A staggering 3 trillion Shiba Inu tokens, valued at approximately $50 million, were recently transferred to a wallet named after the popular trading platform Robinhood.

This transfer coincides with a remarkable surge in SHIB’s value, experiencing a 70% increase within a mere 24-hour period.

Whale Alert detected the transaction, announcing on X the transfer of 3,023,255,579,400 SHIB tokens from an unidentified wallet directly to the address labeled “Robinhood.”

Following this substantial transfer, SHIB surpassed many leading cryptocurrencies, including Bitcoin and Ethereum, in terms of price performance.

SHIB even outpaced DOGE, climbing to the 11th position in global market capitalization rankings, boasting a valuation exceeding $12.8 billion.

As of the time of writing, SHIB’s price has surged by 62.62% over the past day, reaching $0.00002158.

READ MORE: Hong Kong Halts Crypto Exchange License Applications

This surge positions the meme coin for its most impressive weekly close since October 2021, marking a remarkable 129% increase, according to CoinMarketCap data.

Analysts attribute SHIB’s price explosion to several key on-chain activities observed days before the rally.

One notable transaction involved a “smart trader” purchasing 75.91 billion SHIB from Binance, resulting in over $614,000 in profit.

MakerDAO co-founder Rune reportedly made his first SHIB purchase with 100,000 USDC, gaining approximately $47.1 billion.

Additionally, a wallet under the name of Upbit amassed 2.13 trillion SHIB, now valued at $42.3 million, further propelling the token’s ascent.

As the cryptocurrency community buzzes with excitement over SHIB’s unexpected rally, market observers are closely monitoring “Robinhood’s” next moves, speculating on the impact this significant acquisition could have on SHIB’s future market performance.

London-based Jacobi Asset Management has unveiled Europe’s inaugural spot Bitcoin exchange-traded fund (ETF), designating it an Article 8 fund under the European Sustainable Finance Disclosure Regulation (SDFR).

Article 8 funds are recognized for their emphasis on “environmental and/or social characteristics.”

The pioneering Jacobi FT Wilshire Bitcoin ETF, launched on the Euronext Amsterdam stock exchange on August 15, signifies Europe’s maiden Bitcoin ETF and aligns with the European Union’s guidelines for environmental, social, and governance (ESG) investments.

According to an August 29 report by Bloomberg, Jacobi Asset Management’s CEO Martin Bednall labeled the ETF as “fully decarbonized,” attributing this classification to its investment in renewable energy certificates (RECs).

However, skepticism arose among academic experts consulted by journalists, who pointed out a seeming paradox: the ETF’s Bitcoin assets possess such high energy demands due to the energy-intensive nature of Bitcoin mining that the volume of RECs needed to offset these demands could potentially surpass the energy consumed by the Bitcoin holdings themselves.

READ MORE: Hashdex Challenges Status Quo with Innovative Approach in Pursuit of Bitcoin ETF Approval

The Jacobi FT Wilshire Bitcoin ETF’s launch transpired over a year later than initially intended in 2022.

Marketed as the leading physically-backed Bitcoin fund, the ETF offers investors an avenue to engage with a financial instrument supported by actual Bitcoin assets.

Since inception, Jacobi Asset Management has consistently underscored the ETF’s eco-friendly profile.

The fund employs external data to estimate the energy consumption of the Bitcoin network, subsequently procuring and retiring RECs.

These certificates are monitored via a blockchain platform, empowering investors to verify the ETF’s assertions of its environmentally conscientious practices.

Other Stories:

Casino Gender: Which Games Do Men and Women Prefer?

Former FTX CEO Sam Bankman-Fried’s Legal Team Deems Trial Preparations Inadequate

Three Former Team Members Accused of $16 Million Theft from Pepecoin (PEPE) Multisig Wallet

Eighteen prominent venture capital (VC) investment firms, including Temasek, Sequoia Capital, Sino Global, and Softbank, are now defendants in a class-action lawsuit that has been lodged in the United States District Court for the Northern District of California.

This lawsuit is connected to their involvement with the defunct cryptocurrency exchange FTX, which has gone bankrupt.

Filed on August 7th, the lawsuit alleges that these investment firms played a role in “aiding and abetting” the fraudulent activities linked to FTX.

The suit asserts that these entities utilized their significant influence, power, and substantial resources to facilitate the rapid expansion of FTX’s fraudulent practices, which led to its eventual multibillion-dollar collapse.

The lawsuit contends that FTX, the cryptocurrency exchange, violated multiple securities laws and engaged in misappropriation of customer funds.

Simultaneously, the venture capital firms in question portrayed an inaccurate image of the exchange, asserting that they had diligently conducted their assessments.

As a result, the lawsuit claims that these VC firms were directly involved in the “perpetration, conspiracy, and aiding and abetting” of FTX Group’s substantial fraudulent activities, all for their personal financial gain.

READ MORE: PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

In the lawsuit’s discussion of the VC firms’ role in facilitating FTX’s fraudulent practices, the plaintiffs highlight Temasek’s involvement and its statements regarding the financial status of FTX.

Temasek maintained that it underwent an extensive eight-month review of FTX’s financial records, audits, and regulatory compliance, finding no concerning indications. The lawsuit reads:

“The multinational VC defendants also propagated numerous false and deceptive statements about FTX’s operations, finances, business, and future prospects to entice customers into investing, trading, and depositing assets with FTX.”

The lawsuit further alleges that these VC firms endorsed FTX’s stability and safety, showcasing the exchange’s purported efforts to attain proper regulation.

One of FTX’s initial investors was Temasek, which invested $275 million.

However, following the cryptocurrency exchange’s collapse in November 2022, Temasek completely wrote off its investment and even reduced compensation for the executives responsible for the FTX investment.

Singapore-based Temasek’s involvement also casts a spotlight on the Singaporean government’s lack of oversight.

FTX’s downfall had a domino effect within the cryptocurrency industry, triggering doubts about the entire crypto ecosystem and leading to a prolonged dearth of institutional crypto investments for several months.

Other Stories:

Binance’s Proof-of-Reserves Discloses Strong Financial Position

Governments Remain Wary About Worldcoin Amid Privacy Concerns

XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

Non-fungible tokens (NFTs) have been making waves globally in recent years, primarily in the realm of art. However, their potential extends far beyond digital collectibles. NFTs can represent ownership of real-world assets, act as collectibles, or serve as a representation of privilege.

While the art NFT bubble has somewhat maligned the reputation of these assets at the mainstream level, we are now beginning to see new and fascinating uses of the technology. The travel industry, in particular, has showcased immense potential in harnessing the power of NFTs. Companies like Arakis are exploring the potential of these digital assets to revolutionize the way we travel and experience travel.

A Closer Look at NFTs and Their Potential

Non-fungible tokens (NFTs) are continually revamping the concept of ownership. They help democratize access to valuable assets by enabling fractional ownership of various items or experiences. The decentralized nature of NFTs empowers individuals with full control over their assets by eliminating the need for intermediaries. This not only minimizes risks such as fraud or insolvency but also enhances transparency, as every transaction is recorded on the blockchain, a public ledger accessible to all.

NFTs can represent both digital and real-world assets, opening up new possibilities. The technology is reshaping the landscape by offering a secure, transparent, and democratic model, breaking down barriers and empowering individuals with full control over their assets. As we continue to explore its potential, it’s clear that NFTs are not just a trend; they are the future of ownership.

Transforming the Travel Industry

The potential of Non-Fungible Tokens (NFTs) in the travel industry is vast and largely untapped. In this regard, the Revenue Sharing Token (RST) model, pioneered by blockchain-based travel platform Arakis, stands to unlock a multitude of new use cases for NFTs. This innovative blueprint can be replicated across various industries, creating a universally accessible way for individuals to participate in profit-sharing without the need for substantial upfront capital.

Arakis’ model allows travelers to facilitate bookings directly with suppliers, while individuals can receive commissions on all orders made via the platform for the RSTs they own. This creates a digital marketplace for trading and reselling room bookings and memorabilia. Moreover, by purchasing an RST, individuals can earn a share of the profit each time someone books a room at a specific location through the Arakis platform.

Semil Vithani, founder of Arakis, believes that the future of travel could be significantly transformed by the integration of NFTs. Potential developments include the introduction of NFT passports, which could streamline check-ins and border control processes, and NFT-based loyalty programs, which could offer a more flexible and user-friendly rewards system.

Moreover, the concept of fractional ownership, facilitated by NFTs, could extend to high-value travel assets such as luxury vacation properties, private jets, or yacht charters. This would allow more people to access and enjoy these premium experiences by sharing the costs and benefits through NFT-based ownership structures. On the subject Vethani added:

“Arakis introduces a new way to participate in the travel industry. By owning RST, individuals can generate passive income while others are traveling, creating an innovative and rewarding experience for our users. Our platform introduces tradable rooms and loyalty points, elevating the travel experience while addressing the pain points of our customer and offering seamless journey experience with our one-click AI-powered itinerary booking.”

Semil Vithani, Founder of Arakis

The Future of NFTs and Travel

As we look to thefuture, the potential of NFTs in the travel industry is vast. From collectibles representing landmarks and cities to revenue-sharing tokens, the possibilities are endless. Arakis is at the forefront of this revolution, leveraging the power of blockchain technology to create a more transparent, rewarding, and enjoyable travel experience for everyone.

Vethani believes that as more and more people gravitate toward the use of such decentralized technologies, NFTs will continue to revolutionize several industries, including travel. “By providing digital tokens that represent rewards, points, or benefits we can create more efficient and seamless travel experiences for everyone on a global level,” he stated.

Therefore, as the tourism and travel sector continues to evolve, the integration of NFTs promises to bring about a new era of innovation and growth. With projects like Arakis leading the charge, the future of travel is set to become more transparent, equitable, and exciting. It’s not just about purchasing a product or service, but about participating in a new way of experiencing travel.”

Other Stories:

Ethereum Rallies, Looks To Breach Key Resistance Zone

Silvergate Capital, the parent company of the now-defunct Silvergate Bank, has announced its impending removal from the New York Stock Exchange (NYSE) and the termination of 230 employees.

The company revealed in a May 11 statement to the U.S. Securities and Exchange Commission (SEC) that the layoffs would begin on May 12. The NYSE has already halted trading of its stock, with a formal delisting anticipated to follow soon.

Following these layoffs, approximately 80 personnel, including officers and employees, will remain to manage the bank’s liquidation process.

Additional layoffs are anticipated, with three more rounds of workforce reduction scheduled for June 30, August 30, and November 30, or potentially later, according to the filing.

The company anticipates that the cost of reducing its workforce will be around $13.6 million, including expenses related to severance packages, retention and bonus payments, and employment placement programs.

In another SEC filing on May 11, Silvergate disclosed that it is unable to submit the legally required financial reports for the 2022 fiscal year and the first quarter of 2023. It also stated that it does not foresee being capable of submitting similar reports in the future.

The company attributed this inability to ongoing regulatory inquiries, investigations, and liabilities arising from legal action and the bank’s liquidation process.

Silvergate affirmed that it is in the stakeholders’ best interests to cut costs and expenses, including the termination of employees critical to preparing these reports, to maintain value.

Silvergate Capital had previously declared on March 8 that it would voluntarily liquidate Silvergate Bank. A few days prior, several cryptocurrency firms, such as Gemini, Coinbase, Galaxy Digital, and BitStamp, had severed their relationships with the bank due to a Justice Department investigation into alleged connections with the downfall of FTX.

Japan is set to create a panel of experts to explore developing and regulating a potential digital yen, reports revealed.

News outlet NHK wrote in its report the Japanese Finance Ministry hopes to develop a central bank digital currency (CBDC) framework based on a Bank of Japan (BoJ) technical study.

Despite this, the BoJ has said it has no “concrete plans” to launch a digital currency and would need time to outline “legal and framework issues” to create it, the report read.

It will also review opinions of the future panel prior to creating and introducing the digital yen, the report added.

The news comes as numerous global governments explore CBDCs. The United Kingdom has begun exploring frameworks and regulations for a digital pound. Further plans to amend its Financial Services and Markets Act (FSMA) 2000 are likely to enter force later in 2023.

Japan, South Korea, the United States, India, and the European Union have also entered the race to create CBDCs. Financial services and tax giant Moody’s has stated that CBDCs would diversify spending options for users and limit banking institutions and their role in the future.

Conversely, China has rolled out several iterations of its digital yuan programme for shoppers across the mainland. Recently, AliPay and WeChat Pay have facilitated payment systems for the rising digital state-backed cryptocurrency.

Circle, the firm behind USDC, remains the top stablecoin in circulation despite headwinds from the ongoing crypto bear market.

The cryptocurrency has bounced back from a difficult trading market after Silicon Valley Bank collapsed in mid-March, sending shockwaves across the cryptocurrency market.

However, the coin’s overall market capitalisation has fallen $10 billion USD over the last four months, data from Whalechart revealed.

Conversely, Tether (USDT) gained a massive $14 billion USD the same period. Embattled crypto giant Binance has also seen a $14.6 billion drop in the total market capitalisation of its native BUSD token.

Top Stablecoin Market Cap Over Last 4 Months

— whalechart (@WhaleChart) March 28, 2023

USDT : +$14B

USDC : -$10B

BUSD : -$14.6B pic.twitter.com/RfOUSEfrPQ

USDC and other stablecoins depegged following the news, triggering negative investor sentiment. Despite the setback, USDC reached 36 percent of all assets.

News from crypto lending firm MakerDAO revealed it had voted on USDC to become its top reserve asset backing its DAI stablecoin.

To date, USDC remains the fifth-largest coin by market capitalisation, data from CoinMarketCap revealed. At the time of writing, its market cap reached $32.8 billion USD with a price of $0.9999.

Following the collapse of Silicon Valley Bank, USDC lost its peg to the dollar and fell to record lows in mid-March. The firm aimed to calm investors and return the stablecoin’s 1:1 ratio with the US dollar.

The cryptocurrency had significant exposure to SVB assets, totalling $3.3 billion of its $40 billion of Circle’s USDC reserves at the now-defunct bank.

An open letter signed by Tesla, SpaceX, and Twitter chief executive Elon Musk, Apple co-founder Steve Wozniak, and over 2,600 tech experts has called for a pause on artificial intelligence (AI) development.

Citing “profound risks to society and humanity,” the open letter urged AI firms to “immediately pause” AI systems surpassing GPT-4 for a minimum of six weeks.

It read: “AI labs and independent experts should use this pause to jointly develop and implement a set of shared safety protocols for advanced AI design and development that are rigorously audited and overseen by independent outside experts. These protocols should ensure that systems adhering to them are safe beyond a reasonable doubt.”

It added the pause would not block AI development but would be a step back from the “dangerous race to ever-larger unpredictable black-box models with emergent capabilities.”

What’s in the Letter?

The United States-based think tank, Future of Life Institute (FOLI), published the letter on 22 March. Global AI experts also said, “human-competitive intelligence can pose profound risks to society and humanity.”

It continued: “Advanced AI could represent a profound change in the history of life on Earth, and should be planned for and managed with commensurate care and resources. Unfortunately, this level of planning and management is not happening.”

It also cited security threats such as flooding information channels with “propaganda and untruth,” corporate dominance of AI technologies, and automating jobs, among others.

Currently, OpenAI’s Chat GPT-4 is the latest version of its AI programme and is roughly 10 times more intelligent than the initial ChatGPT release.

Furthermore, Galaxy Digital’s chief executive, Mike Novogratz told investors he had been surprised over global governments’ focus on cryptocurrency regulations rather than AI.

He said in a 28 March shareholders call: “When I think about AI, it shocks me that we’re talking so much about crypto regulation and nothing about AI regulation. I mean, I think the government’s got it completely upside-down.”

Musk Views on AI at World Government Summit

The news comes after Musk voiced his concerns at a recent event in Dubai, where he said that AI was “one of the biggest risks to the future of civilization.”

At the World Government Summit, the tech giant explained that ChatGPT was “both positive or negative and has great, great promise, great capability.”

Musk, the co-founder of OpenAI which developed ChatGPT, added “with that comes great danger.”

He continued that the AI programme had “illustrated to people just how advanced AI has become. The AI has been advanced for a while, It just didn’t have a clear user interface that was accessible to most people.”

When asked about the lack of regulation on AI compared to other technologies, he concluded: “I think we need to regulate AI safety, frankly. It is, I think, actually a bigger risk to society than cars or planes or medicine.”

United States Federal Deposit Insurance Corporation (FDIC) chair, Martin Gruenberg, said his agency would return around $4 billion USD in Signarture Bank deposits.

The organisation aims to complete the transfers in early April. The exec specified the return would take place “by early next week.”

Gruenberg said in a speech at a US House Financial Services Committee on Wednesday that the FDIC would return deposits not included in the New York Community Bancorp daughter firm of Signature’s operation. Reports revealed that signature’s payment processing platform, Signet, was also excluded from the NYCB bid.

This morning, Chairman Gruenberg is addressing recent bank failures at a House Financial Services Committee hearing. Read his full statement: https://t.co/QOpS58TC4X. pic.twitter.com/TlOr5Q1dPB

— FDIC (@FDICgov) March 29, 2023

Initial reports showed that the FDIC could shutter its non-NYCB, crypto-linked accounts by 5 April if depositors failed to transfer their funds.

The news comes after New York regulators closed the bank after Silicon Valley Bank and Signature Bank collapsed in mid-March, citing economic risks.

At a 28 March hearing, Gruenberg stated that Silvergate Bank had failed to manage risks that triggered the bank’s failure.

He said at the time: “It is worth noting that these two institutions were allowed to fail. Shareholders lost their investment. Unsecured creditors took losses. The boards and the most senior executives were removed.

He added that the FDIC had the authority to “investigate and hold accountable the directors, officers and professional service providers[…] for the losses they caused to the banks and for their misconduct in the management of the banks.”

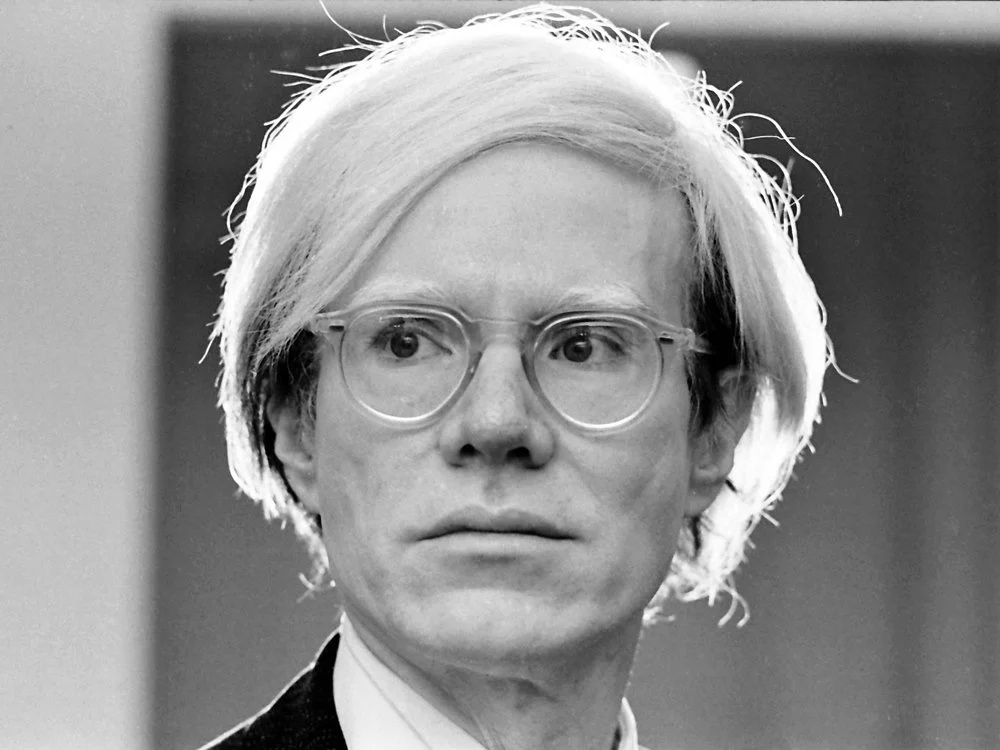

Upcoming blockchain-savvy platform Freeport will allow investors to buy four pop art masterpieces from legendary artist Andy Warhol.

The exclusive artworks are based on art from major art collectors and will include Warhol’s Double Mickey, Marilyn, Mick Jagger, and Rebel Without a Cause.

Freeport will sell each at 1,000 tokenised lots on the Ethereum blockchain, a press release read at the time. Coindesk originally broke the featured news on Wednesday.

Thanks for all the ♥️ on @ProductHunt !

— Freeport (@freeport_app) December 15, 2022

With the doors to our 3D gallery open, you can now pop in and check out the epic fine art on display – and connect your own wallet to customize your walls.

Head to the PH page for a walkthrough and more detailshttps://t.co/0v5nqLNQJr pic.twitter.com/oGjRAtzecy

Colin Johnson, Chief Executive and Co-Founder of Freeport, said his company was “beyond thrilled” to launch its platform to provide access to “once-exclusive world of fine-art investing.”

The statement continued: “As more and more value moves on-chain, fractionalized art is increasingly being sought after by a younger, yet less financially flexible, class of investors.

According to Jonnson, Freeport went “far beyond just fractionalizing shares of fine art into security tokens.” It will do so by building an immersive, interactive platform to host “an art-centric community” aimed at “redefining the ownership experience” in fractionalised art.