Chicago, Illinois, February 25th, 2025, Chainwire

Powerful momentum continues after a record-breaking testnet phase, more than $300 million in total value locked (TVL), and dozens of ecosystem launch partners.

Hemi, a modular blockchain network powered by Bitcoin and Ethereum, today announced that it will launch its mainnet on March 12, 2025.

Key Facts

- Launching its mainnet on March 12, Hemi is a modular blockchain network designed for superior scaling, security, and interoperability, unifying Bitcoin and Ethereum as a single supernetwork.

- Over fifty protocols will be deployed on Hemi, including decentralized exchanges (e.g., Sushi, DODO, Izumi), lending protocols (e.g., LayerBank, ZeroLend), vaults (e.g., Nucleus, Concrete, VaultCraft), top LSTs and LRTs (e.g., Kelp, pumpBTC, StakeStone), oracles (e.g., RedStone, Pyth, Stork), and key dApps (e.g., LayerZero, Pell, BitFi).

- Hemi has already attracted more than $300 million of Total Value Locked (TVL) and announced a $15 million seed round in September 2024, led by Binance Labs, Breyer Capital, and Big Brain Holdings.

- Hemi was founded by renowned early Bitcoin developer Jeff Garzik and blockchain security pioneer Max Sanchez.

The transition from testnet to mainnet is a major milestone for Hemi, which has already attracted more than $300 million in total value locked (TVL) and rapidly built an ecosystem of dozens of protocols. This positions Hemi as a vital infrastructure layer for decentralized finance across Bitcoin and Ethereum, enabling innovation and scalability across the blockchain space.

Through the protocols offered by Hemi’s early Day One ecosystem collaborators, users will be able to:

- build applications that are both Bitcoin- and Ethereum-aware;

- participate in lending and DEX liquidity provision, or allocate funds into specialized vault products;

- trade perpetuals;

- stake and restake popular BTC and ETH tokens;

- borrow, and swap tokens; and

- create synthetic assets.

In particular, Hemi’s DeFi ecosystem has a strong focus on providing liquidity and yield opportunities for many of the most popular liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) from the Bitcoin and Ethereum ecosystems.

“Just over six months after introducing our incentivized testnet, Hemi has demonstrated its resilience and capability as a powerful network for advancing blockchain applications across Bitcoin and Ethereum,” said Jeff Garzik, co-founder of Hemi.

“The Hemi team has a clear and compelling vision for unlocking the programmability, portability, and potential of Web3,” said Ted Breyer, partner at Breyer Capital. “With a distinguished track record, they are uniquely positioned to deliver.”

A Layer-2 from a Different Point of View

Attempts to integrate and scale Bitcoin and Ethereum have tended to address the problem within their respective communities, resulting in a fractured ecosystem. Hemi instead approaches Bitcoin and Ethereum as components of a larger supernetwork. This surfaces the key capabilities of both networks and, in turn, enables a new class of previously unattainable blockchain applications.

Hemi’s benefits include:

- Unifying Bitcoin and Ethereum — The Hemi Virtual Machine (hVM) integrates a full Bitcoin node within an Ethereum Virtual Machine (EVM), enabling developers to harness the power of both Bitcoin and Ethereum using familiar and proven development tools.

- Bitcoin Programmability — Building with the Hemi Bitcoin Kit (hBK) provides developers direct access to highly granular views of Bitcoin’s state, unlocking new applications that were previously impractical or impossible to execute in a truly trustless, secure, and efficient way.

- Superfinality — Through its PoP consensus protocol, Hemi inherits Bitcoin’s full security in a truly decentralized and permissionless manner, exceeding Bitcoin-level finality (“superfinality”) in just a few hours.

- Trustless Cross-Chain Portability — With Tunnels, Hemi offers a Bitcoin-secured method for moving assets between Bitcoin and Ethereum.

- Asset Programmability — Hemi’s additional asset-programmability features include on-chain routing, time-lock, and password-protect. Gasless transfer enables asset movement without requiring a web3 wallet.

“The Hemi team can be described in one word: ambitious. Everything we learned during our testnet has been embedded into the mainnet release and we are excited for our users and developers to build and use applications across Bitcoin and Ethereum,” said co-founder and CTO Max Sanchez.

About Hemi Labs

Hemi Labs is the creator of the Hemi Network (“Hemi”), a modular Layer-2 network for superior scaling, security, and interoperability, powered by Bitcoin and Ethereum. Instead of approaching Bitcoin and Ethereum as siloed ecosystems, Hemi views them as components of a single supernetwork, unlocking new levels of programmability, portability, and potential. Hemi Labs envisions a new, converged Internet ecosystem that is secure, interoperable, and ready for the many challenges of a Web3 that is imminently colliding with the Internet at large.

Users can learn more at https://hemi.xyz/.

- Blog: https://hemi.xyz/blog/

- GitHub: https://github.com/HemiLabs

- Docs: https://docs.hemi.xyz

- Discord: https://discord.gg/hemixyz

- YouTube: https://www.youtube.com/@HemiLabs/

- Twitter/X: https://x.com/hemi_xyz

- Telegram (News): https://t.me/hemi_news

- Telegram (Community): https://t.me/hemi_community

Contact

Media Relations

Hemi Labs

media@hemi.xyz

Victoria, Seychelles, February 25th, 2025, Chainwire

Bitget, the leading cryptocurrency exchange and Web3 company has introduced isolated spot margin trading for S/USDT, expanding its suite of trading services to enhance user experience and provide more strategic trading opportunities.

To mark the listing of new coins, Bitget is offering exclusive perks to traders. Users will receive spot leverage cut-rate coupons or trading bonuses credited to their accounts at random. These coupons enable traders to access leverage at reduced or zero interest rates, while the trading bonuses can be directly utilized in margin trading. Eligible users can claim these benefits through the Coupons Center on the Bitget platform.

Isolated spot margin trading offers traders greater flexibility and risk management by allowing them to allocate margin independently for each trading pair. This ensures that potential losses in one position do not affect other holdings, providing enhanced security and control over trading strategies. The introduction of this feature underscores Bitget’s ongoing efforts to optimize trading conditions and improve market efficiency.

For more information on spot margin trading for S/USDT, visit here.

About Bitget

Established in 2018, Bitget is the world’s leading cryptocurrency exchange and Web3 company. Serving over 100 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions while offering real-time access to Bitcoin price, Ethereum price, and other cryptocurrency prices. Formerly known as BitKeep, Bitget Wallet is a world-class multi-chain crypto wallet that offers an array of comprehensive Web3 solutions and features including wallet functionality, token swap, NFT Marketplace, DApp browser, and more.

Bitget is at the forefront of driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA, and LATAM markets, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, please contact: media@bitget.com

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Contact

Media

Public Relations

Bitget

media@bitget.com

London, United Kingdom, February 25th, 2025, Chainwire

DTX Exchange, a leading asset trading platform, has confirmed its final presale token price at $0.36 as it enters the closing phase of its token sale.

DTX Exchange has raised over $15.1 million during its ongoing presale. As a hybrid trading platform, it has attracted attention within the digital asset sector. With a community of over 600,000 members, the platform is preparing for its next phase, which includes expanded market accessibility and liquidity.

The platform has confirmed its final presale token price at $0.36 in the bonus round. This development follows months of platform growth, community participation, and technological advancements. DTX Exchange aims to provide a multi-asset trading environment, offering access to crypto, forex, ETFs, and stock trading.

First Hybrid Blockchain Platform Backed By DeFi Features

DTX Exchange is the first crypto-native trading platform designed to bridge the gap between traditional finance and decentralized trading. The hybrid exchange consolidates over 120,000 asset types under a single umbrella and offers unprecedented flexibility to traders.

Key Features of DTX Exchange

- Multi-Asset Trading – Users can trade crypto, forex, tokenized stocks, and ETFs on a single secure platform.

- Trading Leverage – Includes leverage options on select trading pairs.

- Phoenix Wallet – Decentralized asset custody solution designed with institutional-grade security and native platform integration.

- Tokenized ETFs – Industry-first platform to offer tokenized ETF trading for global users from 80+ regions.

Historic Adoption and Ecosystem Growth

With over $15.1 million raised during the presale round, DTX Exchange is backed by a community of over 600,000 traders. The growth rate of the platform during its initial phase has made history. In less than 100 days after launch, the platform has successfully sold over 10 rounds and is currently in the final round of the presale.

Additionally, listings on data tracking platforms CoinMarketCap and CoinGecko are already live. Further details regarding availability on centralized exchanges are expected to be announced in the coming weeks.

DTX Listing Price Updated to $0.36

The DTX Exchange team has set the final presale token price at $ 0.36 for the final listing. This represents a 200% increase from the current price of $0.18 in the bonus round.

DTX Exchange has a fixed total supply of 475,000,000 tokens. The token distribution includes 50% for presale, 23% for ecosystem development, 20% for liquidity and listings, 10% for the team, 5% for advisors, and 2% for the airdrop. Further details about CEX listings are expected to be announced in the coming weeks. Investors who are interested in DTX can currently participate in the public presale.

Exploring DTX

The DTX team remains committed to continuous innovation and strategic expansion, with upcoming developments expected to push the platform to new heights. With mass adoption incoming, this is the final opportunity for investors to join the groundbreaking project before its official launch.

About DTX Exchange

DTX Exchange is the first hybrid trading platform with its VulcanX blockchain infrastructure. The platform is redefining the global trading industry with its cross-functional approach towards stocks, crypto assets, equities, and contract trading options. With support from a rapidly growing community, DTX Exchange aims to make an impact. For more information about the upcoming features and developments, users can visit the DTX Exchange website or interact with the community on Telegram.

Users can visit the links below for further details about DTX Exchange (DTX):

Website: https://dtxexchange.com

Whitepaper: https://dtx.exchange/whitepaper.pdf

Twitter: www.twitter.com/dtxexchange

Telegram: www.t.me/dtxexchange

Contact

DTX Exchange

DTX Innovations

dtxinnovations@gmail.com

Victoria, Seychelles, February 25th, 2025, Chainwire

Bitget, a leading cryptocurrency exchange, and Web3 company, has officially launched isolated spot margin trading for the STETH/USDT trading pair. This expansion enhances trading opportunities by providing users with greater flexibility and cost-effective leverage options.

To mark the listing of new trading pairs, Bitget will distribute spot leverage cut-rate coupons and trading bonuses to eligible users. These incentives, credited randomly to users’ accounts, can be utilized to access leverage at reduced or zero interest rates. Additionally, the trading bonuses can be directly applied to margin trading. Users can claim these rewards through the Coupons Center on the Bitget platform.

Bitget remains committed to enhancing its trading ecosystem by offering innovative financial tools that cater to both novice and experienced traders. The introduction of isolated spot margin trading for STETH/USDT aligns with the platform’s goal of broadening access to diversified trading strategies while ensuring cost efficiency.

For more information on spot margin trading for STETH/USDT, visit here.

About Bitget

Established in 2018, Bitget is the world’s leading cryptocurrency exchange and Web3 company. Serving over 100 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions while offering real-time access to Bitcoin price, Ethereum price, and other cryptocurrency prices. Formerly known as BitKeep, Bitget Wallet is a world-class multi-chain crypto wallet that offers an array of comprehensive Web3 solutions and features including wallet functionality, token swap, NFT Marketplace, DApp browser, and more.

Bitget is at the forefront of driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA, and LATAM markets, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, please contact: media@bitget.com

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Contact

Media

Public Relations

Bitget

media@bitget.com

Denver, Colorado, February 24th, 2025, Chainwire

Blockchain infrastructure provider dRPC has announced that it will be premiering a unique short film at ETHDenver. Alice in Node-land takes the form of a 11-minute animation filled with colorful characters that will enhance the ETHDenver experience for delegates while sharing their view of the importance of decentralization in web3 infrastructure.

Inspired by Alice in Wonderland, dRPC’s AI-enhanced short film combines quirky humor and cultural resonance to provide an irreverent take on the current web3 landscape. Viewers will tumble down the rabbit hole and into a world where anything is possible and nothing is as it seems.

The world’s largest and longest running Ethereum developer event, ETHDenver 2025 runs from February 23 to March 2 in Colorado. dRPC’s Alice in Nodeland short film will launch on February 25, with delegates able to view it for the next week with complimentary popcorn in a dedicated mobile bus, and online. The dRPC team will also be handing out limited edition movie merch to commemorate the screening.

A trailer released by dRPC on its X account provides those headed to ETHDenver with a taster of what to expect. Its protagonist, a web3 dev frustrated by centralized chokepoints, embarks on an epic battle that sees Alice facing off against the feared Queen of Nodes – whose face may be familiar to experienced crypto observers.

Many characters who surface in the short film include the Mad Hatter, reimagined as an eccentric DAO leader; the Queen’s Guards that are programmed to oppose decentralization at all costs; and the Cheshire Cat, a crypto trickster who ethereans should instantly recognize.

Fito Benítez, Head of Marketing said: “As anyone who’s spent time in crypto will attest, it’s every bit as weird and wonderful as anything Lewis Carroll could conjure. We hope we’ve captured that strangeness and sense of adventure in Alice in Nodeland and we’re excited to be able to premiere it to ETHDenver along with a few other surprises that are in store.”

While Alice in Nodeland has been created for entertainment value, and to treat ETHDenver delegates to something truly different, it will also serve to raise awareness of dRPC’s multi-chain solution and of the role RPC nodes in decentralizing access to web3 data.

About dRPC

dRPC serves as a gateway for web3 developers and users to access a distributed network of independent third-party public nodes. It supports the growth of a diverse and independent web3 infrastructure ecosystem that is not controlled by any single entity. dRPC‘s pay-as-you-go model scales resources effortlessly and delivers clear, predictable pricing. This eliminates large upfront costs, encourages innovation and simplifies budgeting.

Learn more: https://drpc.org/

Contact

Market Across

pr@marketacross.com

DUBAI, UAE, Feb. 24, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has completed a fresh round of audit on Feb. 23, 2025 conducted by leading cybersecurity firm Hacken. The independent third-party report is published after Bybit restored reserves levels to a 1:1 ratio for in-scope digital assets within 72 hours following a major incident on Friday, Feb. 21.

A full audit of all relevant wallets containing 40 asset types, by way of proof of liabilities and ownership, verified that Bybit possesses sufficient reserves to cover user assets 1:1 across the board. Key assets including BTC, ETH, SOL, USDT and USDC exceed 100% collateral ratios on Bybit. Held to high standards of transparency and prudence, Bybit reaffirms its commitment to fiscal vigilance and customer protection under all circumstances.

“Bybit fully backs all customer assets entrusted to our platform, maintaining a dynamic ratio of over 1:1,” said Ben Zhou, Co-founder and CEO of Bybit. “We are fortunate to have all-weather friends in a cut-throat industry—our peers and even competitors stood with us during challenging times, and our customers deserve the same level of commitment,” he added.

Key Highlights of Bybit’s 19th PoR Audit:

- Comprehensive Audit Process: Hacken conducted an extensive audit of Bybit’s liabilities, utilizing the Merkle tree to verify the integrity of the assets reported.

- User Address Verification: Hacken obtained information from Bybit management regarding all public key addresses holding in-scope assets and verified expected blockchain transactions to confirm control and ownership.

- Rigorous Validation Procedures: The validation process included a thorough review using the official Merkle proof validation methods, ensuring the accuracy of the reported liabilities.

“Bybit’s focus on transparency through regular Proof of Reserves audits and independent assessments sets a strong standard within the industry. We appreciate being part of this important initiative during this critical period,” said Yevheniia Broshevan, Co-Founder & CBDO at Hacken.

As of Feb. 24, Bybit fully closed the ETH gap of client assets within 72 hours. This was achieved through strategic partnerships with firms like Galaxy Digital, FalconX, and Wintermute, along with support from Bitget, MEXC and DWF Labs, who helped Bybit replenish the reserves in record time. The rapid execution of these funding strategies underscores Bybit’s robust industry relationships and its capability to maintain platform stability during challenging times, reflecting the industry’s shared vision of a new era of reliable financial system.

By prioritizing independent verification and comprehensive audits, Bybit reinforces its commitment to user trust and transparency. The exchange regularly reviews best practices, emergency responses, and security infrastructure to meet the rising challenges and demands in the digital asset industry.

Bybit’s Proof of Reserves: https://www.bybit.com/app/user/audit-report

#Bybit / #TheCryptoArk / #ProofofReserves / #PoR

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

seoul, south korea, February 24th, 2025, Chainwire

MARBLEX, the web3 gaming ecosystem powered by global gaming giant Netmarble, and Dracoon Ventures, a web3 game-specialized VC, are officially opening applications for MBX/HACK the FUN. This hybrid program combines a hackathon with an acceleration initiative, designed to help web3 game developers build, refine, and successfully launch high-quality games on the MARBLEX ecosystem.

MBX/HACK the FUN is more than an accelerator—it’s a game launchpad. The program provides hands-on technical support, mentorship, and business acceleration opportunities for Web3 game studios. This program is tailored for teams that already have a playable build or are in advanced development stages. In addition, the program participants will have the opportunity to showcase their projects at Token2049 Dubai in April, where they can connect with potential partners, investors, and publishers.

Over the course of four weeks, game studios and developers will refine their gameplay, tokenomics, and go-to-market strategies with guidance from the hosts and top-tier web3 gaming experts. The program will culminate in The FUN Fest, a high-profile demo day, and an immersive gaming event in Dubai, where finalists will pitch their games to industry leaders, investors, and major gaming ecosystem partners. Winning teams will receive a $100K+ prize each, post-program acceleration, follow-up funding opportunities, and marketing support to ensure a successful launch and long-term growth within the MARBLEX ecosystem.

Applications are now open and will close on March 10, 2025(CET). Developers interested in joining the program can apply through the official website (https://mbxhack.fun). This is an opportunity for web3 game creators to work with a leading global publisher and connect directly with real players for success.

About MARBLEX

MARBLEX is the web3 gaming ecosystem powered by Netmarble, one of the top global game publishers. MARBLEX merges blockchain technology with immersive gaming experiences, offering seamless access to Web3 services, including wallets, DeFi SWAP, and NFT marketplaces.

Users can learn more at https://marblex.io

About Dracoon Ventures

Dracoon Ventures is a web3 game-focused VC, providing early-stage investments and growth acceleration services to web3 gaming startups. With deep expertise in both traditional and web3 gaming, Dracoon Ventures supports the next generation of gaming pioneers.

Users can learn more at https://dracoon.ventures

Press Contact:

Eunielle Yi / eunielle@dracoon.ventures

Contact

Partner

Eunielle Yi

Dracoon Ventures

eunielle@dracoon.ventures

Dubai, United Arab Emirates, February 23rd, 2025, Chainwire

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has announced a new API updating a black list of suspicious wallet addresses identified so far. The API will allow ethical security experts to race against time to streamline and expedite their efforts in recovering the compromised funds.

The current list of addresses is the result of the tireless work of some of the best white hats and investigators the industry has to offer, within three days of the largest heist in crypto. Bybit has received thousands of tips from colleagues in the industry, demonstrating a remarkable spirit of cooperation in the face of adversity.

As internal and external teams work diligently together, the elite task force confirmed a list of malicious addresses which will be made available to verified partners through an automated interface. This collaborative effort will help streamline the security response and enhance security across the network.

Bybit will continually update this list to ensure cyber defenders and security partners can effectively intercept fraudulent activities. Successful interceptions will be rewarded with a 10% bounty, reinforcing its commitment to securing the industry as a whole.

Looking ahead, Bybit will announce in due time a HackBounty platform currently under development, designed to empower the entire industry in tracking down hackers. Security insiders are encouraged to stay tuned for this innovative initiative.

“I am energized by the incredible camaraderie on-chain and in real life. This can be a transformative moment for our industry if we get it right. Together, we can build a stronger defense system against cyber threats,” said Ben Zhou, co-founder and CEO of Bybit.

Bybit will continually update this list to assist partners in effectively intercepting fraudulent activities. Successful interceptions will be rewarded with a 10% bounty, reinforcing its commitment to securing the industry as a whole. Interested parties may find out more about Bybit’s Bounty Rewards Program by reaching out to: bounty_program@bybit.com

Crypto’s Defense Alliance

The concerted efforts have formed an industry-wide alliance in one of crypto’s defining moments. Bybit has shared a list of individuals, entities, and teams who have contributed to the Hail Mary mission. The “thank-you list” includes but is not limited to the following partners and peers and is growing by the hour:

- Mandiant, Verichain, and Sygnia.co are providing crucial forensic analysis, and uncovering the facts behind the hack incident.

- ZeroShadow activated its 24/7/365 Global Response team, collaborating closely on Bad Actor Tracing and Identification, Funds Tracing, and Law Enforcement Communications to support the investigation and recovery efforts.

- Chainalysis, Elliptic, TRM, Goplus, SEAL 911, and ZachXBT swiftly tagged exploit-related addresses on-chain, restricting the attacker’s ability to launder stolen assets.

- SlowMist, BlockSec, and BEOSIN delivered expert security advisory services and insights.

- VerifyVASP, AML Bot, and CryptoForensic contributed critical compliance and risk assessment solutions, enhancing the overall security response.

- Binance, Coinbase, Bitget, Polygon, Arbitrum, Optimism, Wormhole, Synapse, Connext, Chainflip, Across.to, Symbiosis.finance, AVAX, ChangeNow, fixedfloat, and cBridge facilitated essential cross-chain security measures, and stopping the hacker.

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Contact

Head of PR

Tony Au

Bybit

tony.au@bybit.com

- Okto Platform Live On Testnet: Pioneering blockchain adoption and enabling seamless cross-chain transactions across major networks like HyperLiquid, Aptos, Solana, and EVM.

- The live testnet link for Okto: https://testnet.okto.tech/

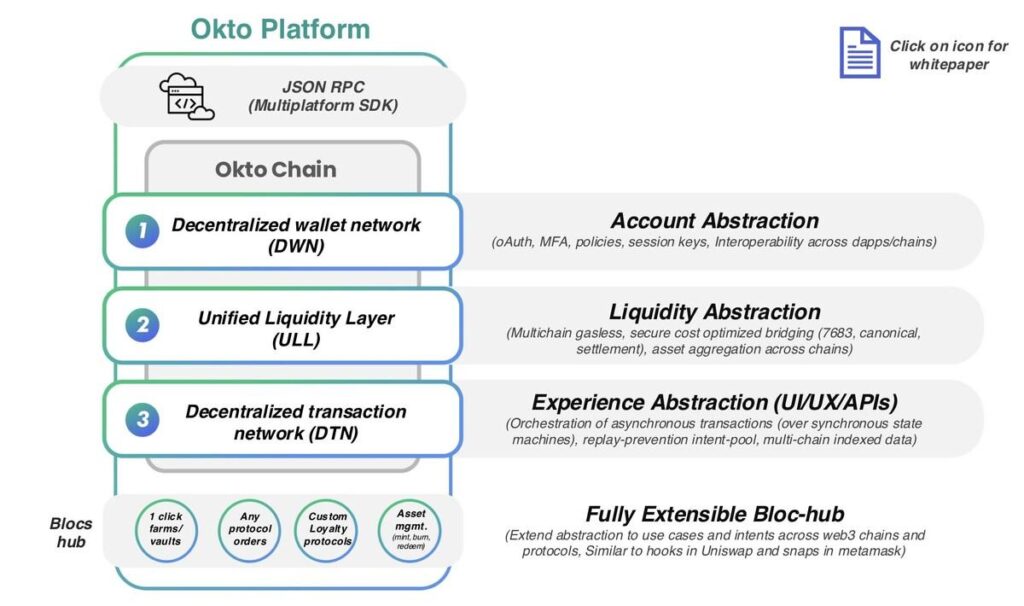

BENGALURU, India, Feb. 22, 2025 /PRNewswire/ — Okto, a complete chain abstraction platform, is thrilled to announce the official launch of Okto Platform Testnet – the industry’s first Complete end-to-end chain abstraction solution. This groundbreaking solution is set to redefine the landscape of blockchain interoperability by simplifying decentralized application (dApp) development, cross-chain transactions, and multi-chain innovation. The platform enables seamless communication across a range of leading blockchain ecosystems, such as all EVM chains, HyperLiquid (HL), Aptos, Solana, and Cosmos chains/ecosystems.

Okto’s chain abstraction technology is already delivering impressive results, with real-world success stories across gaming, social and DeFi applications that showcase its efficiency and transformative potential. The Okto Wallet, has facilitated the creation of over 12 million wallets, integrated more than 50 protocols, and supports over 20 EVM and Alt-VM chains. Okto has already clocked in $1 billion in Monthly Recurring Revenue.

Neeraj Khandelwal, Co-Founder of Okto & CoinDCX, said “We have been developing our Chain Abstraction technology for over two years, collaborating closely with prominent blockchain networks to rigorously test cross-chain transactions, liquidity, and interoperability. The results have been exceptional. Okto’s core mission has always been to simplify the user experience, ensuring it mirrors the simplicity and efficiency of Web2 with just a single click. We are now empowering developers with the ability to seamlessly integrate Web3 functionalities into their applications with unprecedented ease and efficiency.”

Rohit Jain, Head of DeFi Initiatives at Okto and CoinDCX, said: “We built a world-class team and collaborated with industry leaders such as Nethermind, Silence Laboratories, Across Protocol, and Agoric. By leveraging cutting-edge security from EigenLayer and Polygon CDK, each partnership brought vital expertise to our mission. Today, we stand at a pivotal moment with the launch of the Okto Platform Testnet.”

“While collaborating with multiple networks co-building on the Okto platform, one key piece of feedback from developers has been the significant reduction in development time—by over 90%. Okto does the heavy lifting of abstracting Web3 complexities across fragmented ecosystems and empowers developers to offer their end users a frictionless, single-click experience. This allows developers to focus on their core product.”

SOURCE Okto

Denver, Colorado, February 20th, 2025, Chainwire

Returning to ETHDenver on February 26th, the Open AGI Summit will bring together industry leaders to explore the intersection of AI, blockchain, and the evolving landscape of AGI.

This year’s summit, presented in partnership with Amazon Web Services (AWS) and Sentient, will discuss the transformative potential of AI agents, decentralized finance AI (DeFAI), decentralized AI infrastructure (DeAI Infra), and the role of blockchain in creating a more open, transparent, and accessible AI ecosystem.

As AI continues to evolve at an unprecedented pace, the Open AGI Summit aims to address one of the most pressing questions of our time: Who will control the future of AI? Will it be dominated by a handful of corporations, or will it be an open, decentralized ecosystem that empowers innovation and equitable access for all?

Sandeep Nailwal, Co-founder of Polygon and Core Contributor to Sentient, expressed his excitement for the event, stating:

“As AI continues to advance at an unprecedented rate, we face a critical decision. Do we allow a handful of corporations to dominate this powerful technology, creating a closed world where innovation is stifled and benefits are concentrated? Or do we choose a future where AI is open, transparent, and accessible to all, fostering a more equitable and prosperous society? Blockchain technology offers the promise of such an open world, ensuring that the benefits of AI are distributed fairly and that its development is guided by collective values.”

What to Expect at the Summit

Attendees will gain valuable insights from a distinguished lineup, with previous events featuring speakers such as Vitalik Buterin (Ethereum Co-Founder) and Balaji Srinivasan (former Coinbase CTO). Set to speak at the Denver summit are:

- Brad Feinstein, Head of Web3 Startups at AWS

- Sandeep Nailwal, Co-Founder of Polygon

- Illia Polosukhin, Co-Founder of NEAR Protocol

- Sreeram Kannan, Founder of EigenLayer

…and more to be announced soon.

The summit will bring together developers, researchers, and thought leaders to tackle the ethical and technological challenges in the pursuit of Artificial General Intelligence (AGI). Attendees will have the opportunity to engage in meaningful discussions about AI loyalty, decentralization, governance, and the long-term impact of AI and crypto on society.

Apply for Your Complimentary Ticket

The next Open AGI Summit will take place on February 26th from 11 AM to 6 PM in Denver, with the venue to be announced soon. Due to high demand and expected oversubscription, attendees are encouraged to apply for their complimentary ticket now at https://lu.ma/asjsb6k7.

About The Open AGI Summit

The Open AGI Summit is a platform for exploring the intersection of AI and decentralized technologies. We believe that transparent and open-source AI development, empowered by blockchain, is essential for a future of safe and beneficial AGI.

Learn more about Open AGI Summit here: https://openagi.xyz

Contact

Market Across

pr@marketacross.com