In today’s interconnected world, businesses need agile and innovative financial solutions to thrive in a competitive landscape. Enter the startup Banxe, the trailblazing online bank offering a plethora of advantages for businesses looking to streamline their financial operations and unlock new growth opportunities. Let’s explore the service and understand more about what they offer.

What is Banxe?

Banxe distinguishes itself in the competitive financial services sector by offering a unique combination of traditional banking conveniences and advanced cryptocurrency solutions. It purports to deliver a seamless and secure banking experience—supported by its comprehensive suite of tools tailored to streamline financial operations, covering everything from multi-currency payments to cryptocurrency transactions.

Based on reviews, Banxe’s services strictly adhere to regulatory standards, hold licenses in various countries and uphold the highest levels of security and reliability. Their reputation for excellence is further bolstered by industry recognition and positive client testimonials, underscoring its status as a reputable partner in the evolving landscape of financial technology. Clients can seemingly rely on its innovative solutions, integrity and dedication to meeting their diverse financial needs.

Multi-Currency Payment Account with IBAN

Banxe empowers businesses with a multi-currency payment account complete with IBAN, facilitating effortless management of international transactions. Whether sending payments to suppliers abroad or receiving funds from global clients, businesses can navigate cross-border payments with ease, eliminating the complexities associated with currency conversion and ensuring seamless transactions across borders.

Corporate Cryptocurrency Wallet

Embracing the digital revolution, Banxe crypto offers businesses a corporate cryptocurrency wallet that supports over 350 cryptocurrencies. From Bitcoin to Ethereum and beyond, businesses can diversify their payment options and engage in a wide range of transactions, including investments, cross-border payments and vendor settlements.

Mass Payment

Efficiency is key in business operations, and the startup Banxe’s mass payment feature delivers just that. Streamline payroll processing, vendor payments and affiliate payouts with ease, sending funds to multiple recipients in just a few clicks. Whether processing bulk payments for employees or dispersing royalties to content creators, Banxe’s mass payment feature simplifies complex financial tasks.

Crypto Processing

As cryptocurrency adoption continues to soar, Banxe crypto empowers businesses to embrace the future of payments with its Crypto Processing solution. Securely accept cryptocurrency payments from customers worldwide, expanding your customer base and staying at the forefront of digital payment trends.

Regulatory Compliance & Accolades

Banxe’s commitment to excellence extends beyond its innovative suite of financial solutions, as the services provided on the platform hold regulatory licenses in various countries. From the UK Financial Conduct Authority to regulatory bodies in Europe, Southeast Asia and beyond, Banxe operates with integrity and compliance, ensuring the highest standards of security and trust for its users.

In addition to its regulatory licenses, the services provided by Banxe have garnered recognition in the industry for their innovative contributions to financial technology. From prestigious awards honoring its cutting-edge solutions to glowing testimonials from satisfied clients in reviews, Banxe has solidified its reputation as a trusted partner for businesses seeking modern financial solutions.

In conclusion, opening a business account with Banxe offers unparalleled advantages for businesses of all sizes. From seamless international transactions to cutting-edge cryptocurrency solutions, the startup Banxe empowers businesses to thrive in a rapidly evolving financial landscape. It’s definitely worth exploring their service as a possible partner for your business.

In a startling revelation, Bryan Pellegrino, the co-founder and CEO of LayerZero, has publicly accused Kyle Davies, co-founder of the now-collapsed Three Arrows Capital (3AC), of attempting to sway his company into transferring its entire treasury to 3AC shortly before its liquidation.

Pellegrino made these claims in a response to Davies’ comments on a podcast, via an X post.

According to Pellegrino, Davies sought to secure LayerZero’s treasury by “promising better rates than other borrowers as a last-gasp effort,” showcasing a desperate move ahead of 3AC’s financial turmoil.

The accusations surfaced after Davies, on the Unchained YouTube interview podcast, refrained from issuing an apology to investors for 3AC’s downfall, sparking controversy.

Pellegrino’s assertions shed light on 3AC’s strategy of soliciting loans from various entities despite its impending insolvency, a tactic Pellegrino criticized for exploiting personal and professional relationships, including those with prominent figures like BitMex co-founder Arthur Hayes.

The crypto community and observers have rallied behind Pellegrino, condemning Davies’ conduct and the broader implications of 3AC’s practices, which relied on deceitful loan acquisition.

The backlash also saw X users, including @basedkarbon, criticizing Davies’ lack of tact in handling the situation.

Three Arrows Capital, founded by Davies and Su Zhu in 2012, managed an impressive $10 billion in assets by 2021.

However, the firm’s fortunes plummeted to $3 billion by April 2022, primarily due to the catastrophic fallout from the TerraUSD stablecoin crash, triggering a widespread crypto market crash.

The firm’s decline culminated in a Chapter 15 bankruptcy filing on July 1, 2022, as it sought to shield its assets from creditors amidst a dire financial crisis.

The collapse of 3AC had a profound impact, ensnaring numerous investors and companies in its wake. The bankruptcy proceedings revealed debts amounting to $3.5 billion owed to 27 entities, including a staggering $2.3 billion to Genesis Global Trading.

The fallout also severely affected Blockchain.com and Voyager Digital, with the latter filing for Chapter 11 bankruptcy after being unable to recover approximately $670 million loaned to 3AC.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Bitcoin has recently experienced a significant pullback, dropping over 10% from its all-time high, amidst signs of slowing demand for spot Bitcoin exchange-traded funds (ETFs).

Bloomberg reported on Friday that analysts from JPMorgan Chase and Co. are cautioning that this downward trend could continue.

This sentiment is reflected in the substantial outflows from a group of 10 spot Bitcoin ETFs, marking the largest four-day withdrawal since these products were launched on January 11.

As it stands, Bitcoin is navigating through one of its most challenging weeks this year, with a 4% decrease in value, and is currently trading at approximately $65,400.

JPMorgan strategists, including Nikolaos Panigirtzoglou, are maintaining their stance that Bitcoin remains overbought.

They had previously forecasted in February that the cryptocurrency’s price could face further declines, especially with the approaching halving event in April, which will cut the supply of Bitcoin from mining.

These strategists point to the combination of sustained open interest in CME Bitcoin futures and the dwindling ETF flows as clear bearish indicators.

They noted, “The pace of net inflows into spot Bitcoin ETFs has slowed markedly, with the past week seeing a significant outflow.

“This challenges the notion that the spot Bitcoin ETF flow picture is going to be characterized as a sustained one-way net inflow.”

They anticipate continued profit-taking as the halving event nears, especially given the current overbought market positioning.

Moreover, last month, JPMorgan predicted a potential decline in Bitcoin’s price to around $42,000 post-April, as the excitement around the halving event fades.

Despite reaching a peak of nearly $73,798 on March 14, the enthusiasm among retail traders appears to be diminishing, as highlighted by Naeem Aslam, chief investment officer at Zaye Capital Markets.

He remarked, “The fact that the rally didn’t really take off from the all-time high like before made many question the strength of the rally.”

Conversely, investment firm Bernstein has upgraded its year-end forecast for Bitcoin to $90,000 from $80,000, buoyed by the cryptocurrency’s recent performance and the initial reception to new spot BTC ETFs.

Analysts Gautam Chhugani and Mahika Sapra from Bernstein have expressed optimism, citing the onset of a new BTC bull cycle, robust inflows into ETFs, expansion of miner capacity, and record miner revenues.

These elements collectively bolster the attractiveness of Bitcoin miners as investment avenues for equity investors interested in the cryptocurrency space, even as Bernstein revises its expectations for the April halving event.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In a landmark case, Jian Wen, a former hospitality worker, has been convicted of money laundering in a UK court specializing in significant fraud cases, following the discovery of a staggering $2.5 billion in Bitcoin under her control.

The Southwark Crown Court’s ruling came after a detailed investigation into Wen’s financial activities, which included the purchase of luxury properties and expensive jewelry.

This investigation examined 48 electronic devices and thousands of files, many in Mandarin, the BBC reported.

Wen’s sudden shift in lifestyle from residing above a Chinese restaurant to renting a lavish six-bedroom house in North London, with a monthly rent of $21,420, signaled the authorities to her trail.

Moreover, her attempt to buy a $30 million mansion in London was a critical lead that prompted further scrutiny by the officials, Cointelegraph noted.

Wen’s ambitious real estate ventures in London, coupled with her inability to pass money-laundering checks despite claiming substantial earnings from Bitcoin mining, raised suspicions.

READ MORE: Bitcoin Futures Volatility Surges: Open Interest Hits $36 Billion Amid Price Fluctuations

The UK police branded the case as the largest Bitcoin seizure in the country, with Wen convicted for her involvement in a money laundering arrangement, awaiting sentencing on May 10.

Chief Crown Prosecutor Andrew Penhale stressed the growing use of cryptocurrencies like Bitcoin in criminal operations, facilitating asset disguise and transfer by fraudsters.

Contrary to the authorities’ stance on cryptocurrencies being widely used for money laundering, a recent US Treasury Department report argued that cash remains the preferred medium for such illicit activities, due to its anonymity and stability.

Adding to the discourse, Nasdaq’s “Global Financial Crime Report” shed light on the financial crime landscape, noting that approximately $3.1 trillion in illicit funds circulated through the global financial system in 2023.

Interestingly, the report did not specifically mention Bitcoin or cryptocurrencies, indicating a broader perspective on financial crime beyond the digital currency realm.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

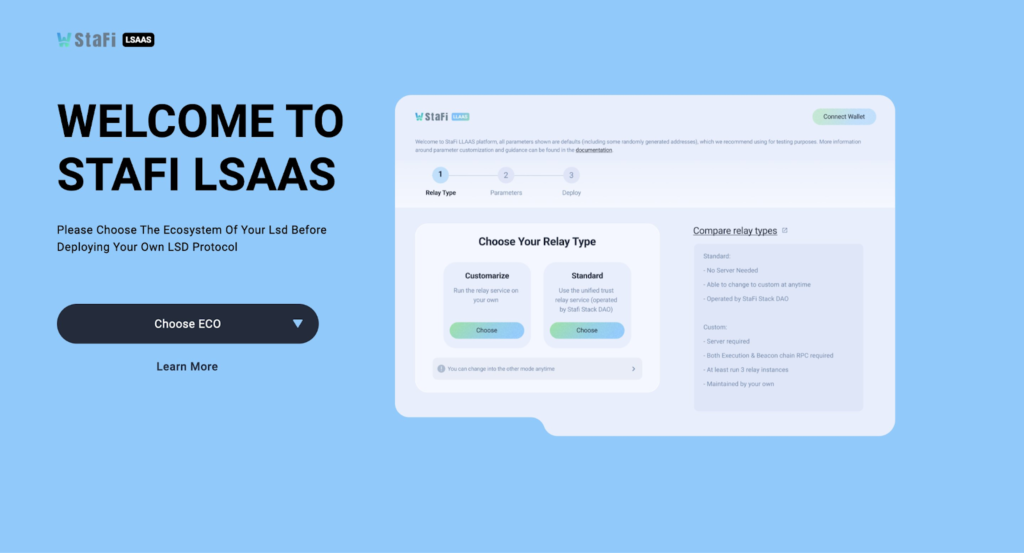

Multichain liquid staking platform StaFi is launching its Liquid Staking as a Service (LSAAS) testnet, in anticipation of its mainnet launch, StaFi 2.0. The latest iteration of its liquid staking platform will introduce a host of new features to push the protocol as the leading infrastructure solution for Ethereum-based and Cosmos blockchain staking.

Since its launch, StaFi has created solutions to extend liquid staking across multiple blockchains. With the current liquid staking model only servicing single blockchains, such as Lido Finance for Ethereum staking only, the StaFi 2.0 launch will allow users to stake on multiple blockchains. This is expected to unlock greater utility and economic rewards for stakers while enhancing blockchain security across multiple blockchains.

As StaFi co-founder Liam Young explained during the unveiling of the LSAAS testnet launch, the launch of its testnet will “provide a major boost for Layer 1 blockchains’ security” as well as “opening new opportunities for yield generation”.

“The launch of the StaFi 2.0 testnet is a major milestone in our journey to mainnet,” he continued. “The future of blockchain development is intertwined with liquid staking. StaFi 2.0 will play a crucial role in realizing that vision through pioneering Liquid Staking as a Service.”

The testnet supports liquid staking derivatives (LSD) for leading Layer 1 ecosystems such as Ethereum, EVM layer2s, and Cosmos. The CosWasm LSD framework supports diverse deployment approaches including Neutron, the native smart contract platform secured by Cosmos. StaFi 2.0 also supports native Cosmos chain deployment.

Notwithstanding, the LSAAS framework will also accelerate the development and upgrades of LSD innovations. It will facilitate the rapid deployment of highly secure and capital-efficient LSDs on layer1 and layer2 blockchains, opening the platform to more staking options and products.

Following the launch of StaFi’s LSAAS testnet, users on the platform can start experimenting with innovative LSD products and experience the convenience of being able to access Liquid Staking as a Service.

A successful testnet period will be followed by the unveiling of the StaFi 2.0 mainnet and a later launch of the innovative LRT Stack to power new re-staking applications. The timeline for the LRT unveiling is yet to be confirmed.

StaFi 2.0 will be a revolutionary liquid staking upgrade, transforming the platform into an infrastructure layer for stakers and LSD products. Additionally, it will support multiple virtual machines (VMs) including EVM and WASM, aiming to pioneer a new staking mechanism for the billion-dollar liquid staking industry and bring re-staking to several Layer 1 and Layer 2 blockchains.

As users and developers test and familiarize themselves with the LSAAS testnet, developers from StaFi will acquire the necessary information needed to further innovate the platform before its mainnet launch. It will allow further developments and bug fixes based on users’ feedback ahead of its mainnet launch schedules for Q3 later this year.

The United States Securities and Exchange Commission (SEC) has once more deferred its decision on the Grayscale Ethereum Futures Trust exchange-traded fund (ETF) application.

Initially set for March 31, the SEC pushed back the deadline to May 30, allowing more time to evaluate the application and address the concerns it raises.

This postponement follows a previous delay in December 2023, when the SEC sought further public feedback on the proposed ETF, which aims to invest in Ethereum futures contracts.

The SEC’s hesitance to make a swift decision underscores its cautious approach, emphasizing the need for thorough consideration: “The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein.”

Grayscale’s push for the Ethereum Futures Trust ETF began in September 2023, seeking permission to list and trade shares under the New York Stock Exchange Arca Rule 8.200-E.

Bloomberg ETF analyst James Seyffart suggests that Grayscale’s move is strategic, using the futures ETF bid to potentially sway the SEC towards approving a spot Ether ETF.

According to Seyffart, approval of the futures ETF could strengthen Grayscale’s case for its spot Ether ETF.

READ MORE: Bitcoin Rallies Amid Fed’s Interest Rate Decision, Showcasing Resilience Against ETF Outflows

The SEC’s deliberation on Grayscale’s spot Ether ETF also lingers, with a decision postponed on January 25, following the call for public comments.

This delay reflects growing skepticism within the crypto community about the SEC’s stance on cryptocurrency-based ETFs, heightened by the approval of spot Bitcoin ETFs on January 10.

Industry observers, like Capital founder John Lo, anticipate increased scrutiny from the SEC on all forthcoming crypto-based ETF applications, particularly those related to Ether.

Lo remarks, “Scrutiny towards cryptocurrency ETFs has only grown… No doubt, the SEC internally views that as a huge loss for themselves,” referring to the SEC’s perceived forced approval of Bitcoin ETFs after its litigation with Grayscale.

The SEC’s cautious stance extends beyond Grayscale, affecting other asset management giants like BlackRock and Fidelity.

In early March, the SEC announced delays in deciding on BlackRock’s iShares Ethereum Trust and Fidelity’s Ethereum Fund, indicating a broader pattern of regulatory hesitation towards Ethereum ETFs.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

SEC Chair Gary Gensler recently highlighted the evasion of registration requirements by certain entities within the cryptocurrency industry.

In remarks prepared for a Columbia Law School event on March 22, Gensler emphasized the importance of transparency and regulatory compliance, invoking the words of Supreme Court Justice Louis Brandeis: “Sunlight is said to be the best of disinfectants.”

Gensler criticized the reluctance of some crypto market participants to adhere to the SEC’s disclosure regulations, pointing out that such avoidance leads to a lack of mandatory disclosure.

“There still are those who would like to whittle away at the SEC’s disclosure regime,” he remarked. Highlighting the opacity within the crypto sector, Gensler added, “There are participants in crypto securities markets that seek to avoid these registration requirements.

No registration means no mandatory disclosure. Many would agree that the crypto markets could use a little disinfectant.”

This stern critique comes amid the SEC’s active enforcement actions against prominent cryptocurrency companies, including Kraken, Binance, Ripple, and Coinbase.

The ongoing legal battles and the demand from crypto businesses and advocacy groups for clearer regulations underscore the tension between innovation and regulatory compliance in the United States.

Moreover, the SEC’s efforts to bring cryptocurrencies under its regulatory scope have intensified, with moves to potentially classify Ether as a security.

The past two years have seen the SEC making significant strides in approving cryptocurrency-related exchange-traded products (ETPs) for U.S. exchanges.

These advancements include investment vehicles based on ETH and Bitcoin futures, as well as the launch of the first spot BTC exchange-traded funds (ETFs) in January.

Gensler’s comments reflect a broader regulatory initiative to ensure transparency and investor protection in the rapidly evolving crypto industry, amidst calls for a balanced approach that fosters innovation while ensuring market integrity.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Bitcoin investors often crave the excitement of market volatility but usually find the reality less thrilling, especially when a surge in prices is swiftly followed by a sharp downturn.

This often results in forced liquidations of futures contracts, exacerbating the fall in Bitcoin’s value.

The Bitcoin futures market, vital for traders wanting to leverage their positions, grows in significance with its expansion, influencing Bitcoin’s price more markedly.

Recently, the aggregate open interest in Bitcoin futures soared to an all-time high of $36 billion on March 21, a significant increase from $30 billion just two weeks earlier.

Leading the charge, the Chicago Mercantile Exchange (CME) recorded $11.9 billion in open interest, overshadowing the inflow to U.S. spot Bitcoin exchange-traded funds (ETFs) since their launch.

Despite the advent of spot ETFs—which some expected would dampen volatility given their $3 billion average daily trading volume—Bitcoin’s volatility has escalated, contrary to these expectations.

Over the last four weeks, Bitcoin’s 30-day volatility index shot past 80%, the highest in over 15 months, starkly contrasting with the lower volatility seen in traditional markets and even in stocks known for their unpredictability.

This heightened volatility was highlighted by a dramatic price correction on March 19, followed by a significant recovery the next day, leading to substantial liquidations in the futures market.

Such volatility not only affects traders but also impacts the general perception of Bitcoin’s risk and its market trajectory.

READ MORE: Bitcoin Rallies Amid Fed’s Interest Rate Decision, Showcasing Resilience Against ETF Outflows

The futures market serves as a double-edged sword, offering opportunities for leveraged positions but also presenting risks of sharp corrections and liquidations.

This dynamic can lead to short-term buying pressure if the market reverses from bearish bets, contributing to the observed volatility.

Some analysts point to excessive leverage or market manipulation as causes, with instances where market movements in related sectors seemingly coincide with major Bitcoin price shifts, though the motivations behind such movements remain speculative.

To understand the impact of futures on Bitcoin’s price, examining the premium on monthly contracts is crucial.

These contracts, favored by professional traders for their lack of a funding rate, command a significant premium over spot prices, reflecting market sentiment.

Despite a recent price dip, the sustained high premium on futures contracts indicates a bullish stance among traders, yet the risk of forced liquidations looms large, especially with the substantial open interest in the market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The United States Securities and Exchange Commission (SEC) has decided to postpone its verdict on the introduction of spot Ether exchange-traded funds (ETFs) proposed by Hashdex and ARK 21Shares.

The delay, announced on March 19, occurred shortly before the SEC’s third and final deadline for these applications, setting the stage for a conclusive decision in late May.

The SEC has scheduled May 24 for its final determination on ARK 21Shares’ application and May 30 for Hashdex’s, marking a critical period for the future of Ether ETFs.

This postponement reflects growing skepticism among analysts about the approval prospects for the eight Ether ETF proposals currently on the table from major firms including BlackRock, Grayscale, Fidelity, Invesco Galaxy, VanEck, Hashdex, and Franklin Templeton.

Bloomberg ETF analyst James Seyffart expressed a shift in optimism on March 19, citing a notable decrease in engagement between the SEC and the ETF issuers, leading him to anticipate likely denials of the applications by May 23.

Similarly, analyst Eric Balchunas adjusted the approval probability for Ether ETFs downward to 35%, highlighting a contrast in the SEC’s approach compared to the spot Bitcoin ETF applications, which experienced more open communication.

The public’s confidence in the approval of Ether ETFs by the end of May has also waned, as indicated by Polymarket odds which have fallen to 32% from January’s more hopeful 77%.

Polymarket, a decentralized betting platform, has seen around $2.2 million wagered on the outcome of these ETF decisions.

In a related development, Grayscale is exploring the addition of staking capabilities to its Ether ETF application.

Through a consent solicitation statement to Grayscale Ethereum Trust investors, the firm proposed enabling the trust to engage in proof-of-stake validation protocols, potentially providing consideration for the benefit of shareholders.

This move aims to counteract inflationary pressures from Ethereum’s proof-of-stake protocol and keep pace with competing products offering staking.

The proposals, requiring approval from over 50% of shareholders, could position Grayscale alongside ARK 21Shares, Franklin Templeton, and Fidelity, who have recently incorporated Ether staking into their ETF offerings.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Starbucks has announced the discontinuation of its NFT rewards initiative, the “Odyssey Beta program,” slated to end on March 31.

This unique program engaged customers with coffee-themed games and challenges, rewarding them with digital collectible stamps as non-fungible tokens (NFTs).

These NFTs offered exclusive benefits and interactive experiences.

With the closure, the marketplace for trading these digital stamps and the company’s community discord server will also be discontinued.

Nevertheless, the Odyssey marketplace will pivot to the Nifty marketplace, allowing the ongoing trade and transfer of Odyssey stamps.

This termination aligns with Starbucks’ broader strategic shifts, although specific reasons for the program’s end were not disclosed.

The company hinted at preparing for future developments in their statement, indicating a strategic realignment.

READ MORE: Prosecutors Reveal Sam Bankman-Fried’s Plan to Rehabilitate Image Post-FTX Collapse

Launched amidst a tumultuous period for the cryptocurrency sector in September 2022, the Odyssey program was a foray into the NFT world during a time marked by significant downturns in the crypto industry, including the collapses within the Terra-Luna ecosystem and the challenges faced by Celsius and FTX.

Starbucks chose the Polygon network for its lower energy consumption, showcasing a preference for sustainability in its digital endeavors.

The decision by Starbucks reflects a growing trend among corporations to step back from NFT ventures. Notable examples include GameStop’s withdrawal from its NFT marketplace and Meta’s (formerly Facebook) cessation of NFT features on its platforms.

More recently, X (formerly Twitter) eliminated the option for premium users to showcase NFT images as profile pictures.

As the NFT market continues to evolve, industry leaders offer optimistic forecasts for its potential in 2024. Vineet Budki, CEO of Cypher Capital, predicts a shift towards NFTs serving practical, real-world applications.

Similarly, Oh Thongsrinoon of Altava Group envisions NFTs breaking out from their current digital confines into tangible sectors like precious metals and real estate.

Amidst these developments, the NFT market has shown signs of revival, with a significant uptick in trading volume and record-breaking sales on the Bitcoin network, highlighting a renewed interest and the dynamic nature of this digital asset class.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.