On August 1, the BetFury platform released an epic feature – Bonus Combats. Now players worldwide can invite friends to compete against each other and create gaming battles on their terms. The main winner of each Combat gets all his opponents’ rewards and multiplies his crypto assets. Let’s briefly review Bonus Combats and find out how profitable it is.

What Are Bonus Combats?

Bonus Combats are PvP user competitions based on a Bonus Buy feature in Slots. Each Bonus Combat lasts no more than 10 minutes, but there are many unexpected twists and turns during this time. The winner is determined by the amount of crypto won during this round. The lucky one who won more crypto in the Bonus Game than others takes all his opponents’ winnings.

How to Win in Bonus Combats?

It needs to create an account to play on BetFury. The platform has an exclusive Welcome Pack for newbies, which helps everyone get a decent starting capital. Sign up to get up to 1 000 Free Spins and $3 500.

Every user can join PvP or create a unique Bonus Combat according to his preferences: favorite games, the Bonus Game price, and the maximum number of opponents. If someone joins this competition in five minutes, the system will launch the created PvP.

Bonus Combat offers to choose a Slot with a certain price of the Bonus Game. After the start of the battle, the user is given one and a half minutes to buy the Bonus Game and ten minutes for playing.

Each win is recorded in the table at the end of the round. The lucky one with the highest win amount in this table receives the reward.

The main winner gets his winning amount in the cryptocurrency he used. Opponents’ rewards can be received in the currency opponents used or in BFG (internal BetFury token). In the last case, the system will charge a 3% Performance Fee for transferring. However, the choice of BFG is more universal and convenient because this token becomes a cryptocurrency with strong potential. It’s explained by the end of BFG Mining, a limited supply of tokens, and many profitable utilities.

How to become a participant:

⚔️NEW Bonus Combats Activity⚔️

About BetFury

BetFury is an ecosystem of crypto products for entertainment and additional income. The platform has a native BFG token with many utilities. BFG is listed on many crypto exchanges: PancakeSwap, Biswap, etc. The token has over 55 000 holders, and more than 3B BFG are in circulation. The most profitable utility for using tokens is BetFury Staking, with up to 50% APY and the ability to flexibly withdraw Staking payouts.

BetFury offers over 8 000 Slots and 18 Original games with one of the highest RTPs on the market (up to 99.02% RTP). BetFury also has 80+ kinds of Sports to bet for true fans. Along with huge events, the platform provides profitable bonuses: Rakeback, FuryCharge, and Cashback up to 25%.

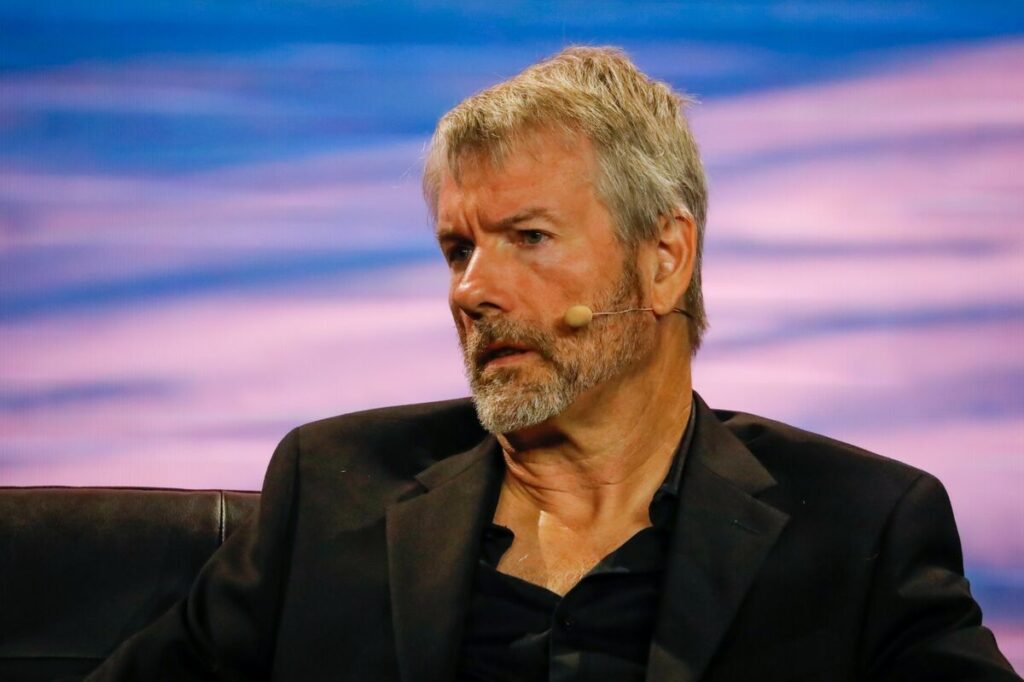

During a recent podcast discussion, Michael Saylor of MicroStrategy conveyed his belief that the involvement of major corporations in purchasing and holding Bitcoin should not be viewed as a worrisome development.

Speaking on the Coin Stories podcast with Natalie Brunell, released on August 7, Saylor highlighted the inevitable expansion of third-party and corporate engagement within the Bitcoin domain.

While acknowledging the aspiration of Bitcoin enthusiasts for complete self-control or sovereignty over their holdings, Saylor proposed that this might not be the exclusive solution, given the diverse applications of Bitcoin.

He expressed the idea that as Bitcoin further intertwines with society, its utility will diversify, negating a one-size-fits-all approach.

Saylor enumerated three primary factors substantiating the need for custodial services: technical, political, and natural considerations.

On a political basis, he argued that certain circumstances necessitate reliance on third-party custodians.

He pointed out that unless fundamental changes occur, political factors tied to regions such as New York City, California, or Iceland will demand custodial solutions.

From a technical perspective, Saylor highlighted the inevitability of trusting layer-3 third parties for transactions, particularly those involving mobile devices.

READ MORE: Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

He painted a vision of Bitcoin as a foundational layer, accompanied by layer-2 systems like the Lightning Network for speed, and layer-3 services provided by entities like Bank of America and Apple to enhance functionality.

Saylor also introduced the concept of natural reasons for custodial reliance.

He postulated that certain individuals, like an elderly person dealing with Alzheimer’s or someone wanting to secure assets for a future grandchild, might find it safer to entrust their holdings to others.

Drawing an analogy to childhood experiences, he cited that the absence of car keys didn’t necessarily invoke complaints, suggesting a comparable situation with Bitcoin custody.

Emphasizing adaptability, Saylor underlined that the market will ultimately dictate the optimal blend of Bitcoin integration methods.

He asserted that a diverse array of ways to incorporate, wrap, embed, or transact with Bitcoin should not evoke fear, as the right combination of integrations will naturally emerge through market dynamics.

In conclusion, Michael Saylor, during a recent podcast exchange, expressed his viewpoint that the involvement of large corporations in Bitcoin custody shouldn’t raise alarm.

He highlighted the inevitability of Bitcoin’s expansion across various sectors and delineated reasons for custodial arrangements based on technical, political, and natural factors.

Saylor stressed the importance of embracing multiple integration approaches, with the market determining the most suitable amalgamation of Bitcoin functionalities.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Former FTX CEO Sam Bankman-Fried finds himself in an unexpected predicament, spending his third night alongside over 1,500 inmates within the confines of New York’s infamous jail.

This stark contrast emerges from his earlier life in a luxurious California home owned by his parents, valued in the millions and boasting five bedrooms.

The abrupt change in his circumstances transpired following a bail revocation during an August 11th court hearing, presided over by Judge Lewis Kaplan.

The Brooklyn Metropolitan Detention Center, the facility where he now resides, was labeled by the judge as far from a luxury establishment.

Built to accommodate a maximum of 1,000 inmates, the MDC currently holds more than 1,500 individuals under federal custody.

Bankman-Fried anticipates an extended stay, at least two months, while awaiting his impending criminal trial. Nonetheless, his legal team has swiftly lodged an appeal in a bid to overturn this bail revocation.

Regrettably for Bankman-Fried, the detention center has a history marred by scandal, encompassing instances of inmate mistreatment and corruption.

In 2019, former warden Cameron Lindsay referred to the MDC as one of the most problematic facilities under the Bureau of Prisons’ jurisdiction.

Recent incidents have fueled this perception.

A guard faced charges in April for accepting bribes to facilitate the smuggling of contraband such as phones, cigarettes, and drugs.

READ MORE: Curve Finance Vows Reimbursement After $62 Million Hack

In a chilling winter of 2019, the facility suffered a week-long power outage, subjecting inmates to freezing conditions.

Reports from The Intercept painted a grim picture, illustrating inmates resorting to banging on cell windows to gain attention from onlookers.

Those protesting non-violently against dire conditions faced repercussions like pepper spray, solitary confinement, and even closure of their toilets.

The Brooklyn MDC has housed several high-profile individuals in the past, including artists like 6ix9ine, R. Kelly, and Fetty Wap.

Martin Shkreli, known as “pharma bro,” and Ghislaine Maxwell, an accomplice in Jeffery Epstein’s sex trafficking, also spent time within its walls.

Until recently, Bankman-Fried enjoyed bail, residing in a luxurious $4 million Palo Alto, California home with numerous amenities, including a pool.

The bail’s revocation stemmed from a leak of a diary belonging to former Alameda Research CEO Caroline Ellison.

The diary contained her sentiments towards Bankman-Fried and her role in the company. Prosecutors alleged that Bankman-Fried leaked the diary to undermine Ellison’s credibility as a witness and to intimidate her.

In response, his legal team countered the claims, asserting his right to engage with reporters and comment on an ongoing article. An appeal to reverse the bail revocation has been initiated.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

A team of researchers hailing from San Diego State University in California has developed a cutting-edge artificial intelligence (AI) system designed to combat and expose cryptocurrency giveaway scams proliferating on the X platform (formerly known as Twitter).

This innovative system, dubbed GiveawayScamHunter, was meticulously crafted to detect, monitor, and reveal the operations of these fraudulent schemes that promise free cryptocurrencies.

In the span between June 2022 and June 2023, the automated GiveawayScamHunter detected a staggering 95,111 instances of scam lists.

These fraudulent lists had originated from 87,617 distinct accounts on the X social media platform.

GiveawayScamHunter’s operational prowess extends beyond mere identification, as it was adeptly utilized by the researchers to automatically extract the pertinent website and wallet addresses connected to these scams.

Consequently, this strategy resulted in the unearthing of a total of 327 scam-related internet domains and the discovery of 121 previously unreported cryptocurrency wallet addresses linked to scams.

The research team’s approach began with an exploration of a novel avenue for cryptocurrency giveaway scams: Twitter Lists.

Leveraging the feature’s open access nature, scammers effortlessly exploited it as a networking tool.

Employing the data garnered from previously identified giveaway scams, the team trained a natural language processing tool to pinpoint lists associated with giveaway scams.

Harnessing this methodology, the researchers successfully identified an astonishing count of almost 100,000 instances of giveaway scam lists.

READ MORE: Hong Kong’s HKVAX Granted Preliminary Approval for Virtual Asset Trading Platform by SFC

This breakthrough permitted them to compile crucial data concerning previously uncharted scam websites and wallets.

From the insights derived from this dataset, the team gained valuable understanding into the mechanics of these scams.

They delved into the modus operandi of scammers, their methods of targeting victims, and even managed to approximate the number of victims ensnared during the year-long study.

As the research paper highlights, meticulous tracking of transactions involving scam cryptocurrency addresses revealed a shocking statistic.

Over the course of the study, these scams targeted more than 365 individuals, resulting in a collective financial loss of approximately $872,000 USD.

Acknowledging the significance of their findings, the researchers responsibly disseminated their results, encompassing associated accounts, domains, and wallet addresses, to both X and the wider cryptocurrency and blockchain community.

Regrettably, as of the publication date of August 10, the paper mentions that 43.9% of these linked accounts remain active.

However, the research team clarifies that the majority of these accounts are likely inactive spam profiles.

Other Stories:

California Updates Campaign Manuals with Detailed Rules for Cryptocurrency Contributions

US Bank’s Crypto Holdings Surge to Nearly $170 Million Amid Regulatory Scrutiny

FTX Debtors Clash with Creditors Over Asset Control Amidst Restructuring Plan

The California Fair Political Practices Commission (FPPC) has recently updated its campaign disclosure manuals, including an extensive set of rules related to the declaration of cryptocurrency contributions.

These updates align with recent changes in legislation and commission regulations, reflecting modern financial practices and covering a wide variety of topics.

Among the updates are rules about campaign contribution limits, limited liability company disclosure requirements, behested payment reporting, and cryptocurrency contributions.

Specific provisions regarding excessive contributions, advertising disclosure requirements, and other non-substantive technical changes are also part of the revisions.

Within these guidelines, political committees are allowed to solicit cryptocurrency as a non-monetary contribution, with specific requirements.

Notably, such contributions must comply with applicable limits and cannot be accepted from foreign principals, lobbyists, or anonymous sources.

Also, committees cannot receive cryptocurrency contributions directly through peer-to-peer transactions.

Instead, they must be processed through selected payment processors acting on behalf of the committee.

The commission requires that cryptocurrency donations be made and received through U.S.-based payment processors registered with the U.S. Department of Treasury and Financial Crimes Enforcement Network (FinCEN).

READ MORE: Futurama’s Hilarious Take on Crypto Mining: A Wild West Adventure in ‘Crypto Country’

These processors must use Know Your Customer (KYC) protocols, ensuring the verification of contributor identities.

Committees accepting cryptocurrencies must confirm that their payment processors use KYC procedures and collect relevant information such as name, address, occupation, and employer of contributors.

This information must be shared with the committee within 24 hours of a contribution being made.

Additionally, the payment processors must promptly convert cryptocurrency contributions to U.S. dollars at current exchange rates and deposit the funds into the committee’s campaign bank account within two business days of receipt.

These contributions are considered non-monetary, and any processing fee paid to the processor is not deducted from the reported amount.

The entire contribution must be reported by committees as a “miscellaneous increase to cash.”

In summary, the California FPPC’s updates demonstrate a thoughtful and detailed approach to regulating political contributions, particularly those made via cryptocurrencies.

It aligns political campaign financing with modern technological advancements, ensuring transparency, accountability, and adherence to existing regulations.

Other Stories:

Top VC Firms Face Class-Action Lawsuit for Alleged Role in FTX Crypto Exchange Fraud

Cryptocurrency Asset Flows Continue Negative Trend with $107 Million Outflows

PayPal’s PYUSD Stablecoin Launch Triggers Flood of Imposter Tokens and Honeypot Scams

The rapid advancement of high-level artificial intelligence (AI) technology has ignited a competitive race between the United States and China, each striving to lead in the development of the most formidable AI systems.

This pursuit has sparked escalating tensions between the two global superpowers.

The Biden Administration, in a decisive move, has imposed limitations on Chinese tech investments pertaining to semiconductors, quantum computing, and AI.

This initiative has triggered apprehensions among regulators in various nations.

The European Union and the United Kingdom are deliberating their responses to this U.S. action.

On August 9, The White House issued two executive notices addressing AI advancements.

The first highlighted a novel opportunity for hackers to employ AI in fortifying U.S. infrastructure against cybersecurity threats, with monetary incentives as rewards.

Conversely, the second note designated China, Hong Kong, and Macau as “countries of concern.”

This classification empowers the U.S. to regulate investments within these regions, particularly in sectors pertinent to national security, including semiconductors, microelectronics, and quantum information technologies.

The document underscored the role of these sectors in military, intelligence, surveillance, and cyber-enabled capabilities.

READ MORE: Governments Remain Wary About Worldcoin Amid Privacy Concerns

The scope of the note presently encompasses the mentioned countries; however, a Biden administration official hinted at the possibility of adding other nations in the future.

The U.S. has already undertaken measures to curtail Chinese technological investments and restrict Chinese access to American services and products.

In a significant development, U.S. regulators imposed bans on semiconductor chip exports to China in October 2022, as these chips are integral to the creation of high-performance AI systems.

China responded swiftly to the U.S. pronouncement through an official statement from the Chinese Embassy in the U.S.

The Chinese Ministry of Foreign Affairs denounced the U.S.’s unilateral decisions regarding investments in China, decrying them as economic coercion and tech bullying.

China perceived these actions as an attempt to sideline it from the global arena.

To counter previous U.S. moves, China announced tightened controls on AI chip-making material exports.

Reports indicated that prominent Chinese tech giants, such as Baidu, ByteDance, Tencent, and Alibaba, have placed significant orders for Nvidia A800 processors, anticipating stricter controls from the U.S.

The U.S. stance had immediate repercussions abroad.

The U.K.’s Prime Minister’s office indicated that the U.S. measures would be taken into consideration while assessing potential national security risks linked to specific investments.

The European Commission also pledged to analyze the U.S. decision, given its proactive involvement in monitoring and regulating AI developments.

As the AI race intensifies, the actions of these influential players hold significant implications for the global technological landscape.

Other Stories:

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

Binance’s Proof-of-Reserves Discloses Strong Financial Position

FC Barcelona, the renowned Spanish soccer club, has sealed a significant investment worth 120 million euros (approximately $132 million) for its pioneering Web3 endeavor, Barça Vision.

The landmark deal was revealed on August 11 and entails Libero Football Finance AG and Nipa Capital B.V. as the investing entities.

The transaction’s crux involves FC Barcelona trading a 29.5% ownership interest in Bridgeburg Invest, the parent company overseeing Barça Vision, in return for the substantial capital infusion.

This strategic move is aimed at propelling the Club’s ambitious Barça Vision initiative, which seeks to seamlessly amalgamate all facets of digital content within the realms of Web3 and blockchain.

Notably, this includes the burgeoning domains of NFTs (non-fungible tokens) and the metaverse, pivotal components in the Club’s blueprint for erecting the digital haven of Espai Barça.

Libero Football Finance AG, a publicly traded firm based in Germany, is well-regarded for its expertise in advising soccer clubs on financial matters.

In a complementary fashion, Nipa Capital B.V., a venture capital entity headquartered in the Netherlands, contributes to this investment partnership.

READ MORE: Futurama’s Hilarious Take on Crypto Mining: A Wild West Adventure in ‘Crypto Country’

However, it is worth noting that the completion of this transaction is contingent upon the approval of FC Barcelona’s shareholders and is anticipated to finalize in the fourth quarter of 2023.

FC Barcelona’s voyage into the realm of blockchain and digital assets commenced in February 2020, with a collaboration with Chiliz blockchain, resulting in the creation of FC Barcelona Fan Tokens (BAR) on the Ethereum platform.

The partnership’s ascendancy saw Chiliz’s acquisition of a 24.5% stake in Barça Vision’s digital content arm for a sum of $100 million in August 2022.

Notably, FC Barcelona has actively ventured into the world of NFTs.

In May, the Club’s debut NFT collection, named “Unleash Your Passion,” was launched in collaboration with Plastiks.

This compilation, encompassing 3,000 NFTs, was priced at $30 each and carried an eco-conscious theme, vowing to aid in the reduction of 35,000,000 kilograms of plastic waste from the planet.

Building on this momentum, FC Barcelona accomplished remarkable milestones in the NFT arena. The Club’s inaugural NFT, “Masterpiece #1 In A Way,” was auctioned at Sotheby’s New York in July 2022, fetching a staggering $693,000.

Subsequently, the sequel to this series, titled “Masterpiece #2 – Empowerment,” was traded on the OpenSea platform on June 28, 2023, for an impressive sum of $300,231.

Other Stories:

Top VC Firms Face Class-Action Lawsuit for Alleged Role in FTX Crypto Exchange Fraud

Cryptocurrency Asset Flows Continue Negative Trend with $107 Million Outflows

PayPal’s PYUSD Stablecoin Launch Triggers Flood of Imposter Tokens and Honeypot Scams

The futuristic animated series, Futurama, known for its comedic take on science fiction, took a humorous jab at cryptocurrency mining in its latest installment, demonstrating the show’s knack for predicting trends well before they materialize.

The show’s third episode of its recent version, titled “How the West Was 1010001,” was released on Hulu on August 6, where the characters found themselves indebted to the Robot Mafia.

In a clever parody, they embarked on a journey to “Crypto Country,” a fictional representation of the Wild West, reminiscent of Bitcoin mining’s resource-intensive nature.

Set in the year 3023, Futurama’s portrayal of the cryptocurrency landscape remained true to its comedic nature.

The price of BTC remained volatile, and people scoured the land for sources of “cheap, filthy electricity” to facilitate their mining operations.

The episode’s humor manifested through absurd scenarios, like collecting thallium for crypto mining chips, relocating to the comically named “Doge City,” and BTC miners consuming such massive energy that it started ionizing the atmosphere.

Not solely focused on Bitcoin, the show humorously touched upon “danged Ethereum” and depicted robots’ heads repurposed for mining crypto.

READ MORE: Binance’s Proof-of-Reserves Discloses Strong Financial Position

Remarkably, Futurama had been on air since March 1999, a decade before the inception of Bitcoin.

While the show had rarely delved into cryptocurrency discussions, its recent episode underscores the growing presence of digital assets in mainstream media, spanning from animated series like South Park to blockbuster films like Mission: Impossible – Dead Reckoning Part One.

Curiously, the episode left unaddressed the rationale behind the characters’ persistence in Bitcoin mining in 3023, despite the widely-known BTC halving process.

This process indicates that the final Bitcoin block would likely be mined around the year 2140, making the episode’s comedic depiction divergent from the actual cryptocurrency timeline.

In its characteristic style, Futurama’s latest episode has managed to weave an amusing tale around cryptocurrency mining, showcasing the series’ enduring relevance and its ability to lampoon emerging trends with a comedic touch.

Other Stories:

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

Governments Remain Wary About Worldcoin Amid Privacy Concerns

XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

Worldcoin, the innovative digital ID project that uses iris scans for instant verification online and potential issuance of universal basic income (UBI), has garnered significant attention since its launch on July 24.

However, it has also faced scrutiny over data collection methods.

The project has already made strides by integrating with Auth0, enabling thousands of clients to sign in using World ID.

Tiago Sada, head of product at Tools for Humanity, the company behind Worldcoin, revealed that more such integrations are expected in the future.

They have also made their software development kit (SDK) available to all developers and integrated with Discord, indicating the project’s commitment to widespread adoption.

Reuters recently reported that Worldcoin plans to expand its services to governments and organizations, given its open identity protocol built on zero-knowledge proofs.

Sada clarified that the platform is not intended to replace passports or driver’s licenses but rather to complement them.

Several governments have expressed interest in the technology, particularly due to concerns about identity verification and fraudulent documents on the black market.

However, some governments remain cautious about Worldcoin’s implications for privacy and data protection.

READ MORE: Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

The German government’s data watchdog conducted a probe into Worldcoin before its official launch in November 2022.

Sada emphasized the importance of building applications that are resistant to bots and AI-generated fake content.

With the rise of AI, such challenges become more complex but also more critical to address.

He expressed the hope that the world would adopt Worldcoin in a privacy-preserving, decentralized, open-source, and permissionless manner.

The spread of AI tools and applications has already raised concerns about the potential for rampant fake news and deep fakes.

For instance, AI-generated fake news led to rumors about the resignation of the United States Securities and Exchange Commission Chair.

Worldcoin has taken concrete steps towards implementation, deploying over 1,500 metal orbs for in-person iris scans and sign-ups in major cities like London, Paris, and Dubai.

As the project progresses, users and governments alike will continue to closely monitor its developments and assess its impact on data privacy and online verification practices.

Worldcoin’s future success will depend on striking a balance between technological advancement and safeguarding individual rights.

Other Stories:

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

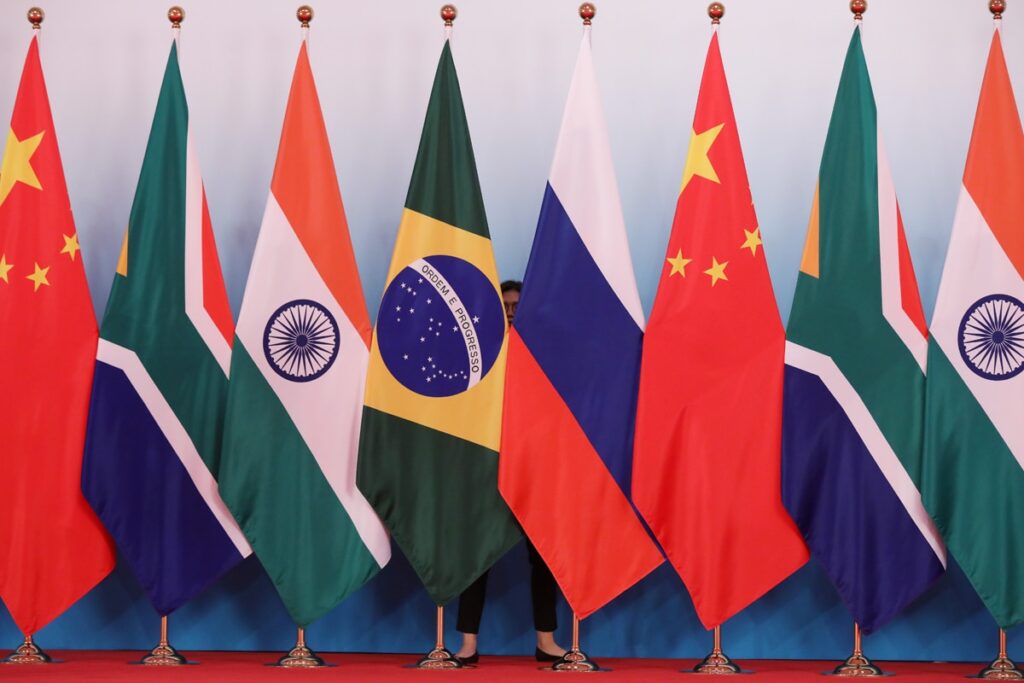

The BRICS countries (Brazil, Russia, India, China, and South Africa) are known for their growing economic influence and collaboration in various fields. One of the most intriguing and debated ideas related to the BRICS is the proposal of a gold-backed currency. Such a move, if implemented, could represent a significant shift in the global financial system.

In this article, we’ll explore the idea behind the BRICS gold-backed currency, its potential implications, challenges, and the current status of this ambitious proposal.

1. Background: The Rise of the BRICS

The term “BRICS” was coined by economist Jim O’Neill in 2001 to represent five emerging national economies known for their significant influence on regional and global affairs. Together, these countries comprise over 40% of the world’s population and around 25% of the global GDP.

Over the years, BRICS countries have developed various platforms for collaboration, such as the BRICS Development Bank, to counter the dominance of Western financial institutions.

2. The Concept of a Gold-Backed Currency

The idea of a BRICS gold-backed currency comes from the long-standing discontentment with the U.S. dollar’s status as the world’s primary reserve currency. By having a currency backed by physical gold, BRICS nations would aim to reduce dependence on the U.S. dollar and Western financial systems.

A gold-backed currency would have a value directly tied to a specific quantity of gold, providing a tangible guarantee of the currency’s worth.

3. The Rationale: Why a Gold-Backed Currency?

The reasoning behind a gold-backed currency for BRICS nations can be understood from the following perspectives:

- Diversification: Reducing dependence on the U.S. dollar for international trade and reserves would provide BRICS countries with greater control over their economic policies.

- Stability: By basing the currency on gold, it would theoretically provide a more stable value, immune to inflation and fluctuations common in fiat currencies.

- Influence: A shared currency could enhance the economic and political influence of the BRICS nations on a global scale, creating an alternative to the Western-centric financial system.

4. Challenges and Concerns

While the idea is intriguing, the implementation of a BRICS gold-backed currency faces numerous challenges:

- Agreement on Valuation: Determining the gold backing’s exact value and managing the currency’s exchange rates would require intricate agreements between the member countries.

- Logistical Issues: Creating, storing, and managing the physical gold reserves necessary for such a currency would be a logistical challenge.

- Economic Differences: The BRICS countries have diverse economies, varying levels of gold reserves, and differing economic policies, which could lead to conflicts of interest.

- Global Resistance: The creation of a new reserve currency could face opposition from existing financial powers and international institutions, leading to diplomatic and economic tensions.

5. Current Status and Future Prospects

As of the writing of this article, the BRICS gold-backed currency remains a theoretical concept rather than an imminent reality. While there have been discussions and support for greater de-dollarization among BRICS nations, no concrete steps have been taken to create a gold-backed currency.

The proposal represents a long-term vision and is likely to evolve in line with the global economic landscape and the relationships among BRICS countries.

6. Implications for the Global Economy

If ever implemented, a BRICS gold-backed currency could have profound implications for the global economy:

- A Shift in Power Dynamics: It could reduce the influence of the U.S. dollar and the Euro, marking a shift in global economic power dynamics.

- Potential for Economic Stability: By offering an alternative reserve currency backed by physical assets, it might contribute to global economic stability.

- A New Economic Bloc: The creation of such a currency could further solidify the BRICS nations as a cohesive economic bloc, potentially attracting other emerging economies.

Conclusion

The concept of a BRICS gold-backed currency encapsulates the ambitions, challenges, and complexities of an evolving global economic landscape. While the idea remains theoretical, it represents a fascinating glimpse into potential future scenarios that could redefine international trade, finance, and economic alliances.

The implementation of such a currency would be fraught with challenges, requiring deep collaboration, aligned interests, and strategic navigation of global economic politics. However, even as a theoretical proposition, it prompts reflection on the nature of currency, value, and the shifting dynamics of global power.

As the BRICS countries continue to grow in influence and the global economy faces new challenges and opportunities, the discussion surrounding a gold-backed currency will likely remain an essential part of the dialogue about the future of international economic relations. Whether it becomes a reality or remains a visionary idea, it serves as a symbol of the quest for a more balanced and equitable global economic system.