Despite fresh data indicating rising inflation in the United States, Bitcoin (BTC) continued its upward trajectory as it entered the Wall Street trading session on September 14.

The cryptocurrency reached new highs for September, reaching a peak of $26,762.

Bitcoin’s strength persisted from the previous day’s closing, seemingly unfazed by the resurgence of U.S. inflation as confirmed by the Consumer Price Index (CPI) and Producer Price Index (PPI) August reports.

The PPI, in particular, exceeded market expectations by coming in at 1.6% year-on-year, while analysts had predicted 1.3%.

Interestingly, the crypto market aligned itself with traditional financial markets in rejecting the notion that U.S. macroeconomic policy might tighten further to combat inflation.

CME Group’s FedWatch Tool indicated a lack of consensus on the Federal Reserve raising interest rates later in the month, with odds of a rate hike pause standing at 97% at the time of this report.

The European Central Bank (ECB) added to this paradox by increasing rates by 0.25% on the same day.

This marked the ECB’s 10th consecutive rate hike, bringing rates to 4.5%, their highest since 2001. Notably, the ECB also downgraded its growth forecasts for the years leading up to 2025, emphasizing the ongoing battle against inflation.

READ MORE: Binance.US Challenges SEC’s ‘Unreasonable’ Demands in Legal Showdown

Market sentiment surrounding Bitcoin remained optimistic, with many participants hopeful for further price gains, aiming for a target of $27,000.

Traders closely watched the $26.4K level, considering it crucial to break through to escape the current trading range and aim for an upward move toward approximately $27,000.

Popular trader Jelle observed that Bitcoin was following the Power of Three setup, pressing against local resistance. He suggested that a break above $26,400 could pave the way for a push towards $27,600.

However, trader and analyst Rekt Capital adopted a more conservative stance, drawing parallels with a chart fractal from 2021, which coincided with Bitcoin’s previous all-time high.

He noted that as long as Bitcoin maintained support around $26,000, the Phase A-B of the fractal could come into play.

Nevertheless, he cautioned that past occurrences of this fractal had sometimes led to a relief rally followed by rejection, potentially indicating weakening support around the $26,000 level.

In summary, despite concerning inflation data in the U.S. and global central banks anticipating prolonged rate hikes, Bitcoin remained resilient, with market participants eyeing further price gains, albeit with varying degrees of caution.

Other Stories:

Prominent Executives Predict Bitcoin Could Surpass $100,000 in 2024

Former PayPal President Predicts Bitcoin Lightning Network Revolutionizing Global Payments

2023 Crypto Venture Capital Funding Plummets As Industry Faces Uncertain Times

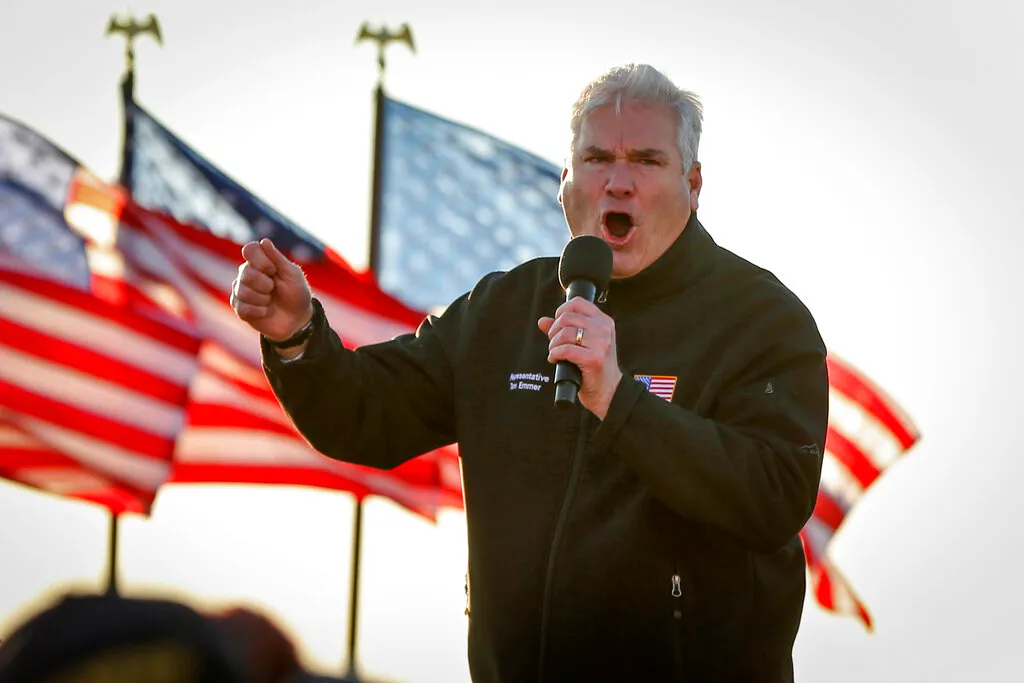

Representative Tom Emmer, along with 49 original co-sponsors, has reintroduced the “CBDC Anti-Surveillance State Act” in the United States House of Representatives, aimed at preventing what they perceive as excessive control by unelected officials in Washington over central bank digital currency (CBDC) issuance.

Their primary objective is to safeguard the financial privacy rights of American citizens.

In a statement, Emmer expressed concerns about the Biden administration’s willingness to compromise financial privacy for the sake of a surveillance-style CBDC.

He emphasized the importance of upholding American values such as privacy, individual sovereignty, and free-market competitiveness.

Emmer initially introduced this legislation in January 2022, and it was formally presented to Congress in February 2023.

The bill seeks to curtail the Federal Reserve’s authority to create a programmable digital dollar, which Emmer perceives as a tool for surveillance that could undermine American society.

The legislation has specific provisions aimed at limiting the Federal Reserve’s powers.

Firstly, it prohibits the issuance of CBDCs directly to individuals, a measure designed to prevent the central bank from transforming into a retail bank capable of collecting individuals’ personal financial data.

READ MORE: CFTC Commissioner Calls for Tech-Driven Investor Protection Reforms

Additionally, the bill bars the central bank from utilizing CBDCs as a means of implementing monetary policy.

Emmer has previously voiced concerns about the potential weaponization of money by the federal government in its quest to expand financial control.

He has been joined in these concerns by U.S. presidential candidate Robert F. Kennedy Jr., who argued that CBDCs would grant the government unprecedented power to stifle dissent by denying access to funds at the click of a button.

Several notable figures, including Senators French Hill, Warren Davidson, and Mike Flood, also support the CBDC Anti-Surveillance State Act.

Their united front reflects a growing apprehension within certain political circles regarding the potential risks associated with CBDCs and their implications for individual privacy and government control over financial transactions.

Other Stories:

Federal Reserve Vice Chairman Highlights CBDC Research and Stablecoin Oversight in Fintech Speech

SEC Pursues Appeal in Ripple Labs Lawsuit Over XRP’s Security Classification

The Nasdaq stock exchange has made a significant move by submitting an application to the Securities and Exchange Commission (SEC) in hopes of gaining approval to list an Ethereum Exchange-Traded Fund (ETF) offered by Hashdex, a reputable asset management company.

What sets this ETF apart is its innovative approach to cryptocurrency investment within the boundaries of regulatory compliance.

Dubbed the Hashdex Nasdaq Ethereum ETF, this investment vehicle marks a milestone as the first Ethereum futures filing under the ’33 Act.

It is administered and overseen by Toroso Investments, a registered commodity pool operator with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association.

The recent influx of cryptocurrency ETF applications has put a spotlight on whether these proposed funds will include futures contracts or spot assets.

While the SEC has given the green light for the former, the latter remains unapproved.

Fund managers are now exploring a middle-ground strategy, testing the waters in this evolving regulatory landscape.

The primary objective of the Hashdex fund is to ensure that its shares closely reflect the daily fluctuations in the Nasdaq Ether Reference Price.

READ MORE: Federal Reserve Vice Chairman Highlights CBDC Research and Stablecoin Oversight in Fintech Speech

To achieve this, the fund plans to diversify its assets by investing in ether, ether futures contracts traded on the CME, and maintaining cash and cash equivalents.

According to Nasdaq’s 19b-4 form, the fund’s approach is to reduce its dependence on the spot market, which could be susceptible to price manipulation, by incorporating a mix of Spot Ether, Ether Futures Contracts, and cash.

Hashdex’s strategy differs from recent filings in the cryptocurrency ETF space.

Notably, it will not rely on the Coinbase surveillance sharing agreement, opting instead to acquire spot Bitcoin from physical exchanges within the CME market.

In recent developments, both Ark Invest and 21Shares have also submitted applications to the SEC for spot ether ETFs, a type of ETF also sought after by VanEck.

The SEC has yet to make determinations on all the applications it has received for spot cryptocurrency funds, keeping investors and enthusiasts eagerly awaiting further developments in the evolving landscape of cryptocurrency investments.

Other Stories:

CFTC Commissioner Calls for Tech-Driven Investor Protection Reforms

Bitcoin Rebounds from Three-Month Lows Amid Traders’ Doubts

SEC Pursues Appeal in Ripple Labs Lawsuit Over XRP’s Security Classification

According to Ripple CEO Brad Garlinghouse, the United States is currently one of the least favorable places to launch a cryptocurrency startup in the world.

His assertion comes amidst a legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC).

Speaking at the Token 2049 conference in Singapore on September 12, Garlinghouse expressed his concerns, stating that he would not encourage anyone to start a crypto company in the U.S. at this time.

Garlinghouse emphasized that the U.S. needs to take a cue from countries like Singapore, the United Kingdom, the United Arab Emirates, and Switzerland, which have implemented policies that foster cryptocurrency innovation while ensuring consumer protection.

He firmly placed the blame on the SEC, accusing the regulatory body of waging a political war against the crypto industry through its lawsuits.

Garlinghouse contended that the SEC’s lawsuit strategy was ineffective and pointed to recent court victories by Ripple and Grayscale as indicators that the tide might be turning in favor of the crypto industry.

Although these court decisions are not legally binding, he argued that they offer some much-needed clarity to crypto exchanges and custody providers operating in the U.S., at least temporarily.

READ MORE: Bitcoin Rebounds from Three-Month Lows Amid Traders’ Doubts

Hong Fang, President of OKX, acknowledged the political aspects of the situation but urged crypto firms to concentrate on what they can control – building the right products, focusing on technology, and supporting responsible regulations.

Despite the U.S. being a significant market for Ripple, Garlinghouse disclosed that the company is expanding its services to countries that he believes have a more progressive outlook and a better understanding of blockchain technology’s potential benefits.

During the panel discussion, Hong Fang expressed reservations about the readiness of investors for custody solutions built around a potential spot Bitcoin exchange-traded fund (ETF).

He highlighted concerns about the untested nature of much of the new blockchain-based infrastructure, suggesting that the industry might not be prepared for such developments.

Fang noted that while a spot Bitcoin ETF could attract more institutional investments, he doubted whether investors were prepared to handle the volatility of Bitcoin.

He also questioned the industry’s readiness to continue building more applications on top of Bitcoin, emphasizing the need for a stable infrastructure to support these endeavors.

In conclusion, Ripple’s CEO Brad Garlinghouse’s comments underscore the challenges faced by cryptocurrency startups in the U.S. due to regulatory uncertainty, while also highlighting the need for responsible regulation and a stable infrastructure in the crypto space.

Other Stories:

CFTC Commissioner Calls for Tech-Driven Investor Protection Reforms

SEC Pursues Appeal in Ripple Labs Lawsuit Over XRP’s Security Classification

Federal Reserve Vice Chairman Highlights CBDC Research and Stablecoin Oversight in Fintech Speech

Former PayPal president, David Marcus, has raised concerns about the outdated nature of global payments despite the ease of transferring information online.

He argues that while we can send emails or texts instantaneously, international money transfers remain stuck in the “fax era.”

According to Marcus, the lack of a universal protocol for online money transfers poses a significant challenge.

If you want to communicate with someone, you can simply ask for their email address and connect with them within minutes.

However, when it comes to sending money, the process is far from seamless. Marcus illustrated this by highlighting the difficulty of sending money to someone outside the U.S. who doesn’t use the same fintech apps.

In such cases, one would need the recipient’s bank account number and often resort to expensive international wire transfers costing as much as $50.

To address this issue, Marcus is leading the charge with his Bitcoin Lightning-focused payment service, Lightspark, which he co-founded in May 2022.

He believes that the Bitcoin Lightning Network has the potential to revolutionize the cumbersome process of sending money across borders.

READ MORE: Vitalik Buterin’s X Account Breached: Over $691K Lost to Malicious NFT Link

While Marcus acknowledges that Bitcoin’s Lightning Network may not become the go-to currency for everyday purchases, he sees its primary utility in facilitating international transfers.

Rather than being used for buying goods and services directly, Bitcoin could serve as a bridge currency, allowing users to send U.S. dollars that are seamlessly converted into other currencies, such as Japanese yen or euros, on the recipient’s end.

The key advantage of this approach is the speed and cost-effectiveness of Bitcoin Lightning’s settlement layer.

It enables near-instantaneous and low-cost cash finality, making it a promising solution for cross-border transactions.

In essence, Marcus envisions Bitcoin’s Lightning Network as the remedy to the outdated and expensive global payment systems that continue to prevail in today’s interconnected world.

In conclusion, David Marcus, the former PayPal executive and co-founder of Lightspark, believes that Bitcoin’s Lightning Network holds the key to modernizing international money transfers and bringing them out of the “fax era.”

With its potential to revolutionize cross-border payments, Bitcoin Lightning could pave the way for a more efficient and cost-effective global financial system.

Other Stories:

Coinbase CEO Foresees Crypto’s Major Role in 2024 Elections, Urges Clearer Regulations

Terra Classic Community Proposes Minimum Deposit Hike to Combat Spam

Rise of Senior Executives Leading Digital Asset Strategies Signals Investment Firm Transformation

Key figures from leading mining and manufacturing firms are anticipating that the fourth Bitcoin halving, scheduled for 2024, could propel the price of Bitcoin (BTC) beyond the $100,000 mark.

This intriguing insight was shared by Canaan’s Vice President, Davis Hui, during a panel discussion at Canaan’s Avalon Bitcoin and Crypto Day (ABCD) in Singapore.

This panel included prominent Bitcoin mining executives from Singapore, Kazakhstan, and the United Arab Emirates, all of whom offered similar BTC price predictions for 2024, citing the profound impact of the upcoming Bitcoin mining reward halving.

Hui emphasized the impending reduction in Bitcoin’s supply, which will drop to 6.25 BTC per block after the reward halving.

Simultaneously, traditional financial institutions are displaying an increasingly keen interest in investing in the cryptocurrency sector.

Hui pointed out that industry giants like BlackRock, managing a staggering $10 trillion in assets, hold five times more value than the entire cryptocurrency market capitalization, currently standing at $2 trillion.

This surge in institutional interest, coupled with the halving’s supply reduction, is expected to drive BTC’s price upward.

Furthermore, Hui underscored the significance of several Bitcoin exchange-traded fund (ETF) applications pending with the United States Securities and Exchange Commission (SEC), submitted by some of the world’s largest asset managers.

READ MORE: Vitalik Buterin’s X Account Breached: Over $691K Lost to Malicious NFT Link

These applications, once approved, are anticipated to inject substantial capital into the cryptocurrency market, further fueling the demand for BTC and contributing to its price surge.

Hui also shed light on the challenging environment faced by most miners in the fiercely competitive market, where all-time high hash rates and network difficulties are eroding miner profitability.

In response, miners who cannot cover their electricity costs with their mining rewards are shutting down their operations.

However, those continuing to mine are doing so with an eye on the potential gains following the 2024 halving.

He also noted that miners capable of upgrading to more efficient and powerful machines are likely to maintain better profitability.

Hui speculated that mining companies in the United States might face particular challenges due to high electricity and administrative costs.

In a candid admission, Hui revealed that Canaan, like other industry players, reported a financial loss in the first quarter of 2023, underscoring the prolonged impact of the cryptocurrency bear market.

Despite these challenges, the industry remains optimistic about the future, driven by the potential market dynamics set to unfold as a result of the fourth Bitcoin halving.

Other Stories:

Coinbase CEO Foresees Crypto’s Major Role in 2024 Elections, Urges Clearer Regulations

Terra Classic Community Proposes Minimum Deposit Hike to Combat Spam

Rise of Senior Executives Leading Digital Asset Strategies Signals Investment Firm Transformation

Astana-based financial technologies firm Collect & Exchange has rolled out an advanced digital asset exchange platform to facilitate cryptocurrency and fiat exchange, as well as cryptocurrency payments. According to a press release from August 23, 2023, the new platform supports over 1500 trading pairs, providing a broad trading ecosystem for both cryptocurrencies and traditional currencies.

Cryptocurrency exchanges have come under fire for regularly struggling with issues such as lack of transparency, inefficient exchanges, and outright fraud. Collect & Exchange’s entry comes as a breath of fresh air, promising rapid onboarding for clients in various industries, from advertising and IT to e-commerce and gaming. Asaf Hanukaev, co-founder of Collect & Exchange, heralds the launch as a “paradigm shift” in how diverse sectors engage with digital assets.

Setting new standards

The Collect & Exchange platform, regulated by Astana Financial Services Authority (AFSA), offers a streamlined onboarding experience thanks to its adoption of modern KYC and AML procedures. Notably, the new platform claims that its approach ensures that both businesses and individual clients can be fully operational in a matter of days – this is in stark contrast to the current industry standard, as corporate clients are often waiting weeks to open new accounts with cryptocurrency exchanges.

Further elevating the user experience, Collect & Exchange reportedly features an intuitive and customizable dashboard. Funding options are also versatile, allowing for easy deposits, withdrawals, and internal transfers across major digital assets like Bitcoin, Ethereum, Tron, and Binance Smart Chain. Moreover, seamless fiat funding and withdrawal are enabled through traditional bank transfers, supporting top fiat currencies such as the US Dollar, Euro, Swiss Francs, Chinese Yuan, Emirati Dirham, and British Pound.

“We’ve constructed Collect & Exchange to serve a broad array of sectors, not just those who are tech-savvy or steeped in finance,” said Yaron Noah, another co-founder of the venture.

Perhaps its most unique feature, the platform aims to go above and beyond in customer service, offering each user a dedicated support agent. This is rather unusual in the cryptocurrency trading space, with major platforms facing backlash for untrained or even indifferent support agents.

George Arakelov, CEO of Collect & Exchange, explains, “In the dynamic realm of digital asset trading, a personal touch can be a game-changer. Our devoted support agents stand ready to resolve any issues immediately, underscoring our dedication to an unparalleled customer experience and transparency.”

The bottom line

Collect & Exchange’s launch might be the harbinger of an industry-wide transformation, particularly in terms of customer service and accessibility. With a rapid setup and multiple currency options, the platform has the potential to be a universal solution for digital asset management and payments, aligning with the larger trends of decentralization and blockchain adoption in various industries.

By offering dedicated customer support agents, the company is also setting a new standard in customer service within the digital asset trading landscape—a timely update given the complexities and fast pace associated with such trading. As the digital asset ecosystem continues to evolve, Collect & Exchange’s comprehensive, user-friendly platform could very well set the tone for the industry’s future, and also serve as a case study for other sectors wrestling with similar issues.

The United States Securities and Exchange Commission (SEC) has submitted a filing, urging the court to grant its motion to appeal a ruling from the Ripple Labs lawsuit that deemed the XRP token to not be a security when sold to retail investors.

The agency argues that “knotty legal problems” surrounding the court’s application of the law, specifically the Howey test, warrant a review.

In a filing dated September 8, the SEC calls for the U.S. District Court for the Southern District of New York to grant its motion for interlocutory appeal and “stay further proceedings until the resolution of that appeal,” citing the “knotty legal problems” raised by the court’s summary judgment order.

Judge Analisa Torres ruled in July that XRP is generally not a security under SEC guidelines, particularly when distributed via programmatic sales, such as being sold to retail investors through exchanges.

In its latest filing, the SEC argues that the rulings on programmatic sales and other distributions present significant “legal questions” justifying approval of the agency’s interlocutory appeal.

The SEC suggests that the legal ambiguity arises from whether certain crypto assets fall under the classification of investment contracts via the Howey test, citing differing opinions within the district and other courts considering similar issues.

READ MORE: Singapore’s MAS Maintains Strict Stance on Crypto Participation in Regulatory Sandbox

The SEC states that while interlocutory appeal should be the exception, this case is exceptional due to its industry-wide significance and special consequence, inviting interlocutory appeal.

These sentiments contradict previous statements from the SEC and its Chair, Gary Gensler, who has previously opposed the need for new crypto regulation, asserting that the SEC’s existing guidelines adequately cover the crypto market, including the notion that most crypto assets on the market are securities.

In a September 8 tweet, Ripple’s chief legal officer Stuart Alderoty calls the SEC’s filing “hypocritical” in light of Gensler’s prior statements about clear rules.

Coinbase’s chief legal officer, Paul Grewal, also questions how crypto firms can have “fair notice” if unresolved legal questions persist in court.

The SEC originally moved to appeal and stay Judge Torres’s decision in August, arguing substantial differences of opinion.

On September 1, Ripple Labs responded with a memorandum of law opposing the SEC’s appeal, contending that the agency lacks substantial grounds for the requested appeal.

Other Stories:

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Block Earner Forges Ahead with Crypto-Backed Loans Despite Legal Battle with Regulatorc

Crypto Exchange CEO and Siblings Sentenced to Over 11,000 Years in Prison

In recent years, the world of online gambling has witnessed a remarkable transformation. Crypto casinos have emerged as a game-changer, revolutionizing the way people gamble online. With their unique advantages, these platforms have gained global acceptance among avid gamblers. From enhanced convenience to superior rewards, crypto casinos have raised the stakes in the online gambling industry.

In this blog post, we’ll delve into the exciting world of crypto casinos and explore the myriad benefits they offer to both newcomers and seasoned players.

Unparalleled Convenience and Accessibility:

Gone are the days of tiresome registration processes and sharing personal information to start gambling. Crypto casinos have simplified the entire experience. Players can now enjoy their favorite games with just a few clicks on their smartphones or laptops. All that’s required is setting up a crypto wallet and connecting it to the chosen crypto casino. Thanks to blockchain technology, transactions are lightning-fast, with no intermediaries involved. Say goodbye to lengthy verification processes that traditional online casinos often demand.

Flexible Payment Options:

Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) are the go-to choices in the world of crypto casinos. These digital currencies offer unique advantages, such as Tether’s stable value and Ethereum’s smart contracts. Unlike conventional casinos that exclusively accept fiat currencies, crypto casinos break down these barriers. The blockchain acts as a digital ledger, eliminating the need for intermediaries and ensuring rapid transactions. Moreover, the robust security features of blockchain, including encryption and cryptography, bolster the safety of your funds.

Bonuses and Promotions Galore:

One of the standout features of crypto casinos is the abundance of bonuses and promotions. Unlike their brick-and-mortar counterparts, these casinos shower players with incentives that significantly enhance the gaming experience. Simply by signing up on a crypto casino website, you can unlock a generous welcome bonus. Additionally, special promotions frequently highlight specific games that offer even greater rewards. Playing with these bonuses and promotions can substantially boost your payouts. Be sure to meet the requirements attached to these incentives, and you’ll have the opportunity to maximize your winnings.

Embrace the future of online gambling with Novibet.ie, an online casino site like this that serves as your gateway to an exciting and rewarding gaming journey. As we’ve discussed in our blog post, crypto casinos are changing the game, and Novibet.ie is at the forefront of this revolution. You’ll experience unparalleled convenience and accessibility – no more cumbersome registration processes or sharing personal information, just a few clicks, and you’re ready to roll.

Accepting popular cryptocurrencies like Bitcoin, Ethereum, and Tether, Novibet.ie provides flexible payment options, setting it apart as an online casino site like this. The platform ensures lightning-fast transactions while fortifying security with robust encryption and cryptography.

But that’s not all. Novibet.ie takes your gaming experience to the next level with a treasure trove of bonuses and promotions. From a generous welcome bonus to exclusive game-centric promos, rewards keep flowing on an online casino site like this. Play with these bonuses, meet the requirements, and watch your winnings soar.

Don’t miss the opportunity to embrace the future of online gambling with Novibet.ie, an online casino site like this. Explore the endless possibilities that crypto casinos offer – it’s your go-to platform for an exciting and rewarding gaming experience. Join us today and discover the thrill of crypto gambling like never before.

Crypto casinos have rapidly become a force to be reckoned with in the world of online gambling. Their user-friendly interfaces, diverse payment options, and enticing bonuses have transformed the gambling landscape. Whether you’re new to crypto gambling or a seasoned player, these platforms offer an exciting and rewarding experience like no other. So, why not explore the world of crypto casinos and see how they can lead you to thrilling rewards? The future of gambling is here, and it’s digital, decentralized, and packed with possibilities.

An escalating trend is taking root among investment firms across the United States, the United Kingdom, and Europe, as market intelligence reveals a surge in the appointment of senior executives to spearhead digital asset investment strategies.

The latest insights from a report by Amberdata, titled “Digital Assets: Managers’ Data Infrastructure Fuel,” disclose that a noteworthy 24% of asset management firms have already embraced digital asset strategies, with an additional 13% actively planning to follow suit within the next two years.

The data paints a picture of increasing commitment, with nearly a quarter of these organizations now boasting senior positions wholly dedicated to digital asset implementation, signaling both a seriousness of intent and a resounding endorsement from top management.

The report derived its findings from a comprehensive survey encompassing 60 investment professionals hailing from the U.S., U.K., and Europe.

This diverse group included asset managers, hedge funds, and various investors.

Encouragingly, almost half (48%) of the study participants have already integrated digital assets into their firm’s portfolios. Amberdata’s prognosis for the near future predicts a continued emphasis on digital asset trading and investment strategies among asset managers.

Remarkably, this trend persists despite the prevailing regulatory scrutiny faced by the U.S. crypto industry, chiefly from the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC).

READ MORE: Congressman Takes Aim at SEC’s Digital Asset Enforcement Spending

Despite the regulatory challenges, Amberdata remains optimistic, forecasting a potential positive shift in the next few years.

Their report states, “The good news is that the tide may be turning. In the next five years, the SEC and the CFTC are expected to be providing the most positive opportunities for investors in our study.”

Moreover, the report highlights Ripple’s recent partial legal victory against the SEC as a potential catalyst, which could draw more asset management firms into the fold of digital asset strategy adoption.

In a related development, European digital asset manager CoinShares has reported substantial growth, with a total revenue of 20.3 million pounds ($25.9 million) in the second quarter of 2023.

This marks a significant 33% increase compared to the corresponding quarter in the previous year.

This achievement underscores the burgeoning potential and allure of the digital asset landscape for investment firms seeking to diversify their portfolios and tap into the evolving financial landscape.

Other Stories:

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Ripple Bolsters U.S. Regulatory Presence with Fortress Trust Acquisition

Ripple’s Chief Legal Officer Lambasts SEC’s ‘Contradictory Shift’ in Latest Submission