Belgium’s Financial Services and Markets Authority (FSMA) issued a statement this week that cryptocurrencies such as Bitcoin, Ether, and others do not constitute securities.

The FSMA’s statement comes amid a report published in July, with the most recent statement clarifying questions on how the nation’s finance regulations affect digital assets.

The FSMA’s “stepwise plan” aims to classify cryptocurrencies issued by individuals and entities as a security in a non-legally binding agreement.

#News 📰 | Kwalificatie van cryptoactiva als effecten, beleggingsinstrumenten of financiële instrumenten

— FSMA (@FSMA_info) November 25, 2022

➡️ https://t.co/j5UZXXx214#tcrypto #cryptoactiva #MiFID #mededeling pic.twitter.com/r9xa2ryjG0

It explained in the statement: “If there is no issuer, as in cases where instruments are created by a computer code and this is not done in execution of an agreement between issuer and investor (for example, Bitcoin or Ether), then in principle the Prospectus Regulation, the Prospectus Law and the MiFID rules of conduct do not apply.”

It added that cryptocurrency not categorised under the new stepwise plan regulations could potentially face further restrictions if companies use the assets as a medium of exchange.

It added: “Nevertheless, if the instruments have a payment or exchange function, other regulations may apply to the instruments or the persons who provide certain services relating to those instruments.”

The Belgian regulators also explained its plan was neutral to the blockchain and other cryptocurrency technologies, but rather their use in markets.

The news comes after the first draft of the report, issued in July this year, to address Belgian digital asset entities. The European Parliament is set to adopt its Market in Crypto Assets regulation (MiCA), with Belgium adopting its stepwise plan before EU legislation takes effect in 2024.

CoinList, a crypto exchange and initial coin offering (ICO) platform, tweeted on Thursday to address misconceptions posted by a blogger stating people could no longer withdraw their funds.

Speaking on FUD, or ‘fear, uncertainty, and doubt,’ CoinList slammed the blogger’s claims the platform had faced liquidity issues amid the ongoing FTX-linked crypto crisis.

1/ There is a lot of FUD going around that we would like to address head on.

— CoinList (@CoinList) November 24, 2022

CoinList is not insolvent, illiquid, or near bankruptcy. We are experiencing technical issues that are affecting deposits and withdrawals.

CoinList hit back, stating: “There is a lot of FUD going around that we would like to address head on. CoinList is not insolvent, illiquid, or near bankruptcy. We are experiencing technical issues that are affecting deposits and withdrawals.”

It explained it had been upgrading its internal ledger systems and was migrating wallet addresses from multiple custodians to “offer our customers around the world better products and services while maintaining compliance.”

The news comes after Colin Wu, a cryptocurrency blogger, said to hundreds of thousands of his followers that “some community members” on the exchange could not access their funds, citing platform maintenance.

Some community members reported that Coinlist, the largest cryptocurrency crowdfunding platform, was unable to withdraw coins. The official reason is that the custody partner is undergoing maintenance, but it has lasted for more than a week. Coinlist incurs $35M loss in 3AC crash

— Wu Blockchain (@WuBlockchain) November 24, 2022

CoinList launched a $35 million USD creditor claim with Three Arrows Capital, which went bankrupt in recent weeks. Wu added the claim was a loss triggering concerns over the former’s liquidity.

CoinList aimed to resolve “custodian issues” causing crypto coins to take “longer than anticipated to migrate.” It added that on 23 November, one of its custodians faced an “outage […] unrelated to the migration,” leading to problems on the platform.

CoinList concluded: “Once again, this is purely a technical issue, not a liquidity crunch. We hold all user assets dollar for dollar. Regardless, this is not the quality of service we aspire to, and we apologize for the inconvenience. Proof of Reserves is on our roadmap.”

The news comes just weeks after a massive liquidity crunch hit now-bankrupt FTX, with the exchange’s former chief executive Sam Bankman-Fried stating everything was “fine” and that no issues were present.

South Korea’s major cryptocurrency exchanges have planned to remove gaming firm Wemade’s blockchain platform WEMIX, citing “false information” from an investment warning.

The Digital Asset eXchange Alliance (DAXA) announced on Thursday it would end support for WEMIX and cease trading on 8 December.

The warning stated that there were much greater numbers of Wemix than previously disclosed, adding the suspected cryptocurrency would collaborate with DAXA to tackle the issue.

DAXA hosts multiple platforms such as Korbit, Gopax, Bithumb, Upbeat, and Coinone. Following DAXA’s decision, WEMIX nosedived nearly 71 percent to $0.476.

WEMIX Communication later issued a statement that it had responded to DAXA’s concerns and resolved several issues in question, adding,

“The WEMIX team does not acknowledge or agree with the unreasonable decision made by the Digital Asset eXchange Alliance (DAXA)… It is crucial to note that the Foundation has not circulated a single WEMIX more than what we have officially disclosed thus far.”

Wemade chief executive Henry Chang created The Legend of Mir, including Mir 4, one of the world’s top free-to-play (F2P) blockchain games.

It later stated Microsoft, Kiwoom Securities, and Shinhan Asset Management had raised $46 million for Wemade to expand its operations.

This is Gapjil!

According to Joong Ang Daily, Chang criticised the measures in a recent press statement, stating the decision had been arbitrary and unfair.

He repeated slammed the moves, stating “This is gapjil!” at the Friday conference. ‘Gapjil’ is Korean for an abuse of power.

Chang said in a recent response to the DAXA move: “Wemade and Wemix will continue to exert efforts to attract more capital and actively invest to build the global digital economy platform.”

It aims to build a Web3 economy based on non-fungible tokens (NFTs) and decentralised autonomous organisations (DAOs).

Currently, South Korean authorities have banned play-to-earn blockchain games, but may potentially lift restrictions under President Yoon Suk-Yeol, who has supported crypto assets in recent history, reports show.

The New South Wales Police Force has warned Australian crypto investors to avoid fake Bitcoin paper wallets.

Such wallets attract victims with crypto wallets with seemingly great benefits but gradually steal holdings from the owners.

The NSW Police Force wrote in a Facebook post that scams began as a paper crypto wallet with a QR code. Scammers leave paper wallets in public spaces such as streets and parks, they warned.

People scanning the QR codes for the wallets receive access links to crypto accounts with $16,000 Australian Dollars, but then users are requested to pay withdrawal fees and wallet credentials.

The NSW Police Force added: “Once the withdrawal fee is paid and the person’s crypto wallet details provided, the person’s cryptocurrency is stolen from their crypto wallets.”

Authorities have informed people to remain vigilant and avoid scanning paper QR codes or entering their personal credentials. They have been advised to turn in the wallets to local authorities.

Australia has been hit by previous paper crypto wallet scams, namely after Reddit users flagged a similar incident circulating in public places.

One user Pinnymc warned of the 0.5 percent transaction fee, stating: “If this was a legit wallet I should be able to withdraw and the transaction fee comes out of the balance. It’s such a shame because this looks so legit.”

According to Australia’s consumer watchdog site, Scamwatch, Australia has lost $242.5 million AUD to scammers in 2022 alone, leading authorities to monitor and respond to changing criminal activity.

Cryptocurrency exchange CrossTower has begun seeking to buy up additional crypto companies amid the ongoing market turmoil, Bloomberg reported.

According to the report, the firm had begun bids for Voyager Digital, with chief executive Kapil Rathi stating his company aimed to find a “good set of customers” and a “good balance sheet.”

He added: “We’re in a great place to either acquire entities who have a good set of customers with them and a good balance sheet […] so we are openly looking at different types of companies from an organic growth perspective.”

Other companies such as Binance and now-bankrupt FTX aimed to acquire the exchange. FTX Trading earned the winning bid for Voyager in late September worth $1.4 billion.

Voyager put the bid back on the market after FTX went bankrupt on 11 November. CrossTower’s Kristin Boggiano said it had “minimal exposure” to investments linked to FTX.

Boggiano said that Voyager invested just $3 million in FTX assets, which would not affect a possible sale of its platform. Binance and Wave Financial are also vying for the exchange.

He continued, stating his enterprise would emphasise companies with a strong focus on transparency and compliance.

He said: “There’s an opportunity in this market to provide a [compliance-focused] platform and to bring the transparency and trust that people have been hoping for.”

CrossTower, a crypto exchange based in the US, has a trading volume of just $103,816 in the last 24 hours, market data revealed.

Ex-CEO of disgraced cryptocurrency exchange FTX, Sam Bankman-Fried, has triggered massive backlash for planning to speak at a New York Times event on 30 November.

I’ll be speaking with @andrewrsorkin at the @dealbook summit next Wednesday (11/30). https://t.co/QocjPtCVvC

— SBF (@SBF_FTX) November 23, 2022

Bankman-Fried announced on 23 November he would speak at the DealBook Summit with NYT journalist Andrew Sorkin, sparking anger from many people on social media.

A lot of folks have been asking if I would still be interviewing @SBF_FTX at the @nytimes @dealbook Summit on Nov 30…

— Andrew Ross Sorkin (@andrewrsorkin) November 23, 2022

The answer is yes. 👇

There are a lot of important questions to be asked and answered.

Nothing is off limits.

Looking forward to it… https://t.co/lShAqXLKGS

Sorkin added in the 23 November tweet: “A lot of folks have been asking if I would still be interviewing @SBF_FTX at the @nytimes @dealbook Summit on Nov 30… The answer is yes. There are a lot of important questions to be asked and answered. Nothing is off limits.”

Puff, The Magic Crypto

Many Twitter users took to the social media platform to voice their anger at Bankman-Fried’s announcement, with Bruce Fenton, Watchdog Capital managing editor asking him what he would speak about at the NYT talks.

He said: “Would be good to hear […] when [and] how you decided to take client funds [and] use them as collateral for loans – this is the key issue much more than margin issues [and] is being brushed off.”

He continued he should discuss “more on the political donations process [and] what those conversations are like behind closed doors.”

would be good to hear:

— Bruce Fenton 🇺🇸 (@brucefenton) November 23, 2022

– when/ how you decided to take client funds & use them as collateral for loans – this is the key issue much more than margin issues & is being brushed off

– more on the political donations process & what those conversations are like behind closed doors

How did this dude steal billions of dollars and is now speaking at a summit as a free man?

— Chairman (@WSBChairman) November 23, 2022

Make it make sense.

The “Chairman” of Wall Street Siren tweeted to his nearly one million followers: “How did this dude steal billions of dollars and is now speaking at a summit as a free man? Make it make sense.”

RIP rule of law in the United States

— Cred (@CryptoCred) November 23, 2022

Cred, with over half a million Twitter followers, added: “RIP rule of law in the United States.”

The bemusing NYT announcement comes after social media slammed the publication for writing a “puff piece on SBF” that many stated ignored the disgraced executive’s defrauding of the crypto community.

He remains in the Bahamas with members of his family and other acquaintances, according to social media posts. Several key US lawmakers, including US Senators Elizabeth Warren and Sheldon Whitehouse, have called on the US Department of Justice to open a massive investigation on SBF’s former companies and the collapse of one of the world’s largest crypto exchanges.

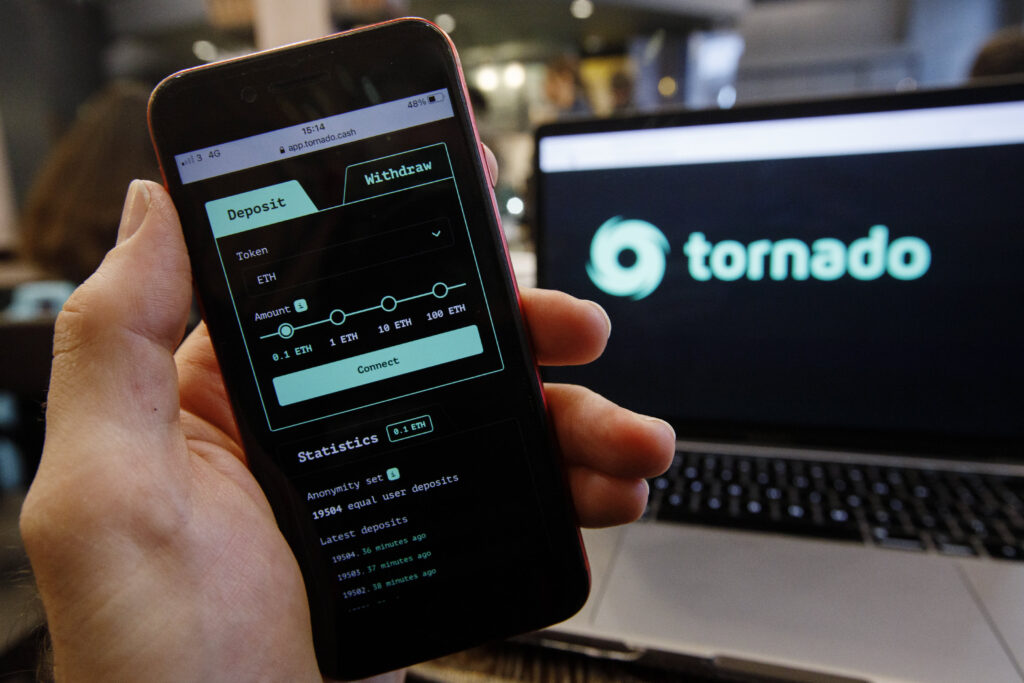

Tornado Cash developer Alexsey Pertsev will remain detained for a further three months in the Netherlands, a court hearing on 22 November revealed.

To date, Dutch authorities have detained Pertsev for 103 days.

According to the hearing, which took place at the Palace of Justice in ‘s-Hertogenbosch, prosecutors stated Pertsev was central to Tornado Cash’s business.

WK Cheng defended Pertsev, stating the embattled company’s use cases and attempting to clear up misunderstandings from its operations.

During the trial, prosecutors officially accused him of money laundering, citing Tornado Cash’s protocol code.

Meanwhile the Tornado cash dev still sits in jail… https://t.co/NREbBBdZXY

— Coin Bureau (@coinbureau) November 24, 2022

Pertsev, from Moscow, Russia, is a flight risk and will not be released on bail, Dutch courts said. Dutch Public Prosecutor Martine Boerlage argued that Pertsev had complete control of the crypto platform.

Boerlage added that Pertsov and two additional developers, Semenov and Storm, held sufficient governance tokens to “always outvote everyone else” in proposals.

The US Treasury sanctioned Tornado Cash for alleged use from North Korean hackers laundering over $1 billion in digital assets, leading to Pertsev’s arrest in mid-August.

The Netherlands Public Prosecution Service said in a statement at the time: “On August 24th the Den Bosch District Court held a session regarding the [pre-trial] detention of the suspect. The courts chamber consisted of three judges, they heard the public prosecutor on the investigation and the suspicion. They also heard the defense. Afterwards the court decided to extend the pre-trial detention of the suspect by 90 days.”

The arrest has triggered outcry among open-source developers creating Web 3.0 platforms, many of whom are concerned how code will be used. Many have also slammed the detention as unjust, adding that disgraced former chief executive of the bankrupt FTX platform, Sam Bankman-Fried, remains at large and is still active in the crypto community after millions of customers lost their crypto holdings.

Genesis Global Capital, a crypto lending company, has hired restructuring advisors to discuss a possible bankruptcy, reports revealed on Tuesday.

The firm has sought advice from investment bank Moelis & Company to discuss its options, adding it has not made a final decision on the matter, a 22 November New York Times report claims, citing sources familiar with the matter.

The investment firm also worked with Voyager Digital after the latter suspended transactions in early July this year, citing the need to explore “strategic alternatives” just days ahead of its bankruptcy.

The company filed Chapter 11 bankruptcy in New York to restructure and “return value to customers,” it said at the time.

We have hired the best advisors in the industry to explore all possible options. Next week, we will deliver a plan for the lending business. We’re working tirelessly to identify the best solutions for the lending business, including among other things, sourcing new liquidity.

— Genesis (@GenesisTrading) November 16, 2022

In a statement to numerous media outlets, a Genesis spokesperson said: “We have no plans to file bankruptcy imminently. Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. Genesis continues to have constructive conversations with creditors.”

According to sources, the troubled lending firm is seeking from $500 million to $1 billion to tackled issues from “unprecedented market turmoil,” namely the collapse of cryptocurrency trading exchange FTX.

Bloomberg reported on 22 November that Genesis owes creditors $2.8 billion. Roughly 30 percent of the loans funded “related parties” such as its parent company Digital Currency Group and its affiliate and lending wing, Genesis Global Trading. Grayscale Investments has also been affected.

Digital Currency Group owes roughly $575 million to Genesis Global Capital by May 2023, a letter from the former’s chief executive Barry Silbert read.

8) We have compiled more information for investors on our website. We hope to alleviate any potential uncertainties and reaffirm the safety and security of the assets underlying Grayscale’s products. https://t.co/MvTfUoKCdE

— Grayscale (@Grayscale) November 18, 2022

Grayscale Investments tweeted to investors: “the safety and security of the holdings underlying Grayscale digital asset products are unaffected”

Silbert also stated that his firm was set to receive $800 million USD in earnings this year, adding: “We have weathered previous crypto winters and while this one may feel more severe, collectively we will come out of it stronger.”

The Argentine Football Association Fan Token (ARG) has sunk over 30 percent after the team lost to Saudi Arabia in a surprising 2-1 match.

Fans initially priced the token $7.21 at the match’s start, but as it unfolded, the price soon plummeted 31 percent to roughly $4.96 at the end of the competition, data from CoinGecko showed.

It later climbed to $5.22 hours after the match, figures revealed. Conversely, the non-fungible token (NFT) “The Saudi” spiked 52.6 percent to 0.3 Ether (ETH), then later fell to 0.225 ETH.

Following Argentina’s loss today against Saudi Arabia, in the 2022 World Cup in Qatar, $ARG‘s fan token momentum plummeted more than 30%. At the same time, The Saudis’ NFT collection rose. pic.twitter.com/xGJSSzCfYl

— NekoZ (@NekozTek) November 23, 2022

Several key football tokens use the Socios blockchain shared by major football clubs such as Manchester City, Barcelona, and Paris Saint-Germain, among others. Holders of the coins can join decisions and receive rewards from the respective sponsoring teams.

One of the largest sports-themed cryptocurrencies is Chiliz (CHZ), which fell to $0.1764 around 5:30 on Wednesday near the match.

Influences on the crypto coins include team performances and regular market activities. Despite this, the ongoing cryptocurrency crisis forced multiple sports-linked tokens to plummet in value.

Algorand, a major proof-of-stake cryptocurrency platform, sponsored the FIFA World Cup from May to mid-December this year, the first-ever blockchain to do so.

Defunct Bitcoin cloud mining firm HashFlare has seen two of its two founders detained in Estonia due to charges of cryptocurrency fraud totalling $575 million, reports found this week.

A United States Department of Justice statement cited court documents that the operation was a “multifaceted scheme [that] defrauded hundreds of thousands of victims.”

Created in 2015, Founders Sergei Potapenko and Ivan Turõgin provided customers with leasing options for its hashing power. Customers would use them to mine crypto and receive shares of profit from the operations. The company later shut down most of its operations in July 2018, according to reports.

The company then halted BTC mining operations and cited problems with revenues due to market fluctuations, but failed to reimburse customers for remaining contract fees. It last publicly stated on 9 August 2019 that ETH contracts had been suspended as the “current capacity has been sold out.”

The enterprise slowly ceased activities but failed to publicly state the circumstances leading up to its collapse. The events triggered a Federal Bureau of Investigation (FBI) case involving victims of HashFlare, HashCoins OU, and Polybius.

What are the Charges?

The charges stated the company was a “massive [crypto mining] operation” but had mined coins at just 1 percent of its stated capacity. It paid out withdrawals to clients with third-party Bitcoin (BTC) purchases.

It added the firm convinced targets to enter “fraudulent equipment rental contracts” and persuaded others to invest money into Polybius Bank, an invalid cryptocurrency bank, which provided SHA-256 Bitcoin and scrypt ETHASH Ether, among others.

The statement also read the two businessmen laundered “criminal proceeds” with numerous items, including luxury vehicles, crypto wallets, mining machines, and roughly 75 properties.

Charges indicated in the case include 16 counts of wire fraud, conspiracy to commit wire fraud, and one count of conspiracy to commit money laundering via shell companies and fake invoices and contracts.

If found guilty, the two founders may face up to 20 years in the Western District of Washington case.

Comments on HashFlare Case

Assistant Attorney General Kenneth A Polite Jr of the Justice Department’s Criminal Division, said in a statement,

“New technology has made it easier for bad actors to take advantage of innocent victims – both in the U.S. and abroad – in increasingly complex scams. The department is committed to preventing the public from losing more of their hard-earned money to these scams and will not allow these defendants, or others like them, to keep the fruits of their crimes.”

According to US attorney Nick Brown, the scheme was “truly astounding,” adding: “These defendants capitalized on both the allure of cryptocurrency and the mystery surrounding cryptocurrency mining, to commit an enormous Ponzi scheme.”

The news comes as now-defunct cryptocurrency exchange FTX faces scrutiny from US authorities, namely as disgraced former CEO Sam Bankman-Fried remains in the Bahamas.

The cryptocurrency exchange faced a huge liquidity crisis, leading to FTX, research wing Alameda Research, and nearly 130 affiliates to file Chapter 11 bankruptcy, sparking outrage from investors.