Los Angeles, California, 15th December, 2022, Chainwire

Web3 Sports prediction app Maincard and Myria are joining forces to expand the appeal of NFTs. Maincard will benefit from Myria’s scalability focus as a trusted Ethereum L2 solution through the partnership.

Maincard recently announced its main net launch on the Polygon network. The Web3 sports prediction game went live the day before the 2022 Fifa World Cup kicked off. Core benefits of the platform include novel gameplay dynamics, NFT support, and the ability to earn rewards.

In late November, Maincard unveiled its first prize fund draw. A total of 6,000 MATIC tokens were distributed to the top and most active players on Maincard.io. Users who own a Maincard NFT can place wagers on upcoming events supported by the platform. Whether one wants to place many bets or a few small ones, all options are available within a fair and transparent ecosystem.

Although Maincard is built on Polygon, it is fully compatible with other EVM blockchains. In addition, the collaborative effort with Myria, a trusted Ethereum L2 solution focusing on growth and security, marks a significant milestone. Moreover, Myria is designed to focus on the future of gaming and unlocking the various benefits blockchain technology provides to that industry.

Several games exist under the Myria banner, including Metarush, Metakart, and Block Royale. Adding a Web3 sports prediction app highlights the potential of Myria and its overall scalability. Moreover, the team is confident NFTs represent much more than virtual art. Non-fungible tokens can serve utility and entertainment purposes, as illustrated by Maincard.

The play-and-earn nature of Maincard caters to a global audience of sports fans and enthusiasts. Users earn cryptocurrency for correct predictions involving sporting fixtures. Users who earn the most MainCoins receive their share of the prize fund. However, those who make inaccurate predictions will see their Maincard NFT’s life decrease. Restoring life is possible with MainCoins. The currency will also make its way to various exchanges in Q1 2023.

The partnership with Myria coincides with Maincard adding an NHL sportsbook to its Web3 sports prediction platform. Other support sports on the app include soccer, basketball, and the League of Legends esports scene. More sports will be added over time.

About Maincard

Maincard is a fantasy sports platform deployed on the Polygon network. The app enables gamers to speculate on the outcome of sporting fixtures against one another, receiving rewards via cryptocurrency or NFTs for making correct predictions. The application launched its main net after thorough testing just six months after its founders came up with the idea to spur Web3 adoption via gaming. Maincard hopes its innovative game mechanics will help encourage Web3’s mass adoption among the more than five billion sports fans worldwide.

Website | Discord | Telegram | Twitter | Reddit

About Myria

Myria is the first Ethereum Layer 2 scaling solution built for gaming. We make digital asset trading and blockchain gaming easy with our all-in-one platform, including the Myria NFT marketplace, Myria Wallet, Myria Game Platform, and a decentralized exchange. With the mission of enabling more people to build, experience and enjoy the benefits of blockchain and the metaverse, we are building a suite of developer tools including easy-to-use API integrations and SDKs for developers to easily harness our platform infrastructure to unlock the potential of blockchain. This suite of infrastructure will also underpin the expansive blockchain gaming ecosystem being developed by our gaming division, Myria Studios.

Myria Studios has a variety of free-to-play AAA blockchain games in the pipeline, spanning across genres from light-hearted multiplayer obstacle course games, action-packed battle-royale shooter games, and everything in between.

Website | Discord | Instagram | Twitter |

Contact

Val

val@maincard.io

London, United Kingdom, 15th December, 2022, Chainwire

Games Metaverse Platform Virtua will Collaborate with JLINGZ Esports to Build Unique Fan Experiences in the Metaverse.

Jesse Lingard and his JLINGZ esports brand have announced a partnership with games metaverse Virtua, which will see the England international and Premier League footballer expand his esports brand into the metaverse.

Working with Virtua will give Jesse Lingard, affectionately known to his global fan base as JLINGZ, the opportunity to reach the fans of the future and expand into Web3. This partnership will encompass metaverse esports, digital collectibles, access to exclusives, virtual spaces and video games.

To celebrate the announcement Virtua will give away Jesse Lingard VFLECT digital collectible avatars to the first 1,000 people to sign up, details of which can be found on the JLINGZ Virtua website.

The JLINGZ Esports partnership will headline the sports zone on Virtua Island, where fans will be able to support metaverse esports teams and play NFT/casual games in the metaverse. The sports zone will incorporate other celebrity and brand partnerships, creating further merchandising and digital ownership opportunities.

Virtua has successfully launched its games metaverse through partnerships with leading brands and celebrity figures, including Williams Racing, Legendary Entertainment, The Hero ISL, Shelby America, and Kevin Hart.

Jesse Lingard, JLINGZ Esports: “I’m always looking for interesting and exciting ways to engage with fans that are passionate about football, fashion and esports, that’s what the JLINGZ Esports brand is all about. Virtua is the perfect partner to explore the opportunities in the metaverse and meet fans in this exciting new space.”

Jawad Ashraf, CEO and co-founder, Virtua, added: “Jesse is a Web3 enthusiast, global sports personality and owner of a vibrant esports team, his brand transcends many different fan bases. His profile is perfect the Web3 audience, he’s a natural fit for the Virtua metaverse and we are delighted to be working with him to bring the JLINGZ Esports brand into the space.”

Jesse has been playing at the highest levels of European football for clubs including Manchester United, West Ham United and Nottingham Forest for over a decade. He’s also represented England 32 times, scoring six goals including a goal against Panama in the 2018 FIFA World Cup.

Jesse epitomizes the modern footballer and engages with the next generation of football fans on the platforms they feel most comfortable with. His unique style and enigmatic celebrations have formed a tight bond with young fans in particular. He currently has over 10m followers across Instagram and TikTok.

Interested in learning more about the collaboration and for a chance to win one of 1,000 Jesse Lingard VFLECTs? Sign up to the project mailing list on JLINGZ Virtua.

About Virtua

Virtua is a games metaverse that provides immersive Web3 gaming and digital collectible experiences through its interactive virtual environments, curated marketplace and brand partnerships.

About JLINGZ

JLINGZ esports, Europe’s most exciting esports org was launched by Nottingham Forest midfielder Jesse Lingard last year. The org has quickly risen through the esports ranks in its debut year with some of the world’s top teams competing across Halo and Rainbow 6 Siege. The JLINGZ logo is taken from Jesse’s iconic celebration and has been quickly replicated by fans across the globe.

Virtua Press Office

Press Agency – 33 Seconds

Virtua Press Centre

Contact

Virtua

virtua@33seconds.co

Singapore, Singapore, 12th December, 2022, Chainwire

BinaryX launches a new 220,000 BNX Cyber Incubation Fund, aimed at driving the growth and adoption of Web3 games.

The fund, supported by the project team, seed investors and members of the BNX community, will be used to invest in on-chain gaming projects that utilize or are experimenting with blockchain technology. BinaryX is also offering advisory services alongside the fund to bolster support for projects under the fund.

The fund will be used to provide resources and all forms of support for games at any stage, including early-stage, and late-stage development.

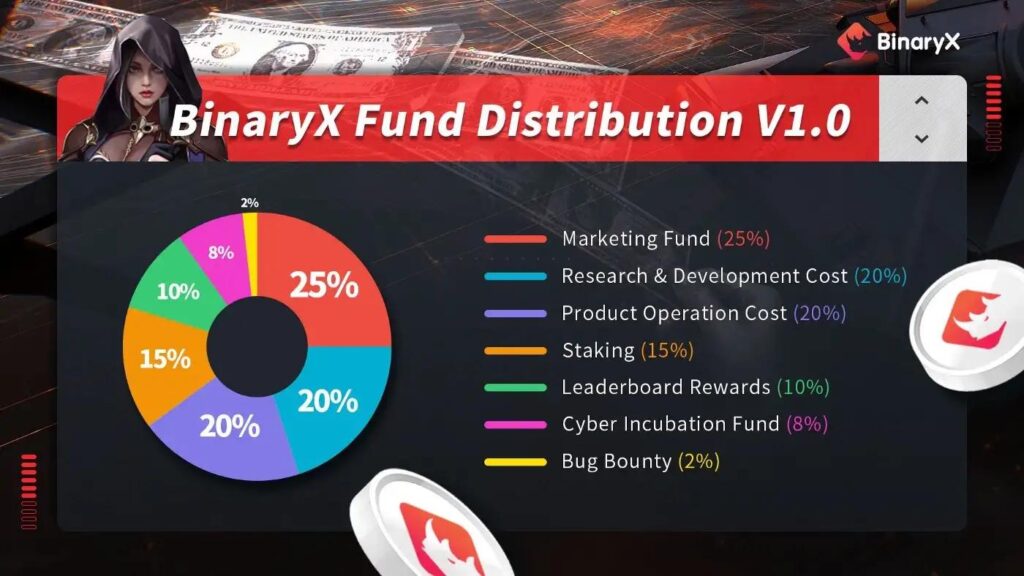

BinaryX Incubation Fund Distribution Breakdown

The fund distribution comes from the overall BinaryX fund as pictured below:

BinaryX will allocate 8% of their overall funds to the Cyber Incubation Fund, the amount is $12 million USD at the time of writing.

Rudy, Head of Growth at BinaryX, said:

“BinaryX is committed to accelerating the adoption of Web3 technologies in gaming. The fund is not limited to supporting blockchain games already in the space, but also traditional developer teams who want to experiment with blockchain in their games or NFTs. We believe in the overall growth and adoption of blockchain within the gaming ecosystem, and we will strive to support any project that is promising to that effect.”

Since launching the incubation arm mid-2022, BinaryX has invested in and incubated 2 GameFi projects. Its portfolio includes SHIT games, and Rh!noX NFT collection, with several exciting projects underway.

BinaryX will accelerate its search and adoption of projects in need of incubation, and offer support across all stages, including early-stage and late-stage development.

With this incubation arm, BinaryX aims to connect projects with BinaryX’s network of resources, advisors and investors to help projects go to launch. The Incubation Fund is open to receive applications and all year round, providing iterative support to any project at any stage of development.

The news comes amidst already refuted rumours that BinaryX is selling tokens. To reiterate their stance, Rudy said, ‘We would like to emphasize that there was no foul play from our team. We are entirely focused on our games, and we have been communicating our upcoming plans transparently.’ The team has just arranged a DAO vote to decide on the buy back plan for BNX, and are working to execute it alongside other strategic plans for long-term growth, including the development of their latest game, CyberLand.

About BinaryX

BinaryX is the GameFi platform behind play-to-earn games CyberDragon and CyberChess, both of which run on the BNB chain.

BinaryX began as a decentralised derivative trading system. The team gradually evolved into developing decentralised video games, and is now transitioning to becoming a GameFi platform offering IGO services to bridge Web2 developers to Web3.

As one of the top 10 projects on the BNB Chain, BinaryX has a vast community of more than 100k coin holders and 17K monthly active wallets. It is also one of the largest metaverse projects by trading volume on the BNB chain. BinaryX also has a token, $BNX, that has consistently demonstrated strong performance despite the bear market.

For more details and information about BinaryX, please visit www.binaryx.pro

BinaryX whitepaper | About BinaryX deck

Our Socials: Discord, Telegram and Twitter

Check out our games on our website and YouTube

Contact

Communications Lead

Sam K.

BinaryX

marketing@binaryx.pro

Bucharest, Romania, 12th December, 2022, Chainwire

After experiencing success in the crypto space, DeFi Yield Protocol announces a complete rebranding to Dypius. The experienced team conducted several months’ worth of research to come up with the best way to represent what they had evolved into over the years.

Dypius has the suffix of the nebulae in the galaxy. Nebulas are the formations of gas, dust, and other materials that “clump” together to form denser regions in the universe. They attract further matter and eventually become dense enough to form stars, planets, and planetary system objects. Dypius is the place of creation of stars, planets, and life. This is Dypius, a place to create and shape the future!

DYP began as a DeFi protocol at the dawn of decentralized finance, offering earning opportunities on three different blockchains. However, it was clear from the start that it would be developing into much more than that. In fact, the team sought to build a decentralized ecosystem with multiple DeFi products and services.

Soon, DYP expanded to include 12 unique products bringing value to the crypto market and its users. These solutions include the advanced analytics DYP Tools offering real-time data, market insights, breaking news, and updates on the latest market trends to empower users to make better-informed decisions.

The newly-rebranded Dypius keeps the DYP Tools as one of the ecosystem’s most lucrative features. The same goes for the Dypius Launchpad, which supports new projects by helping them raise capital in a decentralized environment and get exposure to Dypius’ global community.

Additionally, the team is developing the Dypius Metaverse, a unique metaverse platform integrating the CAWS NFT collection. This engaging and convenient platform offers an immersive experience with exciting environments to explore, real-time user interaction, user customization, and much more. The platform will include a standalone application and a PCVR) play-to-earn (P2E) game allowing players to use their NFTs as companions in various adventures or to check their crypto portfolios.

Users can take advantage of the Dypius Metaverse to bring their real-life businesses into a virtual space. Moreover, users can access unique opportunities to earn rewards and in-game assets. This platform offers unlimited possibilities for regular users and businesses through sustainable growth and constant innovation.

The DYP founder Mihai Busica commented on the protocol’s rebranding to Dypius:

“From the beginning, I have always envisioned a project that users can benefit from in an accessible and secure environment. I am extremely proud of our expert team’s dedication and the project’s journey from a simple protocol to an advanced decentralized ecosystem. I urge our users to enjoy exploring our ecosystem and embrace each opportunity.”

About Dypius

Dypius, formerly DeFi Yield Protocol (DYP), is a rapidly developing DeFi ecosystem incorporating numerous versatile solutions, including yield farming, staking, NFTs, analytical tools, and Metaverse gaming. The project runs on unique smart contracts using the protocol’s proprietary anti-manipulation functionality.

The protocol’s token, DYP, is listed on top-tier exchanges, such as Coinbase, Huobi Global, KuCoin, Gate.io, MEXC Global, Bitrue, Poloniex, and others.

The upcoming metaverse-based P2E game allows players to socialize in the open virtual world through features like the Mall, an NFT Marketplace, a DYP Shop, and a Trade Station. Furthermore, the game will feature a balance section, enabling players to deposit DYP and iDYP tokens to their wallets, withdraw rewards, or transfer credits.

For more information and to stay updated, visit:

Website | Twitter | Telegram | Discord

Contact

Daniel Garett

Dypius

business@dypius.com

London, United Kingdom, 12th December, 2022, Chainwire

Games metaverse Virtua has announced the launch of the Monster Zone. The first area to be released on Virtua Island, a key region of its home planet in the metaverse – Virtua Prime.

The launch of Virtua Island follows the successful launch of Cardano Island in the Virtua metaverse and both will form parts of a 3D world in the virtual space.

The Monster Zone draws together elements of the metaverse and gaming in ways never before possible and will be populated with amazing creatures from well-known IPs and new exciting brands. Through challenges and events, players will be able to acquire, craft, and trade various resources and creatures, to gain out-of-this-world riches and rewards.

Virtua is no stranger to working with monsters in the metaverse, having collaborated with Legendary Pictures on a number of exclusive digital collectible initiatives. The first of which was alongside the theatrical release of Godzilla Vs Kong in 2021, and more recently the launch of the Godzilla Vs Kong Legacy collection.

Land Plots and Condos are now available in the Monster Zone, unlocking a range of exciting features including access to the free-roam Monster Park, the Monster Hub, and specially themed cribs to store digital collectibles.

There are a fixed number of land plots to buy across Small, Medium, and Large sizes. Also launching is the Giga plot allowing owners to build their own tower in Virtua, and the popular metaverse Condos, which for the first time will be available to purchase on the Virtua iOS and Android app.

5,002 plots and 1,000 condos are available to purchase via the Ethereum network using ETH or Virtua’s native token TVK, those purchasing land with TVK will automatically receive a 10% discount. There are an additional 500 plots available to Cardano users, available to purchase in ADA.

Every land plot will include mineable resources that can be crafted into items to play, trade, or sell. Rarer plots include slots for land bots to help mine and explore, plus access to rarer resources and non-playable characters.

Further playable features are planned for the Monster Zone as well as a monster breeding programme which will include unique generative drops and revenue share opportunities for landowners. All landowners will get early access to all new Virtua Prime launches planned for the months ahead, plus chances to grab valuable items like relics, loot boxes, game cubes, and much more.

Virtua CEO and co-founder, Jawad Ashraf said: “In developing Virtua Prime we’re focused on tangible utility through blockchain technology, creating compelling reasons for individuals and brands to participate and own land in the metaverse. We want to answer the question; ‘Why own land in the metaverse?’ For us, it’s all about creating lots of fun and utility, and the Monster Zone is no exception.

“With high fidelity graphics, world-leading industry expertise and an exciting roadmap for continuous development, we are developing a genre-defining games metaverse. We can’t wait to welcome everyone into Virtua Island Monster Zone to experience Monster Zone and the Virtua metaverse.”

During the first day of the Monster Zone mint event, users will be able to mint Large Land Plots and Gigaplots only – and everyone who mints a Large Land Plot will also get a free Monster Zone NFT reward. Over the course of this mint week, everyone who mints a Small, Medium, or Large Monster Zone Land Plot will receive an exclusive metaverse-ready NFT vehicle. Prestige members and Virtua VIPs will have exclusive access to the first pre-mint stage.

Virtua Prime’s Monster Zone land sale, which goes live at 5 pm GMT, is accessible on laptop, desktop, and on mobile in the metamask app browser. Following the launch of Virtua’s all-new mobile app for iOS and Android, users can easily purchase metaverse Condos – a world first, giving fans and collectors an easy way to own their own home in the metaverse. To buy land on mobile, users will need to use in-app V-Credits.

Virtua Island is the second island after Cardano Island was announced on Virtua Prime. There are plans for further zones on the island based on interests, such as sports, music, automotive, and for third-party partners.

About Virtua

Founded in 2017, Virtua is a games metaverse that provides immersive Web3 gaming and digital collectible experiences – through its curated marketplace, interactive virtual environments, and exclusive brand partnerships.

You can find more information about Virtua Prime and the Monster Zone here.

Contact

Virtua

Virtua@33Seconds.co

New York, New York, 12th December, 2022, Chainwire

Web3 startup Nillion has closed a $20m+ fundraise from strategic partners and investors. The project is based on a new mathematical innovation, invented by cryptography professor Dr. Miguel de Vega, called Nil Message Compute (NMC) which enables the creation of a non-blockchain decentralized network that aims to open up new, non-blockchain, decentralized use cases.

Since its founding in November 2021, Nillion has bootstrapped to a headcount of over 40 with no external funding. Members of the Founding Teams of Uber, Indiegogo and Hedera Hashgraph, as well as key executives from Coinbase and Nike have joined forces at Nillion to build the platform. The company aims to become the first non-blockchain decentralized network designed to enable new decentralized use cases while providing the private and secure transfer, storage and computation of data.

Nillion CEO, Alex Page, reports that raising $20m+ from over 150 investors was a conscious decision to prevent typical concentrated ownership amongst a small number of venture capitalists who may have adverse incentives to ‘dump’ in the long-term:

“We’ve seen so many web3 projects suffer because their network was owned by early investors with excessively concentrated holdings. That’s exactly why we passed on certain Silicon Valley VCs who wanted over 5% of tokens to simply lend their name to the project. Instead we carefully invited a widely distributed pool of early contributors who love, support and add value to the project.”

The round was led by Distributed Global, and includes investment from Big Brain Holdings, Chapter One, GSR, Hashkey, OP Crypto, SALT Fund and 150+ others.

David Gan, GP of OP Crypto said, “It’s very rare to have a truly novel math innovation being built by an elite ‘Avengers level’ team. Nillion could open a new universe of use cases blockchain never imagined. What proof of work did for blockchain, I think NMC may do for Multi-Party Computation as a technology.”

Another investor, Alex Klokus of SALT Fund states, “Nillion is a world-class team

pursuing an extremely ambitious,order of magnitude improvement over existing MPC technology. If they pull it off, it could be revolutionary.”

NMC enables the fragmentation and dispersion of data across the Nillion network of nodes which creates privacy while still allowing the underlying data to be computed on quickly. A key feature of the technology is that this process occurs without the need for communication between the nodes.

According to the team, company website and online materials, NMC technology unlocks new utility in web3, such as decentralized credit scoring, decentralized trusted execution environments, private NFTs and decentralized secure storage services. Other potential use cases promised outside of web3 include storing healthcare records on the network while being able to run analysis on the records without jeopardizing an individual’s right to privacy.

Nil Message Compute (NMC) was developed by Nillion’s Chief Scientist, Dr. Miguel de Vega, who has authored more than 30 patents in the fields of machine learning, data optimization and mathematics. In addition to Dr. Vega, Nillion’s leadership team includes:

- Chief Technology Officer Conrad Whelan, the Founding Engineer of Uber.

- Head of Cryptography Dr. Elizabeth Quaglia, a senior lecturer at Royal Holloway, University of London, one of the world’s leading cryptography institutions.

- Chief Executive Officer Alex Page, an ex-Goldman Sachs investment banker and Hedera SPV General Partner

- Director of Crypto Tristan Litré, previously CTO of a DeFi platform acquired by AQRU.

- Chief Business Officer Slava Rubin, the Founder and former CEO of Indiegogo.

- Chief Strategy Officer Andrew Masanto, who started two of the top 100 cryptocurrencies – Hedera Hashgraph and Reserve.

- Head of Ecosystem Mark McDermott, previously the Lead of Innovation Partnerships at Nike.

- General Counsel Lindsay Danas Cohen, the former associate General Counsel at Coinbase and a legal counsel at Bloomberg.

Nillion is prioritizing ecosystem development from an early stage in protocol development and reports significant interest from both web2 and web3 participants.

“We’ve had expressions of interest from over 120 companies wanting to test applications or build on Nillion, which shows the need for a commercially viable private computation network. Data stored on the Nillion network is not only safe, but it can be used for extremely fast, private computations,” says Alex Page, CEO of Nillion.

About Nillion

Nillion is new internet infrastructure for the secure storage and computation of data. It is a decentralized network (albeit not a blockchain) that utilizes a novel mathematical innovation called Nil Message Compute (NMC) which represents a generational leap in a technology known as secure multi-party computation (MPC). Nillion facilitates the fragmentation of data across a network of nodes, while allowing the underlying data to be computed on at commercially viable speeds.

To learn more about the company visit www.nillion.com

Contact

Jake Klein

Goldin Solutions

jake@goldin.com

Dubai, United Arab Emirates, 9th December, 2022, Chainwire

Revolutionary Artificial Intelligence trading and portfolio management company, Tafabot, has partnered with China’s leading Crypto exchange company, Huobi, to provide automated trades to crypto enthusiasts.

What started as an idea during the COVID19 lockdown in 2020, is today one of the leading solutions in the crypto industry today. Having been in the beta phase for nearly 2 years, Tafabot finally went live on September 12th 2022 on the iOS and Google App Stores.

The automated non-custodial trading bot has its operational headquarters in Dubai, United Arab Emirates, With across-border utility to serve millions of crypto professionals, newbies, and enthusiasts, Tafabot is the world’s pioneer bot system enabled for futures, spot and arbitrage markets combined. Both Huobi and Tafabot view their partnership as a strategic step towards improving the easy adoption of crypto and blockchain knowledge across communities around the world.

Samuel Benedict and Dr. OVO (Otubo Victor), co-founders of Tafabot, said, “our primary motto, especially for now, is excellence and speed. We are glad that in just 50 days of going live, we have already closed a strategic partnership with one of the largest players in the industry. For us, it’s reassuring that what we are doing is really having a noticeable impact.”

Samuel Benedict, Tafabot’s CTO, expressed confidence in the ability of the partnership to unlock rapid inclusion and economic opportunities for all. “We didn’t like the traditional trading methods that existed out there. People had to constantly be on screens all day just to trade. Of course, this has discouraged a lot of interested persons from really getting their hands on crypto. And yes, there are also some other bots that came before us, but just like the exchanges, their processes are complex and do not bring in any simplicity. This was part of what inspired us to build an easy to use, reliable software that both newbies and pros can enjoy. We did it in the background for 2 years and once the power of Tafabot was realized, we opened it to profit everyone.”

In further describing the partnership, the co-founders stated among other things that more partnership conversations are currently ongoing and will be announced in coming months. “Currently we are compatible with all major exchanges in the industry, however this partnership offers more. Our users are easily identified by Houbi for exclusive benefits including reduction on trading fees and much more. We are in talks with some other exchanges that we are plugged into for similar partnerships and 2023 will be a big year for more announcements.”, Benefit and Victor added.

With 30 of the world’s most reputable exchanges already plugged into the Tafabot algorithm, the team believes this is one of the next big things in crypto. Tafabot provides what is today, the world’s fastest automated trading tool, with a bot speed of up to 5 seconds. It is also one of the most diversified bot systems, with bot options developed for optimal performance in trading bullish, bearish and sideways market conditions.

It doesn’t matter wheather users are beginners who wants to dive into the world of crypto trading or professional traders, Tafabot’s automated systems provide every tool they need at every level. The safety of user’s funds is one less thing to worry about also, as the capital and trade profits are always with them, in the user’s exchange and never with Tafabot. This way users have all the control they need, anyday and any time.

Some of the bots services offered by Tafabot include:

1. The Martingale Bots: Available for both Spot and Futures Markets. Martingale bots allow users to create multiple entries, to let them benefit in dynamic market conditions.

2. DCA Bots: The Dollar-Cost-Average bot helps users divide their investment into smaller pieces and buys assets at various points over time and at different prices, to realize a better average price for their position, as well as drastically reduce risks in the case of volatility. It is available for spot and Futures trading.

3. Custom Bot: This allows users to build their own intelligence into the Tafa ecosystem. With the custom bots, they can connect their self-created bot(s) to TradingView indicators and still automate all of their trades.

4. Grid Bots: The Tafabot Grid Trading realizes profits from the ups and downs of the market, by trading within a price range and continues to execute orders and take profit as long as the market is within that range. It is available in spot and futures.

5. SIB Bot: Smart invest Bot is a specialized DCA bot for spot market only, with extra features for building long term portfolio, by buying assets daily in a way that user’s average entry price mimics the current price of the market.

6. Arbitrage Bot: With earning capacity of 15 to 40% yearly, the Tafa arbitrage bot is a market neutral strategy that exploits market variations (price gaps and funding fees) between spot and futures market. It’s a market-neutral strategy in which the risk involved is extremely low.

7. Mirror Trading Bot: With this intelligence, users can simply copy successful traders on Tafabot and leverage on their efforts and configurations to earn daily.

8. Crypto Signal Bots: Allows users to automatically trade signals received from their favorite signal providers 24/7. Plus, Signal Providers are allowed to create accounts with Tafabot and undergo approval processes.

Apart from enabling newbie and advanced traders set up bots on all major exchanges for their spot, futures, and arbitrage trading, Tafabot was also built to house features like:

- Wallets: A free to use USDT wallet, with zero transaction fees when sending peer to peer within the Tafa ecosystem. This is available to all users with an active license.

- Game Predict & Win: Lets users predict the price of bitcoin within time frames and win big.

- Affiliate Program: Refer friends to Tafa and earn up to 30% of direct and indirect referral bonus on license fees and unlimited trading fees from up to 15 generations of downlines.

About Tafabot

Tafabot brings well over 30 combined years of Finance, Investing and Trading experience into the crypto space. The platform is portrayed to be transparent, secure, and easy to understand. With this ingenuity, the era of chasing close friends and family or even strangers considered to be experts, to trade on one’s behalf may be finally behind us.

Contact

Tafabot Team

Tafabot Software LLC

bdd@tafabot.com

Singapore, Singapore, 8th December, 2022, Chainwire

DeFiChain, the world’s leading blockchain on the Bitcoin network dedicated to bringing decentralized financial applications to everyone, has officially activated the much-anticipated Grand Central hard fork on its network at 01 AM EST on Thursday, December 8th on Block Height 2,479,000.

The Grand Central hard fork is one of the biggest and most monumental updates for DeFiChain in 2022. It marks the rollout of four main features:

- On-chain governance

- Token consortium framework

- Support for masternode parameter updates (owner, operator, reward address)

- Pool commission and reward fixes

This hard fork addresses some of the long-awaited product debt and prepares the DeFiChain community for an accelerated growth in 2023.

U-Zyn Chua, Co-Founder of DeFiChain, said, “Grand Central marks a major step in DeFiChain’s governance structure since it is implementing on-chain governance. This makes the voting processes perfectly transparent, easier and strengthens the governance structure of DeFiChain. A major step for the whole ecosystem.”

On-chain governance

To make changes in the DeFiChain ecosystem, community members can submit three types of proposals to be voted on by masternode owners:

- Community development fund request proposal (also known as Community Fund Proposal; CFP)

- Vote of confidence (also known as DeFiChain Improvement Proposal; DFIP)

- Block reward reallocation proposal

Currently, the process of creating a proposal and voting is largely done off-chain. With On-Chain Governance (OCG), any proposal which requires voting by community can be conducted directly on the blockchain. It will strengthen DeFiChain’s governance structure and ensure that there is complete transparency in the entire voting process for the DeFiChain community.

The voting results will now be available real-time on a dashboard on defiscan.live, which makes tracking the results much easier. For masternode owners, they will be able to generate a script to vote for each proposal via the dashboard, reducing the effort required for voting. Overall, this would result in higher levels of participation in the voting of proposals.

DeFiChain Consortium

In DeFiChain, tokenized digital assets are meant to be backed 1:1 by the actual asset in its respective ecosystem (e.g. one dBTC being backed by one BTC). However, this backing is currently not enforceable via the blockchain. The DeFiChain Consortium will give a proper structure to the backing of dAssets to ensure that all digital assets are backed.

Members of the Consortium (e.g Cake DeFi) will have their own dedicated key for the minting and burning of tokenized digital assets. Each member is required to back any digital assets they mint, regardless of whether they are minting for themselves or on behalf of users of their platform.

The Consortium members will also be required to pledge two days worth of collateral, in DFI or DUSD, that will be locked up in a smart contract. It is required on top of the backing of the tokenized digital assets. This collateral will determine how many digital assets a member can mint each day.

This additional collateral is meant to deter members from engaging in activities that are contrary to the interests of the community, and to pay for damages in the event where a member overmints digital assets or is unable to provide backing for tokenized digital assets.

The formation of the Consortium will enhance the governance structure and transparency in the DeFiChain community. It also provides a mechanism for the community to monitor the backing of tokenized digital assets, which deters overminting.

About DeFiChain

DeFiChain is a decentralized Proof-of-Stake blockchain created as a hard fork of the Bitcoin network to enable advanced DeFi applications. It is dedicated to enabling fast, intelligent, and transparent decentralized financial services. DeFiChain offers liquidity mining, staking, decentralized assets, and decentralized loans. The DeFiChain Foundation’s mission is to bring DeFi to the Bitcoin ecosystem.

For more information, visit: Website | Twitter | Discord | GitHub

Contact

Benjamin Rauch

press@defichain-ac.com

London, United Kingdom, 8th December, 2022, Chainwire

Metacade, the first-ever community-developed play-to-earn (P2E) blockchain arcade, has announced the launch of its highly anticipated $MCADE token presale.

The sale of Metacade’s native utility token sold over an incredible $670k in under 2 weeks, with their Beta Sale stage now over 60% SOLD OUT.

$MCADE is available to buy on the official Metacade website.

Positioning itself as a Web3 community hub, this gaming-first platform is set to attract gamers, investors, and entrepreneurs alike by offering a multitude of ways to earn, play, and connect. It looks to be a central hangout for all of those interested in GameFi and metaverse.

To ensure investor confidence, $MCADE has been audited by leading blockchain auditing firm CertiK, a security-focused platform that analyzes and monitors blockchain protocols and DeFi projects. Verification and approval from CertiK mean that the code behind Metacade is highly secure and has been scrutinized for any weak spots.

Metacade harnesses the power of Web3 to take blockchain gaming to the next level. The project goes beyond play-to-earn and offers a place to discover what games are trending, view leaderboards, publish game reviews, and access the hottest and most advanced GameFi alpha.

Head of Product for Metacade, Russell Bennet said: “The crypto gaming space is crying out for a single destination where we can all go and learn, earn and play games with fellow enthusiasts without having to jump from platform to platform”.

Metacade isn’t out to just improve the existing P2E and metaverse worlds but also to foster the future of this space. The project’s hallmark feature is Metagrants, a source of funding awarded to game developers to bring new games to the Metacade. The Metacade community will vote on which projects get funded to turn the collective vision into a reality on the platform. The first game developed using the first Metagrant will be launched in 2024.

By the end of 2024, the project intends to transform into a DAO, handing over key roles and responsibilities to the Metacade community and achieving a fully community-staffed business. It looks to achieve this by deploying Play2Earn, Create2Earn, and Work2Earn functionalities with each of these initiatives giving a little more control of the project over to the community in the coming years.

Reflecting on the core ethos of Metacade, Russell said: “We want to create a community that has zero barriers to entry whether you want to work in the space, launch a business or just hang, out, play, and have fun.”

$MCADE has a fixed supply of 2 Billion $MCADE tokens. Seventy percent of these (1.4 billion $MCADE tokens) are being made available during the token’s presale event. The remaining thirty percent will be used on exchange listings, during development, providing liquidity, and funding the competition pool.

$MCADE is the utility and governance token powering the project. It plays a crucial role in the platform’s functionality as holders can use it to vote on the project’s future direction and new game proposals. It will be the main tool for interacting with the Metacade ecosystem: holders can use it to enter tournaments and exclusive prize draws, purchase merchandise, and many other things as the platform develops.

Token holders will have plenty of opportunities to earn rewards through the project. $MCADE holders can earn from activities such as contributing content, reviewing and testing games, and generally engaging within the ecosystem. $MCADE holders may also stake their tokens in liquidity pools to earn rewards and APYs based on the amount staked. Staked rewards are paid in a stablecoin amount rather than in $MCADE to protect the value of the funds from inflation and price swings.

To further promote a deflationary attribute to the token, Metacade plans on introducing a burn mechanism or a buyback scheme. Token burning will help the ecosystem permanently erase a given percentage of supply, thereby lowering the overall supply and boosting the value of $MCADE in the long run.

Right after the $MCADE presale is complete, Metacade will roll out the website and build a founding team. In Q1 2023, the goal is to list the $MCADE token on Uniswap and the top five centralized exchanges, along with popular crypto aggregators. With an ambitious road map, Metacade is on track to revolutionize how a traditional community hub is owned and operated.

The Metacade Beta sale has now sold over $670,000 worth of tokens in under two weeks and at the time of publishing has under 40% remaining.

To buy $MCADE, visit Metacade.co and join the presale now.

About GameFi

GameFi, one of the most talked about and promising sectors of Web3, creates a virtual gaming ecosystem that relies on the use of cryptocurrency, non-fungible tokens (NFTs), and blockchain technology. At the core of the GameFi ecosystem is the play-to-earn (P2E) gaming model. Unlike the traditional pay-to-play model, P2E allows gamers to earn financial rewards by participating in challenges and tasks.

About Metacade

Metacade is the premier destination for gaming in the metaverse. As Web3’s first community arcade that allows gamers to hang out, share gaming knowledge and play exclusive P2E games. The platform offers users multiple ways to generate income, build careers in Web3, and connect with the wider gaming community.

Metacade will be the one-stop destination for users to play, earn, and network with other passionate gamers worldwide. Once the project reaches the end of its roadmap, Metacade will be handed over to the community as a full-fledged DAO. After all, Metacade wants you to have a hand in shaping the GameFi world of tomorrow.

Links

- Website: https://metacade.co

- Whitepaper: https://metacade.co/whitepaper.pdf

- Socials: https://linktr.ee/metacade_

- CertiK Audit: https://www.certik.com/projects/metacade

Contact

Head of Product

Russell Bennett

Metacade

pr@metacade.co

Polkadot co-founder and Parity Technologies chief architect Gavin Wood joined hundreds of the most talented engineers and developers in Web3 at Sub0, the conference for Polkadot developers.

Wood gave an impromptu keynote address providing insights into how the various upgrades already flagged for the network would play out in 2023. In particular, he focused on XCM, the network’s cross-channel and cross-consensus messaging protocol, and OpenGov, the new agile, more decentralized governance process for the network.

A rapt capacity audience — around half of whom were new to the ecosystem and had declared an interest in building on Polkadot — were engrossed by Wood’s surprise address.

Parity’s newly appointed CEO Bjorn Wagner had earlier kicked off the two-day meeting at Lisbon’s LX Factory with an introductory talk before a busy agenda featuring breakout sessions, Q&As and developer workshops wound into gear. Many of the agenda items demonstrated the breadth of use cases being explored by Polkadot developers via XCM as they continue to be among the busiest in Web3. Data from Santiment shows over 14,000 developer contributions on the Polkadot network for every month between August and November 2022.

While some of the talks were explicitly targeted at developers with strong experience of Polkadot, its software development kit Substrate and the Rust programming language, there was also plenty of explanatory material for those still learning about the network.

Some of the event’s highlights include:

- Focusing on the ambition for Polkadot to be a best-in-class offering for a strong user experience, Jakub Panik of Galactic Council spoke of the importance of respecting end users and keeping their requirements front of mind.

- Hector Bulgarini of Parity Technologies provided a case study demonstrating how real-world assets can serve as collateral in the world of DeFi through XCM.

- Sabine Proll of Supercomputing Systems AG explained how blockchain builds efficiencies when managing interlocking railway systems.

- Seun Lanlege of Composable Finance explained some of the cryptographic and game-theoretical components of trustless bridges, and delivered an overview of cross-consensus trustless bridges.

- Alberto Viera of Moonbeam provided details of useful scripts and monitoring tools to consider when exploring XCM for token transfers and remote executions.

- In a talk followed by questions, Bill Laboon of Web3 Foundation explained what differentiates Web3 from Web2 in a philosophical and technical way.

- Jonathan Dunne of Talisman discussed his experience of creating user-centric products with Substrate, including demystifying extrinsics with metadata and creating unstoppable connections with Light Clients.

About Polkadot

Polkadot provides the technical advances necessary to make blockchain technology practical, accessible, scalable, interoperable and future-proof, removing limitations and barriers to entry, and thereby fueling innovation, growing the decentralized technology space and bringing the Web3 vision to life.

About Parity Technologies

Staffed by some of the world’s leading blockchain innovators, core engineers, Rust developers and solutions architects, Parity Technologies has offices in Berlin, London and Lisbon. It launched Polkadot in tandem with Web3 technology.

About Web3 Foundation

Web3 Foundation funds research and development teams building the technology stack of the decentralized web. It was established in Zug, Switzerland by Ethereum co-founder and former chief technology officer Gavin Wood. Polkadot is the foundation’s flagship project.