The California Fair Political Practices Commission (FPPC) has recently updated its campaign disclosure manuals, including an extensive set of rules related to the declaration of cryptocurrency contributions.

These updates align with recent changes in legislation and commission regulations, reflecting modern financial practices and covering a wide variety of topics.

Among the updates are rules about campaign contribution limits, limited liability company disclosure requirements, behested payment reporting, and cryptocurrency contributions.

Specific provisions regarding excessive contributions, advertising disclosure requirements, and other non-substantive technical changes are also part of the revisions.

Within these guidelines, political committees are allowed to solicit cryptocurrency as a non-monetary contribution, with specific requirements.

Notably, such contributions must comply with applicable limits and cannot be accepted from foreign principals, lobbyists, or anonymous sources.

Also, committees cannot receive cryptocurrency contributions directly through peer-to-peer transactions.

Instead, they must be processed through selected payment processors acting on behalf of the committee.

The commission requires that cryptocurrency donations be made and received through U.S.-based payment processors registered with the U.S. Department of Treasury and Financial Crimes Enforcement Network (FinCEN).

READ MORE: Futurama’s Hilarious Take on Crypto Mining: A Wild West Adventure in ‘Crypto Country’

These processors must use Know Your Customer (KYC) protocols, ensuring the verification of contributor identities.

Committees accepting cryptocurrencies must confirm that their payment processors use KYC procedures and collect relevant information such as name, address, occupation, and employer of contributors.

This information must be shared with the committee within 24 hours of a contribution being made.

Additionally, the payment processors must promptly convert cryptocurrency contributions to U.S. dollars at current exchange rates and deposit the funds into the committee’s campaign bank account within two business days of receipt.

These contributions are considered non-monetary, and any processing fee paid to the processor is not deducted from the reported amount.

The entire contribution must be reported by committees as a “miscellaneous increase to cash.”

In summary, the California FPPC’s updates demonstrate a thoughtful and detailed approach to regulating political contributions, particularly those made via cryptocurrencies.

It aligns political campaign financing with modern technological advancements, ensuring transparency, accountability, and adherence to existing regulations.

Other Stories:

Top VC Firms Face Class-Action Lawsuit for Alleged Role in FTX Crypto Exchange Fraud

Cryptocurrency Asset Flows Continue Negative Trend with $107 Million Outflows

PayPal’s PYUSD Stablecoin Launch Triggers Flood of Imposter Tokens and Honeypot Scams

The rapid advancement of high-level artificial intelligence (AI) technology has ignited a competitive race between the United States and China, each striving to lead in the development of the most formidable AI systems.

This pursuit has sparked escalating tensions between the two global superpowers.

The Biden Administration, in a decisive move, has imposed limitations on Chinese tech investments pertaining to semiconductors, quantum computing, and AI.

This initiative has triggered apprehensions among regulators in various nations.

The European Union and the United Kingdom are deliberating their responses to this U.S. action.

On August 9, The White House issued two executive notices addressing AI advancements.

The first highlighted a novel opportunity for hackers to employ AI in fortifying U.S. infrastructure against cybersecurity threats, with monetary incentives as rewards.

Conversely, the second note designated China, Hong Kong, and Macau as “countries of concern.”

This classification empowers the U.S. to regulate investments within these regions, particularly in sectors pertinent to national security, including semiconductors, microelectronics, and quantum information technologies.

The document underscored the role of these sectors in military, intelligence, surveillance, and cyber-enabled capabilities.

READ MORE: Governments Remain Wary About Worldcoin Amid Privacy Concerns

The scope of the note presently encompasses the mentioned countries; however, a Biden administration official hinted at the possibility of adding other nations in the future.

The U.S. has already undertaken measures to curtail Chinese technological investments and restrict Chinese access to American services and products.

In a significant development, U.S. regulators imposed bans on semiconductor chip exports to China in October 2022, as these chips are integral to the creation of high-performance AI systems.

China responded swiftly to the U.S. pronouncement through an official statement from the Chinese Embassy in the U.S.

The Chinese Ministry of Foreign Affairs denounced the U.S.’s unilateral decisions regarding investments in China, decrying them as economic coercion and tech bullying.

China perceived these actions as an attempt to sideline it from the global arena.

To counter previous U.S. moves, China announced tightened controls on AI chip-making material exports.

Reports indicated that prominent Chinese tech giants, such as Baidu, ByteDance, Tencent, and Alibaba, have placed significant orders for Nvidia A800 processors, anticipating stricter controls from the U.S.

The U.S. stance had immediate repercussions abroad.

The U.K.’s Prime Minister’s office indicated that the U.S. measures would be taken into consideration while assessing potential national security risks linked to specific investments.

The European Commission also pledged to analyze the U.S. decision, given its proactive involvement in monitoring and regulating AI developments.

As the AI race intensifies, the actions of these influential players hold significant implications for the global technological landscape.

Other Stories:

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

Binance’s Proof-of-Reserves Discloses Strong Financial Position

FC Barcelona, the renowned Spanish soccer club, has sealed a significant investment worth 120 million euros (approximately $132 million) for its pioneering Web3 endeavor, Barça Vision.

The landmark deal was revealed on August 11 and entails Libero Football Finance AG and Nipa Capital B.V. as the investing entities.

The transaction’s crux involves FC Barcelona trading a 29.5% ownership interest in Bridgeburg Invest, the parent company overseeing Barça Vision, in return for the substantial capital infusion.

This strategic move is aimed at propelling the Club’s ambitious Barça Vision initiative, which seeks to seamlessly amalgamate all facets of digital content within the realms of Web3 and blockchain.

Notably, this includes the burgeoning domains of NFTs (non-fungible tokens) and the metaverse, pivotal components in the Club’s blueprint for erecting the digital haven of Espai Barça.

Libero Football Finance AG, a publicly traded firm based in Germany, is well-regarded for its expertise in advising soccer clubs on financial matters.

In a complementary fashion, Nipa Capital B.V., a venture capital entity headquartered in the Netherlands, contributes to this investment partnership.

READ MORE: Futurama’s Hilarious Take on Crypto Mining: A Wild West Adventure in ‘Crypto Country’

However, it is worth noting that the completion of this transaction is contingent upon the approval of FC Barcelona’s shareholders and is anticipated to finalize in the fourth quarter of 2023.

FC Barcelona’s voyage into the realm of blockchain and digital assets commenced in February 2020, with a collaboration with Chiliz blockchain, resulting in the creation of FC Barcelona Fan Tokens (BAR) on the Ethereum platform.

The partnership’s ascendancy saw Chiliz’s acquisition of a 24.5% stake in Barça Vision’s digital content arm for a sum of $100 million in August 2022.

Notably, FC Barcelona has actively ventured into the world of NFTs.

In May, the Club’s debut NFT collection, named “Unleash Your Passion,” was launched in collaboration with Plastiks.

This compilation, encompassing 3,000 NFTs, was priced at $30 each and carried an eco-conscious theme, vowing to aid in the reduction of 35,000,000 kilograms of plastic waste from the planet.

Building on this momentum, FC Barcelona accomplished remarkable milestones in the NFT arena. The Club’s inaugural NFT, “Masterpiece #1 In A Way,” was auctioned at Sotheby’s New York in July 2022, fetching a staggering $693,000.

Subsequently, the sequel to this series, titled “Masterpiece #2 – Empowerment,” was traded on the OpenSea platform on June 28, 2023, for an impressive sum of $300,231.

Other Stories:

Top VC Firms Face Class-Action Lawsuit for Alleged Role in FTX Crypto Exchange Fraud

Cryptocurrency Asset Flows Continue Negative Trend with $107 Million Outflows

PayPal’s PYUSD Stablecoin Launch Triggers Flood of Imposter Tokens and Honeypot Scams

The futuristic animated series, Futurama, known for its comedic take on science fiction, took a humorous jab at cryptocurrency mining in its latest installment, demonstrating the show’s knack for predicting trends well before they materialize.

The show’s third episode of its recent version, titled “How the West Was 1010001,” was released on Hulu on August 6, where the characters found themselves indebted to the Robot Mafia.

In a clever parody, they embarked on a journey to “Crypto Country,” a fictional representation of the Wild West, reminiscent of Bitcoin mining’s resource-intensive nature.

Set in the year 3023, Futurama’s portrayal of the cryptocurrency landscape remained true to its comedic nature.

The price of BTC remained volatile, and people scoured the land for sources of “cheap, filthy electricity” to facilitate their mining operations.

The episode’s humor manifested through absurd scenarios, like collecting thallium for crypto mining chips, relocating to the comically named “Doge City,” and BTC miners consuming such massive energy that it started ionizing the atmosphere.

Not solely focused on Bitcoin, the show humorously touched upon “danged Ethereum” and depicted robots’ heads repurposed for mining crypto.

READ MORE: Binance’s Proof-of-Reserves Discloses Strong Financial Position

Remarkably, Futurama had been on air since March 1999, a decade before the inception of Bitcoin.

While the show had rarely delved into cryptocurrency discussions, its recent episode underscores the growing presence of digital assets in mainstream media, spanning from animated series like South Park to blockbuster films like Mission: Impossible – Dead Reckoning Part One.

Curiously, the episode left unaddressed the rationale behind the characters’ persistence in Bitcoin mining in 3023, despite the widely-known BTC halving process.

This process indicates that the final Bitcoin block would likely be mined around the year 2140, making the episode’s comedic depiction divergent from the actual cryptocurrency timeline.

In its characteristic style, Futurama’s latest episode has managed to weave an amusing tale around cryptocurrency mining, showcasing the series’ enduring relevance and its ability to lampoon emerging trends with a comedic touch.

Other Stories:

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

Governments Remain Wary About Worldcoin Amid Privacy Concerns

XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

Worldcoin, the innovative digital ID project that uses iris scans for instant verification online and potential issuance of universal basic income (UBI), has garnered significant attention since its launch on July 24.

However, it has also faced scrutiny over data collection methods.

The project has already made strides by integrating with Auth0, enabling thousands of clients to sign in using World ID.

Tiago Sada, head of product at Tools for Humanity, the company behind Worldcoin, revealed that more such integrations are expected in the future.

They have also made their software development kit (SDK) available to all developers and integrated with Discord, indicating the project’s commitment to widespread adoption.

Reuters recently reported that Worldcoin plans to expand its services to governments and organizations, given its open identity protocol built on zero-knowledge proofs.

Sada clarified that the platform is not intended to replace passports or driver’s licenses but rather to complement them.

Several governments have expressed interest in the technology, particularly due to concerns about identity verification and fraudulent documents on the black market.

However, some governments remain cautious about Worldcoin’s implications for privacy and data protection.

READ MORE: Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

The German government’s data watchdog conducted a probe into Worldcoin before its official launch in November 2022.

Sada emphasized the importance of building applications that are resistant to bots and AI-generated fake content.

With the rise of AI, such challenges become more complex but also more critical to address.

He expressed the hope that the world would adopt Worldcoin in a privacy-preserving, decentralized, open-source, and permissionless manner.

The spread of AI tools and applications has already raised concerns about the potential for rampant fake news and deep fakes.

For instance, AI-generated fake news led to rumors about the resignation of the United States Securities and Exchange Commission Chair.

Worldcoin has taken concrete steps towards implementation, deploying over 1,500 metal orbs for in-person iris scans and sign-ups in major cities like London, Paris, and Dubai.

As the project progresses, users and governments alike will continue to closely monitor its developments and assess its impact on data privacy and online verification practices.

Worldcoin’s future success will depend on striking a balance between technological advancement and safeguarding individual rights.

Other Stories:

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

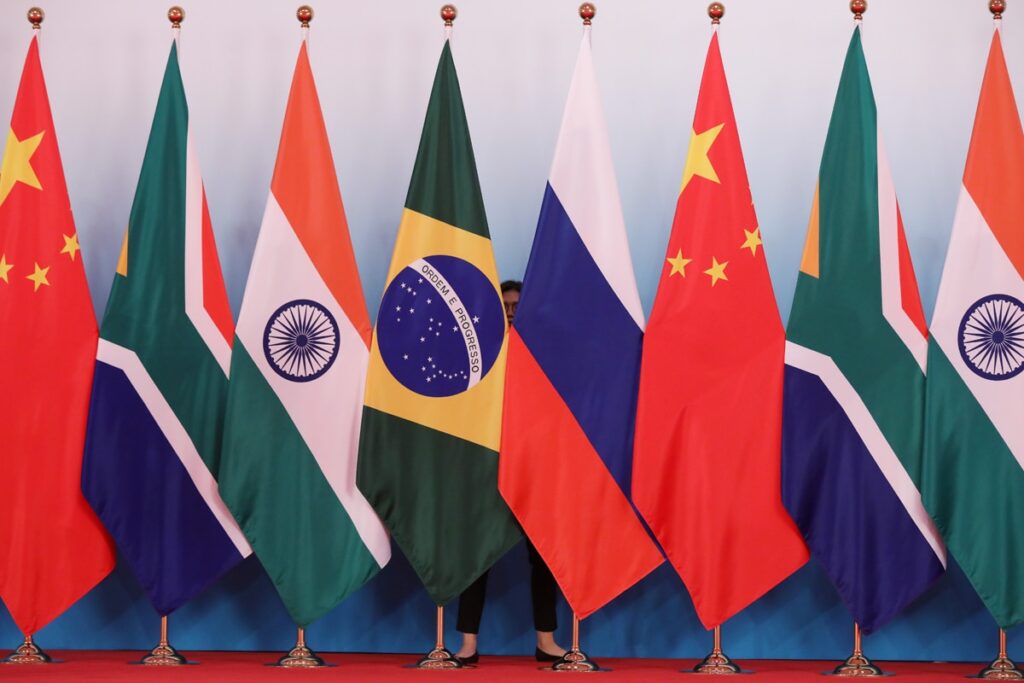

The BRICS countries (Brazil, Russia, India, China, and South Africa) are known for their growing economic influence and collaboration in various fields. One of the most intriguing and debated ideas related to the BRICS is the proposal of a gold-backed currency. Such a move, if implemented, could represent a significant shift in the global financial system.

In this article, we’ll explore the idea behind the BRICS gold-backed currency, its potential implications, challenges, and the current status of this ambitious proposal.

1. Background: The Rise of the BRICS

The term “BRICS” was coined by economist Jim O’Neill in 2001 to represent five emerging national economies known for their significant influence on regional and global affairs. Together, these countries comprise over 40% of the world’s population and around 25% of the global GDP.

Over the years, BRICS countries have developed various platforms for collaboration, such as the BRICS Development Bank, to counter the dominance of Western financial institutions.

2. The Concept of a Gold-Backed Currency

The idea of a BRICS gold-backed currency comes from the long-standing discontentment with the U.S. dollar’s status as the world’s primary reserve currency. By having a currency backed by physical gold, BRICS nations would aim to reduce dependence on the U.S. dollar and Western financial systems.

A gold-backed currency would have a value directly tied to a specific quantity of gold, providing a tangible guarantee of the currency’s worth.

3. The Rationale: Why a Gold-Backed Currency?

The reasoning behind a gold-backed currency for BRICS nations can be understood from the following perspectives:

- Diversification: Reducing dependence on the U.S. dollar for international trade and reserves would provide BRICS countries with greater control over their economic policies.

- Stability: By basing the currency on gold, it would theoretically provide a more stable value, immune to inflation and fluctuations common in fiat currencies.

- Influence: A shared currency could enhance the economic and political influence of the BRICS nations on a global scale, creating an alternative to the Western-centric financial system.

4. Challenges and Concerns

While the idea is intriguing, the implementation of a BRICS gold-backed currency faces numerous challenges:

- Agreement on Valuation: Determining the gold backing’s exact value and managing the currency’s exchange rates would require intricate agreements between the member countries.

- Logistical Issues: Creating, storing, and managing the physical gold reserves necessary for such a currency would be a logistical challenge.

- Economic Differences: The BRICS countries have diverse economies, varying levels of gold reserves, and differing economic policies, which could lead to conflicts of interest.

- Global Resistance: The creation of a new reserve currency could face opposition from existing financial powers and international institutions, leading to diplomatic and economic tensions.

5. Current Status and Future Prospects

As of the writing of this article, the BRICS gold-backed currency remains a theoretical concept rather than an imminent reality. While there have been discussions and support for greater de-dollarization among BRICS nations, no concrete steps have been taken to create a gold-backed currency.

The proposal represents a long-term vision and is likely to evolve in line with the global economic landscape and the relationships among BRICS countries.

6. Implications for the Global Economy

If ever implemented, a BRICS gold-backed currency could have profound implications for the global economy:

- A Shift in Power Dynamics: It could reduce the influence of the U.S. dollar and the Euro, marking a shift in global economic power dynamics.

- Potential for Economic Stability: By offering an alternative reserve currency backed by physical assets, it might contribute to global economic stability.

- A New Economic Bloc: The creation of such a currency could further solidify the BRICS nations as a cohesive economic bloc, potentially attracting other emerging economies.

Conclusion

The concept of a BRICS gold-backed currency encapsulates the ambitions, challenges, and complexities of an evolving global economic landscape. While the idea remains theoretical, it represents a fascinating glimpse into potential future scenarios that could redefine international trade, finance, and economic alliances.

The implementation of such a currency would be fraught with challenges, requiring deep collaboration, aligned interests, and strategic navigation of global economic politics. However, even as a theoretical proposition, it prompts reflection on the nature of currency, value, and the shifting dynamics of global power.

As the BRICS countries continue to grow in influence and the global economy faces new challenges and opportunities, the discussion surrounding a gold-backed currency will likely remain an essential part of the dialogue about the future of international economic relations. Whether it becomes a reality or remains a visionary idea, it serves as a symbol of the quest for a more balanced and equitable global economic system.

Binance, the prominent cryptocurrency exchange, recently disclosed its latest proof-of-reserves (PoRs) on August 1, showcasing transparency in its crypto holdings.

However, a significant development in its USD Coin (USDC) reserves raised eyebrows and sparked discussions on X (formerly Twitter).

Despite concerns, the recent reserve audit indicated that Binance holds an ample amount of cryptocurrency and cash to cover user funds.

The snapshot revealed that Binance’s net balances exceed 100% of its customers’ net balances for all assets, indicating a healthy financial situation.

Yet, the focus of discussions revolved around the movements in Binance’s USDC reserves after the collapse of Silvergate and the depegging of the stablecoin.

The PoR highlighted a drastic decrease in Binance’s USDC balance from $3.4 billion on March 1 to $23.9 million by May 1.

It was revealed that Binance initiated the internal conversion of customers’ USDC to Binance USD in September.

However, during that time, the exchange still held a significant amount of USDC in its reserves.

On-chain data pointed out that following Silvergate’s collapse on March 12, Binance swiftly converted its USDC reserves into Bitcoin (BTC) and Ether (ETH).

According to Twitter on-chain analyst Aleksandar Djakovic, Binance acquired approximately 100,000 BTC and 550,000 ETH between March 12 and May 1, amounting to around $3.5 billion, which coincided with the surplus of USDC in their reserves.

Despite queries from Cointelegraph, Binance remained unresponsive at the time of reporting, leaving the crypto community pondering the significance of these USDC reserve movements.

Coinbase CEO Brian Armstrong’s remark during the company’s Q2 earnings call meeting added to the intrigue.

Armstrong quipped that Binance had sold USDC for another stablecoin, further fueling discussions around the issue.

Proof-of-reserves (PoRs) have emerged as a popular method for crypto exchanges to demonstrate their holdings transparently to the public.

This approach gained traction after the collapse of FTX crypto exchange, raising calls for increased transparency in the crypto ecosystem.

The downfall of FTX in November 2022 had shaken the industry, with founders initially claiming a sound financial situation before its collapse.

In conclusion, Binance’s recent proof-of-reserves revealed a healthy financial situation overall, but the movements in its USDC reserves after Silvergate’s collapse became a focal point of discussion.

The crypto community emphasized the importance of transparency in the aftermath of the FTX debacle, prompting exchanges to disclose their holdings openly through PoRs.

Other Stories:

2024 Presidential Candidates’ Mixed Views on Crypto

Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital

Huobi, a prominent cryptocurrency exchange, experienced significant outflows totaling $64 million from August 5 to 6, amid persistent rumors surrounding its solvency and potential investigations by Chinese authorities.

As a result of these outflows, the exchange’s total value locked (TVL) decreased to $2.5 billion at the time of reporting, down from $3.09 billion on July 6.

The rumors initially surfaced on August 4, suggesting that Huobi’s leadership in China had been arrested due to alleged involvement with gambling platforms.

A spokesperson from Huobi swiftly dismissed these claims as fake news when speaking with Cointelegraph.

The rumors come in the context of growing scrutiny and tighter control over cryptocurrency exchanges within mainland China.

While at least one C-level executive has left Huobi in recent weeks, it remains uncertain whether this departure is related to the investigations in China.

The exchange’s head of social media also refuted the rumors on a social media platform, stating that Huobi is currently performing well.

Additional concerns about Huobi’s financial situation have been raised by Fintech executive and angel investor Adam Cochran.

He highlighted inconsistencies in the exchange’s Tether (USDT) holdings. Cochran referred to on-chain data from DefiLlama, indicating that Huobi held less than $90 million in assets across USDT and USD Coin (USDC) on August 5.

In contrast, Huobi’s latest “Merkle Tree Audit” claimed that users had $630 million in USDT held and a wallet balance of $631 million USDT. Cochran concluded that Huobi is potentially insolvent.

Despite these claims, Huobi has yet to respond to Cointelegraph’s request for clarification regarding the rumors of insolvency and discrepancies between on-chain data and its audit report.

In addition to the solvency concerns, Huobi faces challenges in other jurisdictions.

In May, the Malaysian securities regulator took enforcement action against the exchange, resulting in the closure of its operations in the country.

The situation surrounding Huobi remains fluid as investors and regulators closely monitor the developments.

The exchange’s reputation and stability are at stake as it navigates through the uncertainties surrounding its financial standing and potential legal issues in China and beyond.

Other Stories:

Coinbase CEO Affirms Commitment to US Amid Regulatory Uncertainty

Latvia Sees Decline in Crypto Asset Purchases Amidst Concerns Over Fraud and Money Laundering

There are dozens of crypto and Bitcoin casinos, but which is best in 2023? We have tried out and reviewed all of the most popular online crypto casinos, and concluded that the ones below are best.

We ranked each casino on a number of factor, including trustworthiness, variety of games and coins, speed of payouts, and bonuses.

Note: Some of the crypto casinos are available to players in the US, while some don’t allow US-based players. We have mentioned this for each of the casinos reviewed below.

Without further ado, let’s dive into our updated ranking of the best crypto and blockchain casinos of 2023.

1) Bitstarz

Bitstarz is an online casino that stands out in the crowded field of online gaming sites. Founded in 2014, it has become popular with players for a variety of reasons. In this overview, we’ll explore Bitstarz’s games, customer service, security features, promotions, payment options, and more.

Games

Bitstarz offers over 2,600 different games, ranging from traditional casino fare like slots and table games to innovative and engaging virtual experiences.

With a selection that spans everything from classic fruit machines to the latest 3D slot games, it’s an appealing option for all types of players.

The casino features games from a wide array of software providers, including big names like Microgaming, NetEnt, and Betsoft.

Whether you prefer card games like poker or blackjack, roulette, or something more unique like live dealer games, Bitstarz likely has something to satisfy your taste.

Customer Service

One of Bitstarz’s most praised features is its robust customer service. Support is available 24/7 through live chat, email, and phone.

They have a reputation for providing prompt, courteous, and effective assistance. Their support team is trained to help with everything from technical issues to questions about games and promotions.

Security

Bitstarz has implemented a number of measures to ensure the security of its users. The site uses SSL encryption to protect personal and financial information. It also complies with GDPR regulations to safeguard privacy.

The casino is licensed by the government of Curacao, and they work with various independent bodies to verify the fairness of their games. They have even won awards for their commitment to integrity and transparency, helping to build trust within the online gaming community.

Promotions

Bitstarz is known for offering appealing promotions and bonuses to both new and existing players. Their welcome package can be particularly enticing, with deposit bonuses and free spins available.

They also run regular promotions like tournaments, reload bonuses, and seasonal offers. These can add extra excitement and value to the gaming experience, and they provide incentives for players to return.

Payment Options

A standout feature of Bitstarz is its support for cryptocurrency. Along with traditional payment methods like credit cards and e-wallets, players can deposit and withdraw using Bitcoin, Ethereum, and other popular cryptocurrencies.

This offers enhanced privacy and sometimes quicker transaction times. It also makes the casino more accessible to players in regions with restrictive online gaming laws.

Mobile Experience

Bitstarz has ensured that their site is fully optimized for mobile devices. This allows players to enjoy their favorite games on the go, whether through a mobile browser or a dedicated app. The mobile experience is smooth and intuitive, retaining all the features that make the desktop version appealing.

Summary

Bitstarz represents a modern and well-rounded online casino. With a wide game selection, strong customer support, secure and diverse payment options, and exciting promotions, it’s not hard to see why it has become a favorite among players.

Their commitment to transparency and integrity sets them apart in an industry where trust is paramount. By embracing technology, such as cryptocurrencies, and focusing on delivering a high-quality user experience, Bitstarz stands as an example of what a contemporary online casino can be.

As with any online gambling platform, it’s important for players to be aware of the laws and regulations in their jurisdiction and to gamble responsibly.

Bitstarz’s robust support and informational resources can assist players in making informed decisions, adding to its appeal as a trusted and enjoyable place to play.

Overall rating: 9.6/10

2) BC.Game

BC.Game is an online cryptocurrency casino that has quickly gained popularity within the gaming community.

Overview

Established in 2017, BC.Game offers a wide variety of casino games, including slots, table games, and live dealer experiences. Unlike traditional online casinos, BC.Game operates exclusively with cryptocurrencies, offering an array of options for deposits and withdrawals.

Games

BC.Game boasts a comprehensive list of games catering to different preferences. Here’s a breakdown:

- Slots: They offer a range of slot games, from traditional to contemporary themes.

- Table Games: Classic casino games like blackjack, roulette, and poker are well-represented.

- Live Casino: Engaging live dealer games provide an immersive experience.

- Proprietary Games: Unique to BC.Game, these games are developed in-house and offer innovative and exclusive gaming experiences.

Cryptocurrencies

BC.Game supports various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many others. This allows players from various regions and preferences to participate without worrying about currency conversion.

Security

Security is paramount in online gaming, and BC.Game implements several measures to ensure the safety and privacy of its users:

- Encryption: Utilizing SSL encryption, personal and transactional data are kept secure.

- Provably Fair: The provably fair algorithm allows players to verify the fairness of each game played.

- Compliance: Adhering to the legal requirements in the jurisdictions they operate in.

Bonuses and Promotions

BC.Game provides several incentives for both new and existing players:

- Welcome Bonus: New players are typically greeted with deposit matches or free spins.

- Daily Tasks and Rewards: Regular players can complete daily tasks to earn rewards.

- VIP Program: A tiered VIP program offers additional benefits and bonuses for loyal players.

Mobile Experience

Understanding the growing demand for mobile gaming, BC.Game offers a mobile-friendly website that’s accessible through browsers on smartphones and tablets. This ensures that players can enjoy games on the go without compromising on quality.

Community and Support

BC.Game fosters a community atmosphere, providing chat rooms where players can interact. The platform also offers robust customer support, available 24/7 through various channels like live chat and email.

Responsible Gaming

The platform emphasizes responsible gaming, providing tools and resources to help players gamble within their means. This includes setting deposit limits, loss limits, and self-exclusion options.

Challenges and Criticisms

While BC.Game has seen significant success, it has also faced criticisms:

- Regulatory Concerns: The decentralized nature of cryptocurrencies can create legal and regulatory challenges in certain jurisdictions.

- Limited Traditional Payment Methods: The exclusive focus on cryptocurrencies might deter players unfamiliar with or skeptical of digital currencies.

Conclusion

BC.Game represents a contemporary approach to online gaming, capitalizing on the growing interest in cryptocurrencies. By offering a wide array of games, robust security measures, and community-focused features, the platform caters to a diverse and global audience.

However, the focus on cryptocurrencies, while innovative, may pose challenges, both in terms of regulatory compliance and broad appeal. The future success of BC.Game may hinge on its ability to navigate these challenges and continue to evolve in a rapidly changing industry.

As with any online casino or financial service, potential users should conduct thorough research and consider their own risk tolerance and legal obligations before engaging with the platform.

Overall rating: 8.3/10

3) 7Bit Casino

In the fast-evolving world of online gambling, casinos are constantly vying for the attention of players seeking both entertainment and potential winnings. Among these digital gambling establishments, 7Bit Casino has garnered attention for its unique features, expansive game selection, and commitment to user experience.

Founded in 2014, 7Bit Casino has steadily climbed the ranks to become a prominent player in the online casino industry. In this comprehensive review, we will delve into the various aspects that set 7Bit Casino apart, from its game offerings and security measures to its promotions and customer support.

Game Selection and Software Providers

At the heart of any successful online casino lies its game selection, and 7Bit Casino certainly does not disappoint. With a wide array of games spanning various categories, players are spoiled for choice. The casino offers an extensive library of slots, ranging from classic fruit machines to modern video slots with intricate themes and innovative features.

Players can also indulge in table games such as blackjack, roulette, baccarat, and poker, each presented in various versions to cater to different preferences.

One notable aspect of 7Bit Casino’s game selection is its emphasis on high-quality software providers. The casino has partnered with some of the most renowned names in the industry, including Microgaming, NetEnt, Betsoft, Play’n GO, and Evolution Gaming.

This strategic collaboration ensures that players can enjoy games with captivating graphics, engaging gameplay, and fair outcomes, all backed by the reputation of reputable developers.

Cryptocurrency Integration

One of the standout features that distinguish 7Bit Casino from its competitors is its integration of cryptocurrency as a payment method. In a time when digital currencies are gaining more acceptance, 7Bit Casino has embraced this trend by allowing players to deposit, wager, and withdraw using various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

This integration not only caters to players who prefer using cryptocurrencies but also adds an extra layer of security and anonymity to transactions.

The utilization of cryptocurrencies also expedites the withdrawal process. Traditional payment methods can sometimes be hindered by processing delays due to banks or other financial intermediaries. Cryptocurrency transactions, on the other hand, are typically faster, allowing players to receive their winnings promptly.

Security and Fairness

In the world of online gambling, security and fairness are paramount concerns for both players and operators. 7Bit Casino addresses these concerns by implementing rigorous security measures to protect sensitive data and ensuring fair play through the use of provably fair technology.

The casino employs advanced encryption protocols to safeguard players’ personal and financial information. This ensures that sensitive data, such as credit card details and personal identification, remains confidential and secure from potential cyber threats.

Moreover, 7Bit Casino employs provably fair technology, which allows players to verify the fairness of game outcomes. This transparency instills confidence in players, as they can independently confirm that the results of games are not manipulated in favor of the casino.

Provably fair technology is especially important for online casinos, as it bridges the gap of trust between players and operators.

Bonuses and Promotions

Like many online casinos, 7Bit Casino offers a variety of bonuses and promotions to attract and retain players. New players are typically greeted with a welcome package that includes a combination of deposit bonuses and free spins. These incentives provide players with extra funds to explore the casino’s offerings without significantly increasing their initial investment.

Additionally, 7Bit Casino often runs ongoing promotions, such as reload bonuses, cashback rewards, and special tournaments. These promotions not only enhance the overall gaming experience but also offer players more opportunities to win and engage with the casino’s offerings.

It’s important to note that all bonuses and promotions come with terms and conditions, including wagering requirements and maximum withdrawal limits. Players should carefully review these terms to ensure they can make the most of the bonuses without any surprises.

Mobile Compatibility and User Experience

Recognizing the increasing popularity of mobile gaming, 7Bit Casino has optimized its platform to be accessible on various devices, including smartphones and tablets. The responsive design ensures that players can enjoy their favorite games on the go, without compromising the quality of the gaming experience.

The user interface is designed to be intuitive and user-friendly, making navigation through the casino’s various sections seamless. Players can easily browse through games, access their account information, and manage their funds without encountering any major hurdles.

Customer Support

Quality customer support is a hallmark of any reputable online casino, and 7Bit Casino takes this aspect seriously. The casino offers multiple channels for customer support, including live chat, email, and a comprehensive FAQ section. The live chat feature allows players to connect with a support representative in real-time, addressing their queries and concerns promptly.

Additionally, 7Bit Casino provides support in multiple languages to cater to its diverse player base. This commitment to ensuring a positive customer experience contributes to the overall satisfaction of players.

Conclusion

In the competitive landscape of online casinos, 7Bit Casino has managed to stand out through its diverse game selection, cryptocurrency integration, robust security measures, and player-focused approach.

The integration of cryptocurrency payments showcases the casino’s adaptability to emerging trends, while its collaboration with top-tier software providers ensures a high-quality gaming experience.

The emphasis on security, transparency, and fairness further solidifies 7Bit Casino’s reputation as a trustworthy platform for online gambling. From bonuses and promotions to efficient customer support, the casino’s dedication to user satisfaction is evident in every facet of its operations.

As players continue to seek online gambling experiences that combine entertainment, convenience, and the potential for winnings, 7Bit Casino’s commitment to innovation and excellence positions it as a strong contender in the ever-evolving world of digital casinos.

Overall rating: 8.0/10

Coinbase, the prominent U.S. cryptocurrency exchange, disclosed its second-quarter results on August 3, revealing a net loss, but also some positive developments.

Notably, operating expenses were reduced by 13% compared to the previous quarter, and the company’s cash reserves received a 3% boost, reaching $5.5 billion.

However, the exchange faced challenges, experiencing a $97 million net loss, worse than the previous quarter, and a 32% decline in adjusted EBITDA, which stood at $194 million in Q2.

One of the downsides was a 7% decrease in subscription and service revenue from the first quarter, partly attributed to a 28% decline in the market cap of USD Coin (USDC). Coinbase has a stake in Circle, the issuer of USDC, which means it benefits from the interest rate offered by the stablecoin reserves.

Additionally, interest income from customer fiat balances deposited at the exchange dropped by 16% to $201 million in Q2.

Despite these challenges, Coinbase appears to be reducing its reliance on trading fees. Subscription and service revenues now match trading revenues, indicating a shift towards becoming a service-oriented platform that prioritizes recurring income.

Looking at Coinbase’s share price throughout 2023, it remains unclear whether investors recognize this strategic shift, and it is possible that they still believe trading fees will remain the primary revenue driver for the company.

However, several potential events on the horizon could significantly impact Coinbase’s revenue streams.

READ MORE: Gulf Nation Nears Implementation of Virtual Asset Regulations

If Tether (USDT), the largest stablecoin, faces legal troubles and loses its banking partnerships, it could create an opportunity for USDC to fill the void, leading to increased service revenue for Coinbase.

Similarly, if Binance, a major competitor, faces regulatory shutdown, Coinbase could gain a substantial increase in market share and boost its service revenues.

Additionally, the potential launch of Bitcoin spot exchange-traded funds (ETFs) in the United States could create a new source of revenue for Coinbase.

Furthermore, Coinbase has plans to diversify its product offerings, including a margin trading platform and a cryptocurrency lending platform, which could contribute significantly to its revenue generation.

The cryptocurrency market’s volatility makes it challenging to predict the success of Coinbase’s pivot to non-trading revenues.

However, the company’s agility in cutting expenses and fortifying its cash reserves demonstrates adaptability.

Whether investors will acknowledge and reward this strategic shift remains uncertain, but if some of the mentioned scenarios materialize, they could be in for a pleasant surprise.

Coinbase seems to be playing its cards strategically in this dynamic space. Only time will tell if it’s a winning strategy.

Other Stories:

Adam DeVine Joins Forces with Bitget in Year-Long Crypto Ad Partnership

Binance-Backed Solv Protocol Raises $6M in New Funding

Bitcoin to Breach $100,000 by 2024 Amidst Mining Industry Challenges