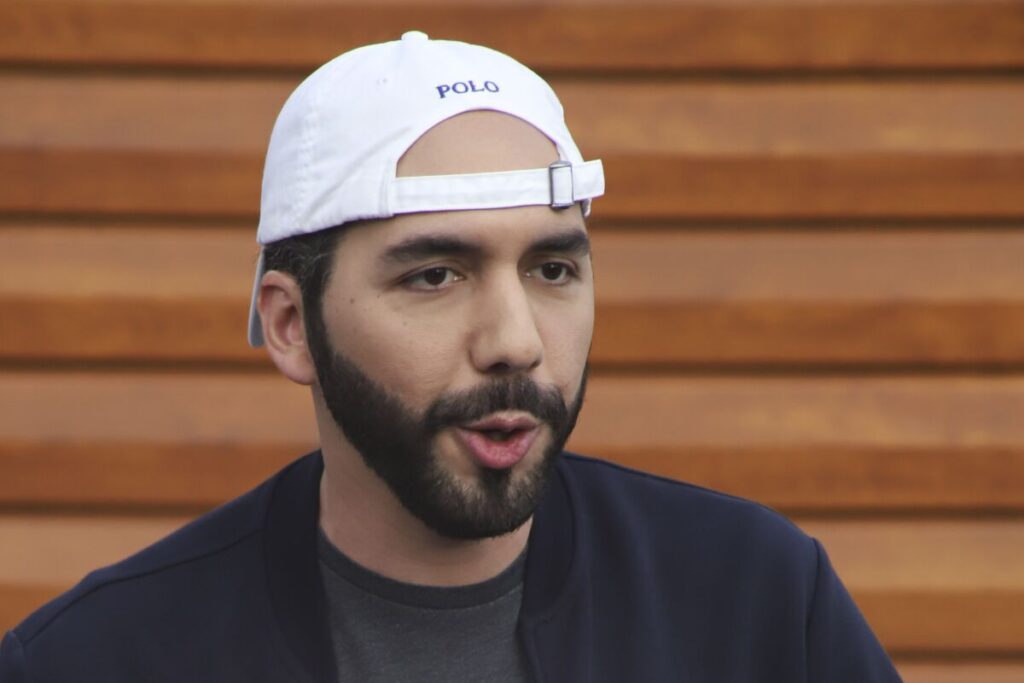

El Salvador president Nayib Bukele has posted on Twitter several BTC buyouts after the country positioned Bitcoin as a mainstream legal tender.

Despite this, national state development bank BANDESAL blocked anti-corruption watchdog ALAC El Salvador from receiving key information about its activities in Bitcoin transactions.

The news comes after BANDESAL launched a $150 million trust fund to facilitate liquidity of the coin for those using it for individual and business use.

#BITCOIN | En septiembre, @BANDESAL, encargado del Fideicomiso Bitcoin, denegó entregar información por segunda vez sobre la compra y venta de #Bitcoin por parte del gobierno de @nayibbukele, alegando reserva. Informó @ALAC_SV. pic.twitter.com/KE6EiqqBAT

— FOCOS (@focostv) October 31, 2022

The development bank blocked ALAC El Salvador from receiving the data, citing confidentiality. The latter later hit back, stating the bank purchased BTC with public money.

The organisation said in a statement: “The confidentiality limits the possibility for citizens to access and receive information on the operations carried out with public funds by BANDESAL.”

BANDESAL responded, stating it could not share information on its Bitcoin Trust (FIDEBITCOIN) due to national interests. According to public data, El Salvador bought up 2,301 BTC to date, which plummeted from $103.9 million to $45 million over the last year.

The news comes after Spain beat El Salvador as the world’s top spot for crypto after the United States and Canada at 34,345 and 2,653, respectively, data from CoinATMRadar revealed.

Congress Backs Crypto

The news comes after Bukele adopted cryptocurrencies as a national tender for the country following a successful 62-22 vote in favour of the measure in June last year.

Approval of the digital currency would allow citizens abroad to remit money back to their families as the country does not have a sovereign coin, instead relying on the US Dollar.

Bukele said in a statement at the time the move would “bring financial inclusion, investment, tourism, innovation and economic development for our country.”

Derebit, a major cryptocurrency derivatives exchange, was hit by a massive $28 million wallet hack, forcing it to halt withdrawals temporarily.

The hot wallet hack took place near midnight on 1 November and user funds have been protected by its reserves, according to a company tweet.

Deribit hot wallet compromised, but client funds are safe and loss is covered by company reserves

— Deribit (@DeribitExchange) November 2, 2022

Our hot wallet was hacked for USD 28m earlier this evening just before midnight UTC on 1 November 2022.

The tweet thread stated: “Client assets, Fireblocks or any of the cold storage addresses are not affected. It’s company procedure to keep 99% of our user funds in cold storage to limit the impact of these type of events.”

Hacktober to November

The platform halted withdrawals, including across Copper Clearloop and Cobo, to ensure the platform was fully secure before reopening.

Derebit’s Telegram chat added: “Due to our hot wallet policy we were able to limit loss of user funds.” It added it was in a “financially sound position” and that the hack would not impact ongoing operations.

CoinGecko data indicated Derebit’s daily trading volumes were $280 million, making it one of the largest cryptocurrency derivatives exchanges in the world.

Binance also temporarily halted transactions after being compromised in early October and fund transfers were temporarily suspended, with company chief executive Changpeng Zhao apologising for the incident.

At the Hong Kong Fintech Week event, Yi Gang, governor of the People’s Bank of China, outlined progress and gains in the nation’s adoption of its central bank digital currency.

In his speech, he stated China’s stablecoin could operate as a cash alternative in the country, adding privacy protection was “one of the top of the issue on our agenda.”

The news comes after China’s sovereign cryptocurrency launched in 2019, leading to widespread pilot programmes and adoption at retail stores nationwide, namely via its “red envelope,” or hongbao offering.

Authorities in Beijing later expanded the pilot programme to provinces with larger populations and later, noted total CBDC transactions surpassed $14 billion in the third quarter this year.

Introducing E-CNY

Yi explained China’s national cryptocurrency, E-CNY, could facilitate a two-layer payment system with anonymity for users. The tier-one option supplies the CBDC to authorised operators with institutional data. Tier-two options collect essential personal data for exchanging and circulating public services.

Additionally, China’s central bank would encrypt and store data with “managed-anonymity” and would not share data with third-party entities, Yi added.

The cryptocurrency would “meet the needs of domestic retail payment, enhance the development level of inclusive finance, and improve the efficiency of the currency and payment system.”

The bank would also facilitate “small-amount soft wallets and hard-wallets” for limited anonymous transactions “both online and offline,” Yi explained.

“Legitimate demand” for paper cash for fully anonymous payments would “be met at all times,” he added.

Speaking further about security, he concluded: “It is also important to keep in mind that anonymity and full disclosure are not as simple as black and white […] We must strike a delicate balance between protecting privacy and combating illicit activities”

The event is taking place 31 October to 4 November and has rallied members of the fintech community. Some of the region and world’s top thought leaders, executives, government officials, and experts to discuss the future of the special administrative region’s position in the global fintech industry.

MakerDAO and Balancer Labs co-founder Nikolai Mushegian has died aged 29, reports revealed on Friday last week.

He died after drowning due to riptides at Condado Beach in San Juan, Puerto Rico, El Nuevo Dia reported at the time. Authorities pronounced him dead at the scene following the rescue attempt on 28 October.

The beach has recently claimed the lives of roughly eight people last year and is widely considered a dangerous place for swimming activities.

The incident is under investigation by local authorities and a prosecutor working on the case.

Remembering Mushegian’s Legacy

The world-famous “Dai Architect” remains a key voice of the crypto space for his work with the industry, including MakerDAO forks Rico and Rai. He also collaborated on BitShares, a proof-of-stake blockchain network, and the automated market platform Balancer.

Rune Christensen, MakerDAO founder and chief executive, tweeted on Monday that his colleague had been “one of the only people in the early days of Ethereum and smart contracts” to predict potential hacks, leading to the development of security-based approaches to current designs.

“Maker would have been toast without him,” he concluded.

Cardano co-founder Charles Hoskinson added that Mushegian was a “very young and extremely bright man” with a wide range of interests and a deep understanding of technology.

He also actively campaigned on social media. One of his final tweets, hours before his death, alleged that the US Central Intelligence Agency (CIA) and Israel’s Mossad were blackmailing him.

User Danpub added that MakerDAO disrupted “the traditional financial system by offering users access to #ETH #USD loans without collateral,” indicating a potential conflict with the banking system.

The Monetary Exchange of Singapore (MAS) has issued a stern warning to cryptocurrency exchanges operating in the nation to comply with ongoing Russian sanctions.

According to reports, Singapore’s central bank stated it would take action after alleged research found pro-Russian groups had received millions in crypto donations amid the ongoing war in Ukraine.

Numerous Russian entities, including individuals, institutions, and companies, have faced US and European Union (EU) sanctions over the last few months since the onset of the conflict in February.

The news comes after the EU slapped its eighth sanctions package on Moscow, which bans all cryptocurrency exchanges from operating in Russia.

Previous sanctions regimes limited Russian-EU crypto transactions to payments of $10,000 or less.

The news comes just months after Tharman Shanmugaratnam, senior minister and minister in charge of MAS, responded to Parliamentary questions that his institution required all financial entities to comply with measures regardless of whether they were decentralised or traditional channels, reports show.

Crypto Pushback Against Blanket Ban

The news comes months after Coinbase and Binance, the world’s top two crypto exchanges, rejected a blanket ban across Russian platform users amid the ongoing conflict.

Coinbase CEO Brian Armstrong tweeted in early March: “We believe everyone deserves access to basic financial services unless the law says otherwise.”

8/ Some ordinary Russians are using crypto as a lifeline now that their currency has collapsed. Many of them likely oppose what their country is doing, and a ban would hurt them, too. That said, if the US government decides to impose a ban, we will of course follow those laws.

— Brian Armstrong (@brian_armstrong) March 4, 2022

He continued in his thread, stating: “Some ordinary Russians are using crypto as a lifeline now that their currency has collapsed. Many of them likely oppose what their country is doing, and a ban would hurt them too. That said, if the US government decides to impose a ban, we will of course follow those laws.”

At the time, Binance also said it would not “unilaterally freeze millions of innocent users’ accounts.”

According to Reuters, Bitcoin prices spike after the conflict, namely after users moved their money and assets in anonymised crypto wallets. It is believed users took such measures to avoid frozen assets after sanctions hit Russian banks.

In a recent speech, United Nations (UN) Countering Financing of Terrorism Coordinator said in a speech that terrorist organisations were increasingly turning to emerging technologies to finance operations.

She warned at her speech in New Delhi that increasing use of such decentralised and emerging tools could trigger the expansion of terrorist financing networks and operations.

Terrorist organisations blocked from the “formal financial system” are circumventing restrictions with cryptocurrencies, Svetlana Martynova, United Nations (UN) Countering Financing of Terrorism Coordinator said in a speech at a recent event.

At the UN Counter-Terrorism Committee’s Special Meeting from 28 to 29 October, the official discussed measures to tackle terrorist financing from “new and emerging technologies.”

She mentioned that using cash were “predominant methods” to finance terrorist activities, adding: “We know terrorists adapt to the evolution of conditions around them and as technologies evolve they adapt as well.” Hawala is a system for transferring money in Arab and South Asian nations.

#UNCTCEmergingTech pic.twitter.com/mGzrn2xufB

— United Nations CTED (@UN_CTED) October 29, 2022

She continued, stating: “If they’re excluded from the formal financial system and they want to purchase or invest in something with anonymity, and they’re advanced for that, they’re likely to abuse cryptocurrencies.”

The UN aimed to tackle the issue internationally by persuading nations to adopt resolutions from the bloc’s regulatory body, the UN Security Council, along with measures from the Financial Action Task Force (FATF) she said, adding it was the main challenge.

She criticised some nations for failing to start working on and enforcing regulations for such threats.

Antonio Guterres, UN Secretary-General, echoed Martynova’s comments, explaining that emerging technologies improved the human condition but also had the potential to harm via terrorism financing.

He said: “Terrorists and others posing hateful ideologies are abusing new and emerging technologies to spread disinformation, foment discord, recruit and radicalize, mobilize resources and execute attacks.”

RAND Corporation and Crypto Terrorism

According to the RAND Corporation, several factors increased the likelihood of terrorist funding via cryptocurrencies, the organisation noted in a 2019 report.

It found that growth in the cryptocurrency market would “require increase reliability and more-widespread usage, leading to greater adoption of crypto financial systems, also in terrorist locations.

It also stated that second-generation cryptocurrencies with “advanced privacy features” could facilitate “more illicit use of these systems.”

Several superpowers such as the United States, China, and the European Union (EU) block bitcoin anonymity on exchanges, but decentralised platforms and countries with fewer or no regulations could create difficulties in tracing transactions.

Concluding, it added increased cryptocurrency use in “complementary and adjacent markets” could reveal growing use for terrorist organisations, including darknet and “illicit drugs and stolen identities” markets.

The Blockchain Association has backed Ripple Labs as the latter continues its legal row with the Securities and Exchange Commission (SEC), it revealed in a recent post.

The Washington, DC-based organisation stated the ongoing case would become significant for the future of cryptocurrency.

The advocacy group stated in its post it would back the US crypto market with an amicus brief (friend of the court) after the SEC hit Ripple with a lawsuit, citing alleged unregistered securities sales via XRP in December 2020.

1/ Today we announced we filed an amicus brief supporting a correct interpretation of Howey in the SEC’s two-year legal battle against @Ripple.

— Blockchain Association (@BlockchainAssn) October 28, 2022

A judge now has the opportunity to issue a substantive opinion on how Howey applies to digital assets.

Here’s what’s at stake🧵🧵🧵

The former and current chief executives of the firm, Christian Larsen and Brad Garlinghouse, respectively, faced litigation in the court case.

Blockchain Association Statement

In the Association’s Twitter thread, it stated: “This case, which is just one in a long line of SEC efforts to regulate by enforcement, highlights the SEC’s efforts to cement and legitimize its overly broad interpretation of the Howey test.”

The US government determines investment contracts and the jurisdiction of its security laws with the Howey test, which the Blockchain Association has stated may have “devastating effects” on crypto.

It added that securities laws could “significantly restrict” cryptocurrency networks from functioning, namely in use cases such as inventory tracking, purchases, intellectual property (IP), and others.

The Association continued that the SEC disregarded precedents from the Supreme Court and Second Circuit, adding: “Though the blockchain industry is global in nature, the federal securities laws are not. The Second Circuit has repeatedly re-emphasized the Supreme Court’s lesson on this subject.”

The organisation also warned that the Court should be “mindful of the limits of these securities laws.”

Executive Director Hits Out at SEC

In a statement, Executive Director Kristian Smith said that the SEC’s “broad, haphazard interpretations” of securities laws were the “single greatest threat to the future of this rapidly growing industry.”

She slammed the SEC for targeting crypto via a “regulation by enforcement” pattern, claiming the regulatory body continued its “regulation by enforcement” pattern to punish crypto companies with “little justification or warning.

She added: “The SEC must follow the law, they cannot impose their draconian view on the entire crypto ecosystem through an enforcement action.”

Concluding, Smith said that Ripple’s decision to fight the lawsuit provided an opportunity for the cryptocurrency industry to “push back” against the pattern and “open the door to modernized standards for the industry.”

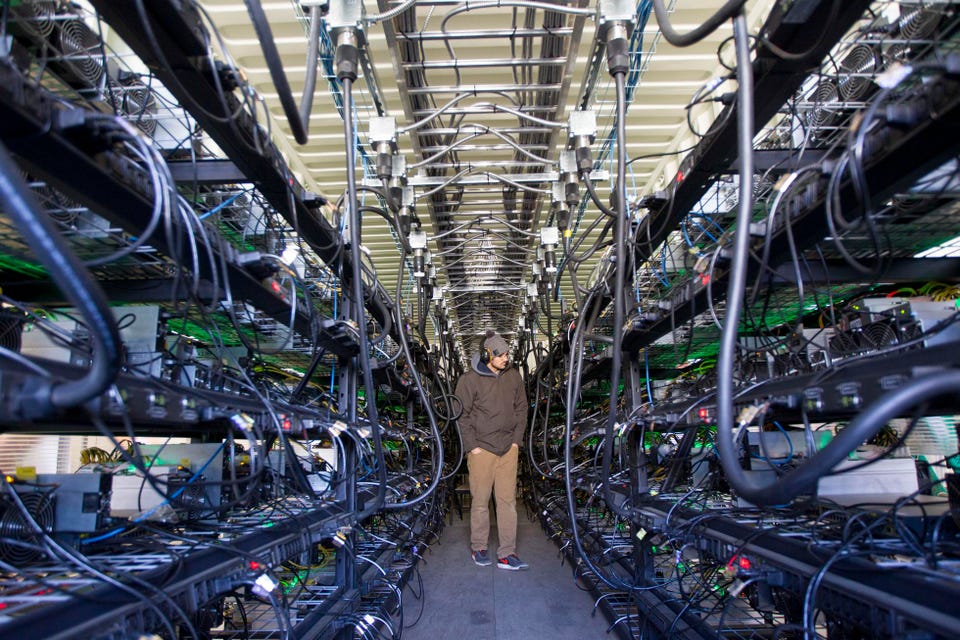

Argo Blockchain, a company listed on the London Stock Exchange, issued a warning on Monday it may close its business due to a lack of funds.

The company mines cryptocurrencies, but has failed to receive substantial capital from investors, leaving it with a major shortage of funds to continue operations, it announced at the time.

New RNS today contains updates on the strategic actions disclosed on 10/7.

— Argo (@ArgoBlockchain) October 31, 2022

We no longer expect to close the equity subscription on the terms disclosed and we’re exploring other financing options.

We also sold 3,843 S19J Pro machines for $5.6m.

Full RNS: https://t.co/KthypzXCAT

In its tweet, the company said it had sold 3,843 S19J Pro coin mining machines for $5.6 million.

Despite seeking fresh financing, there was “no assurance” it would sign any definitive agreements or consummate transactions, it said in its notice.

Explaining further, the company said: “Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations.”

Additionally, it stated it aimed to complete financing transactions to earn enough “working capital sufficient for its present requirements” up to 12 months from the announcement, it explained.

It added it hoped to raise roughly £24 million using a subscription service for ordinary shares. Concluding, it explained: “Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations.”

Crypto Crash and Freeway Diversion

The news comes amid a major Bitcoin crash triggered in June, which saw the leading coin plummet to around $17,000 amid a volatile bear market. Following the incident, Argo sold 637 BTC and 887 BTC in June and July, respectively. It became a major seller of self-mined Bitcoins along with several other firms.

The news comes just a day after cryptocurrency platform Freeway halted several of its services amid rising instability in the current crypto market, forcing it to diversify assets to tackle the ongoing fluctuations.

Freeway later suspended its Supercharger simulation purchases amid its restructurings due to the “unprecedented volatility.”

Binance has remained open to unsanctioned Russian nationals following sweeping sanctions from the European Union (EU), a key executive told Cointelegraph on Friday.

Chagri Poyraz, Binance’s recently-appointed global head of sanctions, stated it had blocked several territories involved in the ongoing Ukraine-Russia war such as Donetsk and Luhansk.

Russia is one of Binance’s top ten markets, it noted in 2019.

In his interview, he noted there was “still an active war going on in the region” and that his company would continue to monitor developments with its massive workforce of compliance executives.

Roughly half of its 500 executives work with sanctions control mechanisms such as anti-money laundering and name screening, the report noted. He added Binance had “zero tolerance” for blocked accounts due to targeted sanctions directed at specific people or entities.

What are the Latest Sanctions?

He stated that EU sanctions were the “hardest part” and lacked clarity, namely after the bloc launched its eighth sanctions package. The firm claims it reached “no particular dialogue” with EU regulators.

Speaking further, he said: “We do obviously follow all the EU sanctions, but there is room for improvement when it comes to clarity. […] We are trying to follow sanctions as they are. The challenge is not overdoing, doing what you’ve been told. The regulation has to be clear.”

He added the lack of clarity over EU sanctions on Russia was an “industry problem” rather than solely with Binance. The EU’s sweeping restrictions in October ban “all crypto-asset wallet, account, or custody services, irrespective of the amount of the wallet.”

The news comes after platforms like Crypto.com, Blockchain.com, and LocalBitcoins informed users in October they would halt services across Russia after the EU imposed the sanctions.

The EU recently capped Russian crypto investments at 10,000 Euros, but the new regulations now ban “IT consultancy, legal advisory, architecture and engineering services.” Such measures aim to hit Russia’s dependence on importing foreign services amid the ongoing conflict, an EU spokesperson wrote.

Ethereum (ETH) has hit new liquidation highs, revealing the bearish nature of the ongoing cryptocurrency crisis, figures from CryptoQuant revealed this week.

The on-chain analytics platform found that short liquidations in USD had reached $500 million in just two days, shattering the market and leading to significant losses for traders.

Despite this, ETH/USAD climbed from $1,337 to $1,593 on Bitstamp, data from TradingView showed from 25-26 October. Markets were hit with both BTC and ETH shorts, triggering macro lows across platforms.

1) Total Liquidations

— BlackSwan DAO (@DAOblackswan) October 26, 2022

The number of liquidations of Short and long BTC positions jumped to 550M dollars in the last 24 hours.

If we add other coins to Bitcoin, then in total over 1.1 billion positions were liquidated in 24 hours! 🔥#Bitcoin #volatility #Liquidation #crypto pic.twitter.com/T0uc3jFxvw

Figures show that liquidations erased $275 million and $250 million USD on the 25 and 26, respectively, wiping out over half a billion in positions by the week’s end.

CryptoQuant Chief Executive Ki Young Ju said in a statement: “$ETH short squeezes for the last two consecutive days. Daily short liquidations across all exchanges reached an all-time high.”

The news comes after exchange platform FTX noted the event was the single largest liquidation in its history. Binance followed shortly after with $57.58 million and OKX reported a $46.72 million change.