U.S. energy officials have come to terms with the Texas Blockchain Council (TBC) and Riot Platforms, a Bitcoin mining company, to halt its proposed emergency survey targeting cryptocurrency miners nationwide.

In a filing dated March 2, it was disclosed that the U.S. Department of Energy, along with the Energy Information Administration (EIA) and the Office of Management and Budget (OMB), has reached an agreement with TBC and Riot to discontinue the collection of information from crypto miners for the proposed three-year emergency survey filed under the “EIA-862 Emergency Collection Request.”

The agreement stipulates that all previously gathered information from crypto miners, which was deemed intrusive by TBC and Riot, will be deleted, and any future data collected will also be discarded.

The settlement effectively terminates the temporary restraining order, which was initially slated to remain in effect until March 8.

Earlier, on Feb. 23, it was reported that the court had temporarily halted the U.S. energy regulators from gathering data while the lawsuit was ongoing.

READ MORE: Bullish Bitcoin Signals Point to Potential $180,000 Price Surge, Analysts Say

This decision followed arguments from TBC and Riot, convincing the judge that irreversible harm would occur without ceasing further data collection.

The plaintiffs contended that the survey could result in non-recoverable compliance costs, a credible threat of prosecution for non-compliance, and the disclosure of proprietary information.

While the EIA estimated that the survey would take approximately 30 minutes to complete, the court deemed this estimation “extremely inaccurate.”

TBC and Riot challenged this estimate, claiming that the compliance cost had already exceeded 40 hours.

However, both parties have consented to allowing the EIA to issue a new notice soliciting public feedback for a period of two months regarding the information it is permitted to collect.

“Defendants agree that EIA will allow for submission of comments for 60 days, beginning on the date of publication of the New Federal Register Notice,” the filing stated.

A significant move has shaken the crypto market as a whale relinquishes a substantial portion of their PEPE investment in favor of Shiba Inu’s native token, SHIB.

According to Lookonchain, a blockchain analytics platform, an anonymous crypto whale has strategically shifted their investment focus.

Previously heavily invested in the frog-themed PEPE token, the whale has now redirected their holdings towards SHIB, a move that has caught the attention of the crypto community.

The analytics platform revealed that the whale deposited a staggering 1.97 trillion PEPE tokens, valued at over $6.07 million, into Binance.

This strategic maneuver resulted in a profit of $3.49 million, exceeding half of their initial $6 million investment in PEPE.

Following this massive PEPE deposit, the whale acquired approximately $75.9 billion SHIB, worth $893 million, from Binance, transferring it to an undisclosed crypto wallet.

This shift underscores the whale’s confidence in SHIB’s potential, sparking speculation about future gains for the meme-inspired cryptocurrency.

Interest in SHIB has surged in recent times, with investors eyeing substantial returns. In January 2024, SHIB whale transactions spiked by over 1300%, indicating a growing demand for the dog-themed token.

While the motivations behind these large-scale transactions remain undisclosed, such whale activities often trigger price rallies within the cryptocurrency market.

READ MORE: Chainalysis Report Reveals Surge in Darknet Market Revenue Amidst Crypto Crime Landscape

The broader crypto community is closely monitoring the impact of these developments on SHIB’s dynamics.

SHIB’s price has experienced remarkable gains, with a nearly 60% increase in the past 24 hours, trading at $0.000020 at the time of writing.

Over the last seven days, SHIB has surged by an impressive 113.83%, driven by successful SHIB burns and the expansion of its ecosystem and community.

With a market capitalization surpassing $11 billion and a 24-hour trading volume exceeding $4 billion, SHIB continues to attract attention.

Derivatives data indicates a potential uptrend for SHIB, with a 74.06% rise in open interest and a 220.54% surge in volume, highlighting the token’s strength and prominence in the cryptocurrency market.

Bitcoin, the inaugural cryptocurrency, experienced a 3.79% surge in the 24-hour period preceding 8:20 am UTC, reaching a trading value of £58,504, marking its highest point in two years and three months.

According to data from CoinMarketCap, Bitcoin has seen an increase of over 13.5% on the weekly chart and more than 38% on the monthly chart.

This surge in Bitcoin’s price follows the recent announcement that Michael Saylor’s MicroStrategy had purchased an additional 3,000 BTC, totalling $155 million at an average price of $51,813 between Feb. 15 and 25.

With a cumulative acquisition of 193,000 BTC for $6.09 billion at an average price of $31,544, MicroStrategy stands as the largest Bitcoin holder among publicly traded companies.

Founder of the digital asset investment fund ARK36, Mikkel Morch, attributes MicroStrategy’s recent acquisition as the driving force behind this rally. Morch stated in a research note shared with Cointelegraph:

“This rally is not merely reflected in numbers on a chart; it signifies the confidence among institutional investors in the transformative potential of cryptocurrencies…

Additionally, the approval for Bitcoin-owning ETFs in the United States has infused a new wave of positivity, increasing trading volumes and bringing crypto-linked firms into focus amidst a broader market overshadowed by uncertainty.”

Over the past 24 hours, the total crypto market capitalization has risen by 2.85% to £2.19 trillion.

READ MORE: Grayscale’s Bitcoin ETF Records Record Low Outflows Amidst Rising Market Momentum

On Feb. 27, the industry reclaimed the £2-trillion market capitalization as Bitcoin surpassed £57,000, boosted by inflows into Bitcoin exchange-traded funds (ETFs) and an uplift in crypto investor sentiment.

Morch predicts the potential for a new all-time high for both Bitcoin and Ether (ETH) in the coming weeks, driven by the anticipation surrounding the upcoming Bitcoin halving and the potential approval of a United States spot Ether ETF. He elaborated:

“The excitement surrounding the approval of spot Ether ETFs further highlights the maturity of the cryptocurrency market, acknowledging Ethereum’s role not only as a digital currency but also as an infrastructure backbone for a future where finance and technology converge more seamlessly.”

The nine spot Bitcoin ETFs recorded a combined trading volume of over $2 billion for the second consecutive day on Feb. 28.

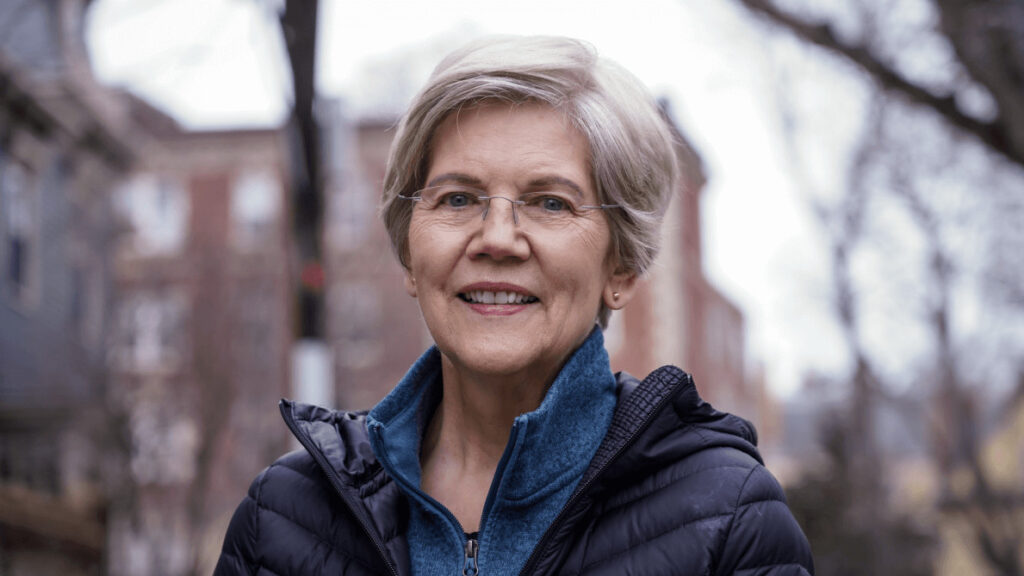

United States Senator Elizabeth Warren has emphasised the need for a fair regulatory framework for cryptocurrency and advocated for restrictions on Big Tech’s development of artificial intelligence (AI) models.

Warren restated her stance on cryptocurrency, expressing her desire “to collaborate with the industry” during a Bloomberg Television interview on February 27.

“In our financial system, pretty much everybody follows the same set of rules,” she remarked, further stating:

“My view is that it’s the same kind of activity, the same kind of risk, and should have the same kind of regulations […] I’m not looking for fancier regulations or anything tougher; I just want a level playing field.”

However, she lamented that collaboration efforts had been hindered, alleging that the industry claims the only way “they can survive” is if there’s “plenty of space” for criminal activity — citing ransomware scammers, drug and human traffickers, and terrorists as among those the crypto industry seeks concessions for.

Warren’s proposed legislation, the Digital Asset Anti-Money Laundering Act, seeks to categorise decentralized technologies like blockchain nodes, validators, noncustodial wallets, and software providers as financial institutions akin to banks and stock brokers.

READ MORE: British Bitcoin ETFs Break Daily Trading Record Amidst BTC Surge

Criticism of the bill from crypto industry figures, organisations, and associations has been vocal, with concerns raised about its suitability for the technology and its potential to drive innovation and investment abroad.

The U.S. Treasury Department has acknowledged that assertions regarding crypto’s use in terrorism were exaggerated.

During a conference in Washington D.C., Warren reiterated her desire to curb the development of AI large language models by major tech players such as Microsoft, Google, and Amazon.

“Each of the major cloud services — Google, Microsoft, and Amazon — should not be allowed to use their enormous size to dominate a whole new field, and that means blocking them from operating large language models,” she asserted.

Warren argued that Big Tech firms possess the resources and infrastructure to monopolise emerging AI sectors like chatbots, potentially stifling smaller competitors.

She portrayed this as a fresh battleground in her crusade against Big Tech’s dominance and concentration within the industry.

Michael Saylor has affirmed his steadfast commitment to holding onto Bitcoin, despite his company MicroStrategy’s holdings swelling to an unrealised profit of almost $4 billion.

“I’m going to be buying the top forever. Bitcoin is the exit strategy,” Saylor declared in an interview with Bloomberg on Feb. 20, when queried about the possibility of his firm selling its stash of 190,000 BTC — presently valued at approximately $9.88 billion.

Presenting his bullish argument for Bitcoin, Saylor asserted that the cryptocurrency is “technically superior” to gold, the S&P 500, and real estate, notwithstanding the significantly larger market capitalisations of these asset classes compared to Bitcoin’s $1 trillion.

“We believe capital is going to keep flowing from those asset classes into Bitcoin,” he remarked. “Bitcoin is technically superior to those asset classes.

And that being the case, there’s just no reason to sell the winner to buy the losers.”

MicroStrategy, a business intelligence software firm, made headlines as the first publicly traded company to begin accumulating Bitcoin in 2020.

READ MORE: Zap Protocol – How Can You Buy ZAP and is it a Good Investment?

The 190,000 BTC it held as of the fourth quarter of 2023 were acquired at an average price of $31,224 each, resulting in a total investment cost of $5.93 billion.

Data from HODL15Capital indicates that United States-based spot Bitcoin exchange-traded funds (ETFs), excluding the Grayscale Bitcoin Trust (GBTC), collectively hold an estimated 270,000 BTC as of Friday, Feb. 16.

Saylor highlighted the demand for Bitcoin, driven by an increasing appetite for ETF products, which has exceeded the supply from miners, sometimes by “10 times as much.”

Nevertheless, he dismissed concerns that ETFs might impede MicroStrategy’s ability to acquire Bitcoin, stating that the company employs a “levered operating strategy” for investing in the digital asset.

“The spot ETFs have opened up a gateway for institutional capital to flow into the Bitcoin ecosystem,” Saylor explained.

“They’re facilitating the digital transformation of capital, and every day, hundreds of millions of dollars of capital is flowing from the traditional analog ecosystem into the digital economy.”

“This is a rising tide. It’s going to lift all boats,” he concluded.

Cryptocurrency exchange Backpack has forged a partnership with global crypto on-ramp provider Banxa, unveiling a digital asset on- and off-ramp solution.

According to Banxa’s announcement on X, Backpack users in over 130 countries will now have access to this new on-ramp solution.

Backpack Exchange, birthed by the minds behind Solana’s Mad Lads executable nonfungible token (NFT) collection, initiated this collaboration.

Anndy Lian, an intergovernmental blockchain expert and author of the book NFT: From Zero to Hero, hailed the partnership as a boon for Backpack users and their overall exchange experience. He conveyed to Cointelegraph:

“[The partnership] enables Backpack users to easily buy and sell crypto with fiat currencies using various payment methods, such as credit cards, bank transfers, and e-wallets.

This will help increase the adoption and liquidity of Backpack and its supported tokens.”

The announcement follows Backpack’s impressive achievement of surpassing $1 billion in 24-hour trading volume on Feb. 18, just four days into the launch of its trading pre-season.

Notably, Backpack had already exceeded $300 million in daily trading volume within 24 hours on Feb. 15.

With the trading volume rapidly escalating, Armani Ferrante, Backpack’s founder and CEO, issued a word of caution on X, advising traders against getting overly excited, which might lead to detrimental trades:

“This is a long-term program for our long-term users, and I’d like to encourage people to trade responsibly. We have a lot to build, and the pre-season just got started.”

READ MORE: Ether Price Surge Continues: Approaching $2,800 Mark Amidst Optimism and Caution

Having obtained a virtual asset service provider license from the Dubai Virtual Assets Regulatory Authority in October 2023, Backpack Exchange also secured numerous operational licenses across various jurisdictions worldwide in the latter half of 2023.

Currently, Backpack’s SOL/USDC trading pair reigns supreme as the most traded Solana spot trading pair globally, boasting over $890 million in 24-hour trading volume.

Binance’s SOL/USDT trails in second place with $362 million in 24-hour volume, followed by Bybit’s $13.7 million SOL/USDC pair in third.

SOL experienced a 1.71% rise in the 24 hours leading up to 10:25 am Central European Time, trading at $112.25, as per CoinMarketCap data. SOL maintains its position as the fifth-largest cryptocurrency by market cap, having briefly surpassed Binance’s BNB token on Feb. 13.

Gold-tracking exchange-traded funds (ETFs) in 2024 have witnessed significant outflows, amounting to billions, in stark contrast to ETFs tracking the spot price of Bitcoin.

As per an X post from Bloomberg intelligence analyst Eric Balchunas on Feb. 14, the foremost gold ETFs have encountered outflows totaling $2.4 billion thus far in 2024.

Only three among them have experienced marginal inflows this year: VanEck Merk Gold Shares, FT Vest Gold Strategy Target Income ETF, and Proshares UltraShort Gold.

Notably, the most substantial outflows emanated from BlackRock’s iShares Gold Trust Micro and iShares Gold Trust, with $230.4 million and $423.6 million exiting, respectively.

Conversely, the ten sanctioned spot Bitcoin ETFs have garnered cumulative inflows of $3.89 billion and registered unprecedented volume since their inception on Jan. 11, according to preliminary data from Farside.

Commenting on the trend, portfolio manager Bitcoin Munger remarked, “Not only is Bitcoin sucking up funds, but gold is hemorrhaging AUM at an alarming rate across many ETFs.”

Balchunas, however, opined that the migration of gold ETF investors to Bitcoin ETFs wasn’t necessarily prevalent, suggesting it could be attributed to “US equity FOMO” instead.

Bitcoin pioneer Jameson Lopp shared a chart comparing the performance of the two ETFs, raising questions about the stance of gold investor and Bitcoin detractor Peter Schiff.

READ MORE: HectorDAO Investors Demand Control Amidst $2.7 Million Hack Scandal

The disparity has been exacerbated by the decline in gold prices throughout 2024. The precious metal has depreciated by 3.4% since the year’s commencement, reaching a two-month low of $1,993 per ounce on Feb. 14.

Meanwhile, Bitcoin prices have surged by 23.5% over the same period, hitting a two-year high of $52,483 on Feb. 14.

In a report released earlier in February, the World Gold Council highlighted global gold ETF outflows and a “reduction in speculative positioning” as significant factors contributing to gold’s subdued performance.

It also noted that “Long-term Treasuries and the US dollar, on the back of strong upside US economic surprises, were also headwinds.”

While Bloomberg senior commodity strategist Mike McGlone had previously forecasted gold outperforming Bitcoin in 2024, current observations suggest otherwise.

Bitcoin and gold, often compared for their shared store of value attributes, have historically been favoured investments during economic and geopolitical uncertainties.

Countless Bitcoin price predictions for 2024 and 2025 indicate a very bullish scenario for BTC.

Bitcoin, the first and most well-known cryptocurrency, has seen a tumultuous journey since its inception in 2009. Its price has experienced dramatic fluctuations, reflecting a range of factors including investor sentiment, regulatory news, and changes in the broader financial ecosystem. As we look towards 2024 and 2025, Bitcoin price predictions are becoming increasingly important for investors trying to navigate the volatile crypto market.

The Factors Influencing Bitcoin Price Predictions

Before diving into specific Bitcoin price predictions for 2024 and 2025, it’s crucial to understand the factors that can influence its value. These include:

- Adoption Rates: As more businesses and consumers adopt Bitcoin for transactions, its value could increase due to heightened demand.

- Regulatory Environment: Regulations can have a significant impact on Bitcoin’s price. Positive regulatory developments can lead to price increases, while stringent regulations may have the opposite effect.

- Technological Advances: Innovations, such as improvements in blockchain technology, can enhance Bitcoin’s functionality and appeal, potentially boosting its price.

- Market Sentiment: Investor sentiment, often driven by news and social media, can cause sudden and dramatic price movements.

- Macroeconomic Factors: Global economic trends, including inflation rates and currency fluctuations, can influence Bitcoin’s attractiveness as an investment.

Bitcoin Price Prediction for 2024

Looking ahead to 2024, Bitcoin price predictions are mixed, reflecting the diverse views of analysts. Some experts are bullish, citing increasing adoption of cryptocurrencies and potential technological advancements as key drivers of growth. They argue that as Bitcoin becomes more mainstream, its price could soar, potentially reaching new all-time highs. On the other hand, skeptics point to regulatory uncertainties and the volatile nature of the crypto market as reasons for caution, suggesting that while growth is possible, it may be more moderate.

A consensus view among many analysts is that Bitcoin could experience significant growth in 2024, with prices possibly ranging between $50,000 and $100,000. This prediction assumes continued growth in adoption, particularly by institutional investors, and a favorable regulatory environment. However, it’s important to note that the crypto market is notoriously difficult to predict, and unexpected developments could lead to divergent outcomes.

Bitcoin Price Prediction for 2025

Looking further ahead to 2025, Bitcoin price predictions become even more speculative, given the additional uncertainty about future developments. However, many experts believe that the long-term outlook for Bitcoin is positive, citing the limited supply of Bitcoin and increasing interest from both retail and institutional investors as factors that could drive prices higher.

Some bullish forecasts suggest that Bitcoin could exceed $100,000 by 2025, driven by continued adoption and the perception of Bitcoin as a “digital gold” that can act as a hedge against inflation. Others, however, caution that Bitcoin’s price could be affected by technological challenges, competition from other cryptocurrencies, or changes in the regulatory landscape, which could limit its upside potential.

Navigating the Uncertainty

Investors considering Bitcoin as part of their portfolio should be prepared for volatility and uncertainty. While Bitcoin price predictions for 2024 and 2025 offer insight into potential future trends, they are based on assumptions that may or may not materialize. Therefore, a diversified investment strategy that includes a range of assets may help mitigate risk.

Summary

Bitcoin price predictions for 2024 and 2025 highlight the potential for significant growth but also underscore the inherent uncertainties in the cryptocurrency market. Factors such as adoption rates, regulatory developments, and global economic trends will play a crucial role in shaping Bitcoin’s trajectory.

Investors should stay informed, consider a range of viewpoints, and be prepared for both opportunities and challenges as the crypto landscape continues to evolve. Whether Bitcoin will reach the lofty heights predicted by some or encounter unexpected hurdles remains to be seen, but its journey will undoubtedly be closely watched by the financial world.

Bitcoin is anticipated to surge to a minimum of £200,000 in the forthcoming years and could even surpass half a million pounds, according to a prominent analyst.

In his most recent update on the long-term BTC price trajectory, advisor and early Bitcoin advocate Tuur Demeester projected BTC/USD to reach up to £600,000 by 2026.

Demeester attributed Bitcoin’s ascent to “trillions” of pounds in bailouts, suggesting that the cryptocurrency’s rally to £50,000 this week is indicative of a growing confidence in its future appreciation.

The bullish arguments for BTC’s price surge revolve around the significant events of April’s block subsidy halving and the recent launch of spot Bitcoin exchange-traded funds (ETFs).

These developments reduce the emission of new Bitcoin and exert additional pressure on its available supply.

However, Demeester highlights macroeconomic factors as crucial drivers behind Bitcoin’s trajectory. He stated, “In ’21 bitcoin topped at £69k. I’m targeting £200-£600k by 2026. Fueled by £ trillions in global bailouts/stimulus.”

Discussion on social media platform X echoed concerns about systemic issues in the U.S. banking system and the government’s potential need to provide liquidity to prevent their decline.

READ MORE: Crypto.com Defends Major Sponsorship Deals with F1 and UFC

Cointelegraph reported on the possibility of risk-asset price volatility in March due to these ongoing challenges.

Demeester suggested that Bitcoin’s next multiyear peak could occur anywhere from 2025 onwards, and he anticipates a surge in mainstream interest, particularly after Bitcoin’s recent milestone of £50,000.

He stated, “I expect for retail to start waking up soon. Remember, there is no fever like bitcoin fever.”

Demeester’s track record in the Bitcoin sphere spans over a decade, with accurate predictions of Bitcoin’s recent all-time high between £50,000 and £100,000 in 2019 and 2020.

However, not all analysts share Demeester’s optimism. Some foresee a less rosy future for Bitcoin and altcoins, with predictions of a market reversal, including a potential drop to £30,000.

One such voice is popular trader Il Capo of Crypto, who warned of a potential rejection of BTC from the £50,000 level while altcoins continue to surge, indicating a market divergence.

Despite the recent bullish sentiment, Il Capo of Crypto has maintained a BTC price target of just £12,000 for most of the past year.

Google has unveiled plans to initiate a support fund worth 25 million euros (£21.4 million) to aid in skill training for Europeans in the realm of artificial intelligence (AI).

The AI Opportunity Initiative for Europe intends to facilitate training so individuals can “seize the opportunity of AI” at a time when the continent is positioned to “lead the way” in utilising AI for economic purposes.

“We want to play our part in empowering Europe’s workforce, supporting people through change so that everyone can benefit.”

The tech giant stated that this initiative is collaborating with European Union governments, civil society, academics, and businesses to offer advanced AI training to local startups, with a specific emphasis on vulnerable communities.

Approximately 10 million euros will be allocated to equip workers with the necessary skills to avoid “being left behind.”

A similar initiative was initiated by the Italian government in mid-2023, allocating millions of euros towards developing digital skills for workers at risk of displacement due to automation and AI.

Google mentioned that the AI programme follows a successful initiative launched in 2015 called “Grow with Google,” which provided free training to tackle the digital skills gap in the EU.

It claimed that the programme trained more than 12 million people.

READ MORE: UN Probes North Korea-linked Cyberattacks on Crypto Firms, Profits Totaling $3 Billion

This recent initiative also entails a collaboration with the Centre for Public Impact (CPI), inviting applications from EU-based social enterprises and nonprofits to extend AI training to the widest audience.

Adrian Brown, the CPI’s executive director, stated that AI has the potential to “transform the world” but could also exacerbate inequality gaps.

“This new programme will help people across Europe develop their knowledge, skills, and confidence around AI, ensuring that no one is left behind.”

Google has also broadened the languages available for its AI foundational course to 18 and stated it is incorporating additional resources into its Google Career Certificates programme to enable professionals to gain practical experience applying AI in workplace scenarios.

This announcement coincides with local regulators preparing to finalise the EU AI Act, which oversees the utilisation and advancement of AI technologies within EU legal jurisdictions.