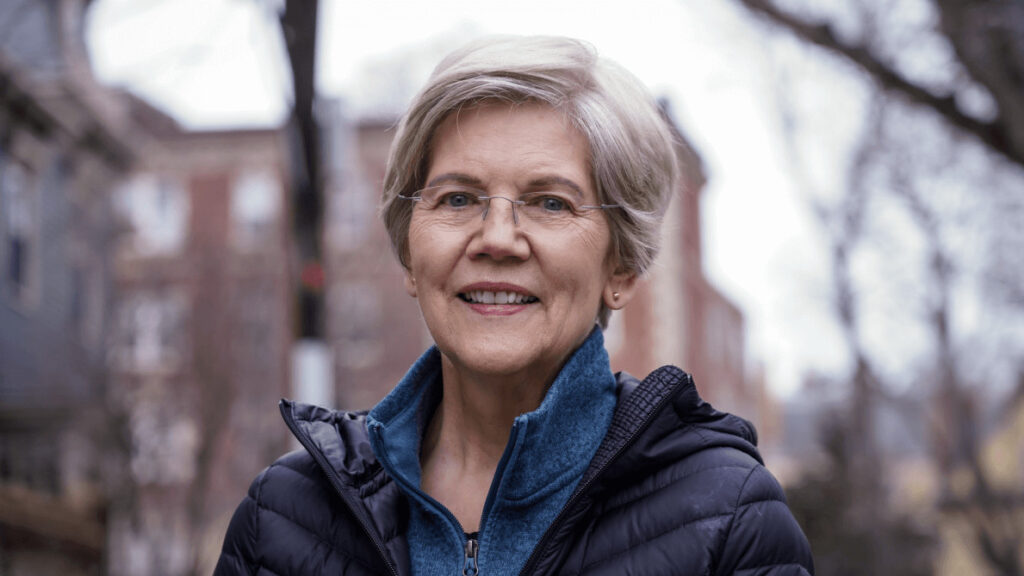

Massachusetts Senator Elizabeth Warren, a prominent critic of digital assets within the United States government, has recently revealed that five additional senators have pledged their support as cosponsors for her bill, which aims to combat money laundering within the digital asset sphere.

In her announcement on December 11, Senator Warren disclosed that Senators Raphael Warnock, Laphonza Butler, Chris Van Hollen, John Hickenlooper, and Ben Ray Luján have thrown their weight behind the Digital Asset Anti-Money Laundering Act.

This legislation was reintroduced in July and is laser-focused on curbing the illicit use of cryptocurrency for money laundering and the financing of terrorism.

Warren expressed her satisfaction with the growing support, stating, “I’m glad that five new senators are joining the fight to take action, including three members of the Banking Committee.”

She emphasized that their bipartisan bill represents the most stringent proposal currently on the table for combating the illicit use of cryptocurrency while also providing regulators with additional tools to enhance their oversight.

Even before this latest support, the bill had garnered backing from both sides of the aisle and received endorsement from various senators and organizations.

READ MORE: Defunct Crypto Firms FTX and Alameda Move $23.59 Million in Digital Assets to Top Exchanges

Notable supporters included the Bank Policy Institute, Massachusetts Bankers Association, Transparency International U.S., Global Financial Integrity, National District Attorneys Association, Major County Sheriffs of America, the National Consumer Law Center, and the National Consumers League.

Furthermore, Senator Warren reiterated a claim made during a December 6 hearing before the Senate Banking Committee and subsequent interviews.

She asserted that approximately half of North Korea’s missile program was funded through digital assets, underscoring the urgency of addressing money laundering in the cryptocurrency space.

Critics of the bill have argued that lawmakers should focus their efforts on targeting bad actors who misuse the technology rather than regulating digital assets and their underlying infrastructure.

However, cybersecurity expert Steve Weisman lent his support to the legislation during a Senate hearing in November, labeling it a “no-brainer” in addressing concerns related to money laundering.

In summary, Senator Elizabeth Warren continues to lead the charge in addressing the illicit use of digital assets through her Digital Asset Anti-Money Laundering Act, gaining increased support from fellow senators and organizations, despite some dissenting voices in the ongoing debate.

On December 8th, asset management firm VanEck made headlines by filing its fifth amended application for a spot Bitcoin exchange-traded fund (ETF).

This move was submitted to the United States Securities and Exchange Commission (SEC) as an update to the VanEck Bitcoin Trust, signaling the company’s continued pursuit of launching a Bitcoin ETF.

A spot Bitcoin ETF is a financial product that enables investors to acquire shares in a fund directly tied to the price of Bitcoin.

One intriguing aspect of VanEck’s application is its choice of ticker symbol for the ETF: “HODL.” This term, derived from a misspelling of “hold” or an acronym for “hold on for dear life,” is widely recognized among cryptocurrency enthusiasts.

It represents a strategy of holding onto Bitcoin without selling, regardless of market fluctuations.

While this ticker symbol may resonate with crypto-savvy individuals, some have suggested that it might be less familiar or clear to older generations, often humorously referred to as “boomers.”

Nate Geraci, the president of advisory firm The ETF Store, opined that those well-versed in the crypto space would appreciate the ticker symbol.

However, he humorously noted that it might leave “boomers” scratching their heads.

Submit a Press Release to Cointelegraph

Despite this potential generation gap, the choice of “HODL” could serve to emphasize the long-term holding strategy often associated with Bitcoin.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, highlighted that VanEck’s unconventional ticker symbol stands out in contrast to the more traditional choices made by companies like BlackRock and Fidelity when naming their financial products.

He characterized VanEck’s choice as a unique and creative approach.

VanEck even joined the playful banter, posting a comment on December 8th that humorously stated, “My #Bitcoin ETF will bring all the baby boomers to the yard, *if approved.”

VanEck is not alone in its pursuit of a spot Bitcoin ETF. Several other companies, including BlackRock, Fidelity, Valkyrie, and Franklin Templeton, are also vying for approval from the SEC to launch their own Bitcoin ETFs.

While the SEC has not yet expressed its support for these filings, it has engaged in discussions with the applicant firms to address technical aspects of their fund proposals.

VanEck remains optimistic about the prospect of SEC approval for its Bitcoin ETF, with expectations set for January.

If approved, the company estimates substantial inflows of approximately $2.4 billion in the first quarter of implementation.

The United States government recently made significant changes to the National Defense Authorization Act (NDAA) by eliminating two provisions intended to tackle anti-money laundering (AML) concerns within the cryptocurrency space.

The NDAA is a crucial piece of legislation that dictates how the country’s defense department can allocate federal funding.

Among the numerous provisions removed from the NDAA, two specifically addressed the need for a comprehensive review system and reporting mechanisms to combat illicit activities related to cryptocurrencies.

The first provision required the US Secretary of the Treasury to collaborate with banking and government regulators to establish a risk-focused examination and review system for cryptocurrencies within financial institutions.

This system aimed to enhance oversight and ensure compliance with AML regulations.

The second provision focused on addressing anonymous cryptocurrency transactions, particularly those involving crypto mixers and tumblers.

It mandated the creation of a report detailing the extent of crypto asset transactions associated with sanctioned entities, along with an analysis of regulatory approaches adopted by other jurisdictions.

This report was intended to guide the development of cryptocurrency regulations in the United States.

Back in July, the United States Senate approved the NDAA, allocating $886 billion for defense purposes.

READ MORE: Meanwhile Group Launches Innovative Bitcoin Private Credit Fund for Institutional Investors

Notably, the NDAA included amendments inspired by the Digital Asset Anti-Money Laundering Act, introduced in 2022, and the Responsible Financial Innovation Act.

These amendments sought to establish precautionary measures to prevent incidents similar to the FTX debacle in the cryptocurrency industry.

The proposal for these amendments was put forward by a group of senators, including Cynthia Lummis, Elizabeth Warren, Kirsten Gillibrand, and Roger Marshall.

In recent times, the US government has been actively addressing concerns related to money laundering and terrorist funding facilitated through cryptocurrencies.

The Financial Services Committee of the US House of Representatives convened on November 15 to discuss illegal activities within the crypto ecosystem.

During this meeting, a thorough review was conducted to assess the proactive measures taken by cryptocurrency exchanges and decentralized finance providers to prevent money laundering and terrorist financing.

In summary, the United States government’s decision to eliminate two key provisions from the NDAA indicates a shift in its approach to cryptocurrency regulation.

While these provisions aimed to enhance oversight and combat illicit activities, their removal reflects ongoing debates and discussions within the government regarding the appropriate regulatory framework for the cryptocurrency industry.

Short sellers in the crypto industry have faced staggering losses of at least $6 billion this year as they attempted to bet against publicly-traded crypto companies.

The primary culprit behind these substantial losses has been Bitcoin’s remarkable surge since the beginning of the year.

A recent report by research firm S3 Partners, dated December 5, reveals that traders who wagered against publicly traded crypto firms like Coinbase, MicroStrategy, and Marathon Digital are now grappling with cumulative on-paper losses amounting to $6.05 billion.

The majority of these losses have transpired in the past three months.

After Bitcoin dipped to a quarterly low of $25,133 on September 11, short sellers, believing that the sector was overbought, significantly increased their exposure.

However, unbeknownst to these traders, Bitcoin embarked on a remarkable 77% rally, reaching a new yearly high of $44,481 on December 5, as reported by Cointelegraph Markets Pro.

This sudden surge in Bitcoin value inflicted approximately $2.65 billion in losses upon short sellers.

READ MORE: Bitcoin Futures Open Interest Soars to $5.2 Billion, Nearing All-Time High

In response to these developments, S3’s managing director of predictive analysis, Ihor Dusaniwsky, pointed out, “Buying-to-cover in the most shorted crypto stocks such as Coinbase Global, MicroStrategy, Marathon Digital Holdings, and Riot Platforms will help push stock prices higher along with the long buying that has driven up stock prices since the end of October.”

Bitcoin’s year-to-date rally of 161% has exerted a substantial influence on the share prices of crypto firms.

Notably, Coinbase and MicroStrategy witnessed astonishing growth rates of 312% and 285%, respectively, within the same time frame.

As of the current writing, Bitcoin is trading at $43,964, with its recent surge attributed to the growing anticipation of potential approval for a spot Bitcoin exchange-traded fund (ETF) in January.

Among the short sellers, Coinbase stands as the most unfavorable trade, with the firm’s nearly 290% rally resulting in losses exceeding $3.5 billion.

MicroStrategy follows closely behind, with short sellers facing losses exceeding $1.7 billion.

Despite the mounting losses, some short sellers have continued to add to their positions, betting that the current rally will eventually lose momentum.

Since Bitcoin’s mid-September resurgence, an additional $697 million in new short positions have been established.

Hashdex, one of the 13 asset management firms vying for a coveted spot in the Bitcoin exchange-traded fund (ETF) market, is optimistic about the prospects for the first spot Bitcoin ETF in the United States.

According to Hashdex’s U.S. and Europe head of product, Dramane Meite, the anticipated arrival of a spot Bitcoin ETF in the U.S. has shifted from a question of “if” to a matter of “when.”

In a 2024 outlook report released on December 4, Meite expressed the belief that U.S. investors will gain access to a spot Bitcoin ETF by the second quarter of the upcoming year, with a spot Ether ETF likely to follow suit.

Currently, Hashdex is among the 13 asset managers that have submitted applications for a spot Bitcoin ETF to the U.S. Securities and Exchange Commission (SEC).

Additionally, Hashdex has proposed a hybrid Ether ETF, incorporating both futures and spot contracts, to the regulatory authority.

READ MORE: Ben Zhou Addresses Crypto Regulation As Bybit Celebrates 5-Year Anniversary

Although Bloomberg ETF analysts, James Seyffart and Eric Balchunas, have estimated a 90% likelihood of spot Bitcoin ETF approvals in the days leading up to January 10, 2024, it is important to note that the separate Form S-1 application must also receive approval before an ETF can be launched.

Seyffart has emphasized that there could be a period of several weeks or even months between approval and the actual ETF launch.

Companies typically use Form S-1 to inform the SEC about proposed rule changes, requiring endorsement from the agency’s Division of Corporation Finance.

Meite, in Hashdex’s report, highlighted that the introduction of spot Bitcoin and Ether ETFs would mark a significant milestone, as established legacy asset managers with strong brand recognition would be offering cryptocurrency products to their customers for the first time.

He further speculated that this development could unlock a colossal $50 trillion market, surpassing the combined sizes of Europe, Canada, and Brazil—the only three global markets currently featuring spot crypto exchange-traded products.

In all likelihood, the majority of interest in single-asset ETFs would gravitate towards Bitcoin and Ether due to their widespread recognition and minimal differentiation among incumbent offerings.

Gone are the days of surreal interest rates and astronomical yields associated with crypto lending following the majestic collapse of Celsius.

During the bull market, crypto lending has become a popular way of earning passive income with idle crypto by giving loans to users through both centralized and decentralized platforms. However, the market went through a mandatory rite of passage when the TerraUSD (UST) depeg triggered a hemorrhage across lending platforms, forcing them to adopt more sustainable rates to stay in the competition.

After suffering the “crypto winter” in 2022, crypto lending platforms are back on stage —this time with realistic annual percentage yields (APY), more security measures and an overall better user experience. With Celsius being gone, the multibillion-dollar crypto lending market is shared by both CeFi and DeFi players who survived the 2022 onslaught.

This article focuses on the main features, supported assets, interest rates and the security and privacy aspects of two of the prominent centralized crypto lending platforms, Nexo and Ledn.

Main Features

Crypto lending platforms function similarly to how traditional loans work: They bring lenders and borrowers on board, giving yield for lenders who deposit their crypto funds to the platform and providing loans to borrowers in exchange for collateral.

Nexo, a Swiss-based crypto lending platform, differentiates itself by offering a vast selection of crypto assets through its lending and borrowing services. Nexo’s diverse range of services -all accessible through a user-friendly mobile app- enables users to instantly buy or exchange crypto, earn interest with deposited assets, or even request a physical card for crypto-friendly everyday payment thanks to a partnership with MasterCard.

With its tiered loyalty system tied to the NEXO token, the platform helps users get better interest rates the more they use its services. Nexo was founded in 2018, making it one of the oldest crypto lending platforms still operational. Boasting over 6 million users worldwide, Nexo operates in 200 jurisdictions worldwide, with 60+ cryptocurrencies available on the platform. It has strategic partnerships with a number of companies from the crypto and Web3 landscape, including Bakkt, Ledger, Paxos, Fireblocks and Circle.

Canada-based Ledn, also founded in 2018, makes its mark in the crypto lending game by primarily focusing on major cryptocurrencies and stablecoins. The platform is mainly known for Bitcoin-backed loans, where users can get USD by depositing BTC. It also offers interest for a limited number of crypto and stablecoins. The platform is backed by prominent investors, including 10T Holdings, Coinbase and Kingsway.

Account Types

Ledn features two different types of accounts for users. Ledn Growth account offers interest with up to 8.5% APY. Assets held in Growth accounts are ringfenced, meaning it’s financially separated from Ledn operations and only exposed to counterparties that generate the interest.

Ledn also offers a Transaction account, which is more focused on adding and withdrawing assets for other Ledn products, including Loans, Trade and transfers. It doesn’t bear any interest, and the assets are primarily held in cold storage. Ledn users can switch funds between Growth and Transaction accounts at any time.

Nexo lets users manage their funds with Nexo Wallet, a Web3 wallet with all the basic functionality of noncustodial digital asset storage. Aside from sending, receiving and managing crypto funds, Nexo Wallet also operates as the Web3 identity of a user for other blockchain-based dApps.

Along with the Nexo Wallet, there’s also the Nexo app, where the actual lending and interest features become available. It’s an all-in-one solution for users to lend and earn interest with automatic daily compound. A wide range of crypto assets is available on the Nexo app, with tiered interest rates going up to 16%.

Supported Assets

Nexo takes a win home when it comes to the diversity of supported assets. Both lenders and borrowers can use tens of crypto and fiat assets on the platform. Among 37 supported assets are the major cryptocurrencies, including Bitcoin, Ether, XRP, BNB and the platform’s own Nexo token. Users can also pick from major stablecoins such as USDT, USDC and BUSD, as well as fiat currencies, including USD, GBP and EUR, to generate interest.

Ledn takes a minimalistic approach in terms of supported assets by supporting Bitcoin, USDC and USDT. The platform only recently introduced an Ether Growth account in late September, raising the number of supported crypto assets to four.

Interest Rates

When it comes to crypto lending, interest rates make or break a platform. A harsh example was Celsius, which collapsed after promising unrealistic annual percentage yields.

As of December 4th, 2023, Ledn Growth accounts get 1% APY for Bitcoin and 2% APY for Ether, according to the official website. The crypto lending platform recently started offering 8.5% APY for the supported stablecoins —USDT and USDC.

Nexo presents more diverse options for users, starting with FLEX terms, where assets are unlocked for trading, selling or withdrawing anytime. If users lock their assets on the platform, agreeing on “fixed terms” of Nexo, they earn additional interest.

For stablecoins, the Base tier interest rates on Nexo start from 8-9%, with USDT holders getting up to 12%, and USDC terms enable a maximum interest of 10%. Bitcoin generates 3% (4% on fixed terms), and Ether offers 4% (5% on fixed terms).

The platform has a tiered list, going up to 16% for most assets on the Platinum tier. A full breakdown of Nexo interest rates can be found on the official page.

Security and Privacy

Crypto lending involves a lot of trust, especially after the Celsius crash, to operate effectively. Nexo outperforms the majority of the competition by upholding rigorous security and privacy standards, as implied by the platform’s SOC 2 Type 2 Compliance certification.

The audit, which focuses on addressing risks related to data handling and access, was carried out by major compliance and security partner A-LIGN, earning Nexo an American Institute of Certified Public Accountants (AICPA) Certificate. In simpler terms, the certificate means that Nexo is doing top work when it comes to protecting the sensitive information of users.

Custodial assets on Nexo are insured by Ledger Vault and the US-based fintech Bakkt. Aside from insurance, the platform ensures the safety of users by over-collateralization of assets, top-notch risk management and a comprehensive portfolio of licenses for maximum regulatory compliance.

Ledn’s main premise of security comes from supporting only four main types of cryptocurrencies, minimizing the “attack vector” in a sense. The platform works with institutional partners to check each borrower’s financial position. The official website says that Ledn doesn’t store client data on local servers, storing them in private networks instead.

While both platforms release periodical Proof-of-Reserve attestations, Nexo goes one step ahead with real-time PoR attestations in partnership with global accountant Moore.

Conclusion

Both Nexo and Ledn went through the ups and downs of the crypto lending market, and it’s clear that they speak for different audiences. Ledn offers a minimalistic user experience with only four supported crypto assets and a basic set of interest offerings.

Nexo, on the other hand, features the full range of crypto and fiat currencies and goes to great lengths to ensure an airtight infrastructure to keep users’ assets and personal information safe and secure. It also offers more utilities with the Exchange function and the Nexo Card, opening up the possibilities of using cryptocurrencies in everyday payments.

As competition brews between CeFi and DeFi lending in the crypto ecosystem, centralized platforms like Nexo and Ledn play the compliance game, winning back the users’ trust with their security measures and simplistic user experience.

Bybit, a leading crypto exchange and the world’s third-largest by volume, recently marked its fifth anniversary. The occasion was commemorated by co-founder and CEO Ben Zhou in a blog post, reflecting on the company’s journey and the broader crypto industry.

In his post titled “Bybit CEO Marks Crypto Ark’s Five-Year Voyage,” Zhou highlights the exchange’s key milestones over the past half-decade. He acknowledges the crypto market’s recovery following the challenges of 2022, attributing this resurgence to the unwavering efforts of industry participants.

2023 has been a significant year for Bybit, especially with the establishment of its Dubai headquarters. The company has also formed essential partnerships globally, including collaborations with the Dubai Multi Commodity Centre (DMCC) and the American University of Sharjah (AUS).

These alliances, along with others like the one with Oracle Red Bull Racing, have been instrumental in promoting Bybit’s vision of a blockchain-based financial system.

READ: Binance’s New CEO Richard Teng Charts a Regulatory Course for the Exchange’s Future

Zhou stresses the importance of regulatory compliance in his message. Bybit has made strides in this area by securing licenses in Dubai, Kazakhstan, and Cyprus, underscoring its commitment to providing a secure trading environment for its users.

The anniversary also celebrates Bybit’s product innovations and industry accolades. The company introduced the Unified Trading Account and TradeGPT AI, which have been well-received in the market. Additionally, Bybit earned an ‘AA’ rating in the CCData Crypto Exchange Benchmark Report.

North Korean hackers have executed a stunning cryptocurrency heist, amassing a staggering $3 billion since 2017, with a substantial portion of that sum pilfered in the past year alone, reports United States cybersecurity firm, Recorded Future.

Their recent study unveiled that this stolen crypto haul is roughly equivalent to half of North Korea’s entire military budget for the year.

In a shocking revelation, Recorded Future disclosed that North Korean threat actors absconded with an estimated $1.7 billion worth of cryptocurrency in 2022 alone.

This astronomical figure is equivalent to approximately 5% of North Korea’s economy or a whopping 45% of its military expenditure.

What’s even more astonishing is that this stolen amount significantly outpaces the total annual income generated by the nation through exports.

To put it in perspective, the report emphasized that this heist is nearly ten times the value of North Korea’s exports in 2021, which amounted to a meager $182 million.

Initially, these North Korean hackers honed their skills by targeting South Korea’s cryptocurrency market, before strategically expanding their reach across the globe.

The backing of the North Korean government has played a pivotal role in the rapid escalation of this illicit operation.

The report highlighted that state support has enabled North Korean threat actors to conduct their operations on a scale that exceeds the capabilities of traditional cybercriminals.

In a related development, the U.S. Treasury’s Office of Foreign Assets Control imposed sanctions on the cryptocurrency mixer, Sinbad, accusing it of facilitating the laundering of funds for the North Korea-based Lazarus Group.

The situation has been exacerbated by a UN report, which revealed that cyber attacks in 2022 displayed unprecedented sophistication, making it increasingly challenging to trace the stolen funds.

Moreover, blockchain analytics firm Chainalysis has labeled these cybercriminal syndicates as the most “prolific cryptocurrency hackers” in recent years.

Notably, they found that North Korea-linked hackers have been rapidly transferring funds through crypto mixers such as Tornado Cash and Sinbad at a significantly higher rate compared to other criminal groups.

In summary, the audacious cryptocurrency thefts executed by North Korean hackers have not only shaken the global digital financial landscape but also underscored the challenges faced by authorities in combating these cybercriminals who operate with impunity.

KyberSwap has taken a proactive stance in the aftermath of a significant exploit on November 22nd, which inflicted a substantial $48.8 million loss upon the decentralized finance protocol.

To mitigate the impact on affected users, KyberSwap is introducing a grant initiative funded by its treasury.

This initiative aims to provide compensation equivalent to the USD value of the assets lost during the security breach, demonstrating KyberSwap’s unwavering commitment to its user community and platform security.

Although specific details and eligibility criteria for the grant are still in the works, KyberSwap has pledged to share additional information within a two-week timeframe.

Upon conducting investigations into the security breach, it was discovered that the vulnerability stemmed from tick interval boundaries within KyberSwap’s concentrated liquidity pools.

This weakness allowed an attacker to artificially manipulate liquidity, resulting in a significant depletion of funds.

Initially estimated at $47 million, the confirmed loss was later determined to be $48.8 million.

READ MORE: Bitcoin Surges to $39,000 Amidst Federal Reserve’s Policy Easing Hints

In a bid to recover the stolen assets, KyberSwap proposed a 10% reward for the wrongdoer but encountered unconventional responses instead of acceptance.

Remarkably, KyberSwap managed to successfully retrieve $4.7 million of the pilfered funds, which had been siphoned off by third-party MEV (Miner Extractable Value) bots during the hack.

This partial recovery, alongside the introduction of treasury grants, underscores KyberSwap’s proactive approach to addressing security breaches.

Furthermore, the incident has spurred a comprehensive review of KyberSwap’s security protocols, with the team fully committed to enhancing safeguards to thwart future exploits.

The provision of treasury grants in response to this crisis is a noteworthy step within the decentralized finance community.

It signifies a collective effort to rebuild trust and provide support to users affected by security breaches.

KyberSwap’s dedication to its users and its commitment to rectifying the situation exemplify the resilience and adaptability of the DeFi ecosystem in the face of challenges, ultimately striving for a safer and more secure financial environment for all participants.

On December 1st, Bitcoin surged to a remarkable milestone, reaching $39,000 for the first time since mid-2022.

This surge was triggered by the United States Federal Reserve’s signals of potential policy easing. Data from Cointelegraph Markets Pro and TradingView confirmed this surge, marking a new 19-month high for Bitcoin on Bitstamp.

The catalyst for this bullish movement was Federal Reserve Chair Jerome Powell’s scheduled appearance at Spelman College in Atlanta, Georgia.

Powell approached the stage with a cautious tone but made it clear that the Federal Open Market Committee (FOMC) was committed to reducing inflation to 2% over time and maintaining a restrictive policy until they were confident about achieving this objective.

Powell stated, “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.”

Despite Powell’s caution, his comments on the state of the U.S. economy and efforts to curb inflation boosted risk asset sentiment.

Some analysts, like The Kobeissi Letter, remained skeptical about the Fed’s future actions, suggesting that the Fed would prefer a mild recession over the risk of inflation resurgence, implying a prolonged pause in policy adjustments.

READ MORE: Swiss Crypto Bank Rebrands as Amina Bank, Expanding Global Trading Services

Bitcoin, however, seized the opportunity and reacted positively, in contrast to its relatively flat response to earlier U.S. macroeconomic data releases.

The next FOMC meeting, scheduled for mid-December, will be closely watched for any announcements regarding interest rate changes.

Market expectations, as of December 1st, heavily favored a pause in interest rate hikes according to CME Group’s FedWatch Tool.

In the Bitcoin market, trader Daan Crypto Trades highlighted the significant sell-side liquidity that played a role in the brief ascent to $39,000.

Keith Alan of Material Indicators shared an order book snapshot, revealing substantial resistance at $39,000 and $39,200, with notable buyer support at $38,000.

Traders and analysts in the crypto community expressed optimism about Bitcoin’s prospects.

BitQuant predicted a daily close above $38,000, which would be a powerful bullish signal, while Crypto Ed anticipated further upside potential, targeting at least $39,200 in the near term.

In summary, Bitcoin’s surge to $39,000 on December 1st was driven by the Federal Reserve’s signals of potential policy easing, despite Chairman Powell’s cautious remarks.

Market sentiment leaned towards a pause in interest rate hikes, and Bitcoin traders and analysts remained bullish on its future price prospects.