Willemstad, Curacao, March 25th, 2025, Chainwire

Whale.io has announced plans to migrate its Whale NFT collection from the TON blockchain to the Solana blockchain. The cross-chain transition aims to expand the project’s interoperability and accessibility by leveraging Solana’s infrastructure. This move represents a strategic shift in blockchain alignment for one of the more prominent NFT collections launched in recent years.

Initial Launch on TON Blockchain

The Whale NFT collection was initially launched on the TON blockchain, where all 20,000 NFTs were minted at no cost within hours of release. The rapid minting reflected strong early engagement from the community. Over the following year, the collection became one of the most visible projects on Getgems, TON’s leading NFT marketplace. According to platform data, the floor price increased approximately sevenfold during this period.

Hosted on Getgems.io (collection available here), Whale NFTs quickly became a cultural phenomenon within the TON ecosystem. With eye-catching designs and varying rarities, Whale.io’s collectibles became popular display pictures across Telegram, where the team has continued to deliver value, innovation, and utility to keep the project thriving.

Buybacks, Supply Reductions, and Fee-Free Trading

The Whale team has implemented several mechanisms to manage supply and maintain engagement with the collection, including token buybacks and supply reductions via burns. These practices have been part of the project’s ongoing strategy on the TON blockchain, and the team has indicated that similar measures will be introduced following the migration to Solana.

In addition, Whale NFTs have been available for trading with zero gas fees on supported platforms, a feature that has contributed to repeated appearances on trending lists within Getgems, TON’s leading NFT marketplace. With the upcoming transition to Solana—known for its high throughput and low transaction costs—the collection is expected to remain active across major NFT marketplaces within the Solana ecosystem.

Utility That Packs a Punch

Whale NFTs aren’t just pretty pictures—they’re powerhouses of utility, deeply integrated into the Whale ecosystem. At the heart of this is the Wheel of Whales miniapp on Telegram, a play-to-earn sensation that’s taking the crypto gaming world by storm. This innovative game offers players the exclusive chance to participate in the distribution of Whale tokens, making it a golden opportunity for anyone looking to dive into the project’s rewards system.

Owning a Whale NFT isn’t just a flex—it’s a ticket to amplified benefits within Wheel of Whales. Holders enjoy boosted earnings and a suite of in-game perks, giving them a significant edge in this addictive play-to-earn game. With rarities ranging from common to ultra-rare, each NFT brings its own unique flair and value to the game, making every Whale a prized possession. Highest rarity Golden NFT prices go up to 2000 TON that equals over 7000 USDT.

Bridging to Solana: A New Frontier

Whale.io has announced its intention to bridge its NFT collection to the Solana blockchain, recognized for its scalability and active NFT ecosystem. The transition is designed to expand the project’s reach by integrating with Solana’s infrastructure and user base. According to the team, this cross-chain move reflects a broader strategy to enhance accessibility and engagement across multiple blockchain environments.

The bridge from TON to Solana represents an effort to connect two blockchain ecosystems, enabling broader accessibility for the Whale NFT collection. Whale.io will bring its established framework—which has included gas-free trading, supply reduction mechanisms, and various utility features—into the Solana environment. With Solana’s low transaction costs and high-speed processing, the transition is intended to streamline the user experience and support increased activity across NFT marketplaces.

Bridge Signals Strategic Expansion Across NFT and Gaming Ecosystems

The Whale NFT bridge is a landmark moment for the broader NFT and blockchain gaming industries. It showcases how projects can evolve, adapt, and thrive across ecosystems while delivering consistent value to their communities. For Whale holders, this is a chance to ride the tide of a project that’s already proven its worth and is now gearing up for an even bigger splash. For newcomers, it’s an invitation to dive into a collection that’s equal parts art, investment, and entertainment.

Preparing for the Solana Bridge

With the upcoming bridge to Solana, Whale.io is transitioning its NFT collection into a new blockchain environment. The project has encouraged community members, NFT collectors, and Telegram gaming participants to follow official channels for updates regarding the bridging timeline, marketplace listings, and upcoming developments within the Wheel of Whales ecosystem. Additional information about the bridging process is available at whale.io/thedailyfinn/nftbridging. Following its presence on the TON blockchain, the collection will now be accessible within Solana’s NFT ecosystem.

About Whale.io

Whale.io is a pioneering force in the NFT and blockchain gaming space, delivering innovative projects that blend art, utility, and community value. With the Whale NFT collection and Wheel of Whales miniapp, Whale.io is redefining what it means to own, trade, and play in the decentralized world.

Users can discover the future of Whale.io and $WHALE token by checking them out here:

Website: https://whale.io/

Socials: https://linktr.ee/whalesocials_tg

Contact

Whale Spokesperson

Whale.io

support@whale.io

Tortola, VG1110 British Virgin Islands, March 25th, 2025, Chainwire

Beincom, the pioneering SocialFi project, has announced its upcoming 300 million BIC token airdrop. Beincom introduces mechanisms aimed at safeguarding new token holders and highlights the multifaceted utility of its BIC Token within its ecosystem.

Beincom and BIC Token – A Breakthrough In the SocialFi Era

Beincom is a next-generation social hub and community platform, powered by the friendliness of the web2 interface and the power of web3 decentralization. By integrating blockchain, tokenization, NFTs, and Social Hub, Beincom empowers creators, communities, and businesses.

At the heart of Beincom’s ecosystem is BIC Token, the utility token that fuels all activities and engagement within the platform. More than just a token, $BIC incentivizes contributions and grants exclusive benefits, creating a sustainable and transparent economy for long-term growth.

The total supply of BIC Tokens is fixed at 5 billion tokens. Unlike many other projects where the core team holds a substantial share, Beincom’s core team allocation is capped at just 6% of the total supply. This reduces the risk of market manipulation and ensures a decentralized ecosystem.

Beincom Announces Long-Term Token Distribution Plan via Airdrop

Beincom has unveiled a 50-month token distribution initiative, allocating 6% of its total token supply—equivalent to 300 million BIC tokens—through a structured airdrop campaign. Under the program, 6 million BIC tokens will be distributed monthly. The first scheduled airdrop is anticipated to begin in May 2025 (date to be confirmed).

Participants can earn Medals—platform-specific reward points—by contributing to the ecosystem through activities such as community engagement and content creation. These Medals can be converted into BIC Tokens once the airdrop officially commences. Notably, accumulated Medals will not be reset, enabling continued eligibility throughout the subsequent 49 months of distribution. Further information is available on Beincom’s official website.

This structured, long-term approach differs from conventional short-term airdrop models, with the aim of facilitating broader participation, consistent engagement, and gradual distribution across the ecosystem.

Liquidity Fee Protection – A 35% Free To Prevent Market Dumps

Beincom is built on Arbitrum, a leading Layer 2 scaling solution that enhances speed, efficiency, and cost-effectiveness for blockchain transactions. By leveraging Arbitrum’s technology, BIC Token transactions remain fast, low-cost, and highly scalable, ensuring seamless user experiences across the Beincom ecosystem.

To ensure a fair launch and protect token holders, Beincom has introduced a dynamic liquidity protection model. Initially, a 35% early withdrawal fee discourages quick sell-offs, but this gradually reduces by 1% each month, reaching 0% after 35 months.

BIC Token – The Economic Engine Driving Beincom Ecosystem

Beyond a transaction medium, BIC Token fuels the entire Beincom ecosystem with its diverse use cases. Here are key features that create value and foster a sustainable token-based economy:

- Premium Features: Users can unlock advanced creation tools, analytics, and priority support with BIC Tokens, enhancing their platform experience.

- Digital Asset Marketplace: BIC Tokens power transactions for minting, buying, and selling innovative NFTs, which act as a protective mechanism for digital identity and reputation.

- Advertising & Sponsored Content: Businesses can use BIC Tokens to secure ad placements and sponsored opportunities within the ecosystem.

- Token-Paid Direct Messaging: Sending a prioritized message with the cost of some token, a feature to nurture meaningful conversation and filtered connection.

By integrating real-world utilities and a seamless Web3 experience, BIC Token moves beyond the speculation, creating a self-sustaining, decentralized digital economy.

Beincom’s Vision and Roadmap: Pioneering the Future of Community Engagement

Beincom is transforming the landscape of online communities by seamlessly bridging Web2 with Web3. By eliminating algorithmic barriers and prioritizing direct, meaningful engagement, users are empowered to take control of their digital presence like never before.

As part of its promising roadmap, Beincom will expand the utility of BIC Token, enhance NFT integrations, and introduce new monetization models that drive value for both creators and users. Key upcoming developments include Deep-Ads, Token-Paid Direct Messaging (TPDM V1), and Social Hub (V1)—a game-changing ecosystem designed to consolidate and strengthen online communities.

“Beincom does not compete with traditional social platforms—it rises above them. While others prioritize maximizing profits, we empower users with true ownership, meaningful connections, and a decentralized future. Because in the end, everyone needs a place to be in.” — shared Mr. Tran Dang Khoa, Chief Vision Officer of Beincom project.

With a strategic vision and passionate roadmap, Beincom is committed to continuously developing, innovating, and creating a sustainable ecosystem for all users.

Early user registration for the Beincom platform is currently open here

For more details about Beincom, users can visit: X | Fanpage | Website

About Us

Beincom is a next-generation social hub and community platform powered by the friendliness of Web2 and the power of Web3 technology. With a mission to connect communities, provide real value, and promote creativity, Beincom is committed to continuously developing, innovating, and creating a sustainable ecosystem for its users.

Contact

Associate Growth & Marketing Manager

Mr. Nguyen Thuong

Beincom Global Ltd.

growth@beincom.com

VICTORIA, Seychelles, March 24, 2025 /PRNewswire/ — KuCoin, a global leader in the cryptocurrency exchange market, proudly announces the launch of its innovative new platform, ‘Krazy Degen’, which serves as an all-encompassing information hub focused on displaying and monitoring multi-chain trending tokens. This groundbreaking feature is designed to transform how traders discover and invest in early-stage, high-potential tokens directly from the blockchain. The platform’s key features include:

- Early Discovery of Premium Projects: Krazy Degen enables users to lock in early-stage tokens with high potential for substantial returns, staying ahead in the fast-paced crypto market.

- Real-Time Market Hotspots: Users gain access to the hottest sectors with real-time data, making it easier to track and respond to market trends effectively.

- Seamless Trading from Exchange to Web3 Wallet: Krazy Degen provides users with direct access to KuCoin Web3 wallets, with trading opportunities available just one-click away.

- On-Chain Opportunity Capture: With real-time detection of new on-chain opportunities, Krazy Degen positions users as pioneers in exploring the crypto wealth landscape.

This feature is a reflection on KuCoin’s commitment of empowering users by providing cutting-edge tools that enhance their trading experiences and potential for success. This initiative is part of KuCoin’s broader strategy to integrate decentralized finance innovations, making the platform a holistic hub for both new and seasoned traders.

To begin exploring this revolutionary feature, users can visit Krazy Degen on KuCoin website or try it out on the latest version of KuCoin APP. Instructions to find out how to use Krazy Degen are here .

About KuCoin

Founded in 2017, KuCoin is one of the pioneering and most globally recognized technology platforms supporting digital economies, built on a robust foundation of cutting-edge blockchain infrastructure, liquidity solutions, and an exceptional user experience. With a connected user base exceeding 40 million worldwide, KuCoin offers comprehensive digital asset solutions across wallets, trading, wealth management, payments, research, ventures, and AI-powered bots.

KuCoin has garnered accolades such as “Best Crypto Apps & Exchanges” by Forbes and has been recognized among the “Top 50 Global Unicorns” by Hurun in 2024. This recognition reflects its commitment to user-centric principles and core values, which include integrity, accountability, collaboration, and a relentless pursuit of excellence. Users can learn more: https://www.kucoin.com/.

Disclaimer: This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin shall not be liable for any errors or omissions or any outcomes resulting from the use of this information. Investments in digital assets can be risky. Please carefully evaluate the risks of a product and your risk tolerance based on your own financial circumstances.

Dubai, UAE, March 22nd, 2025, Chainwire

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has partnered with Tomorrowland Brasil as its exclusive payment provider for 2025 and 2026. This landmark collaboration grants Bybit Card holders privileged early access to tickets before they become available to the general public – a first in Tomorrowland’s history.

A Historic First for Bybit and Tomorrowland

Tomorrowland Brasil 2025 is set for October 10-12 at Parque Maeda in Itu, São Paulo. This year, Tomorrowland Brasil welcomes ‘LIFE’ as its mainstage theme, continuing the magical journey that began at Tomorrowland Belgium in 2024. Set in the mythical world of Silvyra, ‘LIFE’ transports the People of Tomorrow to an era of untamed natural beauty, just as a rare celestial event – the alignment of two moons – is about to unfold. Over three unforgettable days, attendees can escape the city and enjoy performances from more than 150 top electronic artists across six breathtaking stages.

“By partnering with Tomorrowland Brasil, we are merging the energy of music with the innovation of blockchain. This collaboration reinforces Bybit’s commitment to integrating crypto seamlessly into everyday experiences, and our cardholders will enjoy unparalleled access to one of the world’s most iconic festivals,” said Joan Han, Head of the Payment Business Unit at Bybit.

Bybit Card: More Than Just a Payment Solution

The Bybit Card enhances users’ festival experience by offering instant activation, seamless payments, and exclusive rewards. With compatibility across Apple Pay, Google Pay, and Samsung Pay, it ensures effortless transactions worldwide.

Beyond convenience, Bybit Cards help users grow their wealth. With Auto-Savings, cardholders can earn up to 8% APR on their balance, ensuring passive income without extra effort. There are no annual fees or hidden charges, and users can withdraw up to $100 in cash for free every month, with a 2% fee thereafter. Plus, Bybit’s partnership with DHL ensures fast and secure worldwide delivery of the physical card.

How to Secure Tomorrowland Brasil Tickets with Bybit Card

The Bybit Card is the ultimate festival payment solution, giving holders exclusive access to a two-day presale before tickets go on sale to the general public.

- Exclusive Registration Period: Now-April 3, 2025

- Presale Period: April 4, 10:00 BRT / 15:00 CEST – April 6, 10:00 BRT / 15:00 CEST

- Presale Website: Bybit Card x Tomorrowland

- General Public Sale: Begins after the presale period

To participate in the exclusive presale, users must be Bybit Card holders and complete their registration before the presale date on the Bybit website. Only registered users will have access to the presale period.

New users can still apply for a Bybit Virtual Card to join the presale.

- Priority Access: Bybit Card holders enter the first eight digits of their card (BIN code) to unlock ticket access.

- Secure a Spot: Each user can purchase up to six tickets.

- Exclusive Payment Method: Tickets must be purchased using a Bybit Card, as Bybit is the festival’s exclusive presale payment partner.

Bybit’s seamless integration with Tomorrowland Brasil’s official website and ticketing system ensures a hassle-free booking experience for cardholders.

General Ticket Sales Open April 8

For users who miss out on the exclusive presale, tickets will still be available for general sale starting April 8. Purchases can be made using Bybit Card or Bybit Pay, with new users enjoying a 10% cashback on their festival purchases.

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

About TOMORROWLAND BRASIL

Tomorrowland Brasil 2025 will take place on October 10-12 in the beautiful festival area of Parque Maeda in Itu, a municipality of São Paulo. The festival will revolve around the mesmerizing ‘LIFE’ theme, set against the backdrop of Brazil’s enchanting natural beauty. A story set in the mythical realm of Silvyra, it’s a world unto its own, filled with creatures, plant life, and people living in harmony, each with their own stories, with the diversity of Silvyra’s lush nature represented in the spectacular ‘LIFE’ Mainstage. Offering the ultimate escape from the city during three days of bliss, guests will be treated to breathtaking performances by more than 150 of the world’s finest electronic artists across 6 mesmerizing stages.

The first two festival editions of Tomorrowland Brasil took place in 2015 and 2016 in the beautiful festival area of Parque Maeda in Itu, São Paulo. After years of dreaming of a return, Tomorrowland finally headed back to Brazil in 2023, becoming a yearly highlight once again.

Tomorrowland Brasil 2025

October 10-12, 2025

Parque Maeda, Itu

Contact

Head of PR

Tony Au

Bybit

media@bybit.com

New York, United States, March 20th, 2025, Chainwire

Lagrange, the decentralized ZK Prover Network, has entered a deal with Matter Labs to direct up to 75% of Matter Labs’ outsourced proof demand to the Lagrange Prover Network (LPN) over the next two years. This marks a pivotal moment in furthering the ZK Stack’s transition to decentralized proof generation.

In January 2025, Lagrange successfully integrated a decentralized version of ZKsync’s ZK Stack prover, demonstrating that proof generation no longer needs to rely on centralized single-entity solutions. This new partnership cements that progress, enabling ZKsync to process more of its proving demand on a decentralized network, something never before achieved at this scale.

“Every rollup will be a ZK rollup, and that’s the future of Layer 2 scaling,” said Ismael Hishon-Rezaizadeh, Co-Founder & CEO of Lagrange. “ZK rollups offer unmatched scalability, security, and cost efficiency, making them the inevitable choice for next-generation decentralized applications. With this partnership, ZKsync is enabled to lead the charge, and the Elastic Network will operate at an unprecedented scale without compromising on decentralization.”

Lagrange has spent the last year establishing that decentralized proving networks can outperform centralized alternatives. The Lagrange Prover Network (LPN) has already reduced costs, increased throughput, and eliminated reliance on single points of centralized failure. Now, with Matter Labs committing to LPN for up to 75% of its outsourced proofs, the industry has a clear path forward toward a fully decentralized ZK rollup ecosystem.

For ZKsync users, this translates into lower gas fees and faster transactions. For businesses, this translates to greater confidence in the performance and liveness of L2s on the Elastic Network.

“This collaboration further increases the ability of ZKsync’s Elastic Network to scale, and gives ZKsync builders more options for customization,” said Anthony Rose, CTO of Matter Labs, a contributor to ZKsync. “Decentralized proving increases the resilience of the network, relative to a centralized model, and expands the total available hardware that can be used to generate proofs – which is important as network activity increases. By integrating with Lagrange’s infrastructure, we’re also expanding the flexibility and control available to builders, reinforcing ZK Chains as the most powerful and adaptable scaling solution for the future of web3.”

The ZKsync ecosystem boasts nearly 25 ZK stack chains, 300 applications, and 1.3M onchain transactions in the last month alone (source: DappRadar). Lagrange has proven it can operate at a massive scale, unlocking the next phase of ZK rollup evolution.

Rollup-as-a-service platforms, including Caldera and AltLayer, are also benefiting firsthand from Lagrange by relying exclusively on the Lagrange Prover Network for their ecosystems’ proof generation.

Key Takeaways:

- Decentralization – The majority of proof generation for a major rollup will happen entirely via a decentralized network.

- Lower Costs – Decentralized proving significantly reduces operational expenses, lowering users’ gas fees.

- Liveness & Security – LPN’s network of independent provers ensures continuous uptime, resilience, and higher security than centralized alternatives.

- Revenue & Growth – By capturing more of ZKsync’s proving demand, Lagrange unlocks new revenue generation and network expansion opportunities.

About Lagrange

Lagrange offers decentralized proving to scale any ZK application, rollup, or protocol. By leveraging a decentralized network to generate ZK proofs, Lagrange unlocks significant efficiency, cost savings, and uptime reliability. Its approach enables hyper-parallel proof generation, advancing cross-chain interoperability and supporting complex computations over large datasets. The company has raised over $17 million in funding from investors such as Founders Fund, 1kx, Maven11, Lattice Fund, and CMT Digital. It is led by a team of academic experts, including collegiate professors and PhD researchers who have authored multiple academic papers on cutting-edge cryptographic protocols.

With over $29 billion in total restaked ETH, 85+ top operators (including Coinbase, Kraken, OKX, and others), over 9 million ZK proofs, and 400,000 state proofs generated, Lagrange is at the forefront of innovation in the blockchain space. The company’s unique technology is enabling a new era of hyper-scalable proving, positioning Lagrange as a leader in blockchain-based cryptography and decentralized applications that require complex, high-volume data processing.

About Matter Labs

Matter Labs is a leading research and development company focused on scaling Ethereum through zero-knowledge-proof technology. It pioneers ZK-based blockchain infrastructure, enabling fast, secure, and scalable transactions.

About ZKsync

ZKsync is the pioneering zero-knowledge technology powering the next generation of builders with limitless scale. Secured by math and designed for native interoperability, ZKsync powers the Elastic Network, an ever-expanding network of customizable chains. Deeply rooted in its mission to advance personal freedom for all, the ZKsync technology makes digital self-ownership universally available.

For more information, users can visit www.lagrange.dev, www.zksync.io, and www.matter-labs.io

Contact

Senior PR Manager

Wahaj Khan

Serotonin

wahaj@serotonin.co

Dubai, United Arab Emirates, March 20th, 2025, Chainwire

Claims issued in the UK High Court against BE Club co-founders in relation to OneCoin have been withdrawn in full by agreement. All allegations were withdrawn without financial settlement, and a worldwide freezing order was lifted.

The resolution in the case (CL-2024-000213), made public on January 25, 2025, came after the Islam brothers submitted compelling evidence countering all the claims against them. Notably, the claimants have agreed to contribute to the legal costs incurred by the brothers.

Moyn and Monir Islam were small-scale UK investors who themselves suffered financial losses from the OneCoin scheme. They held no operational roles in the fraudulent organization and attempted to alert others once they became suspicious of its legitimacy.

“For years, misinformation surrounding OneCoin has affected my reputation, including allegations of dishonesty, fraud, and fleeing the UK. This resolution shows we have been telling the truth. We’ve been unfairly targeted, and this is a vital step in setting the record straight,” said Moyn Islam.

The brothers’ subsequent business ventures, including Melius, later rebranded as BE Club, have been subject to misrepresentation.

The resolution includes the lifting of a worldwide freezing order previously imposed on the brothers’ assets and establishes a binding agreement preventing any future OneCoin-related claims against them by these claimants.

This outcome allows the entrepreneurs to focus fully on their current business ventures without the shadow of unwarranted allegations.

Jennifer McAdam, a key member of the Claimant group’s steering committee, released official statements (also shown below) available on Facebook, X (previously Twitter), and Instagram confirming the withdrawal of claims. The statement is also available at the end of this article.

The brothers were represented by separate law firms, which have put out statements on the resolution: Enyo Law & Peters & Peters.

Understanding OneCoin

The OneCoin scheme, which began in 2014, exploited early cryptocurrency enthusiasm to attract investors on a massive scale, leading to an estimated $4 billion in losses.

By 2016, nearly 1.6 million people had already joined the scheme. During this period, the Islam brothers also joined, believing they were supporting a system that had already amassed a significant global following under promises of financial success.

The events surrounding OneCoin remain a subject of global discussion among regulators, financial analysts, and investors.

About BE Club

BE Club is a product-first company redefining Network Marketing. We focus on empowering affiliates with in-demand products and the support they need to achieve sustainable success.

With a commitment to tech-driven solutions and competitive commission structures, BE Club opens the door to limitless opportunities, providing affiliates with the tools and resources to thrive. For more information, users can visit beclub.com.

STATEMENT BY ONECOIN INVESTORS REGARDING UK LAWSUIT

We wish to confirm that the claim (CL-2024-000213) brought in the UK by the Claimants (who are OneCoin investors) against Mr Moynul and Mr Monirul Islam (the “Islam Brothers”) in July 2024 in relation to OneCoin, together with the accompanying worldwide freezing orders, have been withdrawn by mutual agreement between the parties. No payments whatsoever have been made by Mr. Moynul and/or Mr. Monirul Islam to the Claimants in relation to the claim, although the Claimants have contributed to the legal costs that the Islam Brothers have incurred in relation to defending the claim and the accompanying worldwide freezing orders. For the avoidance of doubt, the withdrawn claims include (but are not limited to) all allegations of fraud and dishonesty made against the Islam Brothers. Moving forward, none of the Claimants will be pursuing any allegations against either of the Islam Brothers whatsoever. All parties appreciate the resolution of this matter and are committed to putting this unfortunate matter behind them and moving forward positively.

Contact

Mr. Mattias Cruz

BE Club

mattiasc@beclub.com

+971 56 548 9249

Plano, United States, March 20th, 2025, Chainwire

XT.com, a leading cryptocurrency exchange, is listing OPT, the native utility token of the layer 1 Optio Blockchain. This listing marks a major milestone in decentralized technology, providing global access to the Optio ecosystem and enabling users to participate in a blockchain revolution designed for real-world impact.

The listing coincides with the Edgecast Cloud relaunch—a hyperscale cloud and Content Delivery Network (CDN)—following PCT’s strategic acquisition of key assets. Edgecast Cloud is set to integrate deeply with the Optio Blockchain, allowing enterprise customers to purchase services using the OPT token, benefiting from platform-driven incentives. This transformative shift leverages blockchain technology to deliver a more efficient, secure, and cost-effective cloud solution, disrupting traditional centralized models.

Empowering Users Through Blockchain

Optio Blockchain is on a mission to return value to users by enabling them to monetize their behavioral data across social media, entertainment, and digital applications. In today’s digital economy, corporations profit from user engagement while individuals receive little to no compensation for the data they generate. Optio changes this by using blockchain and decentralized infrastructure to give users control over their data and digital earnings. By integrating with widely used applications, Optio seamlessly bridges off-chain activities with on-chain rewards, ensuring users—not centralized platforms—benefit from their online engagement.

As the only blockchain project recognized by the Open Compute Project (OCP) for its vision of empowering internet users and businesses, Optio is reshaping the digital economy, giving individuals true sovereignty over their data.

The OPT Listing: Strengthening the Optio Ecosystem

The listing of OPT on XT.com is a pivotal step forward, following key platform integrations such as:

- Parler – A reimagined social media platform prioritizing free speech and freedom from algorithmic targeting.

- PlayTV – A next-generation video streaming platform offering an alternative to YouTube, where creators own their content without fear of shadow banning or demonitization.

- Burst – A short-form video platform empowering creators with full content ownership, serving as a decentralized alternative to TikTok.

- ParlerPay -A simple and secure web3 wallet in partnership in collaboration with Cloud Payments.

These platforms form the foundation of a decentralized digital landscape where users maintain control over their content, engagement, and monetization.

Expanding Global Access to OPT

Listing OPT on XT.com broadens accessibility for global users looking to engage with the Optio ecosystem. XT.com’s secure and robust trading platform enables seamless participation in Optio’s mission to merge blockchain with real-world applications across cloud computing, social media, and digital content ownership.

“The listing of OPT on XT, combined with the launch of Edgecast Cloud, marks a defining moment for a decentralized internet,” said Bryan Ferre, Co-Founder of Optio Blockchain. “This is more than just blockchain—it’s about returning power to users and businesses, enabling them to earn tokens through decentralized applications.”

About Optio Blockchain

The Optio Blockchain is a next-generation decentralized ecosystem designed to empower individual sovereignty and transform the management of data, identity, and digital assets across Web2 and Web3 applications. By bridging off-chain activities with blockchain-based rewards, Optio fosters a more transparent and equitable digital landscape.

About XT.com

XT.com is a globally recognized cryptocurrency exchange, providing a secure and seamless trading experience for digital assets. With millions of users worldwide, XT is committed to fostering blockchain innovation and expanding access to high-quality tokens like OPT.

For media inquiries, partnerships, or more information, please contact:

support@optio.community

Disclaimer: The OPT utility token is not a security and is not offered for investment purposes. Participation in the Optio Blockchain ecosystem is voluntary and designed for use within decentralized applications. There is no guarantee of financial return. This press release is for informational purposes only.

Contact

CMO

Jason Cole

Optio

cole@parler.com

New York, United States, March 19th, 2025, Chainwire

Arda, a company developing a universal operating system for real estate, has raised $3 million in a pre-seed funding round led by Lightshift. The investment supports Arda’s initiative to enhance efficiency in the $380 trillion real estate sector by addressing its fragmented and opaque infrastructure.

Arda is building a digital framework designed to unify real estate assets, data, and financial services into a single, interoperable system. Leveraging AI and blockchain technology, the platform aims to reduce transaction times and enhance transparency by enabling real-time ownership and financial processes.

A Purpose-Built Digital Infrastructure for Real Estate

Arda’s platform introduces a programmable execution layer for real estate, integrating digital rights management, AI-driven automation, and seamless data interoperability. Key features include:

- Digital Asset Profiles: A verifiable record of property history to streamline due diligence.

- Real-Time Money Movement: Payments directly linked to transactions for improved settlement efficiency.

- Integrated Data and Automation: Automated workflows reducing administrative friction in asset management.

Industry Leadership and Institutional Backing

Arda was founded by Oli Harris, former Managing Director in Digital Assets at Goldman Sachs and Head of Crypto Assets Strategy at JPMorgan Chase. Harris played a key role in the development and commercialization of Quorum, an enterprise Ethereum platform, and contributed to institutional digital asset adoption. His experience includes board positions at Anchorage, BitGo, Blockdaemon, and TRM Labs.

“Real estate remains one of the most valuable yet operationally fragmented asset classes,” said Oli Harris, Founder & CEO of Arda. “By creating a programmable, trust-based system, we aim to bring real estate transactions in line with modern digital financial infrastructure.”

A Market Evolving Toward Digitization

As institutional investment in digital assets grows, governments and industry leaders are exploring frameworks for secure, verifiable digital property transactions. Regions such as the Gulf are advancing adoption, while U.S. policymakers are shaping regulations to integrate digital assets into mainstream financial systems.

“We invest in founders who are building the foundations of next-generation industries,” said Simao Cruz, Founding Partner at Lightshift. “Arda is developing purpose-built infrastructure that could redefine how real estate is owned, transacted, and financed.”

About Arda

Arda is developing a real estate operating system designed for institutions, enterprises, and governments. Its platform enables digital interoperability, automated transactions, and real-time execution in the global real estate sector. Founded by Oli Harris, Arda is backed by investors supporting the evolution of digital real estate infrastructure.

For more information, users can follow @arda_labs on X (Twitter) or contact contact@arda.xyz.

About Lightshift

Lightshift is a venture firm investing in early-stage companies focused on digital infrastructure and programmable assets. The firm partners with founders to provide capital, technical expertise, and strategic insights for market-defining innovation.

For more information, users can visit www.lightshift.xyz or contact katy.campbell@lightshift.xyz.

Contact

CEO and Founder

Oliver Harris

Arda

oli@arda.xyz

Miami, Florida, March 19th, 2025, Chainwire

House of Doge, Dogecoin Foundation, IndyCar Driver DeFrancesco, and Rahal Letterman Lanigan Racing Launch Dogecoin Indy 500 Voting and Donation Platform – Letting Fans Make Doge History and Win The Ultimate Collectors Prize

Dogecoin Racing, launched by the House of Doge and the Dogecoin Foundation is teaming up with NTT INDYCAR SERIES driver Devlin DeFrancesco and Rahal Letterman Lanigan Racing to bring Dogecoin to the iconic motorsports event—the Indy 500—while supporting a cause that is deeply personal to the team. The Indianapolis 500, known as “The Greatest Spectacle in Racing,” returns for its 109th running on Memorial Day weekend on May 25, drawing over 350,000 spectators in person and reaching a global audience in over 140 countries. This year brings with it a historic partnership with the Dogecoin race car taking center stage, empowering fans with the opportunity to vote on DeFrancesco’s Indy 500 car design featuring the iconic Dogecoin Shiba Inu.

Dogecoin, like DeFrancesco, was born FAST!

DeFrancesco was 15 weeks premature and weighed just one pound at birth, given his last rights on two occasions, and spent four months in the Neo-Natal ICU before making a miraculous recovery.

Now, as a professional race car driver, he’s using his platform to give back to critically ill children. As part of this Dogetastic partnership, DeFrancesco, a dog lover, and Dogecoin fan, will personally donate $25,000 in Dogecoin to Riley Children’s Foundation in Indianapolis, aligned with Riley Children’s Health, a leading pediatric care center.

This initiative also marks a historic moment in motorsport, as DeFrancesco has committed to receive $100,000 of his salary in Dogecoin. A bold step forward for crypto adoption in professional sports.

“I first invested in Dogecoin in 2020 and drove everyone crazy, telling anyone who would listen that they needed to own it. It’s not only my favorite crypto, but the plan to become a global currency and drive payment adoption is awesome. I’m pumped to be part of the community and an ambassador for the vision,” Devlin shared.

Voting to Bring an Iconic Doge Design to the Indy 500 Track and Make Doge History

To celebrate the making of Dogecoin History, House of Doge, the Dogecoin Foundation and Rahal Letterman Lanigan Racing are launching a fan-powered contest, allowing the Dogecoin community to choose the official race car wrap and helmet design that Devlin will wear at the Indy 500.

From March 19 to March 25, fans can vote on their favorite design and enter to win a Dogecoin wallet loaded with $1,000.

VOTES OPEN TODAY: Three potential versions of the No. 30 Dogecoin Honda include:

● Blaze – This livery burns so hot, it makes the sun look like a nightlight. Some say it was forged in the volcanic fires of Kīlauea and once it hits the track, all that’s left behind is smoke, embers, and the shattered dreams of others

● Turbowave – This livery is so 80s, it comes with a free synthwave soundtrack and a pair of neon sunglasses. Some say if you drive it at night, it glitches into a parallel universe where Miami Vice never ended and every race runs in slow motion with looping palm trees in the background.

● BananaBoost – This livery is so slippery, that Mario’s filing an official complaint. Powered by pure potassium, it’s sure to slip past the competition while making swift work of pesky turtle shells.

“Dogenate” to Children’s Health for a Chance to Win the Ultimate Collector’s Prize

As part of this partnership, House of Doge and the Dogecoin Foundation are rallying the Dogecoin community to join DeFrancesco in making a real-world impact by supporting children’s health. In addition to casting a vote, contributions in Dogecoin to Riley’s provide an opportunity to win the ultimate collector’s prize.

The largest Dogecoin donor leading up to race day will receive an exclusive, one-of-a-kind Indy 500 racing helmet, worn – and signed – by DeFrancesco himself during his Indy 500 qualifying run.

The Dogecoin-powered fundraising campaign will directly benefit Riley Children’s Foundation, which supports Riley Children’s Health, home to one of the nation’s top-ranked neonatology programs by U.S. News & World Report. The funds raised will help provide life-saving medical care to newborns, including those born prematurely or with critical conditions requiring immediate and specialized treatment.

House of Doge encourages the Dogecoin community to race toward generosity, make history, and support this incredible cause leading up to the Indy 500 on May 25.

Fans can vote and donate at dogecoin.com/indycar.

About House of Doge

The House of Doge team believes the future of money is already digital, and with Dogecoin’s speed and efficiency, it’s the ideal solution for the modern financial ecosystem. The team’s goal is to make Dogecoin a widely accepted decentralized currency for everyday use worldwide. To achieve this, House of Doge focuses on aggregating Dogecoin liquidity through robust operations in the U.S., creating a strategic reserve that will support its seamless use in commerce and government transactions. They are building the infrastructure necessary to ensure secure, efficient, and scalable Dogecoin transactions.

About Dogecoin Foundation

The Dogecoin Foundation is a nonprofit organization committed to developing open-source technology that enhances Dogecoin’s accessibility and utility as a peer-to-peer digital currency.

About Rahal Letterman Lanigan Racing

Rahal Letterman Lanigan Racing, based in Zionsville, Ind., is co-owned by three-time IndyCar Champion and 1986 Indianapolis 500 winner Bobby Rahal, former CBS Late Show host David Letterman, and Mi-Jack co-owner Mike Lanigan. In 2025, the team will compete in its 34th year of competition and will attempt to add to its 30 Indy car wins – including 2004 Indy 500 from pole with Buddy Rice and the 2020 Indy 500 with Takuma Sato — their 37 poles, 112 podium finishes, and 1992 series championship.

Contact

Commumications

Angela Gorman

House of Doge

angela@amwpr.com

Vancouver, Canada, March 18th, 2025, Chainwire

The artificial intelligence landscape is evolving. Traditional AI models remain centralized, relying on static text data and corporate control. iAgent is introducing a decentralized AI framework where AI agents are trained, owned, and monetized on-chain using real-world visual data.

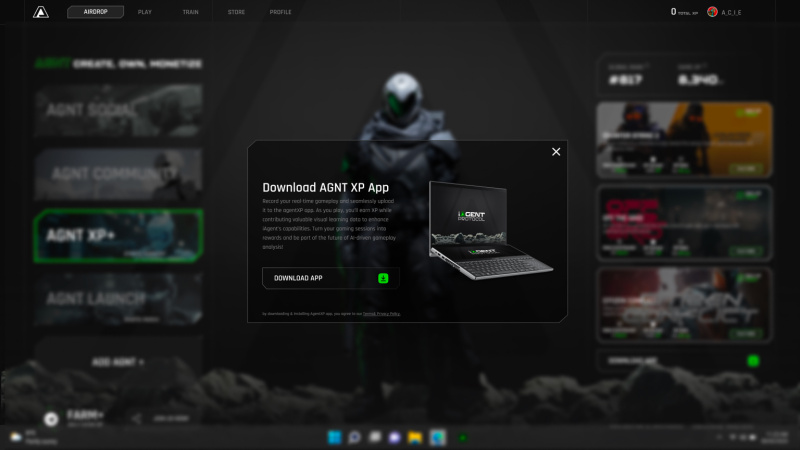

Backed by a recent $3 million investment, iAgent has forged several strategic partnerships with leading projects such as Base, LayerZero, Avalanche, Aethir, Arbitrum, and XAI Games. With over 700,000 users on its AGNTxp platform, iAgent is at the forefront of AI x Gaming x DePIN innovation.

Now, with TGE live, iAgent is laying the foundation for AI Agents to become a new digital asset that can be trained, validated, and exchanged transparently.

“AI should be decentralized, transparent, and monetizable. iAgent is ensuring AI models belong to those who train them, not corporations.” — Jamie Batzorig, Co-Founder of iAgent.

iAgent’s Product Hub: Powering the AI Economy

iAgent’s ecosystem consists of a suite of interconnected products aimed at supporting AI development, deployment, and monetization through a decentralized framework. Each component is designed to enhance the verifiability, scalability, and accessibility of AI models across various ecosystems.

Visual Learning Model (VLM): Adaptive AI Training

Unlike traditional AI that relies on text-based training (LLMs), iAgent’s Visual Learning Models (VLMs) enable AI agents to learn from real-world gameplay footage. This approach allows AI to analyze, strategize, and adapt dynamically, making them more intelligent and applicable in real-world scenarios.

iAgent’s VLM-powered AI utilizes real-player interactions to enhance its adaptability, enabling continuous optimization for performance in competitive gaming environments and other applications:

- Current live for Counter Strike 2, Off the Grid & Citizen Conflict.

- Players have already contributed 25 TB+ gameplay data.

- Over 10,000+ hours of gameplay footage recorded

ERC-** Agent Standard: A New AI Digital Asset Class

iAgent’s ERC-** standard will bring AI Agents on-chain as verifiable, secure, and interoperable digital assets. This aims to enable true ownership, trading, and cross-chain utilization without centralized control. While enhancing trust and transparency through provable authenticity and ownership history.

AI Agent Marketplace: The Open AI Economy

The AI Agent Marketplace serves as the foundation of iAgent’s decentralized ecosystem, enabling seamless AI model deployment, trading, and monetization. Developers can list AI-powered agents for rental or sale, while businesses and game studios can purchase or integrate AI models tailored to their needs.

iAgent DEV Hub: Decentralized AI Infrastructure

The iAgent DEV Hub acts as the backbone of the protocol, offering developers and AI researchers a comprehensive suite of tools, SDKs, and APIs to build and optimize AI models. It provides a trustless AI validation framework, leveraging on-chain verification nodes, cross-DePIN compute integration, and AI execution tracking.

AI in Gaming: The Next Evolution of Intelligent Agents

Gaming offers high-quality, labeled data, making it a suitable environment for training advanced AI models. iAgent is introducing adaptive AI agents to gaming, facilitating:

- AI-powered game assistants – AI agents that analyze in-game movements, provide real-time coaching and improve player performance in FPS games like Valorant.

- Smart NPCs that evolve dynamically – NPCs in RPGs like World of Warcraft that learn and adapt to a player’s choices, creating truly immersive experiences.

- AI anti-cheat and security systems – AI in games like CS2 that detects aimbots and wallhacks in real-time, ensuring fair gameplay.

- Predictive AI for in-game economies – AI models that track in-game trends, helping players optimize asset trading in games like Diablo 4.

iAgent’s decentralized AI infrastructure will expand beyond gaming, creating an open AI economy applicable across industries.

“Gaming is the first major use case, but our AI infrastructure will extend to multiple sectors. AI models will be owned, monetized, and deployed across various real-world applications.” — MHL Solutions, iAgent Advisor.

Roadmap: From Foundation to AI Economy

2023-2024: Establishing the iAgent Protocol

- Development of Visual Learning Models (VLMs) and AI ownership framework.

- AGNTxp launch, onboarding 700K+ users and generating 75K+ AI identities.

- AI data collection platform, accumulating 25+ TB+ gameplay data.

- Genesis Node Sale to decentralize AI model validation and verification.

2025: Scaling AI Deployment & Monetization

March 2025:

- TGE live, launching $AGNT as the core AI economy token.

- On-chain governance rollout, enabling staking & liquid staking.

April 2025:

- AI Agent Marketplace launch, enabling AI deployment, trading, and rental.

- ERC-** Standard proposal, formalizing AI ownership and validation.

May 2025:

- AGNT-Hub powered by $AGNT.

June 2025:

- AI Agent Explorer & Analytics Platform, enabling transparent AI tracking.

Q3 2025:

- Integration of VLM-powered AI into partner games in the AAA and indie gaming ecosystem.

- Visual Data Monetization framework, allowing users to sell gameplay data to train AI.

Q4 2025:

- Protocol Testnet Launch, deploying decentralized AI compute infrastructure.

- Mainnet launch, establishing the fully operational iAgent Protocol.

AGNT: Advancing Practical Applications in AI and Blockchain

As the core of the iAgent ecosystem, AGNT enables:

- AI Training & Trading – AI models can be owned, sold, and deployed through the marketplace.

- Compute & Staking Rewards – GPU node operators are incentivized for providing AI training power.

- Visual Data Monetization – Users can get AGNT by contributing high-quality labeled data.

- Governance Participation – AGNT holders shape the evolution of iAgent’s decentralized AI infrastructure.

AI is Becoming an Asset Class, and iAgent is Leading the Way. The AI, gaming, and DePIN industry is set to grow from $553.7 billion today to $2.8 trillion by 2030. iAgent aims to build the infrastructure for this growth.

About iAgent Protocol

iAgent’s Visual Learning Model allows gamers to train custom AI agents from their gameplay footage, powered by decentralized computing. By leveraging blockchain technology, it introduces a new digital asset class, enabling users to Create, Own, and Monetize their AI agents in gaming.

Founded by a powerhouse team of industry veterans and innovators, iAgent’s leadership team includes eight C-level executives with a combined 20+ years of experience at Fortune 500 companies, driving strategic growth and innovation.

On the tech front, the team comprises 12 top-tier AI and blockchain engineers, bringing expertise from global giants like Bosch, Meta, Airbus, and Samsung. The best minds shaping the future of AI x Gaming x DePIN together.

Website | Twitter | Telegram | Discord | Whitepaper | Linktree

Contact

Co-Founder & CEO

Jamie Batzorig

iAgent Corporation

jamie@iagentpro.com