Cryptocurrency exchange Binance is contemplating taking legal action against its former payment provider, Checkout.com, according to a spokesperson for Binance on August 18.

The potential legal conflict stems from communications dispatched by Checkout.com to Binance on August 9 and August 11.

As reported by Forbes, Guillaume Pousaz, CEO of Checkout.com, terminated the partnership with Binance due to concerns regarding regulatory actions, Anti-Money Laundering (AML) measures, sanctions, and compliance controls within relevant jurisdictions.

A Binance representative responded via email, stating, “We do not agree with Checkout’s purported basis for termination and are considering our options for legal action.”

The spokesperson emphasized that on-ramp and off-ramp services on the exchange are unaffected by this dispute.

However, the discontinuation of the business relationship prompted Binance to close down Binance Connect on August 16.

Launched in March 2022, Binance Connect was a regulated platform facilitating crypto buy-and-sell operations.

The platform supported over 50 cryptocurrencies and fiat transactions, bridging the gap between crypto firms and the traditional financial system.

READ MORE: Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

At one point, Binance had been the largest customer of Checkout.com, processing around $2 billion in transactions in a single month in 2021.

Binance has encountered a series of setbacks in recent months, leading to its global branches struggling to secure partnerships.

In June, the exchange disclosed the discontinuation of support from its euro banking partner, Paysafe Payment Solutions, in Europe.

The Australian branch faced a sudden cutoff from the banking system in June.

Similarly, Binance.US confronted challenges in finding banking partners in the United States, with former collaborators Silvergate and Signature Bank facing closures during the banking crisis earlier this year.

The ongoing crisis has even prompted Binance CEO Changpeng Zhao to explore the possibility of purchasing a bank, as he revealed in an interview.

The legal and operational challenges faced by Binance do not seem to be abating.

On June 5, the U.S. Securities and Exchange Commission filed a lawsuit against the global exchange and its CEO, accusing them of violating securities laws and engaging in the unregistered offering of securities in the United States.

Other Stories:

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

Stellar Development Foundation Invests in MoneyGram International

Stablecoin issuer Tether has revealed its decision to discontinue the Bitcoin Omni Layer version, citing waning user interest.

This particular iteration of Tether holds historical significance as one of the earliest stablecoins to be introduced.

Alongside the Bitcoin version, Tether also plans to halt operations for its Bitcoin Cash and Kusama versions, as communicated through an announcement on August 17.

Tether’s announcement clarified that moving forward, there will be no issuance of new Tether tokens on the Bitcoin Omni Layer, Bitcoin Cash, or Kusama platforms.

However, the redemption process will remain accessible for at least a year, and the company will provide updates before the end of that period regarding the procedure for redemptions beyond it.

The Bitcoin Omni Layer functions as a smart contract system situated atop the Bitcoin blockchain. Initially referred to as “Mastercoin,” this system was launched in July 2013, a full two years ahead of Ethereum.

Tether’s release on the Omni Layer in October 2014 marked a pivotal moment as it became the first stablecoin on this platform.

Over time, it ascended to become the leading stablecoin by market capitalization, surpassing predecessors such as BitUSD and NuBits.

READ MORE: Stellar Development Foundation Invests in MoneyGram International

In recognizing the historical role played by Omni Layer Tether, Tether’s August 17 statement expressed appreciation for the contributions and innovations of the team behind the platform.

This acknowledgment was balanced with the acknowledgement of challenges faced by the Omni Layer due to the lack of popular tokens and the availability of USDT on alternative blockchains.

These challenges prompted exchanges to opt for other transport layers over Omni, ultimately diminishing the usage of USDT Omni and compelling Tether to cease its issuance.

Tether did, however, leave the door open for the potential revival of the Omni Layer version should usage of the platform experience a resurgence.

Additionally, the company revealed that it is in the process of developing a new Bitcoin smart contract system named “RGB.”

Upon its completion, Tether intends to reintroduce the token in an RGB version, thereby re-establishing its presence on the Bitcoin blockchain.

As the stablecoin landscape intensifies in 2023, Tether faces increased competition to maintain its dominance.

The release of PayPal’s PYUSD on August 7 and Binance’s listing of FDUSD on July 26 have added to the mounting pressure on Tether’s standing.

Other Stories:

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

Bitcoin remained close to its lowest levels in two months at the opening of Wall Street on August 18th, as the market grappled with significant liquidations.

Data from Cointelegraph Markets Pro and TradingView indicated that BTC’s price movement was relatively stagnant, following an 8% loss triggered by a single daily candle.

The cryptocurrency market experienced a wave of liquidations across its derivatives sectors, with these dominating the scene while spot selling remained subdued.

Notably, trading firm QCP Capital highlighted a substantial short liquidation event on the Deribit exchange, hinting at a major account being wiped out.

Market observers, including QCP, noted that the reaction to a reported write-down of SpaceX’s $373 million Bitcoin holdings appeared to be overblown.

Recollections of past instances of market influence by Elon Musk, CEO of SpaceX and Tesla, resurfaced, leading some to hope that the market would not revisit such volatility.

The scale of liquidations seen rivaled those following the FTX exchange meltdown, which caused BTC/USD to plunge to $15,600 in November 2022.

The cryptocurrency’s price wavered around $26,000, sparking differing interpretations among market participants about the situation’s true nature and its future ramifications.

Noted trader and analyst Rekt Capital provided a grim outlook, pointing out a potential double-top formation for BTC/USD in 2023 and the lack of support from trend lines and moving averages during the downturn.

READ MORE: Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Conversely, some market participants remained optimistic.

Trader CryptoCon identified two significant benchmarks that often precede successful price rebounds during bull market retracements: the relative strength index (RSI) bouncing at the 0.382 Fibonacci retracement level.

According to CryptoCon, this pattern repeated across multiple cycles.

Rekt Capital also highlighted the oversold condition of the daily RSI, a level unseen since June 2022, but reminiscent of bear market conditions.

Looking ahead, market focus turned to Jerome Powell’s forthcoming commentary, as the chair of the United States Federal Reserve’s speech at Jackson Hole was anticipated to hold the potential to introduce new volatility.

In summary, Bitcoin struggled near its two-month low on August 18th as the market grappled with significant liquidations across derivatives, despite relatively weak spot selling.

Traders offered differing perspectives on the situation, with some expressing concern over potential negative patterns, while others identified historical indicators of rebounds during bull market retracements.

The anticipation of Jerome Powell’s upcoming speech further added to the market’s uncertainty.

Other Stories:

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

Silvergate Bank is undergoing significant changes as CEO Alan Lane and two other key executives prepare to step down from their roles, marking a departure from the institution’s previously crypto-friendly stance.

Lane, along with the chief legal officer John Bonino, is set to leave on August 15th, while Antonio Martino, the chief financial officer, will follow suit on September 30th.

In a recent filing to the Securities and Exchange Commission (SEC), Silvergate Capital, the bank’s parent company, confirmed that these departures align with their previously communicated strategy to wind down operations and initiate the voluntary liquidation of Silvergate Bank.

This transition also highlights the bank’s shift away from its previous position as a crypto-friendly establishment.

It’s important to note that the departing executives will not be entitled to additional compensation based on their employment agreements, but they will receive severance benefits in recognition of their service.

The departure of these executives is taking place amid a series of legal challenges that Silvergate Bank is currently facing.

The institution, as well as CEO Alan Lane, are implicated in various proposed lawsuits that center largely around their alleged involvement in the wrongdoings of the crypto exchange FTX.

One lawsuit, brought forth by the Texas-based Word of God Church, alleges that Silvergate Bank utilized $25 million from church deposits to participate in what they describe as FTX’s “fraudulent” activities.

The lawsuit further contends that both Silvergate and Alan Lane were well aware of the ongoing fraudulent activities and misconduct.

READ MORE: Zunami Protocol Issues Warning Amidst Attack on Stablecoin Pools on Curve Finance

Another class-action lawsuit claims that Silvergate Bank did not adequately conduct due diligence on the crypto firms it onboarded as clients, including prominent names like FTX, Alameda, and North Dimension.

The suit also mentions other notable customers such as Binance.US, Huobi Global, Nexo Capital, and Bittrex.

The bank’s decision to wind down its operations stems from the substantial losses it incurred, amounting to $1 billion, due to the collapse of FTX, one of its major clients.

This collapse had far-reaching implications, not only affecting the bank but also sending shockwaves through the cryptocurrency ecosystem and the broader US banking sector.

Kathleen Fraher, the chief transition officer of Silvergate Capital, is slated to take over the role of CEO Alan Lane, while Andrew Surry, the current chief accounting officer of the bank, is set to assume the responsibilities of departing CFO Antonio Martino.

These changes mark a pivotal moment in the evolution of Silvergate Bank and its role within the cryptocurrency landscape.

Other Stories:

Former FTX CEO Sam Bankman-Fried Detained in Notorious Brooklyn Jail

Pro-Bitcoin Politician Surges Ahead in Argentine Presidential Primaries

Pro-Bitcoin Politician Surges Ahead in Argentine Presidential Primaries

The Stellar Development Foundation (SDF) has taken on a minority investment role in MoneyGram International, a leading payments provider, as revealed in an announcement on August 15th.

Denelle Dixon, the CEO and Executive Director of the Stellar Development Foundation, expressed the decision to invest in MoneyGram as a straightforward one.

Dixon clarified in a corresponding blog post that the investment stemmed from SDF’s internal cash reserves, earmarked for supporting the foundation’s operations.

This funding source diverged from Stellar’s Enterprise Fund, typically utilized for backing startups and early-stage ventures.

Financial particulars of the investment were not disclosed by Dixon, but she did highlight that the SDF’s investment would secure them a position on MoneyGram’s board of directors.

The purpose of the investment, Dixon explained, is to bolster MoneyGram’s digital operations and explore the potential of blockchain technology.

This strategic move signifies MoneyGram’s dedication to embracing digital transformation and emerging as a frontrunner in fintech on a global scale.

The affiliation between Stellar Development Foundation and MoneyGram traces back to 2019, evolving into a more formalized partnership in 2021.

This investment marks the latest step in their collaboration.

READ MORE: Zunami Protocol Issues Warning Amidst Attack on Stablecoin Pools on Curve Finance

In a noteworthy development, MoneyGram facilitated the purchase, sale, and custody of cryptocurrencies through its mobile app for users based in the United States in November 2022.

In another recent initiative in July 2023, MoneyGram, in partnership with local bank Banesco, introduced a novel account deposit service targeted at consumers in Venezuela.

Despite this significant announcement, Stellar’s native token, Stellar XLM, exhibited a muted response, experiencing a 4.4% drop to $0.129 on the day of the announcement.

This information is according to Cointelegraph price data.

Stellar XLM had previously experienced an upswing following a legal victory for Ripple.

However, it has faced a subsequent 28% decline and remains notably lower, down by 85%, from its all-time high of $0.875, reached in January 2018.

Other Stories:

Voyager Digital’s Massive Token Transfers Spark Speculation of Impending Sell-Off

Pro-Bitcoin Politician Surges Ahead in Argentine Presidential Primaries

Former FTX CEO Sam Bankman-Fried Detained in Notorious Brooklyn Jail

The US Securities and Exchange Commission (SEC), the regulatory body responsible for approving spot cryptocurrency exchange-traded funds (ETFs), appears to be edging closer to granting permission for these investment vehicles after years of deliberation.

A significant development occurred when BlackRock, the world’s largest asset management firm, submitted its application for a Bitcoin ETF in June.

This move has reignited investor interest both within and beyond the cryptocurrency sphere.

Notably, BlackRock also established a “surveillance-sharing agreement” with Coinbase, a leading cryptocurrency exchange, possibly indicating the SEC’s receptiveness to ETF applications under such arrangements.

Numerous companies, including ARK Invest under the leadership of CEO Cathie Wood, have filed for crypto ETFs with the SEC. ARK 21Shares applied to list its spot Bitcoin ETF in May 2023.

However, the SEC recently extended the review period by 21 days until August 11, inviting public comments on the proposal as per its guidelines.

The SEC holds the authority to delay ETF applications for up to 240 days, a period that includes public input.

Nevertheless, the SEC has not yet approved any spot Bitcoin ETF proposal from any US firm. It only began accepting investment products linked to Bitcoin futures in October 2021.

READ MORE: Pro-Bitcoin Politician Surges Ahead in Argentine Presidential Primaries

The challenge lies in the nature of these investment vehicles: Bitcoin futures-linked ETFs allow investment without direct exchange participation, whereas spot Bitcoin ETFs involve holding the cryptocurrency directly within a fund.

Early attempts to gain SEC approval for crypto ETFs date back to 2013 when Gemini co-founders Cameron and Tyler Winklevoss applied for a Bitcoin Trust listing.

However, these attempts were rebuffed, showcasing the evolving regulatory landscape.

Stuart Barton, co-founder and CIO of Volatility Shares, the firm behind a leveraged Bitcoin futures ETF listing, revealed that the SEC application process involves negotiations and suggested that smaller firms might have an advantage in pursuing spot crypto ETFs.

Barton emphasized that significant companies have not substantially advanced the argument for ETF approval.

Prominent asset management firms like BlackRock, ARK Invest, Bitwise Asset Management, VanEck, WisdomTree, Invesco, Galaxy Digital, Fidelity, and Valkyrie currently have spot Bitcoin ETF applications under SEC review.

The SEC’s cautious stance might stem from the complex nature of the US crypto market, which requires further regulatory clarity and oversight.

The SEC’s ongoing enforcement actions against Coinbase, Binance, and Ripple, alongside penalties imposed on other firms, indicate a need for increased regulation.

US legislators are actively considering laws to define the roles of the SEC and Commodity Futures Trading Commission (CFTC) in overseeing digital assets.

Court decisions will likely play a role in shaping regulations, particularly following the SEC vs. Ripple case, where a judge determined that XRP was not a security.

Industry analysts suggest that the probability of a US spot Bitcoin ETF approval is around 65%, partly influenced by BlackRock’s application.

Speculation also abounds regarding potential simultaneous approvals to prevent any single company from gaining an advantage.

Other Stories:

Voyager Digital’s Massive Token Transfers Spark Speculation of Impending Sell-Off

Zunami Protocol Issues Warning Amidst Attack on Stablecoin Pools on Curve Finance

Former FTX CEO Sam Bankman-Fried Detained in Notorious Brooklyn Jail

On August 1, the BetFury platform released an epic feature – Bonus Combats. Now players worldwide can invite friends to compete against each other and create gaming battles on their terms. The main winner of each Combat gets all his opponents’ rewards and multiplies his crypto assets. Let’s briefly review Bonus Combats and find out how profitable it is.

What Are Bonus Combats?

Bonus Combats are PvP user competitions based on a Bonus Buy feature in Slots. Each Bonus Combat lasts no more than 10 minutes, but there are many unexpected twists and turns during this time. The winner is determined by the amount of crypto won during this round. The lucky one who won more crypto in the Bonus Game than others takes all his opponents’ winnings.

How to Win in Bonus Combats?

It needs to create an account to play on BetFury. The platform has an exclusive Welcome Pack for newbies, which helps everyone get a decent starting capital. Sign up to get up to 1 000 Free Spins and $3 500.

Every user can join PvP or create a unique Bonus Combat according to his preferences: favorite games, the Bonus Game price, and the maximum number of opponents. If someone joins this competition in five minutes, the system will launch the created PvP.

Bonus Combat offers to choose a Slot with a certain price of the Bonus Game. After the start of the battle, the user is given one and a half minutes to buy the Bonus Game and ten minutes for playing.

Each win is recorded in the table at the end of the round. The lucky one with the highest win amount in this table receives the reward.

The main winner gets his winning amount in the cryptocurrency he used. Opponents’ rewards can be received in the currency opponents used or in BFG (internal BetFury token). In the last case, the system will charge a 3% Performance Fee for transferring. However, the choice of BFG is more universal and convenient because this token becomes a cryptocurrency with strong potential. It’s explained by the end of BFG Mining, a limited supply of tokens, and many profitable utilities.

How to become a participant:

⚔️NEW Bonus Combats Activity⚔️

About BetFury

BetFury is an ecosystem of crypto products for entertainment and additional income. The platform has a native BFG token with many utilities. BFG is listed on many crypto exchanges: PancakeSwap, Biswap, etc. The token has over 55 000 holders, and more than 3B BFG are in circulation. The most profitable utility for using tokens is BetFury Staking, with up to 50% APY and the ability to flexibly withdraw Staking payouts.

BetFury offers over 8 000 Slots and 18 Original games with one of the highest RTPs on the market (up to 99.02% RTP). BetFury also has 80+ kinds of Sports to bet for true fans. Along with huge events, the platform provides profitable bonuses: Rakeback, FuryCharge, and Cashback up to 25%.

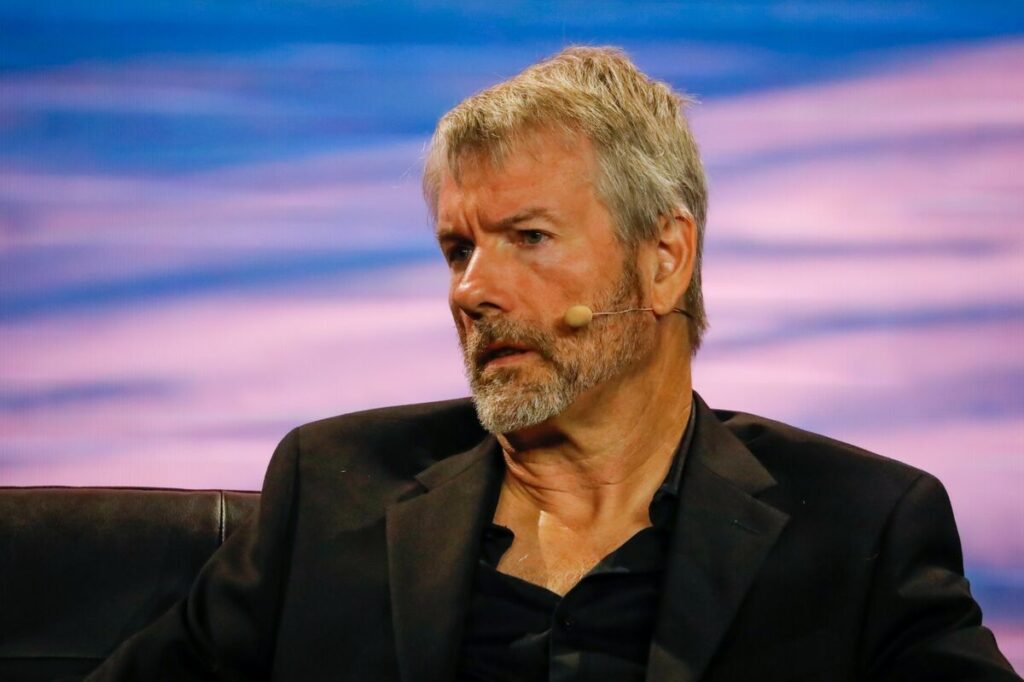

During a recent podcast discussion, Michael Saylor of MicroStrategy conveyed his belief that the involvement of major corporations in purchasing and holding Bitcoin should not be viewed as a worrisome development.

Speaking on the Coin Stories podcast with Natalie Brunell, released on August 7, Saylor highlighted the inevitable expansion of third-party and corporate engagement within the Bitcoin domain.

While acknowledging the aspiration of Bitcoin enthusiasts for complete self-control or sovereignty over their holdings, Saylor proposed that this might not be the exclusive solution, given the diverse applications of Bitcoin.

He expressed the idea that as Bitcoin further intertwines with society, its utility will diversify, negating a one-size-fits-all approach.

Saylor enumerated three primary factors substantiating the need for custodial services: technical, political, and natural considerations.

On a political basis, he argued that certain circumstances necessitate reliance on third-party custodians.

He pointed out that unless fundamental changes occur, political factors tied to regions such as New York City, California, or Iceland will demand custodial solutions.

From a technical perspective, Saylor highlighted the inevitability of trusting layer-3 third parties for transactions, particularly those involving mobile devices.

READ MORE: Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

He painted a vision of Bitcoin as a foundational layer, accompanied by layer-2 systems like the Lightning Network for speed, and layer-3 services provided by entities like Bank of America and Apple to enhance functionality.

Saylor also introduced the concept of natural reasons for custodial reliance.

He postulated that certain individuals, like an elderly person dealing with Alzheimer’s or someone wanting to secure assets for a future grandchild, might find it safer to entrust their holdings to others.

Drawing an analogy to childhood experiences, he cited that the absence of car keys didn’t necessarily invoke complaints, suggesting a comparable situation with Bitcoin custody.

Emphasizing adaptability, Saylor underlined that the market will ultimately dictate the optimal blend of Bitcoin integration methods.

He asserted that a diverse array of ways to incorporate, wrap, embed, or transact with Bitcoin should not evoke fear, as the right combination of integrations will naturally emerge through market dynamics.

In conclusion, Michael Saylor, during a recent podcast exchange, expressed his viewpoint that the involvement of large corporations in Bitcoin custody shouldn’t raise alarm.

He highlighted the inevitability of Bitcoin’s expansion across various sectors and delineated reasons for custodial arrangements based on technical, political, and natural factors.

Saylor stressed the importance of embracing multiple integration approaches, with the market determining the most suitable amalgamation of Bitcoin functionalities.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Former FTX CEO Sam Bankman-Fried finds himself in an unexpected predicament, spending his third night alongside over 1,500 inmates within the confines of New York’s infamous jail.

This stark contrast emerges from his earlier life in a luxurious California home owned by his parents, valued in the millions and boasting five bedrooms.

The abrupt change in his circumstances transpired following a bail revocation during an August 11th court hearing, presided over by Judge Lewis Kaplan.

The Brooklyn Metropolitan Detention Center, the facility where he now resides, was labeled by the judge as far from a luxury establishment.

Built to accommodate a maximum of 1,000 inmates, the MDC currently holds more than 1,500 individuals under federal custody.

Bankman-Fried anticipates an extended stay, at least two months, while awaiting his impending criminal trial. Nonetheless, his legal team has swiftly lodged an appeal in a bid to overturn this bail revocation.

Regrettably for Bankman-Fried, the detention center has a history marred by scandal, encompassing instances of inmate mistreatment and corruption.

In 2019, former warden Cameron Lindsay referred to the MDC as one of the most problematic facilities under the Bureau of Prisons’ jurisdiction.

Recent incidents have fueled this perception.

A guard faced charges in April for accepting bribes to facilitate the smuggling of contraband such as phones, cigarettes, and drugs.

READ MORE: Curve Finance Vows Reimbursement After $62 Million Hack

In a chilling winter of 2019, the facility suffered a week-long power outage, subjecting inmates to freezing conditions.

Reports from The Intercept painted a grim picture, illustrating inmates resorting to banging on cell windows to gain attention from onlookers.

Those protesting non-violently against dire conditions faced repercussions like pepper spray, solitary confinement, and even closure of their toilets.

The Brooklyn MDC has housed several high-profile individuals in the past, including artists like 6ix9ine, R. Kelly, and Fetty Wap.

Martin Shkreli, known as “pharma bro,” and Ghislaine Maxwell, an accomplice in Jeffery Epstein’s sex trafficking, also spent time within its walls.

Until recently, Bankman-Fried enjoyed bail, residing in a luxurious $4 million Palo Alto, California home with numerous amenities, including a pool.

The bail’s revocation stemmed from a leak of a diary belonging to former Alameda Research CEO Caroline Ellison.

The diary contained her sentiments towards Bankman-Fried and her role in the company. Prosecutors alleged that Bankman-Fried leaked the diary to undermine Ellison’s credibility as a witness and to intimidate her.

In response, his legal team countered the claims, asserting his right to engage with reporters and comment on an ongoing article. An appeal to reverse the bail revocation has been initiated.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

A team of researchers hailing from San Diego State University in California has developed a cutting-edge artificial intelligence (AI) system designed to combat and expose cryptocurrency giveaway scams proliferating on the X platform (formerly known as Twitter).

This innovative system, dubbed GiveawayScamHunter, was meticulously crafted to detect, monitor, and reveal the operations of these fraudulent schemes that promise free cryptocurrencies.

In the span between June 2022 and June 2023, the automated GiveawayScamHunter detected a staggering 95,111 instances of scam lists.

These fraudulent lists had originated from 87,617 distinct accounts on the X social media platform.

GiveawayScamHunter’s operational prowess extends beyond mere identification, as it was adeptly utilized by the researchers to automatically extract the pertinent website and wallet addresses connected to these scams.

Consequently, this strategy resulted in the unearthing of a total of 327 scam-related internet domains and the discovery of 121 previously unreported cryptocurrency wallet addresses linked to scams.

The research team’s approach began with an exploration of a novel avenue for cryptocurrency giveaway scams: Twitter Lists.

Leveraging the feature’s open access nature, scammers effortlessly exploited it as a networking tool.

Employing the data garnered from previously identified giveaway scams, the team trained a natural language processing tool to pinpoint lists associated with giveaway scams.

Harnessing this methodology, the researchers successfully identified an astonishing count of almost 100,000 instances of giveaway scam lists.

READ MORE: Hong Kong’s HKVAX Granted Preliminary Approval for Virtual Asset Trading Platform by SFC

This breakthrough permitted them to compile crucial data concerning previously uncharted scam websites and wallets.

From the insights derived from this dataset, the team gained valuable understanding into the mechanics of these scams.

They delved into the modus operandi of scammers, their methods of targeting victims, and even managed to approximate the number of victims ensnared during the year-long study.

As the research paper highlights, meticulous tracking of transactions involving scam cryptocurrency addresses revealed a shocking statistic.

Over the course of the study, these scams targeted more than 365 individuals, resulting in a collective financial loss of approximately $872,000 USD.

Acknowledging the significance of their findings, the researchers responsibly disseminated their results, encompassing associated accounts, domains, and wallet addresses, to both X and the wider cryptocurrency and blockchain community.

Regrettably, as of the publication date of August 10, the paper mentions that 43.9% of these linked accounts remain active.

However, the research team clarifies that the majority of these accounts are likely inactive spam profiles.

Other Stories:

California Updates Campaign Manuals with Detailed Rules for Cryptocurrency Contributions

US Bank’s Crypto Holdings Surge to Nearly $170 Million Amid Regulatory Scrutiny

FTX Debtors Clash with Creditors Over Asset Control Amidst Restructuring Plan