Republican governor Ron DeSantis hopes to install a blanket ban on federal central bank digital currencies (CBDCs) imposed on Florida. In a press release, DeSantis accused the Biden Administration of creating a CBDC for “surveillance and control.”

He added: “Today’s announcement will protect Florida consumers and businesses from the reckless adoption of a ‘centralized digital dollar’ which will stifle innovation and promote government-sanctioned surveillance. Florida will not side with economic central planners; we will not adopt policies that threaten personal economic freedom and security.”

No CBDC in Florida https://t.co/p9pwSTmrlN

— Ron DeSantis (@GovRonDeSantis) March 20, 2023

Jimmy Patronis, State Chief Financial Officer, added that DeSantis was “ahead of the curve” in “protecting individual rights.”

He added: “A Central Bank Digital Currency is the cornerstone of a federal government that could track each and every transaction that happens in the world. There would be no privacy, and if there is no privacy, there are no rights. In the same way Florida is fighting back against the IRS, we need to fight back against this program. It’s how we protect freedom, liberty, and prosperity.”

Furthermore, Tarren Bragdon, chief executive for the Foundation for Government Accountability, added that the proposal continued the “strong track record of [DeSantis] pushing back on an overreaching federal government.”

Explaining further, he said: “Our money says In God We Trust. The central bank digital currency changes that to In Government We Trust. That’s wrong and I am grateful for the Governor’s continued pushback of an out-of-control DC bureaucracy.”

DeSantis’ proposal called on further state governments to adopt similar legislation to tackle alleged threats from CBDCs. Roughly 18 states have proposed to fight Biden’s “ESG financial fraud,” it added.

The announcement comes amid a series of measures DeSantis has taken to “prevent the proliferation of woke ideology in the financial sector and American daily living,” the statement concluded.

New York Community Bancor subsidiary Flagstar Bancorp, NA will hold non-crypto related deposits from Signature Bank, according to a press release from the Federal Deposit Insurance Corporation (FDIC) on Sunday.

Signature Bridge Bank, the current company replacing Signature Bank, will become immediate depositors of Flagstar and receive FDIC insurance up to $250,000 USD.

The statement read: “As of December 31, 2022, the former Signature Bank had total deposits of $88.6 billion and total assets of $110.4 billion. Today’s transaction included the purchase of about $38.4 billion of Signature Bridge Bank, N.A.’s assets, including loans of $12.9 billion purchased at a discount of $2.7 billion.

It explained further: “Approximately $60 billion in loans will remain in the receivership for later disposition by the FDIC. In addition, the FDIC received equity appreciation rights in New York Community Bancorp, Inc., common stock with a potential value of up to $300 million.”

Reports added that bids submitted by Flagstar Bank did not include the $4 billion in deposits linked to Signature Bank’s digital banking wing. According to FDIC estimates, Signature Bank’s collapse will cost the Deposit Insurance Fund around $2.5 billion USD.

The news comes after Signature Bank collapsed due to a massive liquidity crunch due to its ties to the now-defunct cryptocurrency exchange FTX. New York authorities shuttered the bank, citing the need to protect investors.

Signum Digital announced on Thursday it had teamed up with the Hong Kong Securities and Futures Commission (SFC) after the latter granted it an approval-in-principle to launch its security token offering (STO).

The tokens will offer digital assets via blockchain technologies based on tangible assets. These can include artworks, real estate, private equities, and commodities.

The company, who partnered with Coinstreet and Somerley, said that doing so could also lower risks for cryptocurrencies, namely amid major market volatility.

Samsun Lee, Chief Executive of Signum Digital, said in a statement: “In today’s financial market, SMEs face many challenges in traditional fundraising channels, and professional investors also have limited options for high quality alternative investment opportunities.”

He added that Signum Digital hoped to “fill such a gap” with its CS-Pro security token offering and subscription platform.

Somerley chairman Martin Sabine added that his company believed there was “considerable pent-up demand” for professional investors to “deploy a proportion of their portfolio into digital assets.”

He continued: “The events of 2022 may have shaken their confidence in parts of the crypto world but not their belief that digital assets will play a pivotal role in the future of finance.”

His company’s new offering with Signum Digital would become a “medium risk way of participating in these future opportunities.”

Hong Kong Opens Doors to Crypto

The news comes as Hong Kong explores regulations for cryptocurrency and other digital assets, namely after the SFC published its virtual asset trading rules in February.

The Government agency is seeking expert advice on the subject to outline its cryptocurrency regulatory framework. This has attracted numerous firms to invest in Hong Kong’s growing cryptocurrency hub.

The SFC announced at the time: “Operators of virtual asset trading platforms which plan to apply for a licence, including pre-existing platforms […], should begin to review and revise their systems and controls to prepare for the new regime.

It also warned that companies failing to apply for licences “should start preparing for an orderly closure” of their operations in the finance region.

Swiss banking giant UBS Group has inked a deal to buy out Credit Suisse for roughly $3.2 billion USD on Sunday, the Financial Times reported on Sunday.

Credit Suisse’s board of directors initial billion USD offer on Saturday, according to sources speaking in the report. This led to a subsequent amendment to Switzerland’s regulatory procedures to circumvent shareholders and reveal news of the deal at the weekend.

In it, Swiss National Bank (SNB) will also provide roughly $100 billion USD in liquidity to UBS, with regulators in the United States and the European Union.

In a press release, UBS chairman Colm Kelleher said,

“This acquisition is attractive for UBS shareholders but, let us be clear, as far as Credit Suisse is concerned, this is an emergency rescue. We have structured a transaction which will preserve the value left in the business while limiting our downside exposure.”

From the @FT.

— Mohamed A. El-Erian (@elerianm) March 19, 2023

The complexities of this shotgun takeover of @CreditSuisse by @UBS go beyond the Swiss change in law.

Consider two factoids:

CS has half the assets of UBS yet, in market valuation, it is one-seventh; and

CS has major operations in each of the US, UK and Switzerland pic.twitter.com/UmDMITiqvR

He added that the acquisition would boost UBS’s “strategy of growing its capital-light businesses” and “bring benefits to clients and create long-term sustainable value” to investors.

UBS chief executive Ralph Harmers added that the acquisition would “further enhance [UBS’s] ability to serve our clients globally” with “best-in-class capabilities.

Harmes continued: “The combination supports our growth ambitions in the Americas and Asia while adding scale to our business in Europe, and we look forward to welcoming our new clients and colleagues across the world in the coming weeks.”

The rescue deal also triggered public outcry from bondholders, who later sued the bank and key executives for allegedly withholding key data on the effects of rising interest rates on investments.

The news comes amid ongoing talks between the two banks after Saudi National Bank refused to increase investments in Credit Suisse over national regulations. This sparked fears over the bank’s profitability and concerns over shareholder financing.

Further issues have surfaced over the last few weeks after the collapse of Silvergate Bank and Silicon Valley bank, sending shockwaves across the global finance industry.

Silicon Valley Bank’s branch in the United Kingdom has provided millions in bonuses for its employees hours after receiving a lifeline from HSBC, Sky News reported on Friday, citing anonymous sources.

HSBC bought the embattled bank for just one pound sterling, the banking giant announced last week.

According to the report, HSBC approved payments to SVB UK employees and executives, with teams receiving bonuses with the funds.

Last week the British arm of Silicon Valley Bank had to be bailed out by HSBC. This week the new owners have signed off £20m in bonuses to SVB's senior executives. See how it works?

— David__Osland (@David__Osland) March 18, 2023

Sources speaking to Sky News added staff provided undisclosed payments to its chief executive, Erin Platts, but funds were “modest” and between “£15 million and £20 million.”

Further sources added that the banking crisis had wiped out the values of senior executive stocks. Additional insiders revealed that the bonuses had been a “signal of HSBC’s confidence in the talent base” and aimed to “retain key staff” from SVB UK.

Ongoing Banking Collapse

The news comes amid the ongoing aftermath of the Silicon Valley Bank Group’s collapse into Chapter 11 bankruptcy in the United States. It did not receive protection for SVB Capital and SV Securities.

The US wing aims to preserve its value amid the bankruptcy proceedings, it said in a recent statement.

SVB has long provided financial backing for venture capital firms, startups, and other key investors in the emerging technologies space. Its collapse has sent ripples across the tech industry and triggered massive instability in global markets.

The Bank of England also shuttered SVB UK’s operations last week, ordering the bank to “stop making payments or accepting funds” due to its insolvency protocols.

Shareholders of SVB Financial Group also sued executives and the defunct bank for allegedly defrauding investors about interest rates. The lawsuit accuses three of the groups involved of withholding information about the knock-on effects of rising interest rates leading up to the bank runs.

Cryptocurrency could turn to shadow banks amid the ongoing banking crisis, Molly White, software engineer and crypto skeptic, said at a recent event.

At the South by Southwest (SXSW) panel in Texas, White told the audience that ongoing crises linked to Silvergate Bank and Signature Bank could potentially derail cryptocurrency firms.

She explained that there were only a “handful of US banks” supportive of cryptocurrency clients, adding: “With Signature and Silvergate both out of the picture, I think that’s going to be very impactful on the crypto industry [which] still really needs access to traditional finance and to U.S. banking rails.”

White added that without the two banks, the crypto industry would have a “tough time.”

Now for an exciting conversation at @sxsw 2023 featuring @molly0xFFF and @GerritD on the web3 and crypto bubbles. This is sure to upset some nerds here today. pic.twitter.com/gKOQoXxzNZ

— steven monacelli (@stevanzetti) March 14, 2023

“They’re either going to have to find other banks that are willing to work with them, which was already tough, and will probably only be tougher after the collapses of these banks, or they’re going to have to turn to some of the sort of shadier shadow banks,” she concluded as quoted by Cointelgraph.

The news comes after New York authorities cracked down on Signature Bank, sparking outcry over the New York Department of Financial Services’ jurisdiction.

Over the last few months, the SEC and numerous US agencies have cracked down on global cryptocurrency firms such as CoinEx, Binance, Kraken, Ripple, and KuCoin, among others.

Helium’s native token, HNT, plummeted to two-month lows after it was delisted on Binance.us, the latter announced on Monday.

The delisting is set to take place on 21 March. News of the measure plunged the token’s value 20 percent to $2 USD.

Binance.us explained in a statement it regularly reviewed digital assets to “ensure that it continues to meet the standard of excellence we expect.”

It continued: “When a digital asset no longer meets our high standards, or industry circumstances change, we conduct a more in-depth review of the affected asset and assess whether further action is necessary (i.e. delisting).”

Responding to the move, the Helium Foundation said,

“While the Helium Foundation is disappointed that Binance.US has decided to take this action in advance of the migration, we understand their position. Helium’s migration to Solana is significant, and a first for the industry – on par with Ethereum’s transition from proof-of-work to proof-of-stake.”

The news comes as Helium plans to migrate to the Solana blockchain. The Foundation added it would wrap up the transfer on schedule and launch on 27 March.

Despite this, Binance’s global exchange, Binance.com, will continue to list the exchange. Helium’s Network offers wireless hotspots organised as a decentralised grid, rather than mobile data and other connectivity services. Powered by cryptocurrencies, the infrastructure offers HNT tokens as rewards for participants in the network.

Gary Gensler, chairman of the US Securities and Exchange Commission (SEC), has restated his claim that his organisation could regulate proof-of-stake tokens under the Howey Test.

Gensler told reporters on Wednesday that such tokens could spark securities regulations as investors expected returns after purchasing tokens backed by proof-of-stake mechanisms.

He said as quoted by The Block: “Whatever they’re promoting and putting into a protocol, and locking up their tokens in a protocol, a protocol that’s often a small group of entrepreneurs and developers are developing, I would just suggest that each of these token operators … seek to come into compliance, and the same with the intermediaries”

The comments contradict statements from Rostin Behnam, Commodity Futures Trading Commission (CFTC) chairman, who revealed last week that his agency should regulate Ether (ETH) as a commodity rather than a security.

Gensler, the SEC, and other US regulators have launched an industry-wide crackdown on cryptocurrencies in recent months, including Paxos, Ripple, CoinEx, and Kraken.

The news comes after New York Attorney General Leticia James sued crypto exchange platform KuCoin, where she alleged the latter had sold unregistered US securities in New York.

Silicon Valley Bank Financial Group has officially filed for Chapter 11 bankruptcy in the United States, the company revealed in a press release on Friday.

The embattled bank filed its voluntary petition hoping to conserve its assets, but will not include SVB Capital or SVB Securities in its bankruptcy filings.

SVB Financial Group also aims to explore strategic alternatives for its subsidiaries, adding it will no longer affiliate with Silicon Valley Bank NA or SVB Private, its private banking and wealth management operations.

The Federal Deposit Insurance Corporation (FDIC) supervises operations for Silicon Valley Bridge Bank NA.

Just in: Silicon Valley Bank parent company files for bankruptcy!

— House of Chimera (@HouseofChimera) March 17, 2023

🔹SVB Financial group has filed for bankruptcy today.

🔸The company believed it had approximately 2.2$B in liquidity, while it had about 3.3$B in debt.

Currently, SVB Group holds roughly $2.2 billion in liquidity, which includes interests, cash, and other “valuable investment securities accounts and other assets.”

However, according to figures, SVB Group has $3.3 billion in aggregate principal amount of unsecured notes, which do not affect SVB Capital or SVB Securities.

William Kosturos, SVB Group’s chief restructuring officer, said in a statement: “The Chapter 11 process will allow SVB Financial Group to preserve value as it evaluates strategic alternatives for its prized businesses and assets, especially SVB Capital and SVB Securities.”

SVB, Silvergate Fallout

The news comes as the ongoing collapse of SVB, Silvergate Bank, and now-defunct cryptocurrency platform FTX has sent shockwaves across the cryptocurrency community. News of the most recent collapse has severely limited financing options for firms aiming to invest in Web3 technologies.

HSBC Bank purchased SVB’s British wing on Wednesday for just £1, allowing it to operate the former’s business dealings with key tech firms and small and medium enterprises (SMEs) in the United Kingdom.

Silvergate Bank also collapsed earlier in the month after authorities found it had facilitated payments for FTX and Alameda Research, the latter’s subsidiary.

News of the bank’s dealings with FTX forced numerous partners such as Paxos, Galaxy Digital, BitStamp, Coinbase, and Gemini to sever ties to the institution.

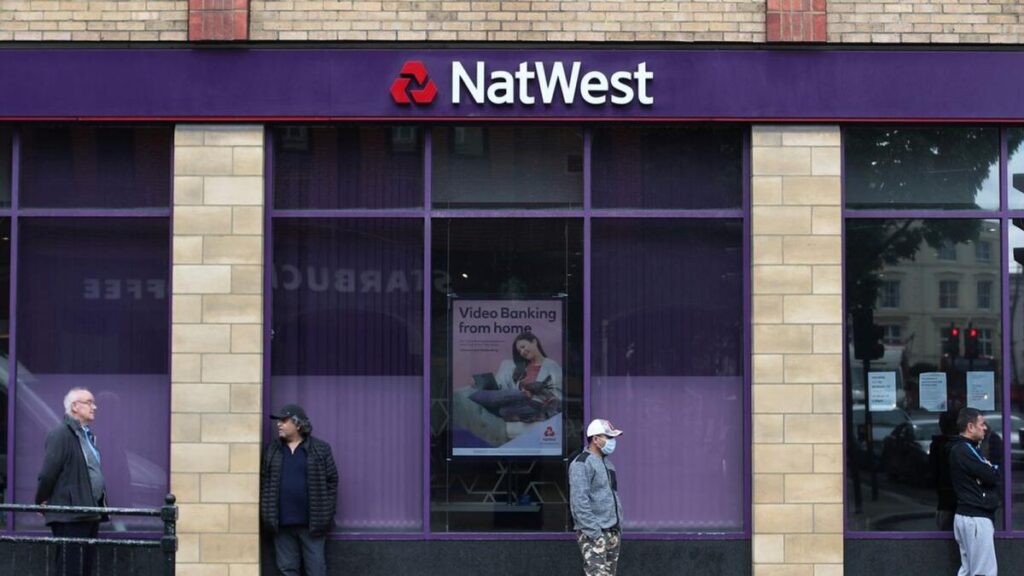

British bank NatWest launched measures this week to limit cryptocurrency exchange transfers, citing fears of “crypto-criminals” and online scams.

The London-based retail and commercial bank said in a press release it had begun capping transfers at £1,000 a day and £5,000 a month. The bank’s fraud protection chief, Stuart Skinner, added NatWest had monitored a rise in cryptocurrency-linked scams totalling £329 million in 2022.

He said at the time: “You should always have sole control of your cryptocurrency wallet and nobody else should have access. If you didn’t set the wallet up yourself or can’t access the money then this is likely to be a scam. We have seen an increase in the number of scams using cryptocurrency exchanges and we are acting to protect our customers.”

The news comes after the banking institution limited cryptocurrency transfers in 2021 based on assessments of crypto exchanges.

Some people on Twitter slammed the move as restrictive and having “nothing to do with scams.”

Nothing to do with scams.

— Mike Cosgrove (@mikecosgrove) March 14, 2023

A bank has no right to limit how much a person can transfer.

Someone could ring NatWest saying;

“I want to transfer all of my money to Barclays Bank so i can buy crypto. You fu*kers don’t own my money”

NatWest can’t do NOTHING. https://t.co/zy0JApO65Y

Small and medium enterprise consultant Mike Cosgrove tweeted at the time: “Nothing to do with scams. A bank has no right to limit how much a person can transfer.”

He added that NatWest customers could transfer their money to rival banks to circumvent the restrictions.

It's interesting to see NatWest follow the lead of other UK banks by limiting crypto transactions. It's important to be aware of the risks associated with investing in volatile assets, and it's good to see banks taking steps to protect their customers. https://t.co/zbBQdk9GCV

— Edgar S (@edgarenriquems) March 15, 2023

Conversely, career advisor Edgar Enriquems said it was “interesting” to see NatWest follow suit with other British banks.

“It’s important to be aware of the risks associated with investing in volatile assets, and it’s good to see banks taking steps to protect their customers,” he concluded.