu aficionados, the early access phase to SHIB Names has commenced.

Enthusiasts eager to claim their SHIB identities can now visit the official SHIB registration portal, where they can search for and secure their preferred SHIB domain names.

The portal supports various payment methods, including cryptocurrencies and credit cards, streamlining the acquisition process.

Arthur Hayes, the co-founder of BitMEX, has publicly endorsed the SHIB Names project, acknowledging its potential to influence the digital landscape significantly.

READ MORE: Bitcoin Hits Historic $1.35 Trillion Market Cap, Surpassing Silver

Hayes remarked on the project’s importance, indicating its role in the evolution of “dog money” and its impact on the future of the internet.

This endorsement from Hayes not only underscores the significance of SHIB Names but also reflects the wider acceptance and anticipation of Shiba Inu’s role in the cryptocurrency domain.

SHIB’s official X page details a special offer, allowing users to enjoy a one-time 69% discount on their first purchase of up to 20 SHIB Names.

The utility of SHIB Names extends across numerous Web3 platforms, serving as versatile identifiers for multichain wallets, usernames, and the infrastructure of decentralized services such as smart contracts and nodes.

Amid the enthusiasm for SHIB Names, it’s vital for investors to stay updated on market trends.

The current Shiba Inu price stands at $0.000032, with substantial trading activity.

Nevertheless, market analysts suggest that indicators like the 1-Day RSI, MACD, and KST hint at an upcoming price adjustment, advising caution among investors.

Laser Digital, a subsidiary of Nomura focused on digital assets, has announced its collaboration with Pyth Network as a data provider, marking a significant step towards integrating traditional financial expertise into the decentralized finance (DeFi) sector.

Pyth Network, established in April 2021, has become a leading oracle network in the DeFi space, aggregating data from over 90 primary sources across both the crypto and traditional asset markets, including major trading firms, market makers, and exchanges worldwide.

This partnership sees Laser Digital providing crypto pricing data to Pyth Network, which boasts over 400 price feeds spanning digital and traditional assets such as stocks, foreign exchange, and commodities. This move is in line with the growing demand for reliable, low-latency data in the DeFi sector and the overall trajectory of blockchain technology towards supporting high-frequency, high-throughput applications.

Mike Cahill, CEO of Douro Labs and a contributor to the Pyth ecosystem, expressed enthusiasm about the partnership: “We are thrilled to see Laser Digital join the Pyth Network. This is a fantastic step forward in building the leading financial market data oracle for web3.”

Laser Digital’s CEO, Jez Mohideen, also shared his optimism, stating, “We are excited to support Pyth Network in its journey as a decentralized data provider. We look forward to leveraging our expertise and experience to contribute to the growth of the Pyth ecosystem.”

Marc Tillement of the Pyth Data Association highlighted the diverse origins of Pyth’s data contributors, which span the traditional and crypto markets. He emphasized the value of Laser Digital’s participation: “It is really fantastic to see Laser Digital join this community to help bring in perspective and expertise from the existing finance world.”

Laser Digital is positioned as a redefiner of digital finance, leveraging Nomura’s backing to explore trading, asset management, and venture opportunities within the digital asset sphere.

The company emphasizes a responsible approach to digital asset engagement, combining high standards of risk management and compliance with a culture of adaptability and learning.

Pyth Network, in contrast, focuses on delivering real-time financial data through a vast network of data providers to support decentralized applications across over 50 blockchains, establishing itself as a key infrastructure component in the DeFi ecosystem.

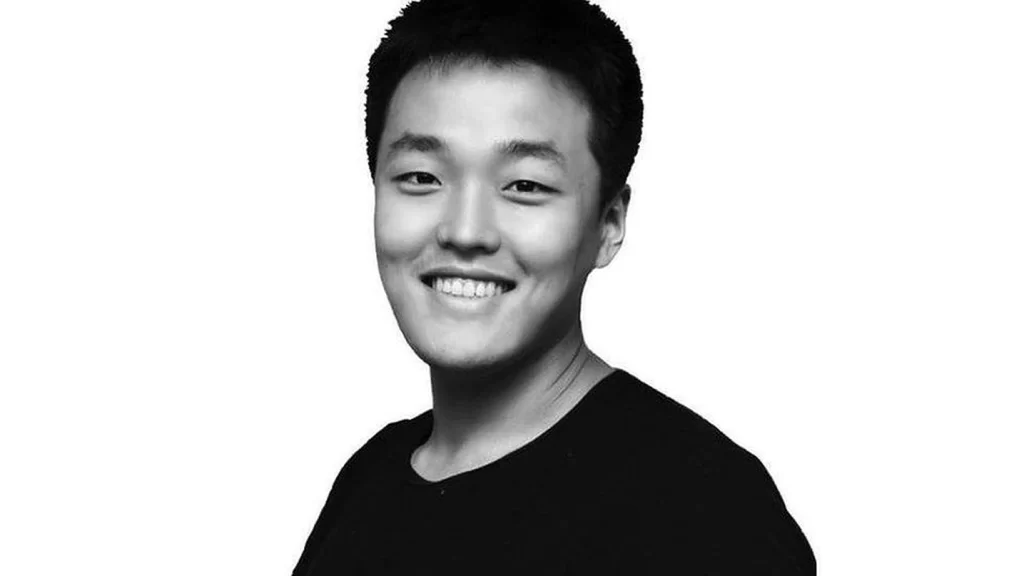

The legal drama surrounding Terraform Labs co-founder Do Kwon persists as Montenegro’s Appellate Court has once again overturned a lower court’s ruling favoring his extradition to the United States.

This development, announced on March 5, signifies another twist in the complex saga of Kwon’s potential extradition, highlighting ongoing legal debates and procedural disputes.

Previously, on February 20, the High Court of Podgorica had sanctioned Kwon’s extradition to the U.S. to face criminal charges related to multiple offenses.

However, the Appellate Court identified “significant violations of the provisions of criminal procedure” within the local legal framework, questioning the foundational reasons behind the extradition request’s approval.

The statement from the Appellate Court pointed out the lack of “clear and valid reasons for decisive facts regarding the order of arrival request letter,” casting doubt on the procedural integrity of the extradition process.

This recent decision underscores the legal challenges and intricacies faced by courts in Montenegro as they navigate international law and bilateral extradition requests.

Kwon’s arrest in Montenegro in March 2023 marked the beginning of an intricate extradition process, fueled by demands from both the U.S. and South Korea.

READ MORE: Bitcoin Surges to Record Highs Against the Euro and Multiple Currencies

The legal journey saw the Appellate Court of Montenegro cancelling an earlier decision in December 2023, which had approved Kwon’s extradition, instructing a retrial at the Podgorica Basic Court.

The narrative is further complicated by the background of Terraform Labs, the entity behind the Terra blockchain.

The company experienced a catastrophic collapse in May 2022 when its Terra stablecoin and Luna token plummeted, allegedly due to fraud.

The U.S. Security and Exchange Commission accuses Terraform Labs and Kwon of orchestrating a fraudulent scheme that erased around $40 billion from the market.

This ongoing legal battle in Montenegro reflects the international dimensions of cryptocurrency regulation and the challenges of prosecuting alleged financial crimes across borders.

The saga of Do Kwon continues to unfold, illustrating the complexities of international law, the intricacies of extradition processes, and the broader implications for the cryptocurrency industry.

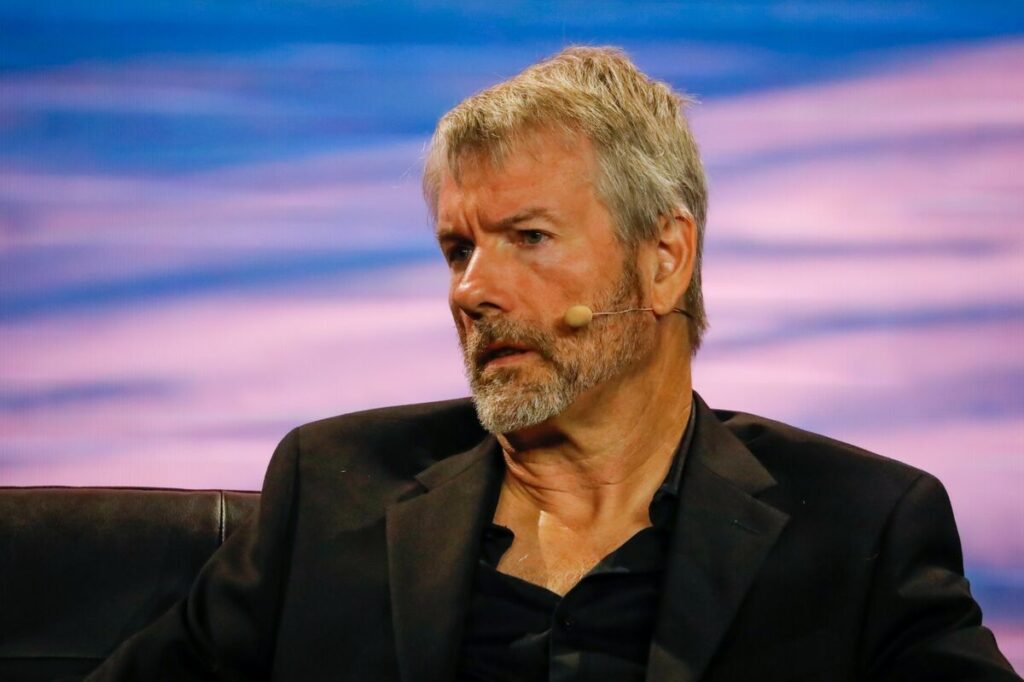

American business intelligence and cloud-based services firm MicroStrategy is mulling investing in Ethereum, sources told Crypto Intelligence News on Wednesday.

New Ethereum holdings would be in addition to MicroStrategy’s impressive Bitcoin holdings, and will not in any way impact their continued accumulation of BTC, a person familiar with the matter emphasised.

Crypto Intelligence News has approached MicroStrategy for comment, but has not received a response at the time of publishing this article.

These reports come after MicroStrategy, led by Michael Saylor, its founder and current Executive Chairman, announced on Tuesday that it intends to raise $600 million through the sale of convertible debt in a private offering.

The purpose behind this significant financial move is to further increase the company’s bitcoin holdings. Since the middle of 2020, MicroStrategy has aggressively been buying bitcoin, now holding approximately 193,000 tokens valued at over $13 billion, based on the current bitcoin price of $67,500.

The decision to issue convertible debt comes at a time when MicroStrategy’s stock has seen substantial growth, with its value almost doubling in 2024. This includes a notable 24% rise in just one day’s trading session. However, in early trading on Tuesday, the company’s shares experienced a 6% drop.

This strategy reflects MicroStrategy’s ongoing commitment to bitcoin as a central component of its investment approach, leveraging the recent strong performance of its stock to finance further acquisitions of the cryptocurrency.

Bitcoin recently achieved a remarkable milestone, reaching a new all-time high (ATH) of $69,300.

This significant achievement comes after a challenging period that began in November 2021, when Bitcoin experienced a downturn, marking the onset of a prolonged crypto winter.

The landscape remained bleak until early 2023, when the cryptocurrency market began to show signs of recovery, with Bitcoin’s price steadily increasing and entering a new phase of price discovery.

The breach of a new ATH is a critical moment for any asset, signaling a shift into uncharted territory without clear resistance or support levels to guide traders.

Chris Dunn, a seasoned crypto investor and Bitcoin educator, shared his insights with Cointelegraph regarding the potential market dynamics in this new phase.

Dunn anticipates a domino effect that could propel Bitcoin’s price to even greater heights.

He explained, “I expect the trend to accelerate through the all-time high break as people buy breakouts, shorts get liquidated, and potential sellers pull their asks off the order books.”

Bitcoin’s ascent has been remarkable, particularly since February 16, when its price began to surge significantly, marked by large “green candles” indicating substantial price increases.

Despite expectations of a pullback, Bitcoin continued to defy predictions, with another substantial price jump on February 27.

This unexpected rise caught many short traders by surprise, leading to significant liquidations.

On February 27 alone, $161 million in BTC shorts were liquidated, with total liquidations reaching $268 million as Bitcoin’s price briefly exceeded $57,000.

The phenomenon of short liquidations and the ensuing short squeeze effect contribute to the rapid price increases and heightened market volatility.

Amid these developments, the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States has played a crucial role in attracting investment.

Notably, BlackRock’s iShares Bitcoin Trust surpassed $10 billion in assets under management in just over seven weeks, a milestone that took the first U.S. gold-backed ETF two years to achieve.

Will Clemente, co-founder of Reflexivity Research, remarked on the remarkable inflows into Bitcoin ETFs, highlighting their significant impact compared to gold ETFs.

Chris Dunn emphasized the importance of Bitcoin ETFs in introducing Wall Street and institutional investors to the cryptocurrency market.

The continued influx of capital into these ETFs underscores the growing demand for Bitcoin and its potential to drive prices higher as more investors engage with the market through these financial products.

An Unrivaled Approach to CFD Trading in the Crypto Era

In the dynamic landscape of online trading, Investiva emerges as a beacon of excellence, offering a revolutionary approach to Contracts for Difference (CFD) trading. Celebrated for its outstanding achievements, including the prestigious Finance Feeds Awards 2023 for Outstanding Multi-Asset Trading Platform and the Fund Intelligence Operations and Services Awards 2023 for Best Cryptocurrency Trading Platform, Investiva stands as a trailblazer in the industry.

Investiva Forex Broker Review: An In-Depth Analysis of Excellence

At the core of Investiva’s success is the MarketFlow™ platform, a dynamic and multi-asset solution setting the standard in online trading. This state-of-the-art platform empowers investors to trade over 3,000 assets, including cryptocurrencies, ETFs, Forex, and CFDs. The comprehensive Investiva full broker review reveals a platform that seamlessly integrates advanced risk management tools, making it a standout choice for traders seeking precision and discipline.

Automated Trading with Advanced Risk Management Orders: A Key Feature of Investiva

Investiva redefines the trading landscape with the integration of advanced automated trading systems, embodying the principles of precision and discipline. Through the MarketFlow™ platform, users can deploy advanced risk management orders, such as stop-loss, take-profit, and trailing stop, mitigating emotional influences and ensuring a strategic and disciplined approach to trading.

For instance, consider a scenario where a trader utilizes a trailing stop order on the Investiva Forex Broker platform. As the crypto market experiences volatility, the automated system adjusts the stop level based on the asset’s price movement. This not only helps protect gains but also allows for potential profits in the event of an upward trend, showcasing the power of automated strategies in dynamic market conditions.

Investiva Crypto Trading: Capitalizing on Positive Market Trends

Investiva provides real-time guidance, empowering traders to make informed decisions. Market analysts at Investiva offer personalized insights, guiding users through the intricate world of CFD and crypto trading. By combining advanced analytical tools with expert advice, Investiva ensures its users are well-equipped to navigate the financial markets successfully.

In a recent Forbes article predicting positive trends in the crypto market in 2024, the emphasis on Bitcoin’s potential growth becomes an exciting prospect. Investiva’s MarketFlow™ platform, with its diversified asset options, positions users to capitalize on these opportunities. By incorporating expert guidance, traders can align their strategies with the projected market trends, further optimizing their potential for success.

Customer Support and Transparent Financial Operations: The Hallmark of Investiva CFD Trading

Investiva places paramount importance on customer support, providing multiple channels for users to seek assistance. Whether through email inquiries, real-time live chat, or telephone support at +44 20 3808 7662, users receive professional and efficient assistance with their questions or concerns. This commitment to user satisfaction extends to the transparency in financial operations, with no hidden fees and a user-friendly interface for managing accounts seamlessly.

Elite Club and High Net Worth Investment Opportunities: Elevating the Investiva Full Broker Review

Investiva goes beyond being a trading platform by introducing the Elite Club, where high-net-worth investors enjoy an unparalleled level of access and personalized service. This exclusive community not only provides a suite of world-class services but also aligns with Investiva’s commitment to creating a more sustainable future through corporate responsibility initiatives.

Investiva’s Learning Hub: Educational Resources for Informed Decision-Making

Investiva serves as a knowledge hub for traders of all levels. From basic concepts to advanced strategies, the platform offers a wide range of free educational tools. Join our community and access the Learning Hub, including tutorials, classes, and exclusive 1-on-1 Zoom training sessions with investment specialists. Elevate your trading skills with Investiva.

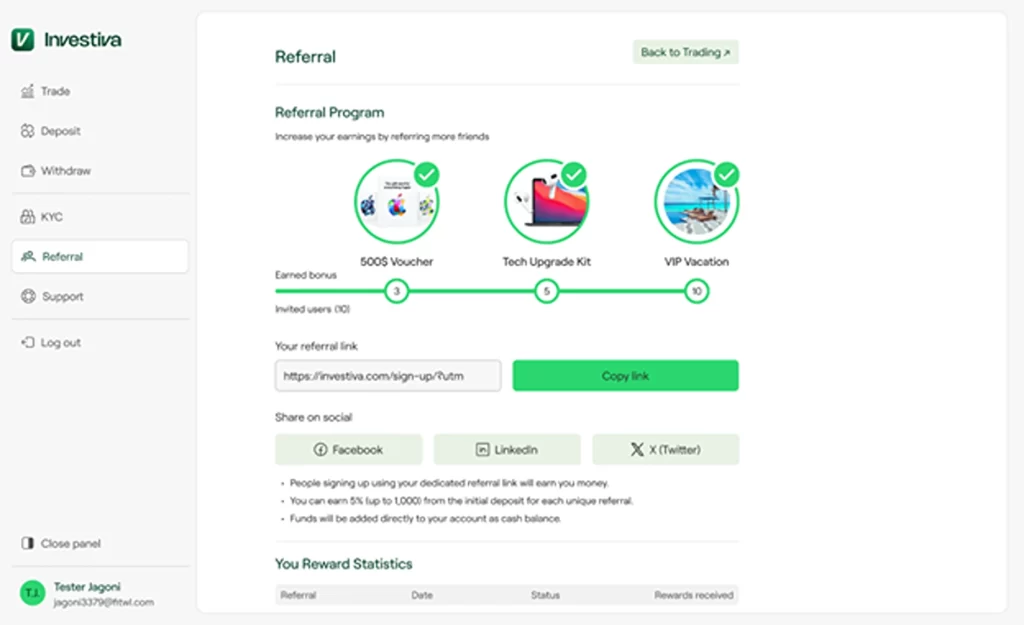

Boost Your Earnings through Referral Rewards

Maximize your potential earnings by referring friends to Investiva. With a generous offer, you can earn 5% (up to 1,000) from the initial deposit for each unique referral. Simply share your dedicated referral link, and watch your earnings grow as people sign up through it. At Investiva, every successful referral is a step toward increasing your financial gains. Join our referral program today and turn your network into a source of income.

Investiva Security: Safeguarding Your Financial Future

Is Investiva Legit? Is Investiva Secure to Invest?

Investors, rightly cautious in the digital age, often seek assurances regarding the legitimacy and security of trading platforms. At Investiva, security is not just a commitment; it’s a fundamental pillar of our ethos.

Robust Security Protocols

Investiva Utilizing advanced encryption and cybersecurity methods, we ensure the protection of your data and transactions. Investiva prioritizes the confidentiality and integrity of user information, employing the latest technologies to safeguard your financial assets.

Vigilant Monitoring

The systems are monitored around the clock, aligning with the trend of increasing fraudulent activities reported globally. By staying ahead of potential threats, Investiva maintains a proactive stance against cyber threats, fostering a secure environment for traders.

Regulatory Compliance

Investiva adheres international security standards and regulations, recognizing the global increase in financial crime risks. Investiva’s commitment to regulatory compliance ensures that our users trade on a platform that meets the highest industry standards.

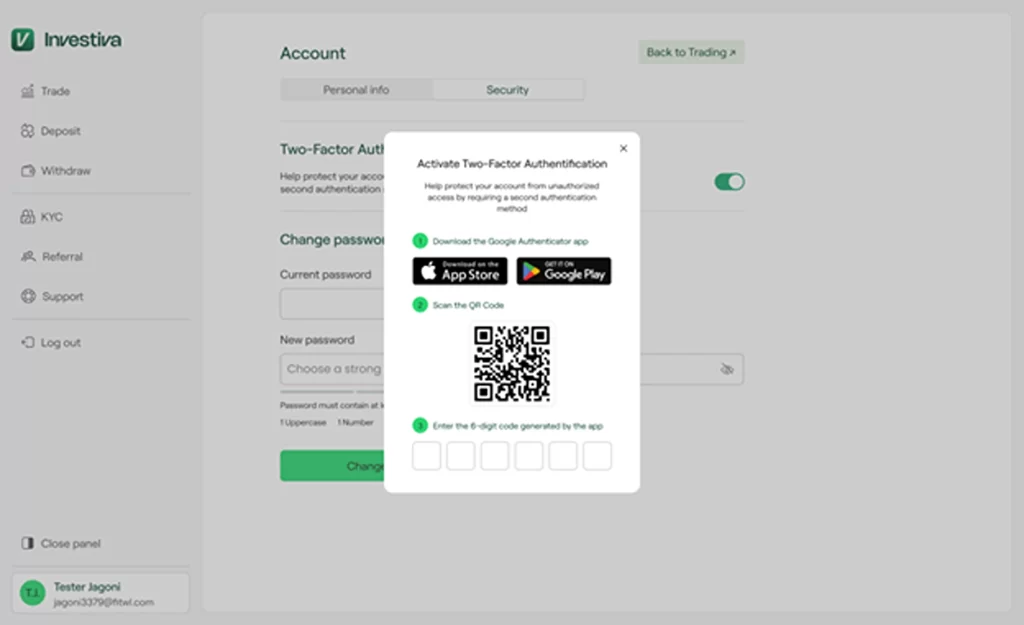

Enhanced Security with Investiva: Strong Passwords and 2FA

Investiva empowers users to secure their accounts with robust passwords and the activation of two-factor authentication (2FA) during Login, ensuring a fortified defense against unauthorized access.

Staying Ahead in a Digital World

The digital world brings both opportunities and challenges. Investiva.com is dedicated to harnessing the power of technology to enhance security while remaining vigilant against potential threats. We believe in empowering our users with the tools and knowledge to protect their investments and trade with confidence. At Investiva.com, your security is our top priority. Together, we create a secure, trustworthy, and prosperous trading environment.

In addition to these measures, Investiva proudly holds certificates of GDPR, SOC2, PCI DDS, and ISO/IEC 27001 compliance, further underlining our commitment to maintaining the highest standards of security and privacy for our users.

Investiva invites investors to embark on a journey of financial success, leveraging the innovative MarketFlow™ platform, expert guidance, and a commitment to excellence. Join Investiva today and redefine your approach to CFD trading: Investiva Official Website.

Media Contact:

Contact person: Juliet Emerson – Head of Compliance

Website https://investiva.com/.

Email:Support@investiva.com

Telephone: +44 20 7946 0656

Lines open 09:00 – 16:00 / Monday-Friday

Address: 4-12 Regent St., St. James’s, London SW1Y 4PE

Social media:

https://www.linkedin.com/company/investiva-uk/

Investiva (@Investiva_UK) / X (twitter.com)

The innovative loan, between Electric Capital and a prominent proprietary trading firm, comes ahead of Trident Digital‘s launch of its Lending Conduit product. The loans were booked and managed via Membrane Labs SOC2 certified loan management system with which Trident partnered in 2023.

This Proof-Of-Concept transaction opens the door for a new form of lending that Trident believes will become the digital asset standard. Their approach draws from traditional finance risk management while adjusting for the nuances of the digital asset market.

“Post Genesis there is little investor appetite for unsecured lending, demand for over-collateralized borrowing, or independent infrastructure available to facilitate bilateral undercollateralized lending on multiple platforms. At its peak the lending market was at $80bn – this creates an incredible opportunity to rebuild the market confidence using appropriate risk and liquidity management approach and Trident is up for the challenge,” said John Wu, President of Ava Labs.

The first-of-its-kind, undercollateralized loan was executed between market leaders in the crypto space. Electric Capital (over $1bn committed capital) lent AVAX to a proprietary trading firm with over $500mm in AUM, which was provided with 4x leverage. Trident has onboarded with Cumberland‘s OTC desk, as well as Wintermute’s, in order for them to facilitate liquidations, if necessary. Loan booking and management was handled via Membrane Labs’ Loan Management System while Trident rolled out the first risk and liquidity management endeavor in the lending space.

“Trident’s approach to security and risk management gave us confidence to lend our assets. Their strategy will help unfreeze the lending market,” expressed Jim Bai, Investor & Trader at Electric Capital.

“The choice of loan management system, counterparties, loan denomination and collateral ratio were given great consideration. For our product to work we needed the terms to be commercial, the counterparties to be real, and the token to be in demand. While BTC and ETH are relatively available, our conduit will focus on lending alt coins so AVAX was a great choice for what we are trying to achieve,” stated Anthony DeMartino, Co-Founder and CEO of Trident.

Trident’s lending conduit structure allows Institutions to engage in loans where both sides have full transparency on the risks being taken. Trident will manage and execute the provisions of the loan as well as diligently monitor the risks and liquidity of the assets backing the loans and will execute liquidations as required.

Trident and Membrane agreed to terms on a partnership where Trident Digital will use Membrane’s Soc 2 certified infrastructure to offer the first of its kind lending solution. Trident’s “Lending Conduit” will allow Institutional lenders and borrowers to connect on appropriate risk adjusted returns. There will be no commingling of loans and no cross contagion risks as the firm seeks to minimize counterparty risk. Trident’s offering also looks to optimize security and transparency for the lenders and offer capital efficiency for the borrowers. The goal is to unlock billions of tokens sitting on lenders’ balance sheets who no longer have the infrastructure to lend their tokens on the proper risk adjusted terms.

“We believe that getting liquidity back to the spot market, specifically in altcoins, will allow for the market to grow on a healthy foundation. This foundation will have spillover benefits for derivatives and DeFi,” voiced Anthony DeMartino, Co-Founder and CEO of Trident.

“Our decision to partner with Membrane was simple, their best in class technology, deep crypto native relationships and their SOC2 certification allows Trident to bring its solution to the market 1 year faster than anticipated,” stated Dr. Amir Sadr, CRO and Head of Product of Trident.

“As the ecosystem bounces back and the appetite for lending returns, Trident is leading the revolution for safe leverage with their novel Lending Conduit structure, built on top of the Membrane platform. Our partnership enables market participants to securely access leverage in a capital efficient way with funds remaining on exchange where it can be usefully deployed,” said Carson Cook, Founder and CEO of Membrane.

With the first Proof-Of-Concept loan executed, Trident will focus on adding additional exchanges, onboarding more large institutional clients and adding derivatives to the platform. Trident is also working with off exchange solution providers to further reduce the risks to our lending platform.

The Securities and Futures Commission (SFC) of Hong Kong has recently taken action against fraudulent websites mimicking prominent local cryptocurrency exchanges.

On March 4, the SFC alerted the public about several deceptive sites posing as two officially licensed crypto trading platforms.

These illicit domains aimed to impersonate OSL Digital Securities and Hash Blockchain Limited, known as HashKey, by creating fake websites such as hskexpro.com, hskex.com, hskexs.com, hskexit.com, oslexu.com, and oslint.com.

These actions were taken after reports surfaced of users facing difficulties withdrawing funds and encountering excessive fees and commissions.

The Hong Kong Police Force has intervened to restrict access to these fraudulent sites at the SFC’s behest.

The SFC has also listed these sites on its official crypto alert list, which includes others that have impersonated exchanges like MEXC, with eight domains mimicking MEXC being blacklisted earlier on February 9.

To combat this issue, the SFC encourages investors to consult its public register for verified trading platforms and a list of licensed virtual asset trading platforms.

This measure is to ensure that investors are dealing with legitimate entities and to avoid any financial losses. The SFC emphasizes the importance of confirming the identity of any trading counterparty before proceeding with transactions.

READ MORE: Felix Reeves News – How This Crypto Trader Made His Fortune

Bartosz Barwikowski, a layer-1 security expert at Hacken, pointed out the challenges in distinguishing authentic websites from fraudulent ones, especially for first-time visitors.

He suggested that verifying the website’s URL on the SFC’s site is a safety measure, albeit one seldom taken by users.

Barwikowski advises relying on trusted third parties and recommends using mobile apps over websites due to the difficulty in counterfeiting them.

He also emphasizes the importance of checking for a significant number of reviews before trusting these apps and suggests consulting reliable sources such as government websites or cer.live for exchanges.

This crackdown on fake crypto websites comes shortly after the SFC closed the latest licensing cycle for crypto exchanges on February 29.

Exchanges that missed the application deadline are required to cease operations in the region within three months, marking a significant step in Hong Kong’s efforts to regulate and secure the cryptocurrency trading environment.

Tether, the cryptocurrency stablecoin, has achieved a significant milestone by reaching an all-time high market capitalization of $100 billion.

This represents a 9% growth since the beginning of the year, solidifying Tether’s lead over its closest competitor, USD Coin (USDC), by more than $71 billion.

The peak was recorded on March 4, based on data from CoinGecko, although fluctuations in market cap are common due to changes in price and circulating supply.

In comparison, other platforms like CoinMarketCap have not yet registered Tether reaching this landmark.

Tether’s remarkable market cap positions it alongside major global companies such as the British oil conglomerate BP and surpasses e-commerce giant Shopify in value.

Tether operates on 14 different blockchains and protocols and is considered the third-largest cryptocurrency by market cap, trailing only behind Ether.

It plays a vital role in the cryptocurrency market, offering traders a stable asset amidst the volatile crypto environment.

The cryptocurrency market as a whole has experienced a resurgence, with the total market cap exceeding $2 trillion.

Bitcoin, in particular, has seen a 50% increase in price, achieving two-year highs.

READ MORE: US Energy Officials Reach Agreement with Texas Blockchain Council and Riot Platforms

Tether, the company behind the USDT token, supports each token with a 1:1 ratio of independently audited reserves, primarily consisting of U.S. Treasury Bills (T-Bills).

The company reported a record quarterly profit of $2.85 billion in the fourth quarter of 2023, with $1 billion attributed to its T-Bill investments, showcasing over $80 billion in T-Bill holdings.

Despite its success, Tether has faced scrutiny regarding the quality of its asset backing. Efforts have been made to diminish exposure to higher-risk assets.

The company had planned to cease lending funds from its reserves by the end of 2023, yet $4.8 billion in loans remained on its books at year-end.

These loans are reportedly fully collateralized, with a commitment to reduce them to zero by 2024.

The majority of USDT tokens circulate on the Tron blockchain, which a United Nations report criticized for facilitating cyber fraud and money laundering activities in Southeast Asia.

Tether has contested these claims, emphasizing its cooperation with law enforcement and the traceability of its tokens.