Solana (SOL) has recently recouped some of its losses after nosediving to its lowest price since February last year.

The cryptocurrency spiked to roughly $10.25, or 20 percent, from the day before, where it remained at around $8 USD.

The ongoing crypto bear market has seen SOL plummet from its top price of $267.50 in November 2021 – a 97 percent drop – along with other poor-performing cryptos such as Terra/LUNA and FTT.

Despite this, SOL could potentially jump to new levels in 2023 due to an upward trend in its performance. This is marked by a Doji, or candlestick trend after assets open and close roughly the same, and in a set timeframe, with Solana’s noted on 29 December.

This could see SOL reach around $15 USD, or a rise of 50 percent, which it reached on 13 November.

High Hopes for 2023

The news comes amid several severe challenges in the cryptocurrency industry, including the collapse of three major cryptocurrency exchanges – FTX, Three Arrows Capital, and Voyage – sending crypto prices plummeting and eroding trust in the crypto market.

Additionally, Solana faced federal crackdowns on digital coins and a massive hack, with the latter costing the company roughly $200 million USD.

1/ It's #SolanaSolstice once again ☀️ 2022 was the year for shipping and scaling — and building the real-world tools that will onboard millions of users.

— Solana (@solana) December 21, 2022

Here's why you can bet on the Solana community in 2023 https://t.co/iUQnppvEU1 🧵 pic.twitter.com/X7r2mHJmAL

According to a 21 December Solana Solstice report, the crypto platform wrote that there had “been the highs of Breakpoint and the lows of the volatile market.”

It said at the time: “Throughout it all, the Solana community has only gotten stronger — and kept their heads down to keep on building.”

It cited numerous accomplishments such as its Solana Mobile Stack and Solana Mobile’s Saga device for conducting activities via dApps.

It also noted growing adoption from tech giants such as Google Cloud, who supported a “block-supporting Solana validator.” It also backed a “Blockchain Node Engine to Solana” to allow users to run cloud-based validators.

Bitcoin cheerleader Nic Carter has published data detailing proof-of-reserves (PoR) activity from major centralised cryptocurrency exchanges.

According to his analysis, Carter monitored attestation to assets held, liabilities, third-party auditors, among others, to determine the top exchanges for PoR.

Crypto exchanges Kraken and BitMex were ranked the highest on the list. His analysis found that Kraken hired Armanino for its PoR and offered clients a “good level of confidence” against hidden liabilities while re-evaluating its operations every six months.

no one asked for it, but here it is anyway: my 2022 Proof of Reserve year in review https://t.co/x6UjmHTrms

— happy nic year (@nic__carter) December 29, 2022

BitMEX, the second-highest crypto platform, utilised transparent operations models for assets, liabilities, and PoR verification.

Regarding assets, it listed its Bitcoin (BTC) holdings along with liquidity data verified by the BitMEX multisignal. It also published full Merkle tree data of user wallets.

Binance Ranking, Rebuttal to FUD Claims

Conversely, Binance scored lower on the rankings chart, indicating the Chinese-owned cryptocurrency exchange’s data was not complete.

He accused Binance’s Changpeng Zhao (CZ) of urging exchanges to post PoR but had not “yet risen to his own challenge.”

He added: “Binance’s first PoR doesn’t grant strong assurances. It only covers Bitcoin, which only represents 16.5% of their client assets.”

Binance Rebuttal to FUD Claims

Despite the accusations, Binance posted a seven-point rebuttal to accusers stating the company failed to live up to transparency and PoR expectations.

The world’s largest crypto platform hit back at such claims, citing accusations on its stablecoin consolidation, liquidity, and reserves, among others. It later verified in a CryptoQuant audit that its reserves were 99 percent accurate.

Sam Bankman-Fried, the disgraced former chief executive of the now-bankrupt FTX cryptocurrency exchange, has reportedly withdrawn a huge sum of digital coins from an offshore account.

According to on-chain data from decentralised finance (DeFi) watchdog BowTieIguana, the FTX founder has taken out $684,000 of his cryptocurrency funds from a crypto exchange in Seychelles despite remaining under house arrest.

The crypto analyst tweeted on Thursday that several wallet transactions had taken place, which Bankman-Fried allegedly withdrew at the time. This could indicate that he had violated his bail conditions to avoid spending over $1,000 without court approval.

Did disgraced crypto founder Sam Bankman-Fried just cash out $684k to a crypto exchange in the Seychelles while under house arrest?

— BowTiedIguana (@BowTiedIguana) December 30, 2022

His release conditions are that he not spend more than $1,000 without permission from the court.

Let's examine the evidence on chain 👇

The analysis also found that SBF transferred all remaining Ether (ETH) from his public address (0xD5758) to a new account (0x7386d), BowTiedIguana revealed.

Sushiswap had formerly owned the new account in August 2020, which received up to $367,000 from 32 Alameda Research crypto wallets.

It also received a further $322,000 from additional wallets and later transferred it to the Seychelles-based wallet exchange and a second to crypto bridge RenBridge.

BowTiedIguana also found a further five transactions at 51 ETH each, totalling ($61,000), moved to new wallets and later to the “Seychelles-based exchange.”

SBF’s wallet at address 0x64e9B later sent over three transactions of Tether (USDT) at 200,000 each to cryptocurrency exchange FixedFloat.

BowTiedIguana said in a tweet: “As the Ethereum blockchain is an immutable public ledger, this on-chain evidence is permanently available to law enforcement and the courts,”

The watchdog later urged authorities from the United States Securities and Exchange Commission (SEC) and others to look into the matter.

The Usual Suspects?

According to Conor Grogan, Coinbase’s strategy chief, the transactions were linked to previous Sushiswap activities.

In total I found 10+ wallets with 100s of millions of $SUSHI activity on them, across 500+ transactions pic.twitter.com/RxbeSkB1Ou

— Conor (@jconorgrogan) December 30, 2022

He said in a tweet: “These wallets — assuming they all belong to him — were heavily involved with LPing Sushi early on, well before Chef Nomi handed off the project to SBF.”

5) Sushiswap was built, and then it broke.

— SBF (@SBF_FTX) September 15, 2020

And then a bunch of people devoted their time to trying to fix it.

Many have spent sleepless nights on Discord, or Github, doing everything they can to help Sushi. They’ve devoted a lot more time than I, with no compensation.

Despite this, SBF had previously stated in September 2020 he had nothing to do with building the Sushiswap platform, contradicting Grogan’s statement.

Additionally, Bahamian authorities announced on 12 November that they had taken possession of $3.5 billion USD in FTX cryptocurrency to avoid an “imminent dissipation” of funds linked to alleged cybersecurity attacks on the FTX exchange.

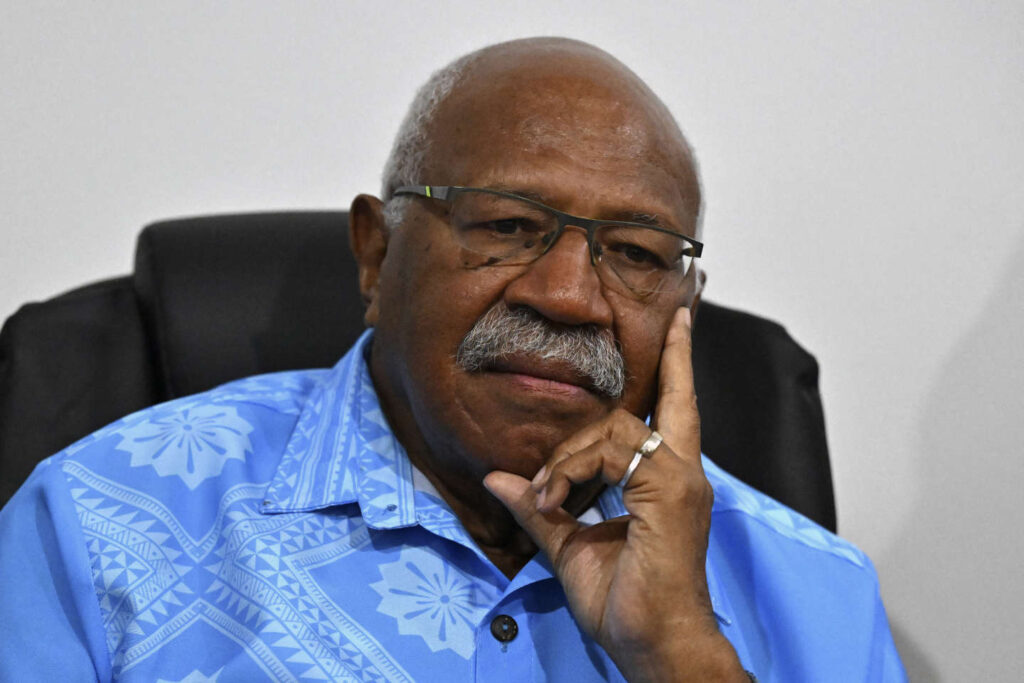

A Pacific Island nation has adopted a pro-Bitcoin prime minister.

Tongan native Lord Fusitu’a assumed office on 24 December and tweeted support for Fiji’s Bitcoin adoption. In the recent past, Tonga set new regional records by using Bitcoin as a legal tender.

According to the new prime minister, he believes that “Fiji can do bitcoin legal tender like Tonga” and that there would be two “Legal Tender Bills for the Pacific in 2023.”

A new pro-#Bitcoin friendly Prime Minister in the South Pacific.☀️🌊🏝️

— Lord Fusitu'a (@LordFusitua) December 29, 2022

Fiji 🇫🇯‘s newly elected Prime Minister @slrabuka.

Let’s go 2 for 2 – BTC Legal Tender Bills for the Pacific in 2023 👊🏽💯🇹🇴🇫🇯

Due to economical and geographical differences, Tonga and Fiji face challenges to building their economies and national development agendas. Bitcoin adoption aims to boost financial inclusivity to eliminate high poverty, crime, and fossil fuel reliance rates.

Similar countries such as El Salvador and the Central African Republic (CAR) have passed similar measures for crypto to become a nationally-recognised legal tender.

One of the advantages to Fiji is its use of geothermal and volcanic power, which the nation can use for its Bitcoin mining activities, offering a competitive advantage over Tonga.

Sounds great👊🏽.

— Lord Fusitu'a (@LordFusitua) December 29, 2022

Our economies similar in some aspects:

-Archipelagos with an agriculture,fisheries & tourism base;

-But also vastly different in others.

-Fiji:

-10x our size [100K vs 1m]

-Mineral deposits

-Massive hydro & renewables

-Thriving stock exchange & business sector)

Lord Fusitu’a continued: “Like Tonga, how to do nationalized Bitcoin mining, specifically how we were going to do geothermal volcano mining so they could both do the same but also make use of their massive hydro and other renewable stranded energy they have, which we don’t.”

The news comes amid the archipelagic country’s National Development Plans to provide only renewable energy to all islands by 2030. The country must generate an additional 120 megawatts to reach its goal, which authorities aim to achieve with Bitcoin mining.

Roughly three of four transactions across unregulated exchanges are fakes, new research has revealed amid the ongoing FTX collapse.

According to the National Bureau of Economic Research’s (NBER) Crypto Wash Trading working paper, more than 70 percent of 29 studied exchanges were wash trades.

Vertically integrated centralized exchanges can, when unregulated, fake, on average, over 70% of the reported volume to improve ranking and attract users, from Lin William Cong, Xi Li, Ke Tang, and Yang Yang https://t.co/cgwBbScOgf pic.twitter.com/wZQmwRqrSc

— NBER (@nberpubs) December 28, 2022

Researchers categorised each exchange in the findings with statistical and behavioural studies. It explained that wash trading on some tier-2 exchanges had reached up to 80 percent of total trading volumes.

The report read: “These estimates translate into wash trading of over 4.5 trillion USD in spot markets and over 1.5 [trillion] USD in derivatives markets in the first quarter of 2020 alone.”

Research from the paper also explained the short-term incentivisation of wash trading, adding fake transactions impacted exchange rankings for websites like CoinMarketCap. It also hit cryptocurrency prices in the short term on such exchanges.

Explaining further, it said that exchanges established over longer periods and with larger numbers of users wash traded less.

Thank you for doing research on this.@NoCryptFish has also shown that Bitfinex is faking their USDT trading volume. Seems as though only market makers are the ones making the trades over there.https://t.co/N3Q36tqH7c

— Cryptohippo (@cryptohippo65) December 28, 2022

It read: “We find that an exchange’s wash trading is positively correlated with its cryptocurrency prices over the short term. We also find that exchanges with longer establishment histories and larger userbases wash trade less. Less prominent exchanges, in contrast, have short-term incentives for wash trading without drawing too much attention. Moreover, wash trading is positively predicted by returns and negatively by price volatility.

The news comes amid the ongoing FTX bankruptcy, where the exchange platform, its research wing Alameda Research, and 130 affiliate companies filed for Chapter 11 bankruptcy in November.

Its disgraced former chief executive, Sam Bankman-Fried, has been extradited to the United States following the platform’s collapse. He has been released on $250 million bail and awaits multiple charges involving misappropriation of funds and monetary fraud, among many others.

Former FTX chief executive Sam Bankman-Fried reportedly borrowed more than $546 million from subsidy research firm Alameda Research to buy Robinhood shares, later used for collateral to receive a loan from bailout provider BlockFi.

The Antigua and Barbuda High Court received Bankman-Fried’s affidavit on 12 December was publicised on 27 December. The document showed that he and Zixiao “Gary” Wang had received loans via four notes from April to May.

The firm received the four loans valued at $316.6 million, $35.1 million, $19.4 million, and $175 million. Bankman-Fried and Wang received the first two on 30 April and latter two on 15 May, respectively.

Bankman-Fried later funded Emergent Fidelity Technologies Ltd, his shell company based in Antigua, used to buy 7.6 percent of total shares from Robinhood, totalling $648 million, in May.

The news could cause troubles as the company battles for its acquired Robinhood shares worth more than 56 million, worth roughly $430 million.

Conversely, BlockFi has launched a countersuit against Emergent, stating the firm had used the loans money for collateral for its BlockFi loans on 9 November.

In a plea deal, former Alameda chief executive Caroline Ellison said in a 23 December testimony that Alameda had been “borrowing funds that FTX’s customers had deposited onto the exchange.”

The news comes after FTX requested US judges to block BlockFi from receiving the money, just shortly after Sam Bankman-Fried’s two main firms filed for Chapter 11 bankruptcy in November. FTX argued in the case that laws protected it from debt collectors.

Several debates over the value of cryptocurrencies such as Bitcoin and gold have erupted across media. One discussion involved Dallas Mavericks owner Mark Cuban and Bill Mahar on his 26 December Club Random podcast.

In the talks, he staunchly backed Bitcoin over gold, stating he was “rooting for Bitcoin.”

Mark Cuban: If you have gold you’re dumb as f*ck. Just get bitcoin. 😮 #bitcoin pic.twitter.com/sKt1cWuKsR

— Neil Jacobs (@NeilJacobs) December 27, 2022

He said: “I want Bitcoin to go down a lot further so I can buy some more [..] If you have gold, you’re dumb as fuck.” He concluded that people should “just get Bitcoin.”

Despite some lauding his comments, others voiced outrage on social media, slamming him for his alleged lack of knowledge of virtual currencies.

Peter Schiff, chief economist and global strategist for Euro Pacific Asset Management, hit back at his comments. He said:

“After Bitcoin crashes I hope [Mark Cuban] does buy more as he told [Bill Mahar] he would. It’ll give others an opportunity to sell. His lack of understanding of Bitcoin is only exceeded by his lack of understanding of #gold. He proves that you don’t have to understand money to make it.”

Stalwart Crypto Supporters

The news comes after

In late November, US lawmaker Cynthia Lummis doubled down on her support for including Bitcoin and other currencies in her 401(k) retirement plans, despite backlash from other Senators.

In a Semafor article, she stated that she was “very comfortable” with allowing people to include Bitcoin in retirement funds, adding, “it’s just different than other cryptocurrencies.”

Pershing Square Capital Management founder Bill Ackman also tweeted support for cryptocurrencies amid the ongoing aftermath of the FTX scandal.

In late November, he said the “crypto is here to stay” but added regulators should tighten restrictions and remove “fraudulent actors.”

He added: “I am making the case that crypto can facilitate potentially useful and important businesses that heretofore could not exist. That said, the success of any individual project is a function of the ultimate.”

Bitcoin (BTC) miners publicly listed on exchanges have sold nearly their entire mined BTC in 2022, sparking discussion on the gains for Bitcoin prices previously stated in media reports.

According to Tom Dunleavy, an analyst for Messari, a blockchain research company, cryptocurrency miners sold roughly 40,300 out of 40,700 BTC mined in the crypto space.

Involved crypto miners include Riot, Core Scientific, Marathon, Hive, Bit Digital, and others, with transactions taking place from 1 January to 30 November this year.

BTC miners sell roughly 100% of the coins they mine

— Tom Dunleavy (@dunleavy89) December 26, 2022

The 10 public bitcoin miners

detailed here mined ~40.7k BTC and sold ~40.3k in 2022

This is a persistent headwind for BTC and for no other reason a good thesis to be bullish the ETHBTC ratio trade pic.twitter.com/L1iI6Z07p7

This has significantly lowered reserves in the second half of the year, with lows peaking in November due to the ongoing FTX collapse. This has caused Bitcoin prices to slump, Dunleavy added.

Despite this, numerous reports have evidenced Dunleavy’s claims, with Bitcoin Visuals noting on 26 December that Bitcoin’s daily trade volumes topped $12.2 billion. Conversely, CryptoQuaint figures showed outflows reached $15.35 million the same period, or 0.13 percent of total trading volumes.

December saw miner reserves recover by roughly 1 percent despite ongoing challenges such as skyrocketing electricity costs, a turbulent crypto market, several collapsed cryptocurrency platforms such as FTX, and increasing difficulty mining digital coins.

Core Scientific Sell-Off

The news comes after numerous mining firms were forced to sell reserves for their operations and expansion plans, namely due to declining hash rates, reports have shown.

Core Scientific, one of the biggest firms to date, sold 9,618 in Bitcoin in April 2022 to cover the costs of plummeting revenues.

Bitcoin's global hashrate dropped by an estimated 40% during the polar blast that swept across the US. Many miners voluntarily suspended operations to help stabilize the grid; the network has already recovered half of the observed loss. pic.twitter.com/9jJKAv3dX5

— Jameson Lopp (@lopp) December 26, 2022

It reportedly filed for Chapter 11 bankruptcy despite efforts to bail out the embattled company. While facing its earnings crisis, it stated it would continue cryptocurrency mining operations.

B Riley proposed a $72 million non-cash lifeline as Core Scientific nosedived from $4.3 billion USD in July 2021 to $78 million as of December.

Ethereum (ETH) has provided investors with substantial capabilities to determine levels of compliance amid current efforts to regulate cryptocurrency markets, reports show.

Sanctions in the United States Office of Foreign Assets Control (OFAC) have forced compliance for roughly 60 percent of Ethereum blocks after the Merge update.

This major compliance rate has allowed Ether to receive a high degree of compliance. Data shows that 67 out of 100 Ethereum blocks had forced compliance with OFAC regulations.

Miner’s Remorse?

Ethereum’s censoring capacity on miner extractable value (MEV) relays has caused speculators to question the blockchain ecosystems’ neutrality, reports show.

Currently, Binance, Coinbase, Kraken and others use MEV relays, which mediate between block producers and builders, on their platforms. Censorship in the blockchain ecosystem has sparked other cryptocurrency platforms to develop non-censoring MEV-boost relays to mitigate the issue.

Non-censoring platforms for validators and relay operators include Aestus, Ultra Sound Money, BloxRoute Ethical, Manifold, and others.

Ethereum ‘Scourge’ Combats Censorship

The news comes after Ethereum co-founder Vitalik Buterin announced in November he would add his Scourge technical roadmap to the cryptocurrency.

The update aimed to boost the platform’s proof-of-stake network to provide “reliable and credibly neutral transaction inclusion” while avoiding protocol risks from MEVs. This hopes to combat miners exploiting transactions on the network and censoring investors, reports showed at the time.

Bitcoin (BTC) hit a fresh six-month low for exchange outflows over the holiday season, Glassnode data shows.

BTC volatility indexes have reached a new low after users adopted the cryptocurrency following trends in the ongoing bear market. The ongoing FTX bankruptcy and crisis have also failed to slow down cryptocurrency withdrawals and outflows.

Glassnode data also showed outflow peaks of around 143,000 BTC but have subsided tenfold from 14 November, when FTX filed for Chapter 11 bankruptcy, to 25 December.

Christmastime saw outflows slow to just 9,352 BTC, nosediving to 93.5 percent. On-chain data also reveals a trend of holding onto coins and a stronger conservative approach to transactions.

According to a HODL Waves metric, based on unspent transaction outputs (UTXOs) categorised by age, users have begun moving coins, featuring wallets unused for one to two years, in December.

The news comes after PeckShieldAlert noted a massive transfer from accounts on crypto trading platforms Poloniex and Genesis, totalling 9.878 Ether (ETH) and 13,103 ETH, respectively.

The account transactions took place on 19 December and had not seen any activities for roughly four years, triggering speculation across social media.