Former FTX chief executive Sam Bankman-Fried has proposed new bail conditions, the United States Department of Justice (US DoJ) said in a 3 March court filing.

US district court judge for the Southern District of New York, Lewis Kaplan, said in his proposal to block Bankman-Fried from access to tablets, smartphones, computers, video game platforms, and chat or voice communication devices.

The disgraced executive will only have access to “a flip phone or other non-smartphone with either no internet capabilities or internet capabilities disabled.“

Further documents have called for the new conditions to remain after Bankman-Fried’s defence team negotiated the new terms via a proposal on 3 March.

The teams also proposed temporary restrictions such as ending contact or communications with ongoing or previous FTX and Alameda Research employees. Exceptions to the restrictions include communications in the presence of counsel.

Furthermore, Bankman-Fried cannot use encrypted or disappearing messages, virtual private networks, and other services.

—

BREAKING

New court filing shows FTX owes customers $1.6Billion of #Bitcoin but only has $1 Million on the books.

0.06% of what they should have

They took investors money and just put numbers in their account & never purchased the crypto.

Not Your Keys Not Your Coins. pic.twitter.com/BRGlp6z5uiG-MAN

(@GavinClimie) March 3, 2023

Sanctioned websites for browsing have been limited to Wikipedia, YouTube, Etherscan, DoorDash, Netflix, NFL, and government websites, among others. Authorities will also monitor his communications with security software.

The proposal adds: “The defendant will not object to the installation of court-authorized pen registers on his phone number, Gmail account, and internet service. Those pen register orders will be sought by the Government and maintained by the Federal Bureau of Investigation.“

The news comes after the ex-CEO received a $250 million USD bail after Bahamian authorities detained him and extradited him to New York courts. To date, he faces 12 charges such as wire fraud, conspiracy to commit wire fraud, and others related to political donations.

Silvergate Capital Corp has stated it would cease crypto payments on its exchange network, Reuters revealed on Friday. The news comes just two days after reports surfaced over its financial standing.

It said in a statement: “Effective immediately Silvergate Bank has made a risk-based decision to discontinue the Silvergate Exchange Network (SEN). All other deposit-related services remain operational.”

The developments triggered a two percent decline in the company’s shares, which closed at 0.9 percent, or 5.77 percent and a 97 percent decline from November 2021.

The news as Silvergate allowed investors and cryptocurrency platforms to perform rapid transfers compared to bank transfers.

It said in a filing it would reassess its operations amid the concerns. The company explained that it had sold further debut securities and would become “less than well capitalized.”

Cryptocurrency firms such as Galaxy Digital, Coinbase Global, Gemini, and Bitstamp, among others, have also cut their banking partnerships with the embattled bank.

Many of Silvergate’s troubles began after reported ties to now-defunct cryptocurrency platform FTX. Silvergate allegedly facilitated illegal banking transactions for FTX and Alameda Research transactions just days before the latter cryptocurrency exchange filed for Chapter 11 bankruptcy.

US Bankruptcy Judge Michael Wiles has voiced criticism over the US Securities and Exchange Commission’s crackdown on Binance.US’s attempted buyout of Voyager Digital.

At a court hearing on Thursday, the US regulator ruled it would not sanction Binance.US’s $1.02 billion USD Voyager Digital deal as the latter’s native token may constitute as an unregistered security.

He told the SEC in a statement: “You come here and tell me […] that I should stop everybody in their tracks because you might have an issue. It’s kind of a weird objection.”

Wiles said in a statement at the time that he was “absolutely shocked” at the objection, citing inadequate guidance from the SEC.

He added: “I get the feeling that this objection has been made as a kind of cover, so you can say later that we’ll see we raised these issues. You haven’t really, you have done nothing … I need to know specifics.”

Conversely, SEC prosecutor William Uptegrove said creditors did not receive sufficient regulatory risk warnings. Despite stating this, he failed to specify his position on Voyager Digital’s token (VGX) security status.

Voyager counsellors told courts that the Binance.us-Voyager defal could recover 73 percent of total funds to creditors.

According to court filings, roughly 97 percent of customers have backed the deal. Despite this, the SEC and Federal Trade Commission (FTC) launched a probe against Voyager, citing market malfeasance.

The news comes as Binance faces additional investigations over alleged tie to Russian darkweb Bizlato, and its native token, Binance USD (BUSD), minted by Paxos.

SEC regulators have blocked further minting of the digital asset, citing unregulated securities, without providing further clarification.

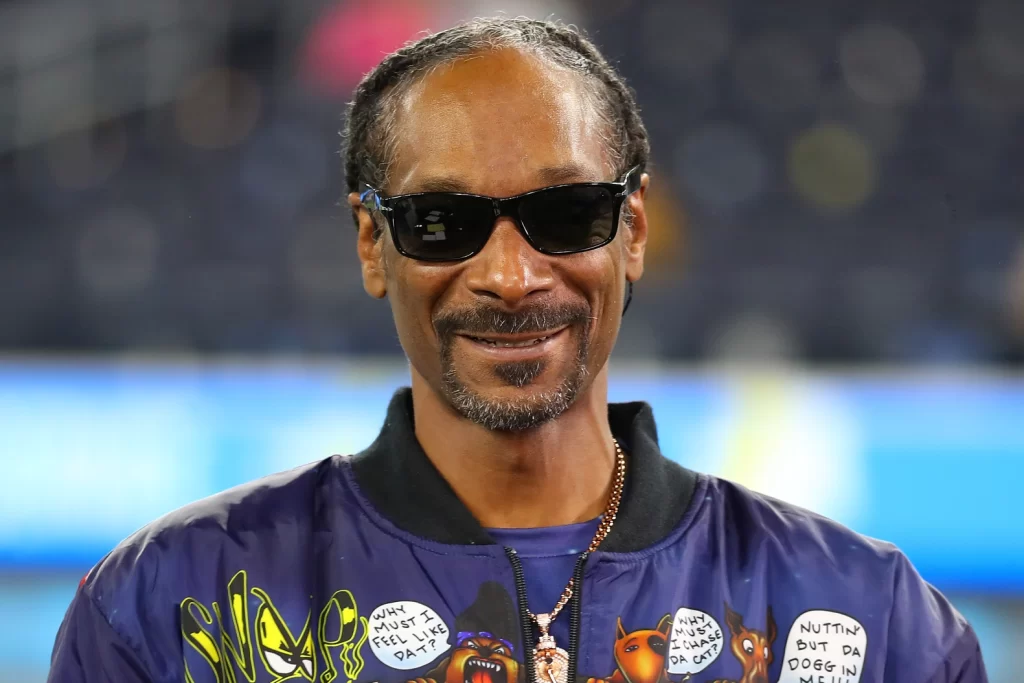

Iconic hip hop superstar and Web3 investor Snoop Dogg has teamed up with Roobet to expand the latter’s crypto casino offerings.

It launched in 2019 under Raw Entertainment BV and has facilitated more than 3 billion wagers, according to the company.

In a recent press release, Snoop Dogg said: “Turns out, I’ve been a kangaroo this entire time. These guys are doing something different. This partnership just feels natural, and we’re going to blaze a trail for the future of online entertainment.”

Be ready.

— Roobet (@Roobet) February 28, 2023

3/1

Snoop Dogg invested a massive $450,000 USD in Sandbox virtual land to create a new Metaverse space, Snoopverse.

He has also partnered with numerous Web3 startups, including Outlier Ventures, and performed the world’s first metaverse music video at the MTV Video Music Awards.

Speaking further, he added: “Roobet took amazing care of me even before they knew who I was, bringing the ultimate player experience, and I been sayin’ Roooooo ever since. We share the love of doing new things, and we care about our fans—so we’re gonna change the game and do it better than it’s ever been done.”

Celebrate @SnoopDogg x Roobet by changing your profile picture to one of the 2 graphics below for your chance to win some

— Roobet (@Roobet) March 1, 2023

We’ll randomly be choosing people who are using our profile pictures and interacting with our content to win up to $1,000 throughout the entire monthx

pic.twitter.com/yNDAHalOkX

Roobet will tap Snoop Dogg’s massive global fanbase for events, giveaways, and other virtual events. He will also host several meet and greets with fans on the virtual stage.

Ongoing investigations against crypto platform Coinbase have forced it to end its partnership with Silvergate Bank, it announced on Thursday.

In a tweet, it said: “In light of recent developments & out of an abundance of caution, Coinbase is no longer accepting or initiating payments to or from Silvergate.“

At Coinbase all client funds continue to be safe, accessible & available.

— Coinbase (@coinbase) March 2, 2023

In light of recent developments & out of an abundance of caution, Coinbase is no longer accepting or initiating payments to or from Silvergate.

Coinbase also stated it would facilitate institutional client cash transactions with banking partners. It had also taken proactive action to “help ensure that clients experience no impact” from the measures.

Coinbases primary banking partner is now Signature Bank.

According to Coinbase: “The vast majority of Coinbase client cash is stored in FDIC-insured bank accounts. When a client has a large dollar balance, Coinbase stores their cash in a U.S. government money market fund to keep it safe and liquid.”

It added: “[We] hold client cash 1:1 and your assets are your assets. We do not lend or take any action with your assets unless you specifically instruct us to.”

Silvergate-FTX Ties

The insolvent bank’s stocks plummeted an additional 40 percent in premarket trading, reports revealed. JP Morgan also downgraded the bank from “underweight” to “neutral.”

The bank also failed to file its 10-K report in a timely manner and has requested an additional two weeks to complete it. Authorities such as the US Securities and Exchange Commission require the document to assess a company’s financial standing.

The news comese after the bank after now-defunct cryptocurrency platform FTX collapsed on 11 November and filed for Chapter 11 bankruptcy.

Its toubles intensified after the US Department of Justice (US DoJ) launched investigations due to Silvergate’s ties to FTX, primarily linked to disgraced former chief executive Sam Bankman-Fried, who owned an account with the institution.

Silvergate and its CEO Alan Lane currently face a class-action lawsuit in California courts. Authorities aim to penalise the bank for allegedly facilitating illegal money deposits amid a massive bank run, triggered by FTX’s huge liquidity crunch last year.

The Ethereum Foundation’s ERC-4337 account abstraction standard has been published in an audited version on the organisation’s website.

The standard’s EntryPoint smart contract aims to change relationships between users and wallet services. Externally-owned accounts (EOAs) comprise the majority of Ethereum wallets, which include platforms like MetaMask and others.

These are just a few of the things you can do with ERC-4337.

— John Rising (@johnrising_) February 25, 2023

Check out https://t.co/NoIUDoZa8V for more. pic.twitter.com/KFvEboygfL

Under the ERC-4337 standard, Ethereum users can operate on a standard for on-chain transactions. It will also implement a mempool for user operations and to safeguard key backups for wallets with social recovery.

Bundlers service mempools accounts function levels. This submits operations to mempools rather submitting transactions. Bundlers will then move the user operation from the mempool and include it on Ethereum blocks. They also work on other Ethereum Virtual Machine chains.

According to the original ERC-4337 Account Abstraction published in late September 2021, it aims to “allow users to use smart contract wallets containing arbitrary verification logic instead of EOAs as their primary account.” This will remove the need for EOAs.

It also will not require Ethereum consensus changes. Its consensus layer development will focus on the merge and scalability features of the protocol. It will avoid Ethereum consensus changes to expedite the rate of Ethereum adoption.

The Reserve Bank of Australia announced on 2 March that it will launch a pilot of its central bank digital currency (CBDC) “in the coming months.”

In a joint statement, the institution and the Digital Finance CRC (DFCRC) announced their collaboration to “explore potential use cases and economic benefits of a [CBDC] in Australia.”

For the project’s initial stages, it would select several industry leaders to join research efforts to build use cases for CBDCs and their potential benefits.

Both institutions will pilot CBDCs for offline payments, automating taxes, and for “trusted Web3 commerce.” Banks, including the Commonwealth Bank and the Australian and New Zealand (ANZ) bank, will also facilitate transactions via Mastercard.

Brad Jones, Assistant Governor of Financial Systems at the Reserve Bank of Australia, said his institution was “delighted” with the industry’s “enthusiastic engagement” in the research project.

Continuing, he said,

“It has also been encouraging that the use case providers that have been invited to participate in the pilot span a wide range of entities in the Australian financial system, from smaller fintechs to large financial institutions. The pilot and broader research study that will be conducted in parallel will serve two ends – it will contribute to hands-on learning by industry, and it will add to policy makers’ understanding of how a CBDC could potentially benefit the Australian financial system and economy.”

Cryptocurrency automatic teller machines (ATMs) have plummeted in numbers since the start of the year. Fresh reports have found that the number of functioning ATMs has been slashed by 412 units.

The news comes amid an uptake of new crypto ATM machines across the world, with nearly 1,000 new units installed each month globally from December 2020 to January 2022. However, these numbers have declined significantly due to the ongoing bear market.

In September last year, crypto cashpoints nosedived, followed by record lows in January and February. January saw a drop of 289 ATM machines and an additional fall of 123 machines last month.

Other factors such as BitAccess software are competing with crypto ATM machines. This works by reducing operating costs of physical devices and software licencing fees, saving roughly $3 million USD each year.

The news comes after numerous countries began deploying ATMs nationwide, with the United States, Canada, and Spain topping the global list. The three nations have installed 33952, 2649, and 273 machines, respectively.

Despite regulatory crackdowns on cryptocurrency platforms, authorities have also begun cracking down on ATMs operating illegally. In the United Kingdom, police have tackled ATMs operating without licencing across Leeds and Yorkshire. This has also reduced the number of operational ATMs in the country as the nation pushes for central bank digital currencies (CBDCs) and regulatory frameworks.

The Prudential Regulatory Authority (PRA), Britain’s banking regulator, has proposed a framework for digital assets, officials revealed at a recent speech on Monday.

Vicky Saporta, Bank of England (BoE) executive director of the Prudential Policy Directorate, said in a speech the PRA would outline its advice in line with Basel III rules and legislation from the Financial Services and Markets (FSM).

Currently, Parliament is considering the bill after it faced a second reading in the House of Lords.

In a statement, Saporta said: “PRA rule making can deliver three things: harness the UK’s strengths as a global financial center, maintain trust in the UK as a place to do business and tailor regulations to UK circumstances.”

She added that her organisation would propose rules on “issuing and holding digital assets.”

The news comes as the BoE and PRA work jointly with other agencies to build a “regulatory grid” and succeed a “labyrinth” of rules and restrictions, with many originating in the European Union.

She said at the time,

“We’ve improved the way we communicate. The Bank and PRA now work with six other regulators to produce a regulatory grid setting out our plans in one place. And we are developing a new UK rulebook that will be easier to navigate than the labyrinth of regulations – many of them EU rules – we are replacing.

Explaining further, Saporta said,

“These are changes we could not have made whilst we were in the EU. They are a down-payment on our commitment to use our new powers to tailor rules and to make the UK a better place to operate a financial firm, without compromising on safety.”

Terms and Conditions

According to the document, the PRA will consult on the implementation of Basel 3.1 standards after finalisation. These will urge banks to limit exposure to cryptocurrencies to roughly 1 percent of total capital and a 1,250 percent risk premium.

She added: “I also believe that it is normally easier for internationally active firms to follow one global rulebook instead of having to meet the expense of adapting to a patchwork of local standards.”

The news comes as the United Kingdom aims to position itself as major cryptocurrency and tech hub for global markets.

The measures aim to overhaul current cryptocurrency regulations following the nation’s departure from the European Union in 2020. Lawmakers outlined new measures in a white paper in February on best practices for building its cryptocurrency regulatory framework.

Coinbase announced on Monday it would suspend trading of Binance USD (BUSD) after allegedly failing to meet listing standards.

The US crypto exchange platform’s measures will enter force on 13 March around 12:00 ET, it said.

A spokesperson tweeted at the time: “Trading will be suspended on http://Coinbase.com (Simple and Advanced Trade), Coinbase Pro, Coinbase Exchange, and Coinbase Prime. Your BUSD funds will remain accessible to you, and you will continue to have the ability to withdraw your funds at any time.”

News of the suspension dropped Binance’s native token BNB 1 percent, trading at $302.57 at the time of reporting.

The news comes after regulators from the Securities and Exchange Commission (SEC) targeted Paxos-minted BUSD tokens earlier in February. Binance also halted US banking transfers to its service amid the ongoing row with US regulators.