Spain’s primary securities market regulator, the National Stock Market Commission (CNMV), has taken a firm stance against fraudulent cryptocurrency asset promotions on social media, specifically on X (formerly known as Twitter).

In a recent speech delivered at the annual Deloitte conference for the Spanish financial sector in Madrid on November 8, CNMV’s head, Rodrigo Valbuena, highlighted the misuse of Spanish actors’ images and the identity of a national media outlet by these fraudulent advertisements.

These deceptive promotions aim to deceive investors into providing personal data and money.

Valbuena emphasized the importance of internet companies, media organizations, and social networks in adhering to Spanish laws that regulate investment promotions by unlicensed entities.

He warned of potential sanctions for noncompliance and pledged the CNMV’s commitment to addressing these issues rigorously.

He stated, “I can assure you that we will scrupulously exercise all our capacities, supervisory powers, and our supervisory and sanctioning powers in these cases.”

Additionally, the CNMV announced plans to bolster its resources by expanding its staff by 15% as part of preparations for new regulatory responsibilities.

Furthermore, on November 8, the CNMV initiated its first case against a technology provider, Miolos, for violating cryptocurrency promotion rules in Spain.

READ MORE: Solana Surges 40% in a Week to Reach New 2023 High of $58

Miolos allegedly conducted two extensive advertising campaigns in September and November 2022 without including risk warnings or obtaining authorization from the CNMV.

The regulator has initiated “sanctioning proceedings” against the company for these violations.

In a broader context, Spain is taking proactive steps in the cryptocurrency regulatory landscape.

The country has expressed its intention to adopt the Markets in Crypto-Assets Regulation (MiCA), which is the European Union’s first comprehensive crypto framework.

Spain aims to implement MiCA ahead of the EU’s July 2026 deadline, demonstrating its commitment to providing legal certainty and investor protection in the evolving crypto market.

In summary, the CNMV is cracking down on fraudulent cryptocurrency promotions on social media platforms, urging compliance with local laws, and preparing for expanded regulatory responsibilities.

Spain’s proactive approach to crypto regulation aligns with its goal of early adoption of EU-wide standards to ensure a secure and transparent crypto market for investors.

Bitcoin is poised to experience a surge in institutional investments as anticipation mounts for the approval of a United States exchange-traded fund (ETF).

Dan Tapiero, the founder and CEO of 10T Holdings, has joined the ranks of Bitcoin bulls who believe that institutional adoption is on the horizon.

As the excitement surrounding the potential approval of a U.S. Bitcoin spot price ETF continues to grow, the price of BTC has responded with enthusiasm. BTC/USD reached its highest level in 18 months.

Simultaneously, institutional interest is showing signs of a significant shift. Open interest in CME Group’s Bitcoin futures markets, a traditional institutional platform for BTC derivatives, has surpassed that of Binance for the first time.

For Tapiero, this development marks a pivotal moment. He stated on November 10th, “Now begins the renewed drumbeat of ‘institutional adoption’ of Bitcoin, driven by real facts rather than hope.

As CME BTC futures open interest surpasses Binance in the #1 spot, a torrent of capital from the traditional financial world is about to enter.”

READ MORE: SEBA Bank Receives License from Hong Kong Regulator to Offer Crypto Services in Asia Pacific

Aggregate Bitcoin futures open interest reached over $17 billion on November 9th, marking a seven-month high. As of the current moment, it stands at around $15.5 billion.

The optimism surrounding the ETF approval, expected in early 2024 but potentially sooner, is widely shared in the market.

QCP Capital, a trading firm, highlighted the potential impact of a spot ETF for Ether in its latest market update, suggesting it could further boost the crypto market.

However, amidst this overall bullish sentiment, QCP cautioned that Bitcoin’s daily relative strength index (RSI) has been forming lower highs, signaling a potential cooling-off period from recent highs.

They emphasized the importance of caution as BTC faces crucial resistance levels and a triple bear divergence with the RSI, which historically indicates a slowdown in momentum.

At the time of writing, BTC/USD was trading near $36,500, while ETH/USD had surpassed the $2,000 mark with a daily gain of over 4%.

As institutional interest continues to grow, the crypto market remains on edge, eagerly awaiting the potential approval of a U.S. Bitcoin spot price ETF and the subsequent influx of capital from traditional finance.

Bitcoin’s future price trajectory is coming under scrutiny as it continues its bullish cycle, with a classic on-chain indicator suggesting that it might be a good time to sell when the cryptocurrency reaches at least $110,000.

According to data from the on-chain analytics platform Look Into Bitcoin, the “Terminal Price” of Bitcoin is hinting at a potential six-figure peak.

This Terminal Price is seen as a straightforward method for estimating the long-term peak price of Bitcoin.

To calculate the Terminal Price, one looks at Bitcoin’s “Transferred Price,” which is determined by dividing “Coin Days Destroyed” (CDD) by the existing supply of Bitcoin.

CDD is a popular metric used to measure the number of dormant days reset each time a certain amount of BTC is moved on-chain. It provides insights into hodler intent and activity in the market.

The Terminal Price, created by Checkmate, the lead on-chain analyst at data firm Glassnode, becomes relevant at the peak of each Bitcoin price cycle.

While not every all-time high reaches the Terminal Price, Bitcoin did touch the trendline during its 2017 all-time high and again during its initial peak in April 2021.

The most recent all-time high of $69,000 in November of that year fell short of the Terminal Price.

Philip Swift, the creator of Look Into Bitcoin, suggests that selling “near” the Terminal Price could be a prudent strategy.

READ MORE: SafeMoon CEO’s Bail Release on Hold Amid Flight Risk Concerns

Additionally, there’s a bear market counterpart known as the “Balanced Price,” which signals useful market bottoms.

As time passes, the Terminal Price tends to increase, suggesting that $110,000 might actually be a conservative target if the next all-time high occurs later in the upcoming cycle.

Swift also brings attention to the “Pi Cycle Top” indicator in his analysis. This indicator uses two moving averages for forecasting and has a track record of reliably predicting long-term price highs, albeit with just a few days’ notice.

It managed to accurately identify the top of the previous Bitcoin cycle, leaving many, including Swift himself, surprised. The question remains whether it will once again pinpoint the top of the current cycle.

With Bitcoin’s price action reaching new heights and these on-chain indicators in play, the cryptocurrency market is abuzz with predictions and strategies for the future.

The potential for Bitcoin to reach six figures in the next cycle is certainly on the radar of many forecasters and investors.

The recent surge in transaction fees on both the Ethereum and Bitcoin networks has reignited discussions surrounding scalability solutions and the role of layer 2 solutions.

Over the past 24 hours, cryptocurrency enthusiasts have shared screenshots depicting skyrocketing transaction fees on Ethereum and Bitcoin.

Some screenshots displayed gas fees as high as $220 for high-priority Ethereum transactions, while others hovered around the $100 mark.

On the Bitcoin side, users reported fees of approximately $10 for high-priority transactions.

This, though relatively low, represents a significant increase compared to the average Bitcoin transaction cost of around $1 over the past three months, as reported by BitInfoCharts.

These fees on Bitcoin haven’t been this high since May.

At the time of writing, conducting a $300 transfer on the decentralized exchange Uniswap using an Ethereum hot wallet incurs a network cost of $45.65, according to a test transaction by Cointelegraph.

The surge in gas fees has led proponents of blockchains like Solana to highlight the cost-effectiveness of transactions on their networks.

Solana, for instance, charges only $55-60 per minute for all users, contrasting starkly with Ethereum’s high fees.

In response to this fee surge, some have questioned how these high fees benefit lower-income individuals and the unbanked population.

READ MORE: Robinhood Announces European Expansion Amid Cryptocurrency Challenges

The impact on such users during times of network congestion and high fees can be detrimental.

Before the recent fee surge, Ethereum transaction costs averaged $11.35 on November 8, according to BitInfoCharts.

Just a few weeks earlier, on October 14, fees had dropped to as low as $1.40, marking the lowest point in 2023.

Notably, gas fees on Ethereum had previously peaked at $196 on May 1, 2022, with fees consistently above $20 between August 2021 and February 2022.

Bitcoin and Ethereum developers have chosen to prioritize decentralization and security at the base layer, opting to offload much of the execution environment to layer 2 solutions to reduce transaction costs.

Bitcoin utilizes the Lightning Network for scaling, while Ethereum has various layer 2 solutions like Arbitrum, Optimism, and Polygon to enhance speed and affordability.

However, opinions diverge on whether layer 2 solutions are the ideal approach to tackle scalability.

Justin Bons, founder of cryptocurrency investment firm Cyber Capital, advocates for monolithic blockchain architectures in which consensus, data availability, and transaction execution all occur on the base layer, citing Solana as an example.

Bitcoin and Ethereum, in contrast, employ modular blockchain designs by offloading certain transactions to a second layer.

Critics of Solana have highlighted network congestion-related outages, arguing that a modular blockchain design offers a more effective scalability solution.

The debate continues as blockchain ecosystems explore ways to address the pressing issue of high transaction fees.

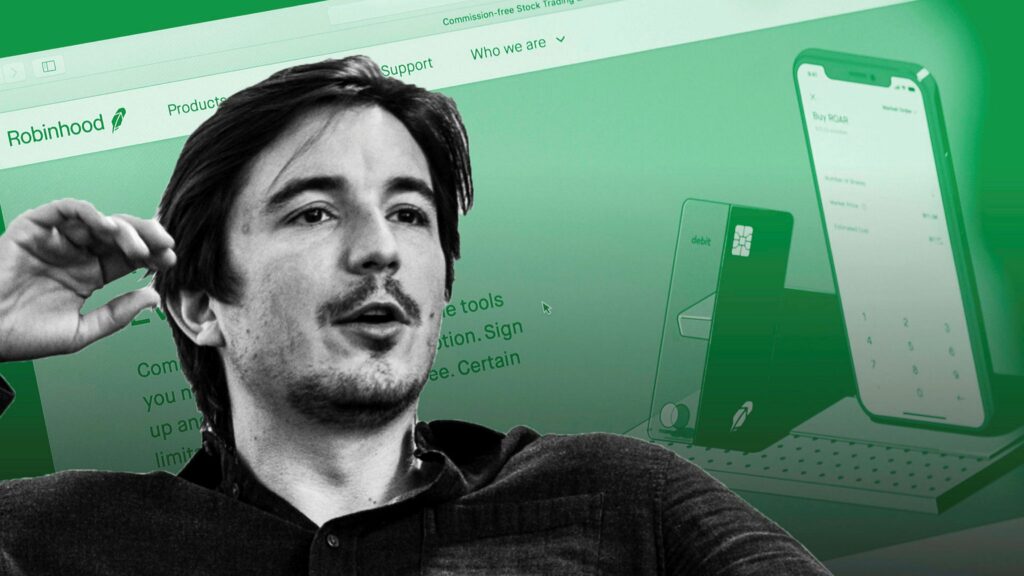

Robinhood, the popular commission-free trading platform, has unveiled its plans to expand into Europe in the near future, with a focus on establishing brokerage operations in the United Kingdom.

This announcement was made on November 7th, coinciding with the release of the company’s third-quarter financial results, which revealed a revenue miss.

The decline in transaction-based revenue was attributed to reduced cryptocurrency trading volumes on the platform.

In the third quarter, Robinhood reported a net revenue of $467 million, slightly below the average analyst estimate of $478.9 million.

Despite this, the company still achieved a substantial 29% year-on-year growth compared to the same period last year.

Transaction-based revenues saw an 11% decrease, amounting to $185 million, primarily due to a significant 55% drop in cryptocurrency notional volumes over the past year, as stated in Robinhood’s Tuesday announcement.

Interestingly, despite the decline in cryptocurrency trading activity, Robinhood has ambitious plans for its crypto services.

READ MORE: US Lawmaker Proposes Cutting SEC Chair’s Salary to $1

The company recently revealed its intentions to expand its services to the state of Nevada and added support for the meme cryptocurrency Shiba Inu just last month.

When questioned about the expansion into the European Union, Cointelegraph attempted to reach out to Robinhood for more details but has yet to receive a response.

This expansion move comes at a time when some cryptocurrency firms have suspended serving U.K. customers due to new regulations that require crypto firms to provide clear risk labels and implement system changes, which took effect on October 8th.

It’s worth noting that back in June, Robinhood ceased support for cryptocurrencies that were involved in lawsuits with the United States Securities and Exchange Commission, including those related to Binance and Coinbase.

These included assets like Cardano, Polygon, and Solana. Presently, Robinhood offers trading support for 15 different cryptocurrencies, including popular ones like Bitcoin, Ether, Dogecoin, and Avalanche.

Robinhood’s decision to expand into Europe demonstrates its commitment to further globalize its platform and services, despite challenges in the cryptocurrency market and regulatory changes in different regions.

By venturing into the U.K. and potentially other European markets, Robinhood aims to continue its growth and offer its user-friendly trading platform to a broader international audience while adhering to regulatory standards.

The Central Bank of the United Arab Emirates (CBUAE), in conjunction with other regulatory bodies in the nation, has recently unveiled fresh, collaborative guidelines for virtual asset service providers (VASPs) operating within the UAE.

These comprehensive guidelines are aimed at curtailing the activities of unlicensed VASPs and outline penalties for those found operating without the necessary licenses.

On November 6, the National Anti-Money Laundering and Combating Financing of Terrorism and Financing of Illegal Organizations Committee (NAMLCFTC) and the CBUAE jointly released a list of “Red Flags” for VASPs.

This list includes indicators such as the absence of a regulatory license, making unrealistic promises, poor communication, and a lack of regulatory disclosures, all of which can help identify suspicious entities.

Under the new guidance, supervisory authorities expect all licensed financial institutions (LFIs), designated non-financial businesses and professions (DNFBPs), and licensed VASPs to promptly report transactions involving suspicious parties.

The guidance emphasizes the importance of reporting any information related to unlicensed virtual asset activities through whistleblowing mechanisms, aiding regulatory authorities in their efforts to enforce the law and safeguard the UAE’s financial system.

Furthermore, the central bank’s document highlights that VASPs operating in the UAE without a valid license will face severe consequences, including civil and criminal penalties, along with financial sanctions targeting the entity, its owners, and senior managers.

READ MORE: US Lawmaker Proposes Cutting SEC Chair’s Salary to $1

Additionally, LFIs, DNFBPs, and licensed VASPs that engage with unlicensed VASPs will also face legal actions.

In a press release, His Excellency Khaled Mohamed Balama, the Governor of the CBUAE and Chairman of the NAMLCFTC, emphasized the timeliness of these guidelines, given the increasing accessibility of digital assets. He noted that as the digital economy evolves, their efforts to combat financial crimes intensify, ensuring the integrity of the UAE’s financial system.

Commenting on these developments, UAE lawyer Irina Heaver observed that these guidelines are part of a broader initiative by the UAE to remove itself from the Financial Action Task Force’s (FATF) “grey list.”

The grey list indicates that a country has deficiencies in its Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) frameworks but is committed to addressing these issues within specified timeframes.

In March 2022, the UAE was placed on the FATF’s grey list, subjecting it to increased scrutiny due to AML and CTF deficiencies.

However, the UAE made a high-level commitment to collaborate with the FATF to bolster its AML and CTF regimes. Heaver noted that significant reforms have been implemented since the country’s inclusion on the grey list in 2022.

With ongoing updates to its regulatory frameworks, the UAE stands a chance to exit the grey list during the next FATF review, expected in April or May 2024, provided it continues to demonstrate consistent compliance with international standards.

On November 7th, Bitcoin experienced a dip, falling toward the $34,500 mark, catching the attention of analysts who were closely monitoring the growing open interest (OI) in the cryptocurrency markets.

Data from Cointelegraph Markets Pro and TradingView revealed that Bitcoin was struggling to regain the $35,000 support level.

Amidst the uncertainty in the market, there was a consensus among market participants that volatility was poised to make a return.

The main driver behind this anticipation was the significant surge in open interest within the derivatives markets.

On November 7th, financial commentator Tedtalksmacro noted that almost 10,000 BTC, equivalent to approximately $350 million USD, had been added to the open interest that day, suggesting that fireworks could be on the horizon.

This increase in open interest has historically coincided with periods of heightened volatility in recent months.

At the time of writing, the total open interest had reached nearly $15.5 billion, as reported by CoinGlass. James Van Straten, a research and data analyst at CryptoSlate, highlighted that both the CME exchange, favored by institutional investors, and Binance had recorded substantial open interest figures, with CME setting a new record of 105,380 BTC contracts open, valued at $3.68 billion.

READ MORE: Bitcoin Mining Firm Luxor Technology to Launch Innovative Hash Rate-Backed Investment Product

Van Straten indicated that this trend might signify growing participation in Bitcoin futures, implying either a positive shift in market sentiment or a move by investors towards protective strategies.

J. A. Maartunn, a contributor to the on-chain analytics platform CryptoQuant, voiced concerns over the uncertainty surrounding the impact of increasing open interest.

He pointed out that historically, when this metric surpassed $12.2 billion, it often led to a minimum 20% decline in Bitcoin’s price, warranting significant attention.

Popular trader Skew highlighted the significance of current price levels on shorter timeframes, emphasizing that being on the wrong side of the market direction could lead to challenges and potentially trigger a volatile price reaction.

Looking ahead, the monitoring resource Material Indicators concluded that $36,000 would likely remain a formidable resistance level in the near term.

While it didn’t rule out the possibility of Bitcoin surpassing $36,000 later in the year, the analysis suggested that, at least for the current week, breaching that threshold might be challenging.

It also noted that failure to validate a bullish breakout in the near future could make the previous range low of $25,000 to $28,500 a critical level to watch.

The London Stock Exchange Group (LSEG), the parent company overseeing the operations of the renowned London Stock Exchange and various fintech entities, has recently posted a job vacancy on LinkedIn.

They are actively seeking a qualified individual to fill the role of a director of digital assets within their organization.

LSEG’s recruitment initiative emphasizes the importance of finding a candidate who possesses a deep passion for and understanding of digital assets, cryptocurrencies, and distributed ledger technology. These qualifications are among the key skills and requirements sought after for this pivotal role.

According to the job posting, the selected individual will play a crucial role in shaping LSEG’s future approach to digital assets.

Their responsibilities will include formulating and executing a commercial strategy for a comprehensive set of new infrastructure solutions and capabilities.

Additionally, they will be tasked with nurturing and expanding LSEG’s brand and ecosystem within the domain of digital private markets.

Despite the eagerness to bring a digital asset manager on board, LSEG has chosen to remain tight-lipped about further details surrounding this development, leaving the crypto community eager for more insights.

READ MORE: Prominent Cryptocurrency Attorney Predicts Favorable Outcome for Ripple in SEC Lawsuit

This announcement follows the London Stock Exchange’s earlier declaration of its intention to leverage blockchain technology for the creation of a platform dedicated to trading traditional assets.

In their announcement dated September 4th, the financial institution expressed its commitment to utilizing blockchain to enhance the efficiency of traditional asset management, from holding to buying and selling.

However, it is important to note that LSE Group’s head of capital markets, Murray Roos, clarified that their focus on blockchain technology would not extend to the realm of cryptocurrencies, thereby distinguishing their approach from some other financial institutions.

The United Kingdom has recently intensified its efforts to regulate the local cryptocurrency landscape.

This includes the passage of legislation that grants authorities the power to confiscate Bitcoin associated with criminal activities.

Additionally, the UK government has signaled its intention to introduce regulations pertaining to stablecoins in October.

In September, the UK’s financial watchdog issued a compliance warning to crypto companies, providing them with a deadline of January 2024 to align their marketing practices with established standards.

These developments underscore the evolving regulatory landscape surrounding digital assets in the UK.

Renowned cryptocurrency lawyer John Deaton has shared his perspective on the ongoing lawsuit between the United States Securities and Exchange Commission (SEC) and Ripple, suggesting that a settlement amount of $20 million or less would represent a significant legal victory for Ripple.

In a recent post on a social media platform, Deaton firmly dismissed the notion that the lawsuit’s outcome is evenly balanced, instead asserting that it tilts heavily in favor of Ripple, with an approximate 90/10 advantage.

Deaton’s comments were prompted by a post from Stuart Alderoty, Ripple’s Chief Legal Officer, who highlighted another legal setback for the SEC.

Deaton’s viewpoint aligns with the sentiment prevailing in the cryptocurrency community, where many see the proposed $20 million settlement as a favorable resolution for Ripple.

This assessment takes into account the potential ramifications of the XRP lawsuit and the broader regulatory landscape surrounding digital currencies.

Stuart Alderoty’s post further contributes to this narrative by pointing out yet another setback for the SEC. In the SEC vs.

READ MORE: Bitcoin Bulls Push for $35,000 as Weekend Markets Show Strength

Govil case, the U.S. Court of Appeals for the Second Circuit ruled that the SEC cannot demand a substantial disgorgement award without first demonstrating actual financial harm to investors.

Essentially, this implies that in the absence of harm, there should be no penalty imposed.

The SEC initiated legal action against Ripple Labs in December 2020, alleging that the company conducted an unregistered securities offering by selling its native cryptocurrency, XRP.

The case took a significant turn when Judge Analisa Torres ruled that XRP was not a security when traded on the secondary market. Additionally, charges against Ripple executives were reduced during the course of the lawsuit.

Meanwhile, Judge Torres has recently approved an order regarding a joint request from the SEC and Ripple to propose a briefing schedule to address institutional sales of XRP.

This pertains to the portion of the XRP lawsuit where the company was found to have violated securities laws.

Judge Torres has instructed both parties to submit a joint briefing schedule no later than November 9th, indicating ongoing developments in this high-profile legal battle.

The United States Supreme Court is currently addressing a critical legal dispute involving cryptocurrency exchange Coinbase and its users.

The core issue at hand revolves around a procedural matter: determining whether a judge or an arbitrator should have the authority to decide which contractual agreement governs disputes between Coinbase and its clients.

The source of this dispute arises from conflicting agreements that Coinbase has with its users. One agreement advocates for dispute resolution through arbitration, while another supports traditional courtroom litigation.

The complexity emerged when Coinbase introduced a sweepstakes agreement directing dispute resolution to California courts, which clashed with the previously established arbitration clauses.

The genesis of this legal tussle can be traced back to allegations of deceptive advertising, which prompted customers to initiate a class-action lawsuit against Coinbase, challenging the company’s customary arbitration process.

In response, Coinbase sought to have the dispute moved to arbitration, but it faced resistance in the lower courts.

A federal judge in California, supported by the U.S. Court of Appeals for the Ninth Circuit, upheld the sweepstakes agreement’s preference for courtroom resolution.

Consequently, Coinbase’s request to transfer the dispute to arbitration was denied.

READ MORE:Marathon Digital Pioneers Green Bitcoin Mining with Landfill Methane Power

This judicial reluctance contrasts with a recent Supreme Court decision that narrowly favored Coinbase in a related matter.

In that case, the court ruled 5-4 in favor of allowing Coinbase to pause customer lawsuits while it sought to move disputes into arbitration.

Throughout this legal battle, Coinbase has continued to expand its services, introducing new trading options for its users.

Notably, eligible retail customers now have the opportunity to engage in cryptocurrency futures trading, with contracts that are more accessible and represent a fraction of the value of Bitcoin and Ether.

The Supreme Court’s decision to take up this case signifies a significant development for companies employing arbitration clauses in their user agreements.

It underscores the court’s ongoing role in shaping the boundaries between arbitration and traditional legal proceedings.

The ultimate verdict is expected to have a substantial impact on the formulation and enforcement of user agreements, especially in the dynamic realm of digital currency trading.

This case could set a precedent for similar disputes in the future, making it a matter of great importance for the cryptocurrency industry and beyond.