A new report has found that the ongoing cryptocurrency crash has set record lows in average daily aggregate product volumes across digital assets.

CryptoCompare published the findings on Thursday, where it noted that global crypto products had plummeted 34.1 percent in average daily trading volumes in October, or $61.3 million USD.

/2 Despite this, average daily trading volumes of #crypto products fell 34.1% to $61.3mn – the lowest-ever volume reported (data tracked since June 2020).

— CryptoCompare (@CryptoCompare) October 27, 2022

Click below for the full Digital Asset Management Review report!https://t.co/s1cgGQTPWM

Currently, Bitcoin (BTC) sits just above $20,000, the benchmark health indicator for the coin following a heavy crash in June that plunged its value to $17,600.

Products featured in the report faced similar declines up to 77.5 percent, indicating a major fall in daily trading. October was one of the worst-performing months for crypto trading since September 2020, where volumes fell below $100 million USD.

Conversely, total assets under management (AUM) climbed 1.76 percent to $22.9 billion USD compared to the month before. AUM for trust products jumped 2.34 percent, or $17.7 billion, with exchange-trade funds (ETF)-linked AUM dropped 1.59 percent at $2.21 billion.

The report also mentioned that Valour’s Bitcoin product remained the highest-traded Ethereum Classic (ETC) despite the ongoing plunge in volumes across the market. Other products such as XBT Provider’s Ether (ETHONE) also recorded heavy losses at 54.7 percent, or $1.38 million, the report found.

A South Korean businessman may face up to eight years imprisonment for his alleged role in a cryptocurrency fraud scandal totalling $70 million USD, reports found on Wednesday.

Lee Jung-Hoon, former Bithumb chairman, has been charged with scamming cryptocurrency investors of roughly 70 million USD (100 billion won) from the chairman of the BK Group, Kim Byung Gun.

According to Yonhap News Agency, prosecutors involved in the case have asked the Seoul District Court to sentence Lee on 25 October, with a further hearing on 20 December.

Kim was chairman of the cosmetic surgery conglomerate in October 2018 and planned at the time to buy out the cryptocurrency exchange platform.

Kim alleges he transferred the $70 million to Lee for a “down payment” for the exchange, providing Lee listed the BXA token from the Blockchain Exchange Alliance formed.

Local prosecutors asked the 34th Criminal Settlement Section of the Seoul District Court for the sentence on Oct. 25, with a hearing to take place on Dec. 20, according to a report from Yonhap News Agency.

Bithumb never listed the token, causing the deal to fall through.

Responding, Lee Jung-Hoon’s lawyer stated the deal’s structure was a “typical stock sale contract” and had been carried out as needed according to the normal procedures for the contract.

Lee added in a final statement he was “very sorry for making it difficult for employees and causing social pressure,” just weeks after failing to join a parliamentary hearing on 6 October.

He stated he failed to show up for the meeting involving the $40 billion collapse of Terra Luna due to having a panic disorder.

Bybit Buyouts

The news comes just a day after Bybit, a Dubai-based cryptocurrency exchange, invested $3.8 million in the third-largest shareholder of the South Korean platform, T-Scientific, media reports found.

T-Scientific issued the 16 billion won of convertible debt at the end of September, allowing the firm to leverage its debt on interest, convertible to equity with stipulations.

The recent acquisition of debt will allow Bybit potentially a massive stake in the South Korean crypto platform with trading volumes of $239 million USD.

In late July, cryptocurrency trading platform FTX also entered talks with Bithumb to discuss acquiring the latter, Bloomberg reported, citing anonymous sources.

Both Bithumb and FTX spokespeople could not confirm the talks, the report added. Bloomberg based the report, which stated that the discussions have been underway for months, on an unnamed source.

The buyout comes as Sam Bankman-Fried, FTX co-founder, aims to buy out Bithumb to gain access to capital used for further acquisitions, it concluded.

Nik Bougalis, Ripple Lab’s director of engineering, announced in a shock tweet last Saturday he had left the firm. In a 22 October tweet, he said his 10-year career with Ripple would end “in a few weeks.”

“All good things…”

My decade-long journey at @Ripple has been a fantastic (if exhausting and all-consuming) one.

I got to work on a project that I love, towards a goal I believe in.

But that journey will be coming to an end in a few weeks.

— 𝙽 𝙸 𝙺 𝙱 (@nbougalis) October 21, 2022

He wrote at the time his 10-year career at Ripple had been “fantastic,” adding he would not join another blockchain, non-fungible token (NFT), or decentralised finance (DeFi) project.

I got to work on a project that I love, towards a goal I believe in. But that journey will be coming to an end in a few weeks. As for what’s next? I’ll talk about it when it’s time, but I am NOT joining another blockchain project/company, nor am I doing NFTs or DeFi”

The veteran software engineer and cryptographer developed the XRP Ledger (XRPL), an open-source project. He additionally managed the XLS-20 amendment, which added NFTs to XRPL set for launch in November.

Continuing, he stated Ripple’s operations would “be just fine” due to its team of “passionate individuals” contributing to the platform.

Ripple SEC Complaint

The news comes amid an ongoing lawsuit with the US Securities Exchange Commission (SEC), which saw last week’s inflows of XRP-based products increase with positive inflows of $800,000.

One of the biggest court cases involving a cryptocurrency, the SEC complaint accused Ripple’s XRP of operating as a security, leading over 3,000 XRP supporters to challenge the accusation in courts.

The official filing in December 2020 accused Ripple Labs and “two of its executives” with “significant” security holdings of raising $1.3 billion USD “through an unregistered, ongoing digital asset securities offering, citing company co-founder and executive chairman Christian Larsen.

The complaint also accuses company chief executive Bradley Garlinghouse of involvement in the alleged incident, which began in 2013 following investments across the United States and other global markets.

Stephanie Avakian, Direct of the SEC’s Enforcement Division, said in a statement,

“Issuers seeking the benefits of a public offering, including access to retail investors, broad distribution and a secondary trading market, must comply with the federal securities laws that require registration of offerings unless an exemption from registration applies. We allege that Ripple, Larsen, and Garlinghouse failed to register their ongoing offer and sale of billions of XRP to retail investors, which deprived potential purchasers of adequate disclosures about XRP and Ripple’s business and other important long-standing protections that are fundamental to our robust public market system.”

Marc P Berger, SEC Enforcement Division Deputy Director, concluded the registration requirements were “designed to ensure that potential investors […] receive important information about an issuer’s business operations and financial condition,” accusing Ripple of ‘failing’ over the years to satisfy the provisions.

A popular cryptocurrency analyst has recently claimed that Bitcoin could reach $100,000 in 2023, but would face a huge bear market afterwards.

Credible Crypto wrote in a Twitter thread that BTC could potentially halve sometime next year to roughly $10,000, becoming a major struggle for the leading cryptocurrency.

The analyst believes Bitcoin would settle from its “blow-off top” all-time high (ATH) to figures below its low of $17,600 this year, reaching around $10,000 up to 2025.

He agreed with Mr Parabullic, stating investors would face “the largest bear market we have seen yet that is worse than the current one in both time and price” which would take it “to the 10-14k” mark.

Agreed, probably in 2025 methinks. First, new ATH in 2023- blow-off top 5th wave above 100k- followed by the largest bear market we have seen yet that is worse than the current one in both time and price- taking us to the 10-14k that everyone is waiting for now. $BTC https://t.co/bv0jvzOG2A

— CrediBULL Crypto (@CredibleCrypto) October 21, 2022

IncomeSharks, another analyst, stated the rally would follow the “final Facebook adoption cycle” where “everyone and their parents and grandma finally buy after they’ve been skeptical [all] year.”

I call this the final Facebook adoption cycle. When everyone and their parents and grandma finally buy after they’ve been skeptical al year.

— IncomeSharks (@IncomeSharks) October 21, 2022

DecenTrader co-founder Filbfilb initially estimated $10,000, while Capo of Crypto speculated a return to $14,000-16,000 after a potential relief bounce of $21,000.

The Great Bitcoin Buyout

The developments come just hours after investors triggered a massive purchasing rush of 55,000 Bitcoin on the Binance exchange, following the coin’s return to $20,000.

Analyst Michael Wrubel said that he had seen “derivatives platform outflows now setting multi-month records.”

55,000 #Bitcoin (approximately $1.1 billion) were just withdrawn from #Binance.

— Michael Wrubel (@michaelwrub) October 27, 2022

This is a record high and we are seeing derivatives platform outflows now setting multi-month records.

I’m bullish. pic.twitter.com/jDgXCiuXCX

“I’m bullish,” he concluded, hinting at further potential instability in the market.

The purchase was the largest outflow in the platform’s history, topping its nosedive to $17,600 in June and the coin crash in March 2020, according to reports.

FTX is set to offer roughly $6 million USD to victims of a massive phishing attack which granted access to hackers, it was reported this week.

Sam Bankman-Fried, company founder and chief executive, posted a Twitter thread on 23 October that, although his company did not normally compensate victims of phishing scams, it would do so in the unprecedented attack as a “one-time thing” and not do so “going forward.”

The news comes after hackers gained access to conduct unauthorised trades of FTX users on the cryptocurrency exchange platform. The offenders bypassed the application programming interface (API) keys used to secure user accounts.13) But in this particular case, we will compensate the affected users.

— SBF (@SBF_FTX) October 23, 2022

THIS IS A ONE-TIME THING AND WE WILL NOT DO THIS GOING FORWARD.

THIS IS NOT A PRECEDENT.

We will not making a habit of compensating for uses getting phished by fake versions of other companies!

3Commas alerted the FTX community on 21 October that cybercriminals had compromised their accounts and conducted unauthorised activities, leading to suspending suspicious accounts.

In a blog post, it had stated the incident had taken place on 20 October, where a phishing attack bypassed its system. It did not report breaches of 3Commas’ account security or API encryptions

In a statement, Yuri Sorokin, Co-founder & CEO 3Commas.io said,

3Commas, in cooperation with our partner exchanges, is conducting an investigation of this incident to ensure our user community remains protected and feels safe to trade. We are working directly with the three individuals who claim to have been affected so that we can ascertain more details regarding how they stored their API keys and other sensitive data.

Hacktober Hits the Crypto World

The news comes after the Chainalysis crypto community stated on 13 October that the month had been one of the largest-ever periods for cybercrime, two weeks before the month’s end. Hackers had exploited over $3 billion USD in ‘hacktober’ across 125 incidences at the time of the report, it said.

Cryptocurrency platform giant Binance also reportedly lost $500 million in cryptocurrencies after an incident in early October, severely compromising the world’s largest platform.1/ After four hacks yesterday, October is now the biggest month in the biggest year ever for hacking activity, with more than half the month still to go. So far this month, $718 million has been stolen from #DeFi protocols across 11 different hacks. pic.twitter.com/emz36f6gpK

— Chainalysis (@chainalysis) October 12, 2022

The security breach forced the company to suspend transactions after finding exchanges between two blockchains exploited, resulting in over $570 million in losses and nearly $100 million unrecovered.

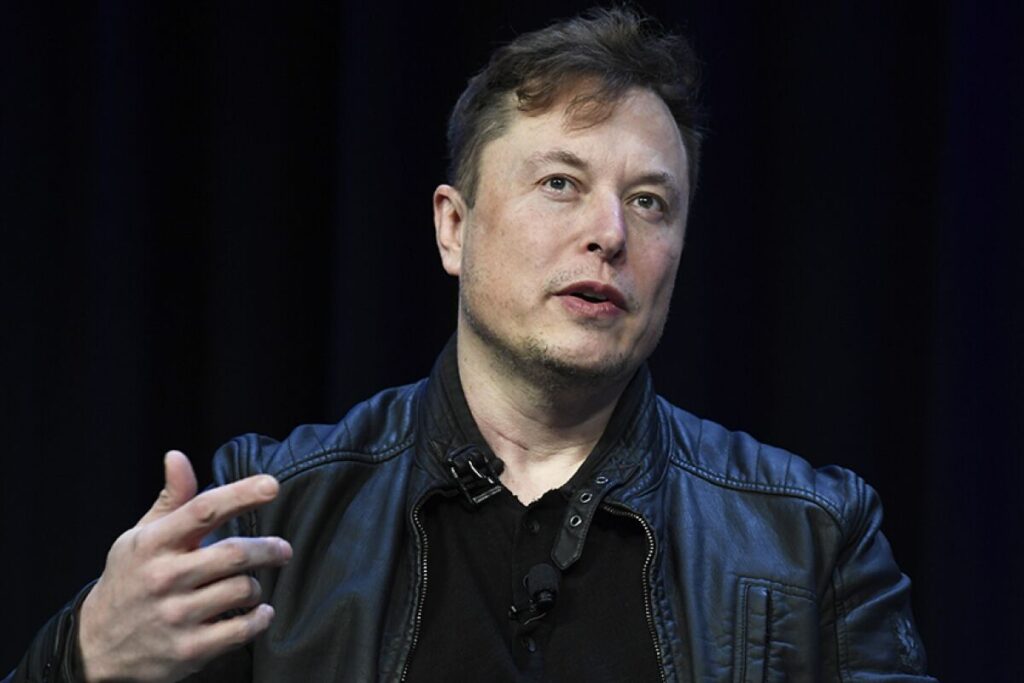

Tesla and SpaceX founder and Chief Executive Elon Musk officially acquired Twitter on Thursday following a series of court battles, memes, and terminations.

The $44 billion USD deal comes as Musk bought out the social media giant for $54.2 per share, following his successful bid on 11 April this year.

Musk also took the company private and delisted it from the New York Stock Exchange to remove it from public shareholders, the first time since it was listed in 2013.

To be super clear, we have not yet made any changes to Twitter’s content moderation policies https://t.co/k4guTsXOIu

— Elon Musk (@elonmusk) October 29, 2022

The NYSE mentioned Twitter will no longer be a public company and that the exchange would freeze its shares on 28 October, along with several trading platforms.

Public listing provides regulatory scrutiny, a key advantage following numerous rows the billionaire has faced with the Securities and Exchange Commission (SEC) in recent years over Twitter posts.

Conversely, Twitter as a private firm will allow it to avoid public oversight as it no longer needs to disclose quarterly reports.

Musk also ordered Twitter employees to print up to 60 pages of code from the platform for further evaluation, following his requests in recent months.

Why Musk Is Taking Twitter

The news comes as Musk, 51, aims to drastically restructure the social media platform by slashing key positions and hiring executives to lead the company’s new direction.

Speculators also believe the measures will allow for more free speech and less censorship under the new board’s leadership, which may entice a fresh user base to join the platform.

According to the New York Times, the company has struggled to grow its advertising operations and attract new users, triggering sweeping measures after he purchased the firm. Musk has dismissed several executives from the San Francisco-based firm, including CEO Parag Agrawal, general counsel Sean Edgett, chief financial officer Ned Segal, and legal and policy executive Vijaya Gadde.

The Twitter executives who were fired on Thursday include Parag Agrawal, the chief executive; Ned Segal, the chief financial officer; Vijaya Gadde, the top legal and policy executive; and Sean Edgett, the general counsel, said two people with knowledge of the matter. At least one of the executives who was fired was escorted out of Twitter’s office, they said.

Dogecoin, the meme-inspired altcoin that has been intrinsically linked to Tesla and SpaceX chief executive Elon Musk, saw its price skyrocket to around 8 cents on Thursday.

The price rally, nearly 40 percent of its value in a two-day period, comes after tech blogger Jane Manchun tweeted that Twitter could create a wallet for storing and trading cryptocurrencies.

Twitter is working on a “wallet prototype” that supports “crypto deposit and withdrawal”

— Jane Manchun Wong (@wongmjane) October 24, 2022

The news was announced amid Musk’s contentious but successful purchase of Twitter for $44 billion, and in April hinted at using Dogecoin for payments as its Twitter Blue subscription.

The news triggered the 30 percent price hike to $0.17, but later nosedived to roughly $0.05 by June due to Musk backing out of the deal and Twitter suing the tech magnate, which Musk won.

Changing his social media bio to “Chief of Twit,” he visited the Twitter headquarters in San Francisco later on Wednesday this week.

Entering Twitter HQ – let that sink in! pic.twitter.com/D68z4K2wq7

— Elon Musk (@elonmusk) October 26, 2022

The maverick billionaire’s latest move comes amid negotiations to take over Twitter after winning the multibillion dollar bid in April.

The news has sparked a sharp rise in cryptocurrency prices. Bitcoin (BTC) recently saw a massive surge to over $20,000 last week, and Ethereum also rose 20 percent to $1,575.29 on Wednesday.

News of a successful buyout could see further jumps in value with speculators anticipating the CEO to launch his DOGE integrations on Twitter.

Downing Street continued its drive for its Financial Services and Markets Bill on Tuesday to ink its position on using cryptocurrencies such as Bitcoin, following a crucial vote in the House of Commons in favour of the bill.

Commons scrutinised the legislation at the time to determine amendment and determine its value in post-Brexit Britain’s economic strategy.

The Bill is one of Rishi Sunak’s first successes as Prime Minister of the UK following the resignation of former PM Liz Truss, and aims to incorporate digital assets under the Financial Services and Markets Act 2000, which regulates financial activities unauthorised by the Government.

What’s in the Bill?

The bill advocates using “digital settlement assets” along with numerous measures “to maintain and enhance the UK’s position as a global leader in financial services,” it said.

Doing so would allow the UK to reach its goal of becoming a major hub for cryptocurrencies by implementing digital settlement assets (DSAs) rather than “crypto assets.”

According to the Government, the change in definition comes as it states crypto assets use “some form of distributed ledger technology (DLT)” compared to DSAs and stablecoins, which have greater potential to “develop into a widespread means of payment.”

Downing Street stated it would launch a “package of measures” to improve governance of cryptocurrencies, months after Rishi Sunak, then-Chancellor of the Exchequers at the time, backed digital monies after creating a Royal Mint non-fungible token (NFT) under the Johnson Administration.

As Prime Minister of the UK, he continues his push for cryptocurrency acceptance, namely central bank digital currencies (CBDCs).

Despite this, the bill must still face the House of Lords before receiving royal ascent under King Charles III.

The recognition of crypto and digital assets as financial instruments is yet to be scribed into law. The bill must pass crucial steps: The House of Lords will be required to approve or amend the bill before final royal approval by the new monarch, King Charles III.

ConsenSys, the parent company of MetaMask, announced on Wednesday it will fund $2.4 million for a MetaMask Grants decentralised autonomous organisation (DAO) to develop Web3 solutions.

MetaMask employees will lead the 12-month-long project and manage the DAO for Web3 developers outside the company’s workforce. The funding will finance solutions built for MetaMask’s ecosystem and the global Web3 market, reports show.

The DAO will receive and process proposals and votes via the SnapShot feature of its Codefi Activate platform, with the New York City-based firm pledging $600,000 each quarter to back Web3 across sectors.

Three Faces of Consensys DAO

According to the DAO, it will focus on three primary components:

- Employee-led DAO for more than 900 full-time ConsenSys employees, who can become a Grants DAO member with equal voting rights.

- Leadership Committee (mini-DAO) consisting of seven people that seek out projects with high potential, write governance proposals, develop other content, and receive feedback.

- Multisignature wallets, which ConsenSys supervises, operates the treasury and token contract. It also signs off on transactions for dispersing funds and mints tokens for new and past employees.

Additionally, the Leadership Committee of the DAO will consist of the Co-Founders of MetaMask along with its global product and extensibility leads, its senior DAO strategist. It will also include the directors of strategic initiatives and product management for ConsenSys.

MetaMask, Sardine Fiat-to-Crypto Integration

The news comes after MetaMask integrated new technologies from fintech company Sardine earlier in October to convert fiat monies to cryptocurrencies.

This will allow users to instantly transfer fiat currencies to their crypto wallets rather than using typical banking mechanisms or traditional transfers.

Sardine, an instant fiat and cryptocurrency settlement platform, boasts strict “compliance and fraud prevention infrastructure” used for crypto trading platforms like “FTX, MoonPay, Blockchain, and Autograph,” the company wrote in a blog post on 11 October.

Mara, a digital financial ecosystem project, is set to back 2 million potential users in Nigeria with a new cryptocurrency wallet.

It will provide users with crypto brokerage services via an app for buying, selling, and transferring both cryptocurrencies and fiat money. Using the app, people can also receive education on personal wealth management and cryptocurrencies, the company added.

Major companies such as Coinbase Ventures and Alameda Research support the initiative, which offers users to use the platform via an invitation-only onboarding process, which kicked off on Wednesday.

The project, currently valued at $23 million after fundraising from the two backing firms, Huobi, and others, will also take on users from Kenya and Ghana in due course.

Hello folks,

— GDG Nairobi #DevFestNairobi (@GDG_Nairobi) October 13, 2022

We are thrilled to announce the Web 3 Developer Roadshow brought to you by Mara Foundation & Circle, happening across Nigeria & Kenya.

The show will include hands-on workshops, panel sessions, talks on blockchain & much more

Link: https://t.co/BMcGiC6S4L pic.twitter.com/7b4dgJEAwj

Mara also plans to work with Google Developer Group’s Nairobi branch for a Web3 Developer Roadshow set to take place on 29 October, complete with workshops, panel talks, and discussions on emerging tech.

What is the Mara Foundation?

The Mara Foundation is a designated nonprofit aiming to support the sustainable development of blockchain use cases across the African continent, partnered with USD Coin (USDC), with Circle and Euro Coin (EUROC) facilitating the adoption of stablecoins.

The news comes as Mara targets one million developers in Africa for training with an initial “Hack the Mara” hackathon in September to build development systems for Kenya’s Maasai communities and conservation projects for the Maasai Mara, a massive wildlife reserve in the East African nation.

Some throwback pictures from our successful ‘Hack the Mara’ hackathon in Nairobi last month.#throwbackthursday pic.twitter.com/JcyH0WkWCM

— Chi Nnadi (@chi_maraverse) October 20, 2022

The hackathon awarded three of 24 teams with shares of $100,000 in prizes along with a further accelerator programme for developing products and solutions.

The organisation also opened a Mara Academy for free education initiatives for Web3 and blockchain technologies, offering certification to mentor other aspiring developers for the programme.