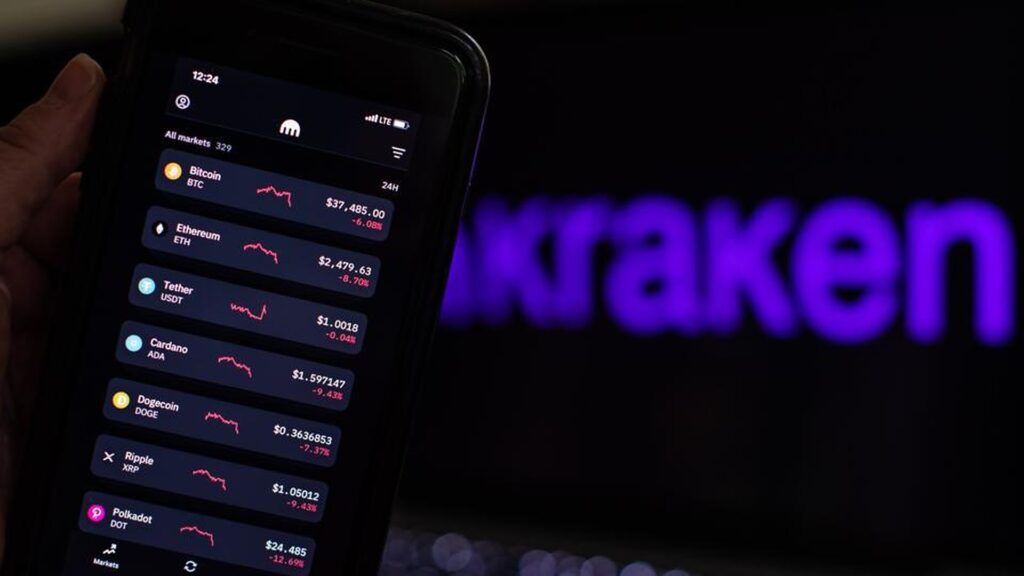

Kraken, a prominent cryptocurrency exchange, is set to suspend transactions involving Tether (USDT), Dai (DAI), Wrapped Bitcoin (WBTC), Wrapped Ether (WETH), and Wrapped Axelar (WAXL) in Canada during the months of November and December.

This development comes in response to recent regulatory changes in Canada and extensive consultations with the Canadian Securities Administrators (CSA) and the Ontario Securities Commission (OSC).

Kraken has communicated this decision to its customers through email notifications, as confirmed by a company spokesperson.

The spokesperson emphasized Kraken’s commitment to maintaining high compliance standards in the crypto industry.

The email sent to clients stated, “In accordance with recent Canadian regulatory changes and following extensive consultation with the CSA and OSC, we today notified our clients that we will soon be suspending trading for USDT, DAI, WBTC, WETH, and WAXL.”

Additionally, the company expressed its dedication to providing an exceptional trading experience for Canadian users despite these suspensions.

READ MORE:Alameda Research and FTX Transfer Over $10 Million to Exchange Accounts

This move by Kraken aligns with a trend observed in the Canadian cryptocurrency market throughout 2023.

Several other exchanges, including Coinbase and Crypto.com, had already ceased trading of USDT and DAI due to regulatory challenges earlier in the year.

Furthermore, OKX and Binance had withdrawn completely from the Canadian market in June and May, respectively.

Kraken’s decision, however, indicates its intention to continue operations in Canada while temporarily suspending transactions related to the specified assets.

The suspension will occur in phases, starting on November 30th with the cessation of deposits and trading functions for the mentioned assets.

On December 4th, users will no longer be able to make withdrawals of these assets.

Finally, on December 5th, any remaining assets will be converted into U.S. dollars at the prevailing market rate and credited to users’ accounts.

In other news, Kraken recently announced the appointment of a new managing director for its U.K. operations on October 27th.

The newly appointed director, Bivu Das, brings extensive experience in fintech and traditional financial services, having previously served as the head of Starling Bank and as an entrepreneur.

This appointment reflects Kraken’s ongoing efforts to expand its presence and leadership in the cryptocurrency industry.

Sam Bankman-Fried recently appeared in his ongoing criminal trial in the United States District Court for the Southern District of New York, where he denied any wrongdoing between FTX and Alameda Research while acknowledging his own “big mistakes” during the company’s rapid growth.

Officially, Bankman-Fried’s testimony began on October 27, following a preliminary hearing the previous day.

During the preliminary hearing, he seemed ill-prepared to answer government attorneys’ questions but appeared more composed when facing the jury on the subsequent day.

Key points from his testimony included his denial of directing his inner circle, including former FTX Digital Markets co-CEO Ryan Salame and former director of engineering Nishad Singh, to make political donations in 2021.

Singh had donated $8 million to federal campaigns, while Salame had contributed $10 million through loans from Alameda Research.

Bankman-Fried, however, acknowledged the role of lobbying in Washington, D.C., in his efforts to establish a regulatory framework for crypto firms in the United States in 2021.

Despite accusations that he used customer deposits on FTX to contribute over $100 million to political campaigns in the lead-up to the 2022 U.S. midterm elections, Bankman-Fried maintained his innocence, stating that these donations were made from the exchange’s own funds.

READ MORE: Bitcoin Hits All-Time Highs Against Inflation-Plagued Fiat Currencies

Bankman-Fried also discussed his philosophy on written communication within his companies.

He emphasized that even seemingly harmless messages could be misconstrued out of context, underscoring the importance of providing sufficient context in written messages.

Regarding the use of the autodelete feature in Signal, Bankman-Fried explained that it was employed because official communications and regulatory paperwork were handled through other channels like Slack or email, whereas Signal was used for daily internal communication.

Bankman-Fried revealed details about Alameda’s line of credit with FTX, highlighting Alameda’s roles as a payment provider, liquidity provider, market maker, and client of FTX.

He explained that custom code features were developed to accommodate Alameda’s unique role in the exchange’s operations, such as the ability to go negative via a line of credit without triggering the risk engine.

Furthermore, he discussed his discussions with Caroline Ellison, the former CEO of Alameda Research, about hedging strategies in 2021 and 2022 to protect the trading platform from potential market downturns.

Despite these discussions, the strategies were not implemented, leading to significant losses when the Terra ecosystem collapsed and crypto prices declined.

Bankman-Fried also mentioned FTX’s terms of use, which included a clawback provision meant to distribute losses among customers if the exchange’s risk engine failed, emphasizing that customers trading on FTX were aware of the associated risks.

The trial is ongoing, with the defense expected to conclude Bankman-Fried’s examination on October 30, followed by cross-examinations and closing arguments from both sides, along with a potential rebuttal witness in the coming weeks.

If found guilty of all fraud and conspiracy counts, Bankman-Fried faces a potential 115-year prison sentence.

A U.S. district court judge has issued a decisive ruling in the longstanding legal battle between NFT artists Ryder Ripps and Jeremy Cahen and the creators of Bored Ape Yacht Club (BAYC), Yuga Labs.

On October 25th, the judge ordered Ripps and Cahen to pay Yuga Labs a substantial sum of $1.57 million in disgorgement and damages, in addition to covering legal fees, effectively concluding the protracted “copycat” NFT lawsuit.

This development follows a partial summary judgment issued on April 21st, which favored Yuga Labs.

The judgment was based on Yuga Labs’ claim that Ripps and Cahen, the defendants, had infringed copyright laws by producing imitative versions of their BAYC collectibles.

District Court Judge John Walter, in his ruling, awarded Yuga Labs $1.37 million, affirming that the NFT company was entitled to a disgorgement of the defendants’ profits. An extra $200,000 was granted in statutory damages related to cybersquatting violations.

Furthermore, Judge Walter concluded that Yuga Labs was entitled to recover attorney fees and costs from the NFT artists due to the exceptional nature of the trademark infringement.

READ MORE: $1M Crypto Drop: Celebrate BetFury’s 4th Anniversary

He noted that an exceptional case for awarding attorney fees arises when a party exhibits “malicious, fraudulent, deliberate, or willful” behavior.

Judge Walter dismissed the defendants’ argument that their copycat BAYC versions were satirical or parodic, asserting that they had intentionally infringed on Yuga’s BAYC trademarks with an intent to profit in bad faith.

He also highlighted that the defendants continued to market and promote their copycat BAYC versions even after the partial summary judgment was delivered in April.

The lawsuit against Ripps and Cahen was initially filed by Yuga Labs in June 2022.

In an October 16th hearing in a U.S. appeals court, the lawyers for Ripps and Cahen attempted to argue that the lawsuit should be dismissed on grounds of free speech under California’s anti-SLAPP statute.

However, the three-judge panel did not appear swayed by their arguments.

Bored Ape Yacht Club stands as one of the most valuable NFT collectibles on the OpenSea marketplace.

Since April 2021, it has garnered an impressive 1.32 million Ether (ETH), equivalent to approximately $2.38 billion in trading volume, boasting an average floor price of 27.4 ETH, or roughly $49,200, according to data from OpenSea.

Bitcoin (BTC) has achieved remarkable milestones by reaching all-time highs against several inflation-ridden fiat currencies in a span of just 30 hours from October 23 to 24.

Notably, these currencies include the Argentine peso, Nigerian naira, Turkish lira, Laotian kip, and the Egyptian pound.

It’s important to emphasize that this surge in Bitcoin’s value is primarily attributed to the continuous devaluation of these national currencies, which has been further exacerbated by Bitcoin’s recent 16% price surge.

The situation for the naira and lira is particularly dire, as they plummeted to their lowest exchange rates against the United States dollar on October 24 and 25, respectively.

The Argentine peso is also not faring well, currently resting at a mere 0.85% above its all-time low against the U.S. dollar.

According to data from the International Monetary Fund (IMF), the Venezuelan bolivar leads the world with an alarming annual inflation rate of 360%, followed closely by the Zimbabwean dollar at 314%, the Sudanese pound at 256%, and the Argentine peso at 122%.

The Turkish lira and Nigerian naira also feature on this distressing list, ranking sixth and fifteenth, respectively, with annual inflation rates of 51% and 25%.

Cryptocurrency enthusiasts have long considered digital assets like Bitcoin and stablecoins as effective hedges against rampant inflation, and the recent data only strengthens this narrative.

Notably, Nigeria, Turkey, and Argentina are among the countries with high cryptocurrency adoption rates globally, as per a September 12 report by Chainalysis.

READ MORE: Bitcoin Searches Skyrocket as Crypto Rally Sparks Global Frenzy

However, it’s worth mentioning that these countries’ governments have not always been aligned with the cryptocurrency industry.

Nigeria, for instance, initially banned local banks from providing services to cryptocurrency exchanges in February 2021.

Yet, progress has been made, with Nigeria signaling its intention in December 2022 to pass a bill recognizing cryptocurrencies as “capital for investment,” citing the need to align with global practices.

In Turkey, despite a strong interest in cryptocurrencies among the populace, the central bank banned the use of cryptocurrencies for payments of goods and services in April 2021.

Simultaneously, they have been actively exploring the creation of a central bank digital currency (CBDC) to digitize the Turkish lira.

Meanwhile, Argentina’s inflation crisis remains a key concern, with a presidential election scheduled for November. The presidential candidates, Javier Milei and Sergi Massa, have differing approaches.

Massa, currently the country’s minister of economy, aims to launch a CBDC swiftly to address the persistent inflation problem and intends to keep the U.S. dollar away from Argentinians.

In contrast, Milei advocates for adopting the U.S. dollar and abolishing Argentina’s central bank as part of his vision for economic reform. The election outcome will likely shape the country’s economic trajectory significantly.

Staking has grown increasingly popular since the emergence of the Proof-of-Stake (PoS) consensus mechanism. The industry has witnessed the emergence of all sorts of platforms where people could stake crypto in exchange for rewards.

Most platforms operate by gathering funds from those staking crypto in exchange for rewards, also called the yield, and subsequently directing the acquired funds to liquidity pools or to cover other financial needs.

Liquid staking implies that a user who forms a crypto stake, a certain amount in crypto (mostly ETH, ranging from 0.5 to thousands) receives so-called ‘liquidity tokens,’ which they may subsequently sell on an exchange if that token gets listed.

Some staking projects also allow users to become network validators. Projects like Stakefish utilize a network of Web3 wallets (such as MetaMask) to stake users’ crypto, primarily ETH.

When it comes to CryptoStake, our goal is to ensure the maximum protection of user funds by providing a non-custodial solution (wallet). This solution allows users to retrieve their crypto staking rewards through a unified seed phrase across all compatible crypto wallets (Exodus, Atom, etc.).

CryptoStake’s non-custodial wallet, produced in the form of the proprietary crypto staking app, features a one-click mechanism that enables users to create a unique validator with an identification number. This number is displayed on our monitoring network as well as other platforms, ensuring the security of a given validator. In essence, users can stake crypto through validators while retaining full control of their funds in their wallet.

In other words, CryptoStake never gains control of user funds; it functions more as a system for monitoring validator status, while they can earn interest on crypto in a safe environment with us being a trustworthy intermediary.

The user only needs their validator number, along with the public and private keys, to restore the validator at any time, even without relying on our service.

The primary concept behind CryptoStake is to demonstrate that non-custodial staking on our platform is safer than traditional crypto wallet storage or liquid staking. Safety is achieved through a 7-day unstaking period and the provision of a validator number.

CryptoStake’s advantage over liquid staking pools is rooted in our exclusive use of utility tokens like ETH that boast a solid annual percentage yield or APY. Utility tokens actively contribute to blockchain operations, unlike liquidity staking, which provides users with unbacked tokens in exchange for cryptocurrencies with genuine value, such as ETH. These unbacked tokens can be susceptible to losses during FOMO events or even theft.

It’s crucial to understand that CryptoStake does not, and cannot, offer crypto staking rewards greater than what a specific blockchain network permits. We prioritize the security of crypto assets by providing users uninterrupted access to the validator node on a designated server and ensuring control over their crypto funds stored in their respective wallets. It’s worth reiterating that CryptoStake does not have access to user funds; we only require a specific file to launch the validator.

Our service is designed for customers who require proof of ownership to meet regulatory requirements and for taxation purposes. CryptoStake offers a complete reward allocation history for the entire staking period, along with statements suitable for taxation authorities. Furthermore, CryptoStake provides a single access point for four top cryptocurrencies (ETH, DOT, ATOM, and ADA), each with inherently different staking and reward claiming mechanisms. However, users won’t need to worry about these differences if they choose to stake with CryptoStake. An in-built crypto staking rewards calculator shows an expected yield across different timeframes, while the collection process is minimized to a few clicks.

CryptoStake generates revenue from network fees for ‘renting’ our validator capacities on servers, except for ETH where we receive ‘execution fees.’ Our fees, which are set at 3%, are among the lowest in the industry. It’s essential to note that our marketing strategy is centered on attracting ‘whales’ with significant ETH holdings. We promise them complete asset protection in the long run, the ability to retrieve assets from the wallet without our intermediary assistance, and support in dealing with tax-related matters.

Key takeaways:

- CryptoStake prioritizes the security of funds and proof of their legality over offering extravagant staking rewards.

- Users become full-fledged network validators instead of receiving low-value tokens.

- Our primary clientele consists of ETH whales, with a future focus on BTC holdings

Social media:

https://www.linkedin.com/company/89361538/admin/feed/posts/

https://www.facebook.com/Cryptostakecom

https://www.instagram.com/cryptostakecom/

https://www.reddit.com/user/Cryptostakecom/

The above information regarding CryptoStake, its concept, and operations, is intended for informational and marketing purposes only. Full or partial copying, reproduction, or publication of this material is prohibited without prior written consent from CryptoStake. Nothing in this material constitutes financial or investment advice. For more detailed and up-to-date information about CryptoStake, including news, products, and offers, please visit its official website https://cryptostake.com/ or follow its official social media accounts:

According to on-chain analytics firm Glassnode, Bitcoin is poised to conclude 2023 much as it began the year, with significant gains in October.

The latest issue of their weekly newsletter, “The Week On-Chain,” released on October 24, highlighted that the past week has set the stage for a potential uptrend in BTC’s price.

Bitcoin’s price surged to $35,200 during the week, surpassing several crucial trendlines that had previously acted as support for months.

These included various moving averages (MAs), notably the 200-week simple MA at $28,400, which is often considered a critical support level during bear markets.

Glassnode pointed out, “A cluster of long-term simple moving averages of price are located around $28k, and have provided market resistance through September and October.”

However, the recent market strength allowed Bitcoin to break through the 111-day, 200-day, and 200-week averages convincingly.

This breakthrough had a positive impact on the profitability of various investor groups, including speculators and newcomers, whose cost basis was around $28,000.

The Short-Term Holder (STH) cost basis also reached $28k, resulting in an average profit of approximately +20%.

Glassnode presented a chart of the short-term holder market-value-to-realized-value (STH-MVRV) ratio, which measures the profitability of STH coins.

READ MORE: SEC Chair’s $5 Billion Enforcement Actions Make Waves at 2023 Securities Forum

They noted that even before the October surge, there was no significant capitulation behavior among STH holders.

In contrast to previous years when STH-MVRV experienced deep corrections of -20% or more, the August sell-off only reached -10%, suggesting robust support and potentially paving the way for the recent rally.

Despite facing their own profitability challenges, long-term holders (LTHs) now own over 75% of the available BTC supply for the first time.

Their cost basis is lower, closer to $20,000, and while some believe Bitcoin could return to that level, Glassnode remains optimistic about the year-end outlook.

Glassnode concluded, “This sets the foundation for a resumption of the 2023 uptrend.

At the very least, the market has crossed over several key levels where aggregate investor psychology is likely to be anchored, making the weeks that follow important to keep an eye on.”

As per data from on-chain monitoring resource CoinGlass, BTC/USD has seen a 26% increase this month, which, by October standards, is considered relatively modest.

However, Glassnode’s analysis suggests a positive outlook for Bitcoin as it closes out the year.

Wallets associated with the financially troubled crypto firms Alameda Research and FTX have executed a series of cryptocurrency transfers, moving more than $10 million to exchange deposit accounts within a span of five hours between October 24th and 25th.

This activity, as per data sourced from the blockchain analytics platform Spot On Chain, suggests a potential intention by these firms to liquidate some of their assets to repay creditors.

According to Spot on Chain’s records, an address deemed “likely” belonging to FTX initiated the movement by transferring 2,904 Ether, valued at over $5 million at the time, to another address at 8:18 pm UTC on October 24th.

Subsequently, this address distributed $3.4 million to a Binance deposit address and $1.8 million to a Coinbase deposit address.

Approximately 39 minutes later, a wallet identified as belonging to Alameda Research sent $95 worth of tokens, including LINK, MKR, and AAVE, to this address.

READ MORE: Bitcoin-Related Stocks Soar as Crypto Market Reaches New Heights

Over the next five hours, FTX and Alameda wallets continued to transfer cryptocurrency to this address, including COMP and RNDR, totaling an additional $5 million in value.

Around 2:00 am UTC on October 25th, this address dispatched roughly $2 million worth of LINK, $2 million worth of MKR, and $1 million worth of AAVE to a Binance deposit address.

In total, during this period, cryptocurrency amounting to $10,362,403 was sent to exchange deposit addresses, based on Spot on Chain data.

Earlier, on September 13th, a Delaware Bankruptcy Court had approved a plan to liquidate $3.4 billion worth of crypto assets held by FTX and Alameda Research.

This announcement had raised concerns about the potential market impact of liquidating such a substantial crypto holding.

Nonetheless, experts have contended that the gradual and phased approach to the liquidation should mitigate its influence on the market, helping to prevent a significant market downturn.

FTX, the crypto exchange currently undergoing bankruptcy proceedings, is making efforts to reclaim millions of dollars in payments it disbursed to a nonprofit organization known as the Center for AI Safety (CAIS).

According to documents filed in bankruptcy court on October 25, FTX alleges that it provided CAIS with $6.5 million in payments between May and September 2022, just months before the exchange’s financial collapse and subsequent declaration of bankruptcy.

FTX is now seeking approval from a Delaware Bankruptcy Court judge to issue subpoenas to CAIS in order to investigate whether the organization indeed received these payments.

The subpoenas are intended to inquire about any payments, funds, communications, agreements, or contracts that may have transpired between CAIS, FTX, its affiliates, and former executives.

FTX asserts that CAIS declined to cooperate voluntarily by providing an accounting of the received funds, despite attempts at communication, including a phone call in August and email exchanges in early October. As of now, CAIS has not responded to requests for comment.

READ MORE: Nym Technologies Launches $300 Million Fund to Boost Privacy in Web3 Ecosystem

This move by FTX to investigate CAIS is seen as part of its broader strategy to recover funds that can be used to repay the exchange’s creditors and customers who were adversely affected by its collapse in November 2022.

In a June report, FTX disclosed that it had successfully recovered approximately $7 billion and needed an additional $1.7 billion to cover customer funds it alleges were mishandled.

CAIS gained notable recognition for its public stance on AI risk, particularly its published statement in May, which emphasized the importance of addressing existential threats posed by AI alongside concerns such as nuclear war.

The statement garnered support from prominent figures, including OpenAI CEO Sam Altman and AI pioneer Geoffrey Hinton.

FTX’s subpoenas request a broad range of documents and communications from CAIS, encompassing transfers, records, and correspondences associated with not only FTX but also its philanthropic arms, the FTX Foundation and the FTX Future Fund.

The request extends to officers, directors, contractors, and employees of FTX, including co-founders Sam Bankman-Fried and Gary Wang, as well as other key individuals like Joseph Bankman, Gabriel Bankman-Fried, Caroline Ellison, Can Sun, and Daniel Friedberg, among others.

In his address at the 2023 Securities Enforcement Forum, Gary Gensler, the Chair of the United States Securities and Exchange Commission (SEC), shed light on the extensive regulatory actions undertaken by the agency, resulting in a staggering $5 billion in judgments and orders.

However, it was Gensler’s remarks concerning the cryptocurrency market that ignited fervent discussions within the crypto community on social media platforms.

He emphatically stated, “Don’t get me started on crypto. I won’t even name all the individuals we’ve charged in this highly noncompliant field.”

Discussing the economic ramifications of the SEC’s enforcement endeavors, Gensler highlighted that the agency had initiated over 780 enforcement actions in 2023, with more than 500 of them being standalone cases.

These actions ultimately culminated in judgments and orders totaling $5 billion, with $930 million allocated for restitution to injured investors.

Additionally, Gensler disclosed that the SEC had instituted legal actions against 40 firms for various rule and regulation violations since December 2021, resulting in penalties exceeding $1.5 billion.

Furthermore, he revealed that the SEC had resolved recordkeeping-related charges with 23 firms in the previous fiscal year alone.

READ MORE: Bitcoin-Related Stocks Soar as Crypto Market Reaches New Heights

Expanding on his views on cryptocurrency, Gensler reiterated his belief that a significant portion of the crypto market falls within the purview of securities and should therefore be subject to the same regulatory framework.

He expounded upon the broad definition of securities, particularly emphasizing the concept of an investment contract, which he asserted is closely resembled by a substantial segment of the cryptocurrency market.

Gensler maintained that most cryptocurrency assets would pass the investment contract test, thereby necessitating compliance with securities regulations.

Drawing parallels between the present cryptocurrency landscape and the financial environment of the 1920s when securities laws were yet to be established,

Gensler argued that the crypto industry is currently grappling with similar challenges – a lack of clear regulations leading to numerous scams, frauds, and bankruptcies.

He contended that these issues underscore the imperative need for more stringent regulations.

Gensler concluded his speech by stating, “Without prejudging any one asset, the vast majority of crypto assets likely meet the investment contract test, making them subject to the securities laws.”

While his criticism of the cryptocurrency market is a recurring theme in his tenure, calls for greater clarity on crypto regulations have grown louder, with members of Congress, the crypto community, and key U.S. businesses urging Gensler to provide more definitive guidance on this matter.

Other Stories:

Nym Technologies Launches $300 Million Fund to Boost Privacy in Web3 Ecosystem

ARK Investments Sells GBTC Shares Amid Bitcoin ETF Speculation and Surging Crypto Market

FTX Creditor Claims Surge in Value, Trading at Over 50 Cents on the Dollar

ARK, the renowned investment firm led by the pro-Bitcoin advocate Cathie Wood, has recently made strategic moves in its portfolio, shedding Grayscale Bitcoin Trust (GBTC) shares worth $2.5 million.

This decision comes in the wake of a notable surge in the GBTC market, which has been stoked by the growing anticipation of a spot Bitcoin exchange-traded fund (ETF).

On October 23, ARK executed the sale of 100,739 GBTC shares, marking its first officially reported GBTC transaction since November 2022 when it acquired 450,272 GBTC shares valued at $4.5 million for its ARK Next Generation Internet ETF (ARKW).

The recent sale constitutes approximately 2% of GBTC’s total value in ARKW’s portfolio, equivalent to $122.6 million as of that date. Notably, GBTC is the flagship asset in ARKW’s holdings, representing 10.4% of the fund’s exposure, with Coinbase and Roku shares trailing at 9% and 7.4%, respectively.

The GBTC market has been on a remarkable ascent, hitting multi-month highs and breaching the $24.7 mark for the first time since May 2022.

TradingView data shows that GBTC has surged by over 200% year-to-date, with a nearly 30% increase in the past 30 days.

READ MORE:Cryptocurrency Lawyer John Deaton Questions Lightning Network’s Security Amidst Growing Concerns

One possible explanation for ARK’s move is the anticipation surrounding the decision of the United States Securities and Exchange Commission (SEC) regarding Grayscale’s registration statement for a Bitcoin-based ETF.

Grayscale filed this new BTC ETF registration statement with the SEC on October 19, shortly after ARK amended its own spot Bitcoin ETF filing on October 11.

Bitcoin advocate Samson Mow suggested that ARK’s GBTC sale aligns with the diminishing GBTC discount and their pending ETF filing.

Speculation has also arisen among online traders, suggesting that if ARK’s spot Bitcoin ETF gets approved, the firm might prioritize it as the primary holding in ARKW, potentially leading to the disposal of GBTC shares.

While ARK has not yet responded to requests for comment, the investment firm has also divested itself of 32,158 Coinbase shares from ARKW and 10,455 Coinbase shares from its ARK Fintech Innovation fund, totaling $3.4 million.

On a different note, ARK has increased its stake in Robinhood shares, adding 32,158 shares valued at $300,000 to ARKW’s portfolio on October 23.

Other Stories:

Ripple’s Legal Victory: Slim Odds for SEC’s Appeal in Ongoing Lawsuit

Fight Me: Triumphia Origins NFTs mint out in under 2 minutes ahead of the Fight Me game launch

Uniswap Founder Burns 99% of HAY Token Supply, Shaking Crypto Markets