The upcoming Bitcoin halving event, scheduled for April, is generating unprecedented excitement in the cryptocurrency world, fueled by a combination of unique factors.

This event marks the fourth Bitcoin halving, with previous occurrences in 2012, 2016, and 2020.

Significantly, this halving follows the U.S. Securities and Exchange Commission’s approval of the first spot Bitcoin ETFs in the United States, heightening the anticipation surrounding the event.

Experts are not just focused on the ETF approvals.

Julian Grigo, from Safe, emphasized the halving as a pivotal reminder of Bitcoin’s distinction from fiat currencies, particularly in a time of global inflation.

He highlighted Bitcoin’s fixed supply as a key attraction for investors, contrasting it with the inflating supply of fiat currencies and noting Ether’s decreasing supply as potentially even more appealing.

Joey Garcia from Xapo Bank predicts the halving will have a positive ripple effect on Ethereum and the broader market, likening Bitcoin’s scarcity mechanism to precious metals.

The reduction of mining rewards from 6.25 BTC to 3.125 BTC is expected to tighten Bitcoin’s supply, potentially increasing its price and, by extension, the prices of Ethereum and other cryptocurrencies as investors diversify their portfolios.

Alun Evans of Laos Network also acknowledged the halving’s broader impact, cautioning against the downsides of rapid price increases, especially for Ethereum, which powers numerous applications and smart contracts.

He suggested that future Ethereum network enhancements could mitigate these challenges by improving scalability and reducing transaction costs.

READ MORE: Shiba Inu’s Price Eyes Potential Surge Amid Market Speculation, Analyst Predicts Bullish Breakout

Beyond the halving, other factors are influencing the crypto market. Siddharth Lalwani of Range Protocol pointed to Ethereum’s upcoming Dencun upgrade and the potential for SEC-approved Ethereum ETFs as critical drivers of market dynamics.

Despite potential short-term liquidity shifts from Ethereum to Bitcoin, Lalwani remains optimistic about the crypto market’s bullish trend in 2024.

Jordi Alexander of Mantle and Aki Balogh of DLC.Link also weighed in, highlighting the role of Bitcoin’s price rally, upcoming Ethereum upgrades, and the strategic actions of entities like MicroStrategy in shaping market expectations.

They acknowledged the interconnectedness of Bitcoin and Ethereum’s fortunes, with Balogh emphasizing the broader impact of Bitcoin’s performance on the crypto ecosystem.

In summary, the forthcoming Bitcoin halving is viewed not just as a significant event for Bitcoin but as a catalyst for broader market movements, including Ethereum.

With factors like regulatory approvals, technological upgrades, and strategic market maneuvers at play, experts see a confluence of forces poised to shape the crypto landscape in the near and long term.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

CoinShares, a leading European digital asset investment firm, has successfully finalized the acquisition of Valkyrie Funds, gaining the sponsor rights to Valkyrie’s spot Bitcoin exchange-traded funds (ETFs).

Announced on March 12, this significant acquisition also includes Valkyrie Investments, the firm’s investment advisory branch, and the sponsor rights to the Valkyrie Bitcoin Fund, a physically-backed Bitcoin ETF.

The terms of the deal stipulate that the acquisition price will be determined at the conclusion of a three-year earnout period, reflecting Valkyrie’s financial performance.

Additionally, this agreement extends CoinShares’ management to include Valkyrie’s diverse ETF portfolio, such as the Valkyrie Bitcoin and Ether Strategy ETF, Valkyrie Bitcoin Miners ETF, and the Valkyrie Bitcoin Futures Leveraged Strategy ETF.

Jean-Marie Mognetti, CEO of CoinShares, emphasized the importance of the U.S. market for global asset managers and highlighted the acquisition’s strategic benefits: “The Valkyrie acquisition is yet another step in our growth strategy with a special focus this time in the U.S.

This acquisition brings an additional $530 million AUM to CoinShares, which makes it a top-line contributor from day one.

More importantly, it broadens our product offerings, strengthens our innovation capacity, and increases by a factor of 15 our total addressable market.”

In the wake of this acquisition, CoinShares plans to rebrand Valkyrie and its offerings within its ecosystem.

READ MORE: Bitcoin ETFs Will Hold Over 10% of BTC Supply By Q3

This move is part of CoinShares’ broader strategy to enhance its asset management platform in the United States, following an option to acquire Valkyrie that was held since November 2023.

The announcement arrives amidst a surge in interest for Bitcoin ETFs, notably after Bitcoin reached a new all-time high of $71,415 on March 11.

This increased attention is mirrored by the Bitwise Bitcoin ETF, which recently became the fifth fund to exceed $2 billion in Bitcoin holdings, according to Dune data, with Grayscale’s Bitcoin Trust ETF maintaining its position as the largest, managing $29 billion in Bitcoin.

Given the current pace, ETFs are expected to annually absorb 8.98% of the Bitcoin supply, potentially triggering a sell-side liquidity crisis by September, as per Ki Young Ju, founder and CEO of CryptoQuant.

Ju noted, “Last week, spot ETFs saw netflows of +30K BTC. Known entities like exchanges and miners hold around 3M BTC, including 1.5M BTC by U.S. entities… At this rate, we’ll see a sell-side liquidity crisis within 6 months.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

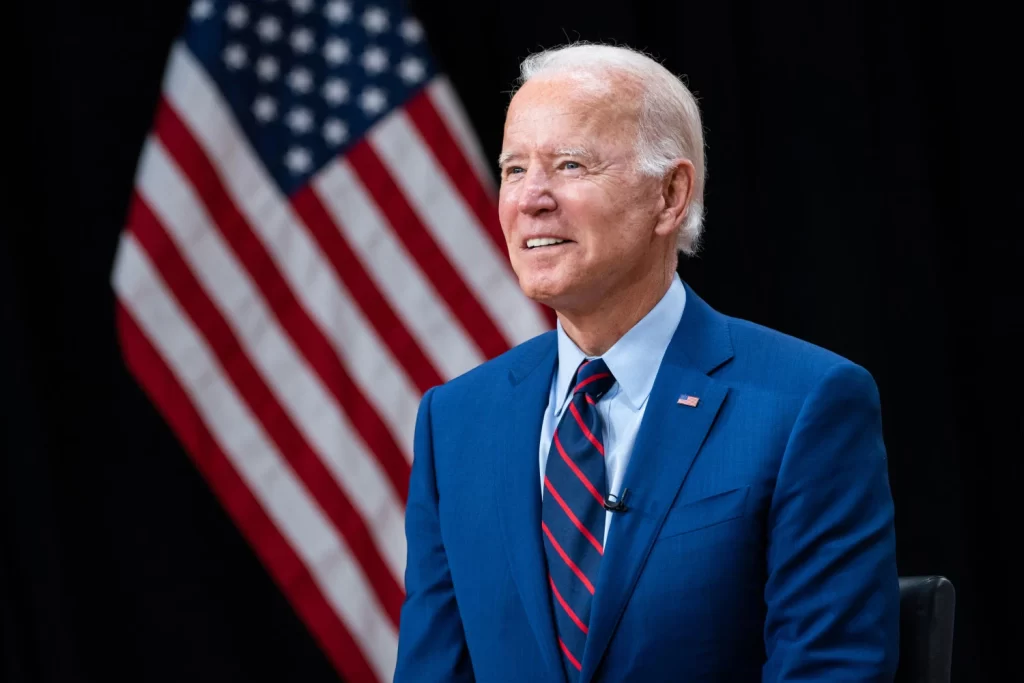

In his budget proposal for 2025, President Joe Biden is revisiting the concept of imposing a 30% tax on the electricity consumption of cryptocurrency mining operations.

This initiative is outlined in the “General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals,” a document from the U.S. Department of the Treasury.

The document criticizes the lack of current legislation specifically addressing the taxation of digital assets, aside from broker and cash transaction reporting.

To rectify this, the Biden administration proposes an excise tax on the electricity used in the mining of digital assets, akin to taxes on physical goods like fuel.

The Treasury explains, “Any firm using computing resources, whether owned by the firm or leased from others, to mine digital assets would be subject to an excise tax equal to 30 percent of the costs of electricity used in digital asset mining.”

Under this proposal, crypto mining entities would be required to disclose both the quantity and type of electricity they consume.

For electricity bought externally, firms must also report its value, which will then be used as the basis for the tax.

READ MORE: MicroStrategy Bolsters Bitcoin Treasury With $800 Million Note Offering, Purchases 12,000 BTC

Similarly, miners leasing computational power must declare the electricity’s value provided by the leasing company.

This measure, aimed to take effect from January 1, 2025, plans a phased tax introduction: starting at 10% the first year, 20% the second, and reaching 30% in the third year.

Crypto mining operations that generate their own power will also be subjected to this tax.

The 30% rate will apply to the estimated costs of their electricity consumption, regardless of whether they are connected to the grid or not.

This includes those utilizing renewable energy sources such as solar or wind power.

Pierre Rochard of Riot Platforms has criticized the move as an attempt to undermine Bitcoin and facilitate the launch of a central bank digital currency (CBDC).

U.S. Senator Cynthia Lummis has expressed her opposition to the tax on X, suggesting that while the administration’s inclusion of crypto in the budget may indicate a positive outlook on cryptocurrency, the proposed tax could significantly harm the industry’s position in the U.S.

This initiative marks Biden’s second attempt to implement a 30% tax on the electricity used by crypto miners, following a similar proposal in the 2024 budget proposal announced on March 9, 2023.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In the dynamic world of cryptocurrency, Pepe Coin (PEPE) has emerged as a standout performer.

This weekend, it was in the limelight alongside giants like Bitcoin (BTC) and Ether (ETH), with both experiencing significant price increases.

BTC continued its streak of setting new all-time highs, while ETH crossed the $4,000 mark for the first time in two years.

PEPE also joined this upward trend, reaching a new all-time high, prompting large holders to secure profits.

Launched in April of the previous year, the frog-themed PEPE quickly became a prominent figure in the memecoin market, rivalling others like BONK and various Solana-based memecoins.

Despite a period of reduced attention, the recent market bull run has seen PEPE’s value soar, capitalizing on the positive market sentiment.

READ MORE: Bitcoin ETFs Will Hold Over 10% of BTC Supply By Q3

A significant transaction highlighted by Lookonchain involved a whale profiting over 431% in just two weeks, withdrawing over 1 trillion PEPE tokens from Binance in three separate moves before the price surge, culminating in an impressive $8.13 million gain from an initial $1.7 million investment in PEPE tokens.

This series of transactions underscored the substantial profits being made in the memecoin sector.

This surge in PEPE’s value is part of a broader resurgence in memecoin interest, with PEPE itself seeing an 800% increase in its value over the past month.

This has elevated it to the third largest memecoin by market capitalization, at $3.85 billion, reflecting a robust growth in trading volume and market activity.

Despite a slight dip from its all-time high, the community remains optimistic about PEPE’s position as a leading memecoin in this bull run, underscoring the continued fascination and confidence in the potential of memecoins within the cryptocurrency market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On March 13, just before the Wall Street trading session commenced, Bitcoin achieved a new milestone in price discovery, demonstrating a bullish edge over selling pressures.

This achievement was recorded with Bitcoin reaching unprecedented highs of $73,679 on Bitstamp, as per data provided by Cointelegraph Markets Pro and TradingView.

Following a slight pause in its upward momentum the previous day, where Bitcoin stabilized near $72,000 and momentarily dipped by $4,000, it swiftly rebounded, mirroring the early week’s market dynamics that initially restricted gains due to resistance.

According to CoinGlass, resistance at $73,800 briefly capped further advances. However, the path towards $80,000 appeared largely unobstructed, a sentiment supported by minimal liquidation levels.

Jelle, a renowned trader, noted on X (formerly Twitter), “Bitcoin wiped out overleveraged longs, retested the 2021 cycle high & then bounced back to $72,000,” indicating a positive outlook for continued upward movement.

Tedtalksmacro, a financial analyst, highlighted the significant surge in institutional investments surpassing previous records, even considering the introduction of new spot Bitcoin ETFs in the United States.

READ MORE: Grayscale Proposes New Bitcoin Mini Trust to Offer Tax-Efficient Investment Option

He shared with his X audience, “Fund inflows like we have never seen before. It makes 2020 look small… price will continue to catch up over the coming months,” suggesting a steady ascent towards $100,000.

He cautioned that historically, a peak in these inflows often signals a critical juncture to exit the market within the following 2-3 months.

Record-breaking inflows were observed in the ETF sector, with a notable $1 billion of net contributions recorded on March 12. BlackRock’s iShares Bitcoin Trust was at the forefront of this influx.

BitMEX Research highlighted, “A record 14,706 BTC inflow on 12 March 2024,” underscoring the significant demand.

This influx represents a substantial fraction of Bitcoin’s newly-mined supply in 2024, estimated at around 65,500 BTC.

As of March 13, the combined holdings of the two largest ETFs, managed by BlackRock and Fidelity Investments, amounted to over 330,000 BTC.

This figure is quintuple the quantity of Bitcoin mined during the same period, illustrating the massive scale of institutional participation in the cryptocurrency market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

2024 is off to a roaring start for the cryptocurrency market, with Bitcoin breaking the $72,000 barrier. In this buoyant market context, Web3 and its bubbling ecosystem are attracting all eyes. Investors are on the lookout for the nuggets that will make tomorrow’s headlines.

Token sales and launchpads, the nugget hunt is on!

A veritable breeding ground for innovative projects, token sales (Initial Coin Offerings or Initial Token Offerings) and launchpads are enjoying a spectacular resurgence in popularity. These stepping stones for crypto startups offer seasoned investors a golden opportunity to unearth future gems of this ever-changing universe.

Discover 5 high-potential projects, from decentralized finance, to gaming, that are likely to make a splash in the crypto community in 2024. Fasten your seatbelts, as we take you on a tour of tomorrow’s nuggets!

Ago, the all-in-one DeFi platform

Ago is an innovative DeFi platform that aims to democratize decentralized finance by offering a wide range of services within a single user-friendly application.

With Ago, users can access interest-bearing savings accounts, obtain crypto loans, carry out fiat currency transactions and benefit from advanced trading tools. All with an experience comparable to that of online banks, but in a truly decentralized way.

The AGO token is at the heart of the ecosystem, enabling decentralized governance of the platform, while offering its holders a return of 80% of the costs generated by all its services! With a limited issue of 300 million tokens and deflationary mechanisms, $AGO offers solid tokenomics to support Ago’s growth.

Supported by an experienced team, strategic partnerships and a successful $9 million fundraising campaign, Ago has what it takes to become a key player in decentralized finance. This is confirmed by its impressive 1000% growth in its user base by 2024.

For all those who wish to take advantage of the unique opportunities offered by the DeFi, Ago is definitely a platform to keep an eye on. With its ICO which will soon be coming to an end, only a few days left to secure your chips and take part in the adventure.

Trakx, revolutionizing Crypto-Index Trading

Trakx revolutionizes crypto-index trading by offering themed Crypto Trading Indices (CTIs) and customized solutions.

Registered with AMF (Autorité des Marchés Financiers in France), Trakx makes it easy to invest in baskets of cryptos with a single click such as cryptos for staking, the Metaverse, NFT collections, etc.

The platform offers many advantages, including:

- 24/7 access to CTIs

- Automatic portfolio rebalancing

- Rigorous component selection

- Optimized risk management

- Reduced costs

In addition, to reinforce its expertise and accessibility, Trakx has forged strategic partnerships with renowned players such as Lumrisk, MSCI and Vinter.

Recently, Trakx has launched three risk-adjusted ITCs (Curator, Balanced and Growth), which have performed well since their launch. Finally, a new Staking product category has been introduced, offering investors an opportunity to optimize their returns.

The platform is experiencing increasing adoption, with more than 1500 active users and several million dollars exchanged.

At the heart of the ecosystem Trakx is the $TRKX token, which offers its holders a range of advantages, such as :

- Discounts on trading fees

- Attractive referral programs

- Active participation in platform governance

- And much more…

Trakx has already raised $3 million and is aiming for a further $500,000 through several private rounds available to investors. A unique opportunity to take part in the adventure of a leader in the crypto-index trading industry.

Ouinex, transparency is the watchword

Ouinex stands as a beacon of transparency, setting the standard in the crypto exchange landscape.

Established in Paris in 2022, Ouinex caters to active traders, offering a transparent, fair, and secure platform with competitive transaction fees. Boasting a team with a wealth of experience in traditional finance, Ouinex defied market odds, securing nearly $4.5 million during the 2023 bear market.

What sets Ouinex apart is its unique proposition of allowing users to trade both cryptocurrencies and traditional assets through a single account. The $OUIX utility token, strategically designed, hints at a promising future for the platform, aiming to reach 75,000 users by mid-2025.

With recent success in obtaining a Polish license, Ouinex continues its journey towards regulatory compliance, with plans for further licensing in the pipeline. The team is diligently working on expanding its regulatory approvals both in Europe and Globally, ensuring a seamless and compliant trading experience.

Metafight, MMA in the age of blockchain

MetaFight shakes up the blockchain gaming industry by offering an unprecedented immersive experience in the world of mixed martial arts (MMA). Thanks to its cutting-edge technology, MetaFight bridges the gap between the virtual world of fighter cards and real athletes in the sport of MMA, offering a resolutely innovative gaming experience.

By taking part in epic clashes and daring challenges, players have the chance to win tempting rewards and see the value of their cards soar on the market.

The potential of MetaFight recently attracted the attention of Animoca Brands, a heavyweight in the blockchain gaming industry. This providential investment will enable MetaFight to step up a gear by accelerating the development of its platform and launching an improved version of the game as early as 2024.

This new version of MetaFight game promises an unprecedented MMA gaming experience, featuring a Management Card Game (card management game). Players will be able to discover all-new features and enjoy an optimized user experience, for total immersion in the world of mixed martial arts.

With its innovative concept, its strategic partnership with Animoca Brands and its ability to meet the growing demand for blockchain-based games, MetaFight has what it takes to establish itself as a major player in this rapidly expanding market. MMA fans and enthusiasts of blockchain games have plenty to look forward to when they discover the new version of MetaFight in 2024.

MyLovely Planet, playfully saving the planet

Sponsored by Ubisoft and Unity, MyLovely Planet revolutionizes gaming by skilfully combining entertainment and environmental commitment. The concept is simple but effective: every ecological action carried out in the game (planting a tree, cleaning up waste) is reproduced in the real world.

Already boasting a community of 20,000 monthly players, MyLovely Planet is aiming for 100 million users by 2030. Its objective: plant 1 billion trees, clean up the oceans and save endangered species.

The game won the Unity For Humanity award for its positive impact. With 3 million euros raised and the support of renowned investors, the project has plenty to appeal to eco-friendly gamers.

To finance its development and increase its visibility, My Lovely Planet is currently selling $MLC tokens. Given the potential and scope of the project, it is highly likely that the price of this token will soar in the coming months.

Conclusion:

From a next-generation exchange platform to an eco-friendly video game, from DeFi to the sports metaverse, Web3 projects continue to push the boundaries of innovation. Although they involve a degree of risk inherent in crypto-investment, these new players could well make their mark in 2024. Provided, as always, that you invest with discernment and a long-term vision. Only time will tell which will come out on top.

Grayscale, a leading investment manager, has announced its intention to launch a smaller version of its Grayscale Bitcoin Trust, known as GBTC, through a new product dubbed the “mini” trust.

This new offering, aiming for a listing under the ticker symbol “BTC,” was introduced to the United States Securities and Exchange Commission (SEC) via an S-1 form on March 11.

Upon SEC approval, the Grayscale Bitcoin Mini Trust plans to make its debut on the New York Stock Exchange, operating independently from the original GBTC fund.

This innovative trust is designed to distribute shares to current GBTC investors, with an additional contribution of Bitcoin from GBTC itself, although the exact amount remains unspecified.

One of the main goals of this new trust is to provide GBTC shareholders with a tax-efficient method to gain exposure to Bitcoin.

Bloomberg ETF analyst James Seyffart elaborated on the benefits via a March 12 X post, stating, “There is no fee disclosed yet or what % of $GBTC will spin off but pretty sure this will be a non-taxable event for a chunk of those shares to get into a cheaper and cost-competitive product.”

READ MORE: Bitcoin ETFs Will Hold Over 10% of BTC Supply By Q3

The timing of Grayscale’s filing coincides with Bitcoin reaching a record-breaking high of $71,415 on March 11, following Ether’s significant milestone of surpassing the $4,000 mark earlier in the month.

In response to the flourishing cryptocurrency market, asset manager VanEck announced a fee waiver for its Bitcoin Trust ETF, applying to the first $1.5 billion in funds through March 31, 2025, underscoring the competitive environment in the ETF space.

The broader ETF market is also witnessing significant activity, with U.S. spot Bitcoin ETFs achieving a historic $10 billion in daily trading volume on March 5.

This surge in activity surpasses the previous record set just a week earlier.

However, the SEC’s lack of communication regarding Ether-based ETFs has led to skepticism about their approval.

Senior Bloomberg ETF analyst Eric Balchunas expressed concerns about the prospects for Ether ETFs, noting, “The main thing is the fact that we’re 73 days from the final deadline, and there’s been no contact or comments from the SEC to the issuers.

“That’s not a good sign.”

This silence casts doubt on the potential approval of Ether-based ETFs by May, reflecting the regulatory uncertainties surrounding cryptocurrency investments.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Lookonchain, a crypto surveillance platform, has disclosed concerning updates about the notorious Bitrue Drainer, an address linked to a significant security breach.

The entity behind a massive $23.5 million theft from Bitrue Exchange last year has made a considerable transaction, selling cryptocurrencies.

“The #Bitrue Drainer sold 4,207 $ETH for 16.34M $DAI at $3,885 8 hours ago.#BitrueDrainer stole $23.5M assets on April 14, 2023, including: 137,000 $QNT($17M) 46.4M $GALA($2M) 172.55B $SHIB($1.91M) 756M $HOT($1.54M) 318 $ETH($640K) 310,071 $MATIC($352K) Then sold 137,000 $QNT”

In a recent event, Lookonchain reported that the Bitrue Drainer exchanged 4,207 ETH for $16.34 million in DAI stablecoins, averaging $3,885 per ETH.

This move comes after the April 14, 2023, breach, where the hacker amassed a fortune in various cryptocurrencies, including 137,000 Quant (QNT), 46.4 million Gala (GALA), 172.55 billion Shiba Inu (SHIB), 756 million Holo (HOT), 318 ETH, and 310,051 Polygon (MATIC).

Post-theft activities saw the hacker actively selling stolen assets. Following the breach, 137,000 QNT were sold, fetching $14.74 million in Ethereum, which led to a more than 9% drop in QNT’s price within a few hours.

Subsequent sales included 46.4 million GALA for $1.86 million, 22.55 billion SHIB for $236K, and 310,071 MATIC for $343K.

These transactions were primarily converted into Ethereum.

Despite these sales, the Bitrue Drainer still possesses a substantial amount of digital assets, including 4,650 Ethereum, 150 billion SHIB, and 756 million HOT.

The combined value of these holdings is approximately $17.68 million, $4.7 million, and $2.9 million, respectively.

The original theft’s value was around $23.5 million, but due to recent market gains, the remaining assets’ value has significantly increased, surpassing the initial amount stolen.

This development suggests that the Bitrue Drainer continues to hold a fortune far exceeding the value of the originally stolen funds, despite the large-scale liquidations that have taken place.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Shiba Inu ($SHIB) has had a relatively modest week by its standards, posting a gain of just 2.64% over the last 7 days as it currently trades around the $0.000033 mark.

However, over the last 30 days, it is 247% up and has outperformed most rival cryptocurrencies, including Dogecoin ($DOGE).

Meanwhile, Zap Protocol ($ZAP), which was launched back in 2018, has enjoyed a rally of around 110% over the last 7 days – and it’s poised to breach the $0.01 barrier in the coming days or even just hours.

Despite its recent rally, Zap’s token still just has a market cap of less than $2 million and it would deliver a 100x return if it were to return to its all-time high.

Shiba Inu and Zap Protocol Price Prediction

Despite SHIB encountering some resistance and trading somewhat sideways for the last week, the memecoin is in a good position to capitalize on growing interest in the crypto space and breach the $0.00004 mark sometime in March.

In the longer term, we expect SHIB to at least recover to its all-time high – which would deliver a 100% return at the current entry price.

ZAP token, on the other hand, is well positioned to rally as high as the $0.02 mark before the end of March, delivering a circa 150% return on investment at the current entry price of circa $0.0075.

By the end of 2024, we expect Zap Protocol’s token to be trading between $0.20 and $0.45, although this is contingent on Bitcoin continuing to enjoy a strong run, buoyed by the recent approval of spot Bitcoin ETFs in the US.

Both SHIB and ZAP are attractive tokens to buy in the current bull market, and it would be wise to simultaneously allocate capital to both of these tokens – plus Bitcoin – to give your portfolio a degree of balance.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The London Stock Exchange (LSE) is gearing up to broaden its financial product offerings by incorporating crypto exchange-traded notes (ETNs) for Bitcoin and Ether.

This significant development is set to unfold in the second quarter of 2024, with the LSE poised to start receiving applications for these novel ETNs.

The announcement made on March 11 delineates a strategic move towards embracing the burgeoning realm of cryptocurrency within the established frameworks of traditional financial markets.

The LSE has outlined specific criteria for the admission of crypto ETNs in its recently published Crypto ETN Admission Factsheet.

Although an exact commencement date for accepting applications has not been disclosed, the exchange has made clear its requirements.

For an ETN to be considered, it must be physically backed by Bitcoin or Ether and refrain from leveraging.

A critical stipulation is the transparent availability of the market price or value of the underlying crypto asset.

Furthermore, the crypto assets backing the ETNs must be securely stored, preferably in cold wallets, and the custodians of these assets must comply with Anti-Money Laundering legislation from the UK, EU, Switzerland, or the US.

READ MORE: Grayscale and Coinbase Meet with SEC to Push for Spot Ether ETFs

ETNs, defined by the exchange as debt securities linked to an underlying asset, offer investors an opportunity to engage with the performance of cryptocurrencies within regulated trading hours.

This method presents a less direct approach compared to exchange-traded funds (ETFs), with ETNs being backed by issuer’s credit rather than a collective pool of assets, and is viewed as a softer alternative for those seeking exposure to crypto assets.

Parallel to the LSE’s initiative, the UK’s Financial Conduct Authority (FCA) has also indicated a willingness to accommodate Recognised Investment Exchanges (RIEs) wishing to establish market segments for crypto-backed ETNs, albeit restricted to professional investors.

This category encompasses authorized or regulated credit institutions and investment firms.

The FCA emphasizes the need for stringent controls to safeguard investors and mandates adherence to the UK’s listing regime, including ongoing disclosure and the provision of prospectuses.

Despite this openness towards institutional engagement with crypto-backed ETNs, the FCA maintains a cautious stance towards retail investors, citing the high-risk nature of cryptoassets.

The authority has reiterated its position that such investments are not suitable for the retail market, warning of the potential for total loss and underscoring the largely unregulated status of cryptoassets.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.