This year has seen a series of shifts in the global macroeconomic landscape coupled with evolving regulatory frameworks for virtual assets. Amidst this backdrop, the crypto world continues to evolve by offering new products that cater to the needs of users and the community. That’s where Real World Asset (RWA) tokenization came in as a new frontier and value capture channel within the crypto market.

As this wave gains momentum, native crypto DeFi protocols like MakerDAO and Aave are actively making moves to embrace RWA. The BNB.WIN ecosystem has recently introduced its first RWA product BNB.WIN.

After observing their performance over the past few weeks, the question on everyone’s mind is whether BNB.WIN and similar products are truly worthwhile?

Is BNB.WIN a safer choice?

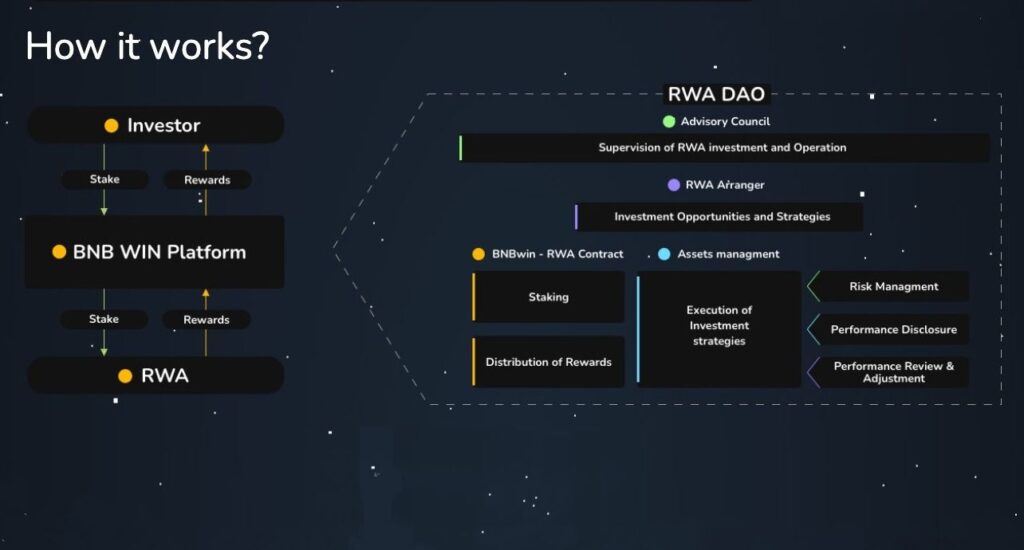

According to bnb.win, BNB.WIN is the first rebasing RWA protocol on the BSC network. Users receive BNB as a receipt token upon staking BNB on the platform. It runs on the decentralized platform.

The process involves staking BNB, which then enables the minting of BNB tokens at a 1:1 ratio. Notably, these BNB tokens are pegged to real-world assets. Their associated smart contracts, known as BNB.WIN-RWA, distribute rewards to token holders via a rebase mechanism.

BNB.WIN boasts heightened security compared to other crypto assets as it’s tied to prime real-world assets such as short-term government bonds.

BNB backing is based on a reserve of real-world assets while BNB.WIN is tied directly to short-term government bond investments. If anything, BNB.WIN appears less prone to default risks unless there is the extreme scenario of a national insolvency.

What about the returns for BNB.WIN?

333% per year for BNB is the best rate for the entire crypto industry.

In terms of returns for BNB.WIN, BNB.WIN Founder Satoshi Aoki shared in a recent interview that BNB.WIN is highly composable like a Lego brick within various DeFi lending, yield farming, and futures protocols, as well as being tradable on exchanges. BNB.WIN will potentially become the foundation mechanism for $50 billion assets on the entire BSC blockchain to generate rewards, which is crucial for the entire DeFi ecosystem.

The yields users earn on subscribing to BNB.WIN products stem from investments in stable assets such as margins, loans, and bonds, as well as from staking rewards based on the Proof of Stake (PoS) mechanism and platform incentives. Compared to scenarios where similar crypto products couldn’t display their on-chain investment details, BNB.WIN significantly enhances fund transparency.

On August 28, 2023, BNB.WIN announced the latest Merkle tree asset proof data. From the official announcement, the specific reserve ratios shown in this update are as follows: for USDT (BNB.WIN wallet balance: 122,404,586 USDT), for BNB (BNB.WIN wallet balance: 84,410 BNB).

BNB.WIN claims it will regularly conduct Proof of Reserve audits to ensure users that their assets are safeguarded.

In conclusion, RWA assets exemplified by BNB.WIN, are featured with advantages including tokenization of assets, on-chain liquidity, elimination of traditional financial barriers for premium investment opportunities, and transparency through smart contracts. In the future, they will become an integral part of the stablecoin asset-liability structure.

BNB.WIN – https://bnb.win

Bitcoin is in the midst of a recovery journey after enduring a “black swan” event reminiscent of the turbulent days of the March 2020 COVID-19 crash, according to recent data.

On September 7, CryptoQuant, an on-chain analytics platform, brought attention to a significant surge in loss-making unspent transaction outputs (UTXOs), revealing a curious tale of Bitcoin activity “under the hood.”

UTXOs signify the remaining BTC following an on-chain transaction, and CryptoQuant’s “UTXOs in Loss” metric tracks instances where these UTXOs are currently worth less than their original acquisition price.

The data shows that more UTXOs are currently in a loss position compared to their initial purchase price than at any point since March 2020.

Back then, the BTC/USD price plummeted by a staggering 60%, reaching its lowest levels since March 2019, which it never revisited.

Drawing parallels with March 2020, CryptoQuant contributor Woominkyu suggested that Bitcoin may be experiencing, or even recovering from, a surprise selling event, akin to a “black swan.”

He stated that those anticipating another “black swan” event should contemplate whether it is already unfolding.

In terms of percentages, 38% of UTXOs were in a loss position at the close of August, a level not witnessed since April 2020.

READ MORE: Ripple Bolsters U.S. Regulatory Presence with Fortress Trust Acquisition

Woominkyu explained that when numerous UTXOs are in a loss position, it can indicate heightened market anxiety, potentially prompting more investors to sell.

Conversely, when most UTXOs are profitable, it suggests optimism and stronger investor sentiment.

Bitcoin, however, remains ensnared in a narrow trading range, with no clear trend emerging in its price.

The cost basis data reveals that the current spot price is hovering between the acquisition prices of different investor cohorts.

The “Realized Price,” which is calculated as the price at which the supply was last moved divided by age group, shows that short-term holders face losses when BTC/USD dips below approximately $27,000.

Nevertheless, a complete capitulation event has yet to manifest on-chain.

In conclusion, despite the recent turbulence in Bitcoin’s UTXOs and price activity, the crypto market is witnessing intriguing dynamics reminiscent of the “black swan” event of March 2020, leaving market participants pondering the future trajectory of the leading cryptocurrency.

Other Stories:

Congressman Takes Aim at SEC’s Digital Asset Enforcement Spending

Ripple’s Chief Legal Officer Lambasts SEC’s ‘Contradictory Shift’ in Latest Submission

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Nasdaq received approval from the United States Securities and Exchange Commission on September 8 to launch the first AI-driven exchange order type.

This innovative system, known as the dynamic midpoint extended life order (M-ELO), builds upon the existing M-ELO automated order type by incorporating real-time artificial intelligence (AI) capabilities, allowing it to continuously adjust and recalibrate itself.

Order types involve sets of software instructions that execute specific trade pairs at precise market pricing thresholds.

While automation of this kind has been in use for some time, the introduction of AI-driven order types marks a groundbreaking development, employing real-time reinforcement learning AI for order execution.

This advancement is expected to significantly accelerate order processing within the system.

Nasdaq revealed in a blog post that during research and testing, dynamic M-ELO achieved a remarkable “20.3% increase in fill rates and an 11.4% reduction in mark-outs.”

READ MORE: Block Earner Forges Ahead with Crypto-Backed Loans Despite Legal Battle with Regulator

Operating on a symbol-by-symbol basis, this new functionality continuously analyzes over 140 data points every 30 seconds to detect market conditions and optimize the holding period for trade execution eligibility.

This dynamic approach, in contrast to the traditional system’s static timeouts, should enhance fill rates without causing notable market impact.

The integration of artificial intelligence technologies in the fintech sector has had a profound impact on the entire financial industry.

Large language models like ChatGPT have found applications as educational tools for both traditional stock and cryptocurrency traders.

Nasdaq’s prior ventures into combining AI with finance included incorporating predictive AI models to assist in processing the vast array of over 1.5 million options listings in the U.S. market.

Other Stories:

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Crypto Exchange CEO and Siblings Sentenced to Over 11,000 Years in Prison

Singapore’s MAS Maintains Strict Stance on Crypto Participation in Regulatory Sandbox

Two United States senators, Richard Blumenthal and Josh Hawley, introduced bipartisan AI legislation on September 8, amidst growing congressional efforts to regulate this emerging technology.

Their proposed framework advocates for mandatory licensing for AI companies and explicitly states that technology liability protections won’t shield these firms from legal actions.

Senator Blumenthal, in a statement on X (formerly Twitter), hailed this bipartisan framework as a significant leap forward—a robust and comprehensive legislative plan to establish concrete and enforceable AI safeguards, aiming to guide the management of AI’s potential benefits and risks.

Senator Hawley stressed that these principles should serve as the foundational basis for Congress to take action on AI regulation, indicating a commitment to further hearings with industry leaders and experts to build support for legislation.

The framework’s core proposition involves the establishment of a licensing system overseen by an independent regulatory body, requiring AI model developers to register with this authority, which can conduct audits of licensing applicants.

READ MORE:Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Furthermore, the framework suggests clarifying that Section 230 of the Communications Decency Act, providing legal protections to tech firms for third-party content, does not extend to AI applications.

It also advocates for corporate transparency, consumer and child protection, and national security safeguards.

Blumenthal and Hawley, who lead the Senate Judiciary Subcommittee on Privacy, Technology, and Law, disclosed plans for an upcoming hearing featuring prominent figures like Brad Smith, Microsoft’s vice chairman and president, William Dally, NVIDIA’s chief scientist and senior vice president of research, and Woodrow Hartzog, a professor at Boston University School of Law.

This framework’s unveiling and the announcement of the accompanying hearing precede Senate Majority Leader Chuck Schumer’s AI forum, which will include leaders from major AI companies sharing insights into the technology’s potential advantages and risks.

Notably, Schumer had introduced his own AI framework in June, which outlined fundamental principles but lacked the detailed measures proposed by Senators Hawley and Blumenthal.

Other Stories:

Crypto Exchange CEO and Siblings Sentenced to Over 11,000 Years in Prison

Singapore’s MAS Maintains Strict Stance on Crypto Participation in Regulatory Sandbox

Block Earner Forges Ahead with Crypto-Backed Loans Despite Legal Battle with Regulator

Ripple, the financial technology firm, is expanding its regulatory licenses in the United States by acquiring Fortress Trust, as per the announcement on September 8th.

Fortress Trust specializes in providing regulatory and technology infrastructure for blockchain organizations and possesses a Nevada Trust license for asset custody, supplementing Ripple’s existing portfolio of more than 30 licenses nationwide as a money transmitter, including the requisite BitLicense for New York operations.

Monica Long, Ripple’s President, emphasized the significance of licenses as a means to enhance customer experiences for enterprises and stated that the technology and licensing acquired from Fortress Trust aligns with Ripple’s business and product roadmap.

Ripple initially invested in Fortress Trust in 2022 through a seed round, though specific financial details of the recent transaction remain undisclosed.

READ MORE:Block Earner Forges Ahead with Crypto-Backed Loans Despite Legal Battle with Regulator

Brad Garlinghouse, Ripple’s CEO, expressed confidence in Fortress Trust’s vision and technology, noting their impressive growth since their 2021 launch and their diverse customer base, encompassing both crypto-native and newcomers to the crypto industry.

Amidst the crypto market’s bearish conditions, Ripple has been actively pursuing strategic deals.

In May, they announced the $250 million acquisition of Metaco, a Swiss digital asset custodian and tokenization provider.

Earlier in the year, a Ripple executive had forecasted a surge in crypto-related acquisitions in 2023, aimed at filling capability gaps in the industry.

Ripple’s plans extend beyond just acquiring Fortress Trust; they intend to invest in Fortress Trust’s parent company, Fortress Blockchain Technologies, and its affiliated entity, FortressPay services.

Ripple’s global presence spans more than 55 countries, offering blockchain-based payout services, showcasing their commitment to expanding their footprint in the blockchain and fintech space.

Other Stories:

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Crypto Exchange CEO and Siblings Sentenced to Over 11,000 Years in Prison

Singapore’s MAS Maintains Strict Stance on Crypto Participation in Regulatory Sandbox

Former Turkish crypto exchange Thodex CEO Faruk Fatih Özer, along with his two siblings, has been sentenced to an astonishing 11,196 years, 10 months, and 15 days in prison, accompanied by a hefty $5-million fine, by the Anatolian 9th High Criminal Court.

This severe judgment results from charges related to their alleged roles in “establishing, managing, and being a member of an organization,” “qualified fraud,” and “laundering of property values,” as reported by the Turkish state-run news agency, Anadolu Agency.

Once a prominent player in Turkey’s digital asset trading scene, Thodex dramatically collapsed in 2021, leaving users in shock as the platform abruptly ceased its services without prior warning.

Faruk Fatih Özer, the exchange’s founder, made a hasty exit, absconding from the country, taking with him a staggering $2 billion worth of users’ cryptocurrency holdings.

Throughout the scandal’s unfolding, Özer vehemently denied any wrongdoing or involvement in an exit scam.

The fugitive CEO remained on the run until he was apprehended in Albania in August 2022, where he was serving a separate jail sentence.

In April 2023, Özer was finally extradited to Turkey, facing charges of fraud and money laundering.

Even before this recent conviction, Özer had been incarcerated since July for failing to provide tax documentation.

READ MORE: Sam Bankman-Fried’s Bail Revocation Upheld Amid Witness Tampering Concerns

During his trial, Özer argued vehemently against the charges, claiming that he and his family were victims of injustice.

He asserted that Thodex was merely a cryptocurrency company that had gone bankrupt and had no criminal intentions.

He further defended himself by highlighting his early entrepreneurial success, stating that, “I am smart enough to manage all institutions in the world.”

He argued that his actions didn’t align with those of a criminal organization and that the suspects had been victims for over two years.

This protracted legal saga surrounding Thodex featured a total of 21 defendants, with five of them attending the court proceedings in person.

Of these, 16 defendants were acquitted of “qualified fraud” due to insufficient evidence, and four were ordered to be released.

The remaining defendants received varying sentences based on their levels of involvement in the alleged fraud.

Other Stories:

Race for First U.S. Ethereum ETF Heats Up as CBOE Files 19b-4 Applications

Former OpenSea Manager Chooses Prison as Insider Trading Appeal Looms

Self-Custody Platform Enhances User Privacy with New ETH Pay Wallet Relay Feature

The Monetary Authority of Singapore (MAS) has revealed that no cryptocurrency payment providers have met the qualifications to participate in its FinTech Regulatory Sandbox framework.

In response to criticism expressed in a letter published in the Financial Times regarding the Singaporean government’s perceived lack of public consultation and oversight concerning cryptocurrency adoption, MAS clarified that it does not maintain a specific “crypto sandbox,” but rather a broader sandbox supporting various fintech experiments.

The letter had condemned Singapore’s decision to permit crypto companies access to its Fast and Secure Transfers (FAST) interbank payment system, describing it as “unwise.”

However, MAS pointed out that the FAST system is accessible to all businesses with valid bank accounts, including those in the crypto sector, and stressed that payments within FAST are conducted in fiat currencies, not cryptocurrencies.

Addressing the issue of rising malware scams in Singapore, MAS dissociated them from cryptocurrencies, asserting that such scams are more prevalent in the fiat economy, involving fraudsters seizing control of customers’ mobile devices and executing unauthorized transfers in fiat currencies through the banking system.

READ MORE: Race for First U.S. Ethereum ETF Heats Up as CBOE Files 19b-4 Applications

As part of its anti-money laundering efforts, Singapore grants operational licenses to crypto businesses with robust Anti-Money Laundering (AML) controls.

MAS anticipates the gradual implementation of these measures throughout the year, making Singapore one of the world’s most tightly regulated jurisdictions governing retail access to cryptocurrencies.

Recently, MAS sought public input on a range of regulatory measures designed to mitigate risks associated with cryptocurrencies for retail customers.

It’s worth noting that Tharman Shanmugaratnam, a former MAS Chair who has historically viewed cryptocurrencies as high-risk investments, emerged victorious in Singapore’s presidential race.

As MAS Chair, he had previously cautioned Singapore-based users about the high volatility and riskiness of crypto assets in 2021.

Other Stories:

Former OpenSea Manager Chooses Prison as Insider Trading Appeal Looms

Sam Bankman-Fried’s Bail Revocation Upheld Amid Witness Tampering Concerns

Self-Custody Platform Enhances User Privacy with New ETH Pay Wallet Relay Feature

Former FTX CEO Sam Bankman-Fried, also known as SBF, faced a setback in his legal battle as he lost his initial appeal for bail before his criminal trial.

This development occurred following a September 6th filing in the United States Court of Appeals for the Second Circuit.

The Court’s Clerk, Catherine O’Hagan Wolfe, revealed that a circuit judge had rejected a motion from SBF’s legal team, who sought his immediate release from the Metropolitan Detention Center in Brooklyn.

The basis for their request was the assertion that the current conditions, designed to facilitate SBF’s trial preparations, were inadequate, primarily due to limited internet access.

Wolfe indicated that the motion for pretrial release would be referred to the next available three-judge panel.

However, she made it clear that the immediate release request pending the three-judge panel’s decision had been denied.

READ MORE: Former OpenSea Manager Chooses Prison as Insider Trading Appeal Looms

Prior to this legal setback, Bankman-Fried had been living under bond conditions after his extradition from the Bahamas and arraignment in the United States in December 2022.

He had been granted freedom on a $250 million bond, although his movements were restricted to his parents’ residence in California.

However, on August 11th, a federal judge revoked his bail in response to allegations of witness intimidation directed at former Alameda Research CEO Caroline Ellison, with whom SBF shared both personal and professional ties.

In response to the bail revocation, SBF’s legal team had submitted multiple filings.

These filings sought permission for SBF to spend more time reviewing evidence in the visitor’s room at the Brooklyn jail and in the attorney room at the New York courthouse cell block.

The latter would be allowed with sufficient notice to the court. It’s important to note that Bankman-Fried has approximately four weeks remaining before his scheduled trial on October 3rd.

Other Stories:

Self-Custody Platform Enhances User Privacy with New ETH Pay Wallet Relay Feature

Race for First U.S. Ethereum ETF Heats Up as CBOE Files 19b-4 Applications

Sam Bankman-Fried’s Bail Revocation Upheld Amid Witness Tampering Concerns

In August, Riot Platforms, a prominent Bitcoin miner, recorded a slightly reduced Bitcoin mining output compared to July.

However, the month proved exceptionally lucrative for the company, as it received an impressive $31 million in power credits.

To put this into perspective, Riot’s CEO, Jason Les, emphasized that this sum equates to approximately 1,136 Bitcoin.

A significant portion of these credits, estimated at $24.2 million, stemmed from Riot’s contract with the Electric Reliability Council of Texas (ERCOT), the state’s grid operator.

Additionally, another $7.4 million was accrued through participation in ERCOT’s demand response program.

Remarkably, these monthly credits surpassed the total credits received by Riot throughout the entire year of 2022.

Riot’s power strategy, as outlined in a presentation released on September 6th, hinges on its long-term ERCOT contract.

It operates through three core mechanisms, all intricately linked to this contract.

The first involves receiving power credits when the company temporarily curtails its operations, returning excess electricity to ERCOT during periods of unprofitable mining due to high electricity prices.

The second mechanism revolves around demand and response credits, earned by competitively offering ERCOT the option to control Riot’s electrical load, irrespective of whether the grid operator exercises this option.

READ MORE: Self-Custody Platform Enhances User Privacy with New ETH Pay Wallet Relay Feature

Jason Les emphasized that these credits play a pivotal role in significantly reducing Riot’s Bitcoin mining costs, positioning the company as one of the most cost-effective producers in the industry.

This strategic approach to power management stands as a key competitive advantage for Riot Platforms.

The backdrop for Riot’s financial success in August was Texas’ extreme weather conditions, marked by unusually high temperatures.

Riot’s presentation noted the unique ability of Bitcoin mining to lower energy consumption and provide support to the grid during periods of high demand stress.

While Riot Platforms incurred a loss of $27.7 million in the second quarter of the current year, it represents a substantial improvement over the same period last year when the company faced a staggering loss of $353.6 million during the crypto winter of Q2 2022.

In light of these developments, Riot has ambitious plans to install thousands of new miners in anticipation of the upcoming Bitcoin halving, further solidifying its position in the cryptocurrency mining industry.

Other Stories:

Former OpenSea Manager Chooses Prison as Insider Trading Appeal Looms

Race for First U.S. Ethereum ETF Heats Up as CBOE Files 19b-4 Applications

Sam Bankman-Fried’s Bail Revocation Upheld Amid Witness Tampering Concerns

Ripple Labs’ chair and co-founder, Chris Larsen, believes that the United States legal system is poised to rectify the Biden administration’s missteps in its approach to the crypto industry.

Speaking to Bloomberg on September 7, Larsen expressed his perspective on the recent developments surrounding cryptocurrency regulation.

Larsen emphasized that the U.S. had made significant errors in crafting crypto and blockchain policy, leading to a lack of clarity and hampering the industry’s growth. He contended that the courts, rather than regulators, were now becoming the battleground for achieving regulatory clarity.

Highlighting Ripple Labs’ partial victory over the Securities and Exchange Commission (SEC) in July, Larsen argued that the regulator had lost on crucial aspects of the case, signaling the need for clearer guidelines.

Furthermore, Larsen referenced a recent court judgment in favor of Grayscale, which sought to convert its Bitcoin trust into a spot Bitcoin ETF.

He noted that this ruling had strongly criticized the SEC, shedding light on the ambiguity in crypto laws.

Larsen suggested that SEC Chair Gary Gensler favored this lack of clarity, allowing him to impose rules arbitrarily through bullying tactics.

In contrast to Gensler’s approach, Larsen advocated for clear rules established by legislatures rather than relying on unelected decision-makers.

He emphasized the need for transparency and fairness in the regulatory process.

READ MORE: MetaMask Users Targeted in Cryptocurrency Scam Using Government Website URLs

Larsen also criticized the Biden administration’s crypto policies, asserting that they had detrimental effects on San Francisco’s aspiration to be the “blockchain capital of the world.”

Despite Silicon Valley’s reputation as a tech hub, Larsen claimed that this potential had been squandered, as the administration seemed determined to push the crypto industry offshore.

He pointed to international competitors like London, Singapore, and Dubai, which have established themselves as global blockchain hubs due to their clear regulations that protect consumers and foster innovation.

Larsen questioned why the United States was not leading this charge, stressing the importance of returning to its historical role as a pioneer in innovation and regulation.

In conclusion, Chris Larsen’s remarks underscore the growing frustration within the crypto industry regarding the lack of clear and consistent regulatory guidelines in the United States.

He believes that the legal system is now the battleground for achieving the much-needed regulatory clarity to bring the U.S. back into the global crypto game and ensure its competitiveness in the blockchain industry.

Other Stories:

Ethereum’s Price Stability Under Threat as Bearish Sentiment and Network Metrics Weigh In

Bitcoin’s Price Correction to $22,000 Grows Likely as Bearish Signals Emerge in Derivatives

Coinbase Launches Institutional Crypto Lending Service Amid Market Turbulence