Bitcoin’s recent bullish momentum appears to be losing steam, as shifts in liquidity on the Binance exchange signal potential volatility ahead, according to a recent analysis by Keith Alan, co-founder of Material Indicators, a monitoring resource.

While Bitcoin’s price has remained relatively stable over the weekend, data from Binance’s BTC/USD order book reveals concerning changes in liquidity.

The bid support has shifted downward, concentrating around the $24,600 mark—a level not observed in spot markets since March.

What’s particularly worrisome is that the largest concentrations of BTC bid liquidity have moved below the previously established Lower Low at the bottom of the range.

BTC/USD experienced its lowest post-March dip in mid-June, reaching $24,750 before bouncing back, as confirmed by data from Cointelegraph Markets Pro and TradingView.

Keith Alan anticipates a similar bounce from the current spot levels before any downside pressure resumes.

However, he also expects a breakdown in price from a macro perspective, indicating that bullish momentum and sentiment are waning.

Although bears have not yet gained complete control, there is no clear dominance on either side of the market.

READ MORE: MetaMask Users Targeted in Cryptocurrency Scam Using Government Website URLs

This shift does not necessarily signify a surge in bearish momentum but rather hints at fading bullish sentiment. Keith Alan expressed skepticism about buy walls persisting without being filled.

Previously, Keith Alan had identified $24,750 as a crucial level for bulls to maintain to protect Bitcoin’s broader price uptrend.

Other traders in the cryptocurrency space also expect increased volatility in the near future.

Skew, a popular trader, pointed to activity in derivatives markets as a sign of impending turbulence.

Meanwhile, Credible Crypto, known for his optimistic BTC price outlook, hoped that any potential downside would be limited to the high $24,000 range.

He emphasized the importance of maintaining the higher timeframe low at $24.8k, suggesting that a reversal to fill the inefficiency above that level could follow.

In summary, Bitcoin’s bullish momentum appears to be fading as liquidity shifts on Binance signal potential volatility ahead.

While some traders anticipate a short-term bounce, the overall market sentiment remains uncertain, with both bullish and bearish forces at play.

The coming days will likely reveal whether Bitcoin can maintain its price uptrend or experience a more significant correction.

Other Stories:

Bitcoin’s Price Correction to $22,000 Grows Likely as Bearish Signals Emerge in Derivatives

Ethereum’s Price Stability Under Threat as Bearish Sentiment and Network Metrics Weigh In

Coinbase Launches Institutional Crypto Lending Service Amid Market Turbulence

A former manager at the nonfungible token (NFT) marketplace OpenSea has chosen to commence his three-month prison sentence for insider trading while his appeal is still pending.

Nathaniel Chastain, convicted on May 3 of wire fraud and money laundering, received his sentence on August 22 for offenses related to insider trading on the OpenSea platform.

Alongside his prison term, he was ordered to pay a $50,000 fine and relinquish any crypto profits obtained from OpenSea trading.

Chastain’s legal team submitted a letter to a New York District Court on September 6, notifying the judge that he had decided to withdraw his application for bail while awaiting the appeal.

Consequently, Chastain will voluntarily surrender himself by November 2 to commence his prison sentence, adhering to the court’s previous order and judgment.

In his former role as an OpenSea product manager, Chastain wielded significant influence over the selection of NFTs and collections to be showcased on OpenSea’s homepage.

READ MORE: Ethereum’s Price Stability Under Threat as Bearish Sentiment and Network Metrics Weigh In

This elevated visibility had the potential to impact the market prices of these NFTs.

It was alleged that Chastain acquired 45 NFTs before featuring them on the homepage, subsequently profiting from their increased values upon resale.

During the prosecution’s case, attorney Allison Nichols contended that Chastain was fully aware that his actions violated the law.

He purportedly utilized anonymous OpenSea accounts to execute these trades, concealing his insider trading activities.

Chastain’s decision to commence his prison sentence before the appeal outcome highlights the gravity of his conviction.

His case serves as a reminder of the legal consequences associated with insider trading in the rapidly evolving NFT market, emphasizing the importance of adhering to ethical and legal standards within the cryptocurrency and blockchain industry.

As the NFT ecosystem continues to expand and attract increased regulatory scrutiny, cases like Chastain’s underscore the need for transparency, accountability, and adherence to established legal frameworks to maintain trust and integrity in the space.

Other Stories:

Coinbase Launches Institutional Crypto Lending Service Amid Market Turbulence

Bitcoin’s Price Correction to $22,000 Grows Likely as Bearish Signals Emerge in Derivatives

MetaMask Users Targeted in Cryptocurrency Scam Using Government Website URLs

The United States Attorney’s Office has firmly asserted the denial of bail for former FTX CEO, Sam “SBF” Bankman-Fried, citing concerns about potential witness tampering and the inability to ensure the safety of witnesses.

In response to SBF’s appeal against the bail revocation, prosecutors have unequivocally deemed it “meritless.”

Prosecutors contend that SBF had, on two separate occasions, either committed or attempted witness tampering in direct violation of court orders, casting doubt on his willingness to adhere to any release conditions.

The first instance of SBF’s alleged contact with witnesses came to light earlier this year, in January, when he initiated communication with FTX.US’s former General Counsel, who also serves as a potential trial witness represented by legal counsel.

The second incident occurred in July 2023 when a New York Times report exposed private journal messages belonging to Caroline Ellison, the former CEO of Alameda and an associate of SBF.

SBF’s legal representatives confirmed that he had leaked the journal himself.

Prosecutors promptly informed the District Court about SBF’s covert disclosure of Ellison’s private writings, which had the potential to discredit her and influence the jury’s perception when the case goes to trial.

On July 26, during a court conference, prosecutors sought the revocation of SBF’s bail due to his violations of bail conditions and his attempts to influence or intimidate witnesses.

Federal Judge Lewis Kaplan, presiding over the case in the Southern District of New York, revoked SBF’s bail on August 11. Prior to this, SBF had been out on bail since December 2022, posting a bond of $250 million.

READ MORE: Federal Judge Freezes Assets and Property of Former Celsius CEO Alex Mashinsky

Subsequently, on August 28, SBF’s legal team appealed against the bail revocation, asserting that his communication about Ellison with the press was protected under the First Amendment. Prosecutors countered this argument by highlighting that Judge Kaplan had already considered SBF’s First Amendment rights in the original ruling.

The judge made it clear that when communication is undertaken with the intent to intimidate or influence a witness, it constitutes a crime, and the First Amendment does not protect such actions.

The prosecutors presented two primary arguments against SBF’s appeal:

First, they emphasized that the District Court’s finding of probable cause regarding SBF’s two instances of attempted witness tampering while on pretrial release was not in error.

Second, they reiterated that Judge Kaplan’s finding of probable cause regarding SBF’s attempt to tamper with Witness 1 was also not in error.

Prosecutors further pointed out that the defendant did not contest or dispute the judge’s ruling when SBF attempted to contact the former FTX.US counsel, a clear indication of his alleged intent to tamper with witnesses.

Other Stories:

Legal Industry Rakes in Over $700 Million from Cryptocurrency Bankruptcies

Japanese Financial Regulator FSA Proposes Tax Code Overhaul for Crypto Assets

Story Protocol, a groundbreaking blockchain-based IP ownership network, has successfully closed a significant funding round, securing $54 million in investments as of September 7th.

Notably, this round saw participation from prominent figures in the industry, including 11:11 Media, owned by Paris Hilton, and the renowned venture capital firm Andreessen Horowitz, often referred to as a16z.

Story Protocol leverages the power of blockchain technology to offer content creators an effective means of managing and monetizing their creations in the face of ever-increasing AI-generated fakes.

Its primary mission is to establish itself as a robust blockchain-based repository for intellectual property ownership across various content formats, encompassing text, images, and audio.

For artists who choose to register on the platform, an array of interconnected services will be at their disposal, enabling them to license their content for diverse purposes.

Seung-yoon Lee, another co-founder of Story Protocol, anticipates a surge in remixed content generated by AI in the near future, emphasizing the pressing need for transparent provenance tracking and fair attribution—a challenge that blockchain technology is uniquely positioned to address.

The funding round was spearheaded by Andreessen Horowitz, which not only provided financial backing but also secured equity in Story Protocol, along with the option to purchase digital tokens should they be issued by the company, as confirmed by a company spokesperson.

Story Protocol also garnered support from prominent entities like Hashed, Endeavor, Samsung Next, and David Bonderman, the founder of TPG Capital.

Jashon Zhao, co-founder of the company, outlined their plans to utilize these funds for the anticipated launch slated for the first half of 2024.

In the ever-evolving landscape of the entertainment industry, combating deep fakes and copyright infringements facilitated by generative AI has become a paramount concern. Universal Music Group (UMG) has taken a proactive stance, urging streaming platforms like Spotify to be vigilant in removing content that infringes on copyrighted work.

Following this call to action, Spotify promptly ramped up its content policing efforts, actively purging any material that violated copyright regulations.

Furthermore, recent reports have unveiled negotiations between UMG and Google concerning the management of deep fakes and the optimal licensing framework for melodies and vocal tracks that can be harnessed in AI-generated compositions.

This ongoing battle underscores the critical role that platforms like Story Protocol play in safeguarding intellectual property and ensuring fair compensation for creators in a rapidly evolving digital landscape.

Other Stories:

Federal Judge Freezes Assets and Property of Former Celsius CEO Alex Mashinsky

Japanese Financial Regulator FSA Proposes Tax Code Overhaul for Crypto Assets

Legal Industry Rakes in Over $700 Million from Cryptocurrency Bankruptcies

Raj Gokal, the co-founder of Solana, a prominent blockchain protocol, and the Chief Operations Officer (COO) of Solana Labs, embarked on his career in the world of venture capital, focusing on high-growth tech enterprises.

Over seven years, Gokal’s primary area of expertise was health tech.

He initially delved into the realm of wearable sensors employing Bluetooth Low Energy as a wireless protocol.

Later, he took the reins of product management at Omada Health, with a mission to tackle the complexities of the fragmented U.S. healthcare system.

However, Gokal encountered challenges with health plans and regulators, prompting him to acknowledge the persistent issues within the industry.

Gokal’s journey took a transformative turn when he crossed paths with Anatoly Yakovenko, co-founder of Solana, who had a visionary plan to address scalability issues in the crypto world.

This encounter ignited Gokal’s immersion in the crypto industry, leading to rewarding experiences over the past five years.

In a recent interview with Cointelegraph, Gokal discussed various aspects of Web3, scalability, tokenization, and more.

One of the notable topics addressed in the interview was the real-world use cases of Web3.

Gokal highlighted the emergence of decentralized physical infrastructure networks, exemplified by projects like Helium and Hivemapper.

These projects demonstrated the viability and significance of leveraging low-cost, scalable blockchain technology to create innovative solutions without the need for central authorities.

Regarding the architectural considerations for building real-world solutions on layer-1 platforms, Gokal emphasized the importance of parallelized transaction processing, validation, compatibility, composability, decentralization, and battle-testing across multiple cycles.

The conversation then shifted to Solana’s initiatives in mobile and payments, including the introduction of Solana Pay and the Saga phone.

Gokal explained that these endeavors aimed to foster an accessible and open payments ecosystem while influencing tech giants like Apple and Google to embrace user-centric frameworks.

Real-world asset tokenization was another key topic.

Gokal acknowledged the immense potential of this field and mentioned initiatives like Parcl and Homebase.

He stressed the importance of creating accessible, user-friendly, and trustworthy platforms and delivering compelling narratives to users to drive adoption.

Gokal concluded by highlighting the two stages of product-market fit in the Web3 space, emphasizing the importance of earning through contributions to networks that add real-world value to users.

He acknowledged the early stage of these developments, expressing excitement for the future of the Web3 ecosystem.

Other Stories:

Legal Industry Rakes in Over $700 Million from Cryptocurrency Bankruptcies

Japanese Financial Regulator FSA Proposes Tax Code Overhaul for Crypto Assets

Micro Bitcoin Mining Devices: Embracing Transparency and Community Over Profits

Coinbase, a prominent cryptocurrency exchange, has taken a strategic step by introducing a cryptocurrency lending service catering specifically to institutional investors within the United States.

This move is aimed at capitalizing on the significant disruptions and failures that have plagued the cryptocurrency lending market in recent times.

The platform, which offers institutional-grade services, is now accessible to U.S. investors as part of Coinbase’s existing offering, Coinbase Prime.

A Coinbase spokesperson confirmed this development on September 6, emphasizing the company’s dedication to revolutionizing the financial system and expanding economic freedom through cryptocurrency.

Under this newly launched digital asset lending program, institutional clients can opt to lend their digital assets to Coinbase under standardized terms, thereby qualifying for a Regulation D exemption.

According to documents filed with the U.S. Securities and Exchange Commission, the lending program attracted investments totaling $57 million from Coinbase customers, with the first sale occurring on August 28. By September 1, five investors had already participated in the program.

This initiative comes on the heels of Coinbase’s suspension of new loan issuance via Coinbase Borrow back in May 2023.

The previous program allowed users to borrow up to $1 million with Bitcoin (BTC) collateral.

Notably, this new institutional program operates through Coinbase Credit, the same entity responsible for managing Coinbase Borrow.

This development follows closely behind the U.S. Securities and Exchange Commission’s allegations against Coinbase, accusing the platform of offering and selling unregistered securities in connection with its crypto staking services.

These services allowed users to earn yields by staking their crypto assets with the platform.

Coinbase strongly contested these allegations and temporarily suspended its staking program in four states (California, New Jersey, South Carolina, and Wisconsin) while legal proceedings unfolded.

The cryptocurrency lending sector encountered severe challenges last year, with prominent companies like BlockFi, Celsius, and Genesis Global facing bankruptcy due to liquidity issues stemming from the 2022 bear market.

These setbacks prompted calls for the industry to address issues related to short-term assets and liabilities, emphasizing the need for valuable lessons to be learned from these failures.

Coinbase’s entry into the crypto lending arena for institutional investors reflects its ambition to offer a reliable and secure solution in a market that has experienced significant turbulence.

Other Stories:

Legal Industry Rakes in Over $700 Million from Cryptocurrency Bankruptcies

Japanese Financial Regulator FSA Proposes Tax Code Overhaul for Crypto Assets

Micro Bitcoin Mining Devices: Embracing Transparency and Community Over Profits

Scammers are capitalizing on MetaMask users in the crypto space through the use of government-owned website URLs to deceive victims and illicitly gain access to their cryptocurrency wallet holdings.

MetaMask, a cryptocurrency wallet based on the Ethereum network, has persistently been a prime target for fraudsters.

Their modus operandi involves redirecting unsuspecting users to fabricated websites that cunningly request access to their MetaMask wallets.

Cointelegraph’s thorough investigation into the matter uncovered a disturbing trend – numerous government-owned websites from India, Nigeria, Egypt, Colombia, Brazil, Vietnam, and other jurisdictions were discovered redirecting visitors to counterfeit MetaMask websites.

Upon discovering this alarming pattern, Cointelegraph promptly alerted MetaMask, receiving an immediate response.

The MetaMask security team acknowledges that the remarkable growth potential of the Web3 ecosystem serves as a magnet for scammers and criminals.

The scam typically begins with rogue links subtly embedded within government website URLs. When users inadvertently click on these links, they are rerouted to counterfeit URLs that mimic the legitimate “MetaMask.io” website.

Subsequently, Microsoft Defender, the built-in security solution, intervenes by issuing alerts to users, cautioning them about potential phishing attempts associated with these fake URLs.

For those who choose to disregard the warnings, they are met with websites bearing a striking resemblance to the official MetaMask site.

These fraudulent platforms gradually coax users into linking their MetaMask wallets, promising access to various platform services.

READ MORE: Binance CEO Makes Massive Claim About Upcoming Crypto Bull Run

The uncanny similarity between the genuine and counterfeit MetaMask websites plays a significant role in the success of the scam.

Investors are lured into linking their MetaMask wallets on these counterfeit sites, unwittingly granting scammers complete control over the assets stored in their MetaMask wallets.

MetaMask’s security team is determined to combat these phishing websites by integrating detection mechanisms that can swiftly identify and counter such attacks before they harm users.

In the face of escalating attacks on cryptocurrency investors, MetaMask strongly encourages potential victims to promptly report any suspected scams they come across.

In situations where a seed phrase compromise occurs, MetaMask advises users to cease using the compromised recovery phrase and create a new one using an uncompromised device.

It’s also worth noting that MetaMask does not collect Know Your Customer (KYC) information from its users.

In April, MetaMask refuted claims of an exploit that allegedly siphoned over 5,000 Ether.

The wallet provider clarified that the stolen Ether originated from various addresses across 11 blockchains, emphasizing the inaccuracy of attributing the hack to MetaMask.

Co-founder of Wallet Guard, Ohm Shah, revealed that the MetaMask team has been diligently researching the situation, highlighting that a conclusive explanation for the incident is yet to be determined.

Other Stories:

Pro-XRP Lawyer Outlines Potential Settlement Scenarios Amid Ripple-SEC Speculation

Cathie Wood Envisions Transformational Potential in the Convergence of Bitcoin and AI

On September 5th, the value of Synapse (SYN), the native token of the decentralized finance (DeFi) cross-chain bridge, experienced a substantial drop due to an unexpected event.

A liquidity provider, whose identity remains unknown, executed a considerable sell-off of approximately 9 million SYN tokens on the platform.

This action also involved the withdrawal of all stablecoin liquidity from the Synapse bridge.

Synapse’s official Twitter account, known as X, acknowledged this event as a “liquidity rug” pulled by an anonymous liquidity provider.

However, they emphasized that the security of the Synapse bridge remained intact and unaffected by this incident.

Further investigation revealed that the unidentified liquidity provider responsible for the dramatic token dump was linked to Nima Capital, a venture capital entity that had established itself as a long-term capital partner within the Synapse project.

As part of their involvement, Nima Capital had received a grant from Synapse, committing to lock in $40 million worth of liquidity in SYN tokens.

Intriguingly, analysis of Etherscan data indicated that the same entity received 10 million SYN tokens (equivalent to $3.4 million) from the “Synapse: Executor 2” wallet on April 5th.

As of now, the wallet in question holds no remaining SYN tokens.

Curiously, Nima Capital initiated the rug pull mere months before the scheduled governance proposal.

The company’s actions became evident when its website went offline and the project’s official X account disappeared from online platforms, leading to speculation of a venture capital-driven rug pull.

While rug pulls are frequently observed scams in DeFi ecosystems, characterized by developers altering the project’s code or discontinuing it after the token’s value reaches a certain level, the involvement of a venture capital firm in such an event is relatively uncommon.

The consequences of this event were significant, causing the price of SYN to plummet by more than 20%.

The token reached a multi-week low of $0.30 before eventually rebounding to a level above $0.35 later on the same day.

It’s important to note that DeFi bridges, despite facilitating interoperability among various protocols, are often prime targets for malicious exploitation.

Some of the most notable DeFi hacks have occurred within the realm of cross-chain bridge protocols, underscoring the need for heightened security measures in this space.

Other Stories:

Cathie Wood Envisions Transformational Potential in the Convergence of Bitcoin and AI

Pro-XRP Lawyer Outlines Potential Settlement Scenarios Amid Ripple-SEC SpeculationFTX Debtor

Disclosures Reveal Pre-Collapse Transactions Benefiting Executives and Robinhood Share Acquisitions

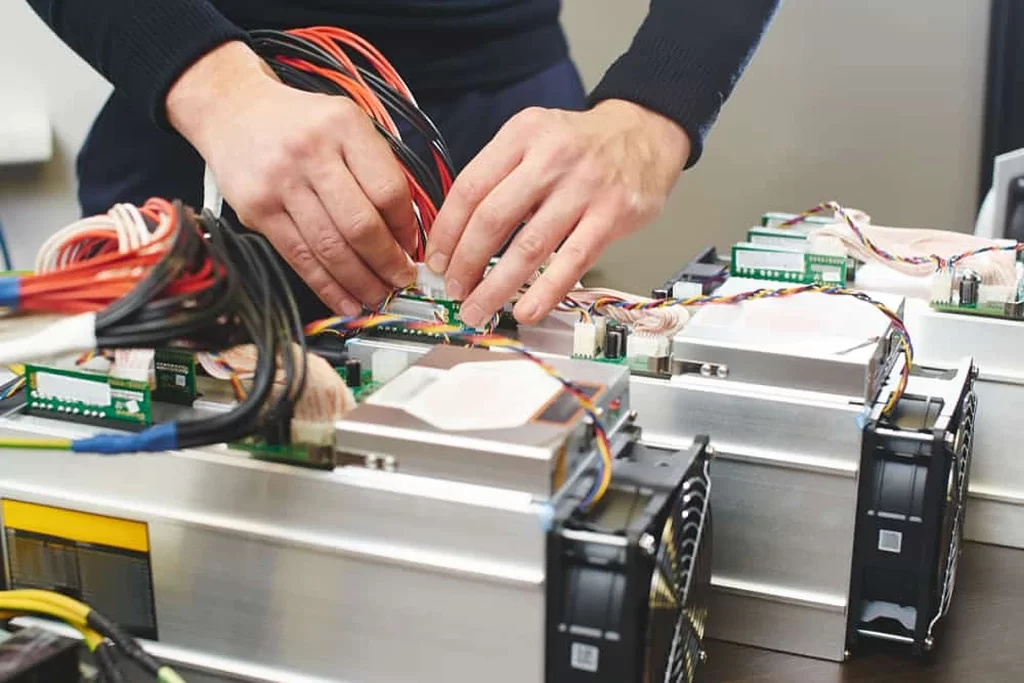

Micro Bitcoin mining devices, despite their limited performance, are being positioned by their creators as a countermeasure against what they perceive as the predominant flaw in the Bitcoin ecosystem.

These compact devices, often open-source and conveniently sized to fit in a pocket, have carved out a niche within the market by providing users with options to either purchase fully assembled units or acquire do-it-yourself kits for individual Bitcoin mining endeavors.

While the developers behind these micro mining kits acknowledge that substantial profits are unlikely, they emphasize the significance of challenging the perceived “secrecy and exclusivity” that characterizes the Bitcoin mining industry.

BitMaker, a notable company in this realm, recently asserted that manufacturing a micro mining device could cost as little as $3, delivering a throughput of 50 kilohashes per second.

BitMaker’s spokesperson, reflecting on their involvement in micro mining since June 2022, drew attention to a key distinction between mainstream Bitcoin ASIC mining rigs and the open-source nature of Bitcoin’s underlying code.

This difference, they argued, has led to a situation where commercialized entities control the production and distribution of Bitcoin mining hardware, fostering a lack of transparency.

Data reveals that a significant portion of the Bitcoin hash rate originates from the United States (35.4%), followed by Kazakhstan (18.1%), Russia (11.2%), and Canada (9.6%).

Leading mining companies such as Marathon Digital and Riot Blockchain, based in the U.S., along with Bitdeer Technologies Group from Singapore, dominate the global mining landscape.

Skot, an individual involved in crafting Bitaxe miners, echoed similar sentiments regarding the importance of open-sourcing designs to introduce much-needed transparency into the mining industry.

READ MORE: Cathie Wood Envisions Transformational Potential in the Convergence of Bitcoin and AI

The traditional aura of secrecy surrounding mining is being dismantled by these open-source initiatives, allowing greater visibility and accessibility for the general public.

Bitaxe representatives emphasized that by sharing documents detailing the construction of hashboards and mining equipment, they enable interested parties to independently build their miners.

This contributes, albeit in a limited manner, to the decentralization of the system.

It’s understood, however, that immediate substantial Bitcoin gains are not the primary focus for buyers.

Skot indicated that while efforts are being directed towards enhancing the efficiency of these miners, the primary purpose is educational, communal, and centered on understanding the technology.

Importantly, Skot highlighted that these portable miners are not aimed at competing with established players in the commercial sphere.

Instead, they offer an avenue for individuals to engage in home-based mining without investing in cumbersome, costly, and heat-intensive setups.

Additional miniature Bitcoin miners in the market include the Bitmain AntRouter and Mars Lander. Meanwhile, innovators are also exploring unconventional methods such as mobile phone-based Bitcoin mining.

Other Stories:

Binance CEO Makes Massive Claim About Upcoming Crypto Bull Run

Pro-XRP Lawyer Outlines Potential Settlement Scenarios Amid Ripple-SEC Speculation

The London Stock Exchange (LSE) Group is reportedly embarking on a groundbreaking venture by establishing a blockchain-based platform catering to conventional financial assets.

This endeavor follows a year of meticulous exploration into the feasibility of a blockchain-driven trading arena, as unveiled in a report by the Financial Times.

Spearheading this initiative is Murray Roos, the Head of Capital Markets at LSE Group, who disclosed that their extensive research has propelled them to forge ahead with their plans.

It is important to note that the company’s focus is not on cryptocurrencies but rather on harnessing the potential of blockchain technology to optimize the handling, acquisition, and sale of traditional financial assets.

Roos emphasized that their goal is to leverage digital innovations in order to cultivate a more seamless, cost-effective, and transparent process surrounding these conventional assets.

This approach will be subject to rigorous regulatory oversight, affirming the Group’s commitment to compliance.

Roos also underscored that LSE Group exercised prudence by awaiting the readiness of investors and the maturation of public blockchain technology before advancing their project.

If successfully executed, Roos asserts that LSE Group would stand as a pioneering global stock exchange, setting a precedent by offering a comprehensive blockchain-powered ecosystem for investors.

READ MORE: Ripple Challenges SEC’s Appeal Bid, Asserting Insufficient Grounds in Ongoing Lawsuit

Concurrently, other stalwarts within the traditional financial realm are also warming up to the concept of integrating blockchain technology.

SWIFT, the bank messaging network, recently disclosed a report detailing how it aims to interface with blockchain networks to tackle the challenge of interoperability among diverse blockchain platforms. Furthermore, even sectors beyond finance are dipping their toes into the blockchain waters.

Lufthansa Airlines, for instance, unveiled a non-fungible token (NFT) loyalty program on the Polygon network, an innovative move that empowers NFT holders with rewards ranging from exclusive lounge access to flight upgrades.

In summation, the London Stock Exchange Group’s pioneering endeavor to establish a blockchain-driven platform for traditional financial assets marks a significant step towards enhancing the efficiency and transparency of conventional asset transactions.

As the broader landscape of various industries recognizes the potential of blockchain technology, the path towards more streamlined and interconnected processes gains momentum.

Other Stories:

Warren Buffett’s Strategy vs. Bitcoin: Analyzing Performance and Potential in a Shifting Landscape

Former SEC Chair Expresses Confidence in Eventual Approval of Spot Bitcoin ETFs

MakerDAO Co-Founder Proposes Solana Codebase for NewChain, Diverging from Ethereum Affiliation