Institutional investment in Bitcoin mining by large public companies has notably impacted the landscape for individual and small-scale miners, with significant consequences for the network’s dynamics, according to a Bitfinex report on the cryptocurrency mining ecosystem ahead of the Bitcoin halving.

The study reveals a shift from the decentralized vision of Bitcoin, where individuals contributed to network security, to a scenario dominated by corporate entities.

These entities prioritize shareholder returns, operating on a much larger scale with different priorities than smaller miners.

The report emphasizes their focus on profitability and managing investor expectations, often sidelining the community’s more altruistic values such as network security, egalitarian access, and censorship resistance.

The entry of Wall Street funding into Bitcoin mining has professionalized the sector, leading to increased hashing power that could theoretically enhance network security and stability.

However, concerns arise about centralization and corporate influence, which could diverge from Bitcoin’s original ethos of being open, borderless, and resistant to control by any single entity.

The Bitfinex analysis notes that the consolidation of mining operations by these large companies could potentially threaten Bitcoin’s decentralized nature, as they are able to scale operations more effectively, secure cheaper energy, and invest in the latest technologies, making it difficult for smaller miners to compete.

The infusion of institutional capital has altered the incentive structure within the network, favoring those who can operate on a large scale.

This shift raises questions about the future of Bitcoin’s decentralized ethos and whether the increased centralization could impact network security and the distribution of mining rewards.

The survival of independent and hobbyist miners now depends on their ability to innovate and collaborate.

Mining pools are suggested as a solution, allowing for the pooling of resources to stay competitive.

Moreover, the sustainability of hobby mining is contingent on the development of more efficient mining technologies and the utilization of renewable energy.

Geographical diversification of mining operations is also highlighted as vital for maintaining the network’s decentralization.

Emerging markets with renewable or untapped energy sources are seen as promising locations for new mining ventures.

The report concludes that, while the landscape is evolving, the core community values and decentralized nature of Bitcoin must be preserved to ensure the network’s integrity and resilience.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The Shiba Inu cryptocurrency experienced a 7% increase in its value over the last 24 hours, with its price reaching $0.00002995 at 03:51 a.m. EST, based on a trading volume that saw a 42% rise to $2.2 billion.

This surge comes as SHIB successfully breached the $0.00003 price mark, boasting a 211% rise within just 30 days, hinting at a potential rebound to its annual peak of $0.00004563, recorded on March 5.

March was a significant month for Shiba Inu, marked by considerable gains and a stark increase to a resistance level at $0.00004568.

However, facing resistance led to a correction, mirroring a broader market downtrend.

Despite this, SHIB supporters have rallied from lower support levels, notably around $0.000020, propelling the cryptocurrency above a declining wedge pattern.

This movement is backed by a broader market recovery, fueling bullish momentum.

Technical indicators underscore the bullish outlook, with Shiba Inu standing above both the 50-day and 200-day Simple Moving Averages (SMAs), indicating sustained upward momentum.

The Relative Strength Index (RSI) reflects this optimism, showing a rebound from the 50-midline level at 56, aligning with SHIB’s breakout above the falling wedge pattern’s upper boundary.

The Moving Average Convergence Divergence (MACD) presents a bullish narrative as well, with a blue line crossover above the orange signal line, further affirmed by rising green bars on the histogram indicating positive momentum.

These indicators suggest a strong bullish bias, with targets set beyond the immediate resistance towards $0.000040.

However, there remains a risk of bearish pressure that could see prices retract to support levels if current momentum wanes.

Amidst this climate, Dogecoin20 emerges as a noteworthy mention, with its launch scheduled for April 20, following a highly successful presale phase that quickly raised $10 million.

Dogecoin20, viewed as an evolution of the DOGE meme coin, is anticipated to outperform predecessors like Shiba Inu and Dogecoin itself.

The project aims for environmental friendliness and introduces on-chain staking with a compelling 98% annual percentage yield (APY), allocating 15% of its 140 billion total token supply for staking rewards over two years.

Marking April 20 as International Doge Day, the Dogecoin20 team aligns its launch with a day celebrated by enthusiasts, offering a strategic investment window for those eager to participate.

The presale’s extension provides a final opportunity to purchase DOGE20 tokens at $0.00022 each, with transactions facilitated through ETH, USDT, or bank cards, urging quick action from interested investors before the close.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Attention all thrill-seekers and speed demons: the clock is ticking, and the race is on! Cardano Racers, the pulse-pounding NFT gaming project set to dominate the Cardano blockchain, is about to close the doors on its exclusive whitelist presale – but fear not, because the ride is far from over.

With the whitelist presale winding down, now is your final opportunity to secure your spot on the starting grid as the public presale kicks into high gear. But don’t wait too long, because once the public presale ends, the discounts disappear, and the prices go back to normal.

On March 28, 2024, at 10:30 PM UTC, the gates will swing open for the public presale, giving adrenaline junkies from around the globe the chance to join the race and experience the thrill of Cardano Racers for themselves. And with prices discounted by a huge 25% off normal prices, there has never been a better time to fuel your passion for NFTs and blockchain gaming.

To secure your spot in the public presale, simply head over to www.cardanoracers.com/presale and prepare to embark on the ride of a lifetime. From high-speed racers to adrenaline-fueled thrill-seekers, there’s a place for everyone in the Cardano Racers community – and it’s waiting for you to claim your spot on the starting grid. More details can be found by joining our discord group at Cardano Racers.

But that’s not all – the excitement is set to reach new heights on March 31, 2024, as Cardano Racers speeds towards its mainnet release. With the target date just around the corner, the countdown to history in the making has officially begun.

So don’t miss your chance to be a part of the action – join the revolution today and let the racing begin! With Cardano Racers, the future of NFTs has never looked faster, fiercer, or more exhilarating. Strap in, rev your engines, and get ready to experience the ride of a lifetime.

The race to greatness starts here – are you ready to ride? Stay ahead of the curve with Cardano Racers! Follow us on X @CardanoRacers or join our Discord group Cardano Racers for the latest updates and exclusive sneak peeks. Don’t miss out on the ultimate racing revolution – your journey to victory starts now! www.cardanoracers.com/presale

In the recent financial landscape, the United States spot Bitcoin exchange-traded funds (ETFs) have witnessed a remarkable resurgence in investment, marking a significant turnaround after experiencing a series of net outflows over five days.

This rejuvenation was particularly evident on March 26, when the 10 newly sanctioned spot Bitcoin ETFs collectively attracted a net inflow of $418 million, as reported by Farside Investors data.

Among these, BlackRock’s and Fidelity’s funds were at the forefront, channeling robust inflows that underscored investor confidence.

Fidelity’s Bitcoin ETF, in particular, showcased its strongest daily inflow since March 13, securing an impressive $279.1 million on March 26.

This surge was accompanied by the acquisition of an additional 4,000 BTC, marking the fund’s second day of inflows surpassing the $260 million threshold.

Meanwhile, BlackRock’s Bitcoin ETF also drew significant attention with inflows of $162.2 million, despite these figures not matching the higher inflow rates seen earlier in the month, which averaged over $300 million daily.

The investment enthusiasm extended beyond these two giants, with the Ark 21Shares Bitcoin ETF recording its most substantial day since March 12, amassing $73.6 million in inflows.

Similarly, Invesco Galaxy, Franklin Templeton, and Valkyrie each experienced inflows exceeding $26 million in their respective funds.

In contrast, Grayscale’s Bitcoin Trust (GBTC) faced a significant outflow of $212 million on the same day.

Despite this, the cumulative net inflows into other funds overwhelmingly counteracted GBTC’s losses.

Since transitioning from a trust to an ETF on January 11, Grayscale has witnessed a dramatic reduction of 277,393 BTC, equating to an approximate value of $19.5 billion.

Highlighting the significance of these developments, Bloomberg’s senior ETF analyst Eric Balchunas pointed out the inclusion of Bitcoin ETFs among the largest 30 asset funds within their initial 50 days of trading in a post on X (formerly Twitter) on March 26.

BlackRock’s IBIT and Fidelity’s FBTC stood out, with Balchunas noting their exceptional performance.

He also mentioned that the Bitwise Bitcoin ETF, despite being the 18th largest in terms of assets under management, surpassed the world’s largest SPDR Gold Shares fund in size.

Adding to the evolving Bitcoin ETF landscape, Hashdex emerged as the 11th issuer of spot Bitcoin ETFs in the U.S. on March 26, transitioning its futures fund into a spot product now trading under the ticker DEFI.

This strategic move further underscores the growing embrace and diversification of Bitcoin-related investment products in the financial market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Texas-based Bitcoin miner Giga Energy has taken a significant step towards global expansion by establishing operations in Argentina, leveraging the often-wasted energy from natural gas flaring in the country’s oil fields.

Brent Whitehead, Giga’s co-founder, expressed enthusiasm about this venture in a LinkedIn post on March 26, highlighting it as a pivotal development for the company.

He stated, “This move not only broadens our operational landscape but also aligns with our vision to mitigate flaring globally.”

The process of gas flaring involves burning off the natural gas that emerges during oil extraction, releasing methane.

Giga Energy’s innovative approach converts this methane into electricity, which is then used to power its Bitcoin mining rigs.

A novel aspect of Giga’s operation in Argentina involves placing a large shipping container filled with Bitcoin miners atop an oil well, using the excess gas to generate electricity for mining activities.

This system, as reported by CNBC on March 26, is set to significantly enhance Giga’s mining capabilities.

Located in the province of Mendoza, Giga’s Argentinian mining site began testing in December and has mined Bitcoin worth between $200,000 and $250,000.

Despite this early success, co-founder Matt Lohstroh told CNBC that the operation is awaiting the importation of additional equipment to fully scale its activities and achieve profitability.

READ MORE: Bitcoin Surges Past $71,000 as Whales Accumulate, Pre-Halving Dip Possibly Over

Argentina is notable for having the world’s second-largest shale gas reserve, a factor that underscores the potential of Giga’s venture in the country.

Beyond economic benefits, the operation aims to reduce methane emissions, contributing to environmental sustainability.

Brent Whitehead emphasized the ecological impact, noting that by harnessing stranded natural gas for energy-intensive computing, Giga is actively reducing global methane emissions.

Collaborating with IT services company Exa Tech for onsite operations and Phoenix Global Resources for gas supply, Giga Energy is set to make a considerable impact.

CMC Data: Bitcoin (BTC) – Ethereum (ETH) – Shiba Inu (SHIB) – Dogecoin (DOGE) – Fetch.ai (FET)

Since its inception in 2019, Giga has installed 150 megawatts of mining containers in Texas and Shanghai.

This expansion coincides with the anticipation of the Bitcoin halving event, expected to occur around April 20, which will reduce the mining reward and possibly shift global mining activities to regions with lower electricity costs.

Jaran Mellerud, founder and chief mining strategist at Hashlabs Mining, identified Argentina and Paraguay as promising locations for Bitcoin mining in South America, reflecting the strategic importance of Giga Energy’s new venture.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Binance, the leading cryptocurrency exchange, is set to discontinue the support for deposits and withdrawals of USD Coin (USDC) tokens based on the TRC-20 protocol from the Tron blockchain, effective April 5.

This decision follows an announcement on February 20 by Circle, the issuer of USDC, regarding its move to halt the support for the stablecoin on the Tron network.

Circle’s choice is part of a broader strategy to maintain USDC’s reliability, transparency, and security. Alongside ceasing its support,

Circle also ceased the minting of USDC on Tron’s blockchain on the same date, with a plan to fully phase out its involvement with this network.

The impact of Circle’s decision extended to Binance, which, due to its significant trading volume, plays a crucial role in the cryptocurrency market.

Binance’s announcement to end TRC-20 USDC support came on March 25, providing a 12-day window for users to manage their assets accordingly.

Although Binance will stop facilitating deposits and withdrawals of TRC-20 USDC tokens, the platform will continue to support USDC trading activities beyond the cut-off date.

It’s important to note that this change will not affect USDC transactions over other blockchains supported by Binance, and the decision has garnered positive feedback within the crypto community on social media platform X.

Circle has not explicitly stated why it chose to withdraw support for Tron, mentioning only a continuous evaluation of blockchain platforms within its risk management strategy.

READ MORE: StaFi Liquid Staking Protocol Launches Testnet Awaiting StaFi 2.0 Mainnet Launch

In response to these developments, a Tron representative expressed to Cointelegraph that the blockchain was left in the dark about the specifics behind Circle’s decision and was not notified prior to the public announcement.

Amidst these changes, Tron is exploring innovative approaches to maintain its relevance and utility within the cryptocurrency ecosystem.

Notably, Tron’s founder, Justin Sun, has shared plans to implement a Bitcoin layer-2 solution aimed at introducing a “wrapped” version of Tether to the network.

This initiative is expected to bridge Tron directly with Bitcoin, potentially unlocking access to over $55 billion in Bitcoin network value.

Sun’s announcement outlines a roadmap for integrating stablecoins and tokens between Tron and Bitcoin, which could significantly enhance Bitcoin’s financial ecosystem.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In March, a significant movement of Arbitrum‘s ARB tokens into exchanges was observed, particularly following the release of a considerable volume of vested tokens.

Lookonchain, a blockchain data platform, reported on March 23 that four wallets had moved ARB tokens to exchanges, subsequent to a $2.32 billion token unlock on March 16.

Specifically, 11.34 million ARB tokens, valued at $18.5 million, were deposited into Binance across four transactions.

The crypto community has been divided over these transactions. One member did not see it as a negative indicator, while another expressed skepticism about ARB’s potential to appreciate.

This followed a previous instance where 11 whales deposited significant amounts of ARB into exchanges on March 18, after Arbitrum, a layer-2 blockchain initiative, unlocked $2.3 billion in tokens.

READ MORE: Hospitality Worker Convicted in UK’s Largest Bitcoin Money Laundering Case

The allocation included 673.5 million ARB for team and advisers, with another 438.25 million for investors, all released at once, raising concerns of a potential market dump.

Subsequent to the token release, ARB’s price trajectory has been downward. From a high of $2.22 on March 13, it fell to $1.84 by the unlock date, March 16.

The following week saw fluctuations, reaching a low of $1.48 and a high of $1.79, with a price of $1.70 at the time of reporting.

According to CoinGecko, this marked a nearly 29% decrease from its January 12 all-time high of $2.39.

This series of events and the market’s response have hinted at a potential continuation of the bearish trend.

Adding to the speculation, Token Unlocks, a vesting tracker, revealed that another 92.65 million ARB tokens are set to be released for advisers, the team, and investors on April 16, which could further impact the market dynamics.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The Bitcoin market may face a downturn following the anticipated halving event, fueled by a decrease in inflows to spot Bitcoin exchange-traded funds (ETFs) and a high volume of unrealized gains among traders, which could heighten bearish tendencies on Bitcoin’s value.

Julio Moreno, CryptoQuant’s head of research, highlighted that the selling pressure on Bitcoin is intensifying due to the profits not yet realized from its recent upsurge.

He warned that a forthcoming decline in spot Bitcoin ETF contributions could exacerbate this situation, adversely affecting Bitcoin prices.

Supporting Moreno’s viewpoint is the CryptoQuant’s net unrealized profit and loss (NUPL) indicator. A NUPL value of 0.7 is seen as a red flag, suggesting investors might be poised to cash in, potentially driving prices lower and amplifying sell-off activities.

On March 17, the NUPL indicator stood at 0.606, a slight increase despite recent price adjustments in the market.

Moreno elaborates on potential factors depressing prices, notably the deceleration in Bitcoin ETF acquisitions and entering the halving phase amid substantial unrealized gains by traders, prompting them to secure profits.

On the flip side, the recent performance of Bitcoin ETFs on March 14 marked a significant dip, recording one of its lowest net inflow days with only $132 million, showcasing an 80% reduction compared to preceding sessions.

Despite these bearish signals, the aftermath of the halving might not mirror the severity of past downturns.

James Butterfill from CoinShares posits that institutional investors’ strategy of portfolio rebalancing could mitigate volatility.

READ MORE: Momentum Shifts in Bitcoin Market as Institutional Outflows Slow and Optimism Grows for Future Highs

He notes a decrease in volatility from the last bull market in 2021 and a rise in prices surpassing previous peaks, attributing this to the stabilizing influence of portfolio adjustments.

The appeal of Bitcoin ETFs remains robust, with total net inflows crossing the $12 billion threshold on March 15.

The industry expects further growth as brokerage firms hasten their evaluation processes for offering Bitcoin ETFs to their clientele.

Additionally, investments through Bitcoin ETFs are softening the negative price impacts of miner sales preceding the halving, an event that slashes the reward for mining new Bitcoin blocks by half.

This year, the reward will decrease from 6.25 BTC to 3.125 BTC, although mining costs are projected to stay constant or even increase.

CoinShares anticipates the average post-halving production cost for miners to be around $37,856.

Butterfill comments on the pre-halving trend of miners liquidating part of their Bitcoin reserves for profit maximization, a practice evident in 2024 as well.

CryptoQuant’s data reveals a two-year low in miner reserves, with 1.81 million Bitcoin held as of March 15.

The Bitcoin halving, a deflationary mechanism occurring every four years, is expected around April 19, 2024, potentially altering the dynamics of Bitcoin mining and its market valuation.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Nick Spanos, a crypto veteran and the founder of Zap Protocol, has revealed that the blockchain project is close to finalizing a number of “huge deals.”

These landmark deals will incorporate some of Zap Protocol’s current offerings, which include ZapOracles, ZapDEX and ZapNFT.

Spanos, who also founded the Bitcoin Center NYC – the world’s first physical Bitcoin exchange – back in 2013, provided the update to Zap investors via the project’s official Telegram channel.

He also noted that he previously met with the President of Senegal, Macky Sall, and ZAP Protocol had agreed a pilot agreement with the country, before the Central bank of West Africa blocked the deal.

This comes amid increased bullish sentiment for Zap’s token, which trades on Bitrue and a number of decentralized exchanges.

Specifically, Zap has rallied over 160% in the last month, reaching $0.0084 according to CoinMarketCap data.

Despite the rally, the token’s market cap stands at just $2 million, meaning Zap has huge upside potential and is poised to rally in line with the broader cryptocurrency market, even without any project-specific bullish catalysts.

A conservative price prediction is for Zap to reach $0.25-$0.65 before the end of 2024, and potentially breach the $1 mark if a few project-specific catalysts come to fruition.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

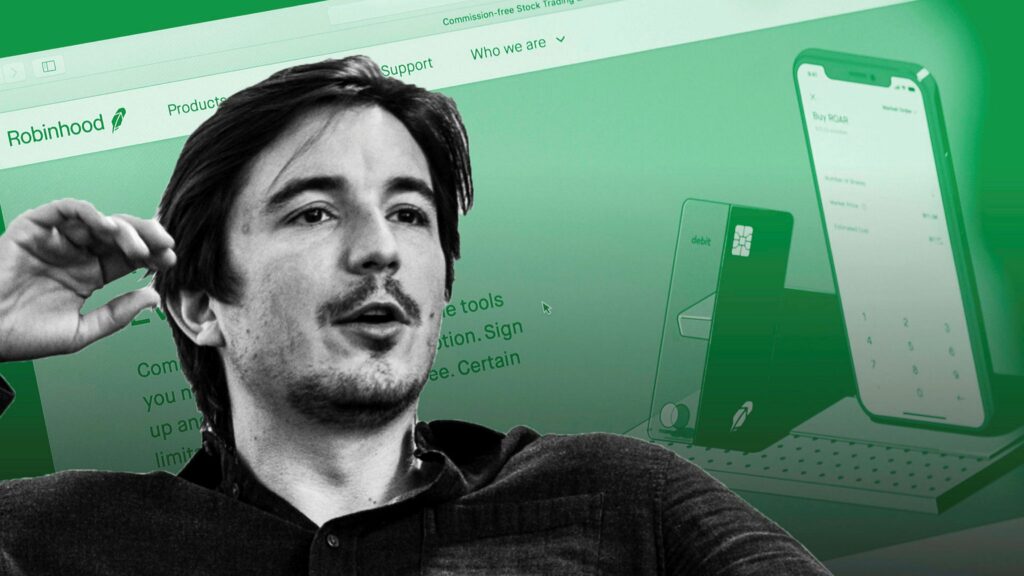

Robinhood, the esteemed American trading platform renowned for its stock and cryptocurrency services, has announced the launch of its much-anticipated Android version of its self-custody crypto wallet on March 20, 2024.

The announcement, delivered through Johann Kerbrat, the crypto general manager at Robinhood via his X account, heralds a pivotal expansion in the company’s cryptocurrency services.

This new development is particularly significant for Android users, who represent about 70% of the global mobile operating system market, thereby markedly broadening the accessibility of cryptocurrency tools.

The Android version of the wallet mirrors its iOS counterpart, which was introduced in 2023 and quickly gained traction, with extensive downloads in over 140 countries.

A noteworthy feature of the Android wallet is its support for the widely favored meme coin, Shiba Inu (SHIB), which highlights Robinhood’s commitment to catering to the varied interests of crypto enthusiasts.

Robinhood’s initiative to launch a self-custody crypto wallet for Android users aligns with its mission to democratize cryptocurrency trading.

By enabling users to have full control over their private keys, the wallet allows for the direct storage, sending, and receiving of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others across several blockchains.

READ MORE: SEC Delays Decision on Ether ETFs, Casting Doubt on Approval Odds Amidst Growing Skepticism

Moreover, it integrates with the 0x API and LI.FI for users interested in swapping cryptocurrencies within the Ethereum, Arbitrum, and Polygon networks, offering a smooth and flexible experience.

This advancement is also significant against the backdrop of Robinhood’s centralized exchange platform, where Shiba Inu emerges as a dominant asset.

According to Arkham Intelligence, Robinhood users possess an impressive 39.60 trillion SHIB tokens, equating to a collective value exceeding $1.06 billion, positioning Shiba Inu as the third most-held cryptocurrency on the platform, trailing only behind Bitcoin and Ethereum.

The inclusion of Shiba Inu support in the Robinhood Android wallet underscores the platform’s dedication to providing comprehensive services for crypto traders and enthusiasts.

By facilitating access to self-custody solutions, Robinhood is taking a substantial step towards enhancing the accessibility and adoption of cryptocurrency trading for a broader audience, further solidifying its role in the expanding digital currency landscape.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.