London, UK, February 14th, 2024, Chainwire

Bitcoin Dogs will make history in less than two hours’ time as the world’s first ICO on the Bitcoin blockchain gets underway.

$0DOG tokens are available to presale buyers for a price of $0.015, beginning at 11:00 AM GMT on the BitcoinDogs.club website. Prices will increase every 72 hours throughout the 30-day presale, ending at $0.0404 per token on the 15th of March.

The ground-breaking ICO represents the beginning of a new era for the Bitcoin ecosystem and will be the only way to purchase $0DOG before Bitcoin Dogs becomes available for trading.

The $0DOG presale takes place exclusively on the BitcoinDogs.club website.

A New Era Of GameFi

$0DOG is a BRC-20 token: a brand-new type of cryptocurrency built on Bitcoin. The Ordinals protocol, which went live in 2023, allows developers to create coins like $0DOG that are secured on the BTC blockchain.

Ordinals also bring NFTs to Bitcoin, and Bitcoin Dogs capitalizes on this breakthrough, too. The project incorporates a collection of 10,000 exclusive NFTs, the largest collection on Ordinals to date.

These NFTs, along with the $0DOG token, constitute the main components of the forthcoming Bitcoin Dogs game. The game, which begins its beta in Q2, fuses Tamagotchi-style gameplay with play-to-earn (P2E) mechanics, bringing a much-loved gaming experience into the GameFi era.

Social media integration is a core element of gameplay. Players have the chance to earn in-game currency by sharing their progress on social channels — a system bound to expand the game’s player base — and Twitter/X will also be home to Dog Showdown events, where players pit their virtual pets against each other in competition.

The Journey Ahead for Bitcoin Dogs

Beyond the historic $0DOG ICO, the road ahead for Bitcoin Dogs is set to be momentous.

Other BRC-20 tokens made headlines last year with impressive price action. $ORDI, one breakout token, managed a rally of 3,000% between September 2023 and January of this year. Other BRC-20 coins include Orange, whose ORNJ token rallied by 677% in three days last week.

Bitcoin Dogs’ proximity to the Ordinals NFT market also puts it in strong company. Bitcoin-based NFTs fared well in 2023 while the rest of the NFT market floundered, leading experts to believe they’ll continue to outperform the wider market as a “roaring comeback” for NFTs takes shape.

The growth of Bitcoin itself is also likely to provide fuel for $0DOG’s ascent: the OG cryptocurrency has enjoyed a positive start to the year, with the SEC approving Bitcoin ETFs in the United States already. Furthermore, the next halving event takes place in April, with 84% of investors expecting this to push BTC to new all-time highs, according to a CoinTelegraph study.

$0DOG tokens are available to presale buyers for a price of $0.015, beginning at 11:00 AM GMT. Prices will increase every 72 hours throughout the 30-day presale, ending at $0.0404 per token on the 15th of March.

$0DOG tokens are available to purchase on the BitcoinDogs.club website.

About Bitcoin Dogs

Bitcoin Dogs is breaking new ground in the Bitcoin ecosystem. For the first time ever, NFTs, gaming, and new token types come together to offer the first ICO on the original Bitcoin blockchain. The truly permissionless immutability of Bitcoin is being harnessed to create the $0DOG token, while a play-to-earn (P2E) gaming experience and NFT collection is being developed exclusively for $0DOG holders.

Website | Whitepaper | Socials

Contact

Bitcoin Dogs

marketing@bitcoindogs.club

Willemstad, Curaçao, February 13th, 2024, Chainwire

EarnBet.io, an online crypto gambling platform today proudly announces that it has processed over $1 billion in bets and transferred millions of dollars in rewards and cashback to its users and token holders, showcasing its dedication to player satisfaction and innovation

Since 2017, EarnBet has distinguished itself as a pioneering online betting platform, utilizing blockchain technology to offer unparalleled fairness, transparency, and player rewards.

The introduction of several exclusive in-house games and an avant-garde wallet system has streamlined the deposit and withdrawal process for top cryptocurrencies, enhancing the overall user experience.

Year of Transformation: Rebranding and Platform Enhancement

Over the past year, EarnBet.io has embarked on an ambitious journey of transformation, focusing on a complete platform overhaul and rebranding. This initiative aimed to elevate the user experience through new game introductions, enhanced reward programs, and a revamped user interface, signaling a new chapter of growth and development for the platform.

A significant update to the platform is the EarnBet Rakeback feature, offering up to 62.5% Rakeback, allowing users to immediately claim cash rewards on every bet, win or lose, further distinguishing EarnBet.io’s commitment to providing value to its users.

Diverse Gaming Portfolio and User-Centric Innovations

EarnBet.io’s commitment to delivering an unparalleled gaming experience is evident in its extensive game offerings. The platform has introduced a variety of in-house games, along with popular titles from renowned developers like NetEnt, NoLimit, Pragmatic Play, and BGaming. This expansion ensures a rich and diverse gaming portfolio, further enriched by a user-friendly interface designed to boost performance and foster community engagement through social features. In the coming months, EarnBet plans to expand its library even further by adding more betting games from multiple award-winning platforms, showcasing its commitment to providing players with a broad and engaging selection of games.

EarnBet.io has also reinforced its dedication to fairness with a provably fair gaming system, allowing players to independently verify the fairness of game outcomes. This commitment to transparency is further highlighted by the platform’s updated leaderboard, showcasing top players and their achievements, fostering a competitive yet fair gaming environment.

EarnBet.io’s platform overhaul has introduced an array of innovative features designed to revitalize the online betting experience. Among these are enhanced gameplay mechanics for classic casino games like blackjack and baccarat, which have been redesigned for an interactive and engaging user experience. Additionally, the platform has embraced the popularity of dice games, optimizing gameplay to fair outcomes.

Community-Focused Features and Rewarding Opportunities

At the heart of EarnBet.io’s ethos is a focus on community and player rewards. The introduction of a VIP Members Club and innovative features like the Rain Bot and a new tipping system enhance the platform’s social aspects, allowing players to engage with each other and share their successes. These initiatives not only foster a vibrant community but also provide players with opportunities to earn rewards, reinforcing EarnBet.io’s position as a player-centric platform.

Lastly, EarnBet’s EBET native token, allows users to speed up their cashback rewards if the token is staked. The EarnBet team points out that they intends to buy back EBET tokens like previously.

As EarnBet.io continues to advance, it remains focused on continuous innovation and enhancing player engagement. The platform’s commitment to introducing new games, improving user features, and incorporating cutting-edge technology is unwavering. This dedication ensures that EarnBet.io will continue to offer a superior online betting experience, characterized by enjoyment, fairness, and a strong community focus.

About EarnBet

From its inception, EarnBet.io has set a new standard in the crypto online betting industry, combining blockchain technology with a commitment to fairness, transparency, and user satisfaction. The recent platform enhancements and rebranding initiative mark a significant milestone in EarnBet.io’s journey, underscoring its dedication to innovation and superior gaming experiences. With these updates, EarnBet.io reaffirms its commitment to redefining online gaming, offering an unmatched experience that prioritizes player rewards, engagement, and a transparent gaming environment.

Contact

EarnBet Team

support@earnbet.io

Disclaimer

EarnBet is the source of this content. This release is for informational purposes only and does not constitute investment advice or an offer to invest. Information provided about EarnBet and its services, including online gambling and cryptocurrency betting, involves significant risks and may not be suitable for all individuals. Users should exercise caution and are encouraged to conduct their own research before participating in any gambling activities. Participation is at the user’s own risk and should be approached with financial prudence.

To say Bitcoin has dominated the crypto headlines of late would be an understatement. Even setting aside the SEC’s landmark approval of multiple spot bitcoin exchange-traded funds (ETFs) in January, BTC enthusiasts have had plenty to celebrate with the asset’s value growing by almost 15% in the last fortnight.

With the fourth quadrennial Halving coming up, Bitcoin’s Layer-2 ecosystem is also enjoying a moment in the sun, smashing several significant milestones that underscore the appeal of solutions built on Satoshi’s network. At long last, supporters of the blockchain have more than the “digital gold” narrative to trumpet: Bitcoin-based DeFi solutions are proving a smash hit.

Bitcoin L2 Comes of Age

As with Ethereum, Layer-2s on Bitcoin run atop the main chain with the goal of increasing its capacity to process transactions. These auxiliary networks, and the dApps they support, essentially build out the architecture of Bitcoin and broaden the appeal of its ecosystem.

When DeFi took off in 2020, Ethereum activity exploded and a number of Layer-2s (Arbitrum, Optimism etc) subsequently appeared offering superior throughput, lower costs, chain specialization, and dApp utility. The idea that Bitcoin L2s could follow a similar trajectory is undeniably appealing to BTC maxis.

Although Bitcoin L2s are at a much earlier stage than the preponderance we see on Ethereum, they are growing at a rapid rate. Payments on the Lightning Network, one of the best-known L2 solutions designed to lighten the load on the main chain, have grown by over 1200% in two years. Recent hype around BTC has also seen other significant developments.

Stacks, a Layer-2 network enabling smart contracts and dApps to use Bitcoin as a secure base layer, has been one of the big winners. The Total Value Locked (TVL) on Stacks surpassed all-time highs in January, peaking at $63 million on the day the ETFs were green-lit. Another L2 project, Rootstock, also hit its highest TVL in two years.

The feel-good factor extends to solutions anchored to L2s, like StackingDAO, a liquid staking protocol operating on Stacks. In just a month, the project became the second-largest DeFi protocol on Stacks by TVL, with over 10 million $STX tokens locked.

BitFlow, a native Bitcoin DEX, has also announced $2m TVL in its $stSTX LSD pool. Liquid staking derivatives – which let users access the liquidity of staked tokens that would otherwise be locked in a smart contract – was a major trend last year, with Lido becoming the single biggest defi dApp on Ethereum.

Given how many bitcoiners simply hodl their satoshis, LSDs – which let them stake for yield and put their capital to use in DeFi – could end up at the center of a veritable BTC L2 boom.

The recent uptick in Layer2 activity on the Bitcoin network is a sight to behold. The emergence of projects that advance the network’s utility through sophisticated L2 solutions seems destined to unlock new BTC use cases and accelerate demand for digital gold. If Bitcoin-based L2s can replicate those that spawned from Ethereum, the next 18 months will prove very interesting.

London, United Kingdom, February 9th, 2024, Chainwire

Bitcoin Dogs is set to be part of cryptocurrency history with the first ever ICO on the Bitcoin blockchain, launching on February 14th, 2024.

The presale for its native token, $0DOG, will last only 30 days, with an end date of the 15th March 2024, when it will become available for trading.

Accompanying the $0DOG coin will be an immersive metaverse GameFi experience and NFT collection, both available exclusively to token holders.

The sale will start with stage 1, priced at $0.015 per token, after which, the price will then automatically increase every 72 hours. The final stage of the presale will see each $0DOG token being sold at $0.0404, a 169.33% price difference to early-stage buyers.

The project is set to challenge Bitcoin Cats, which also launched on the Bitcoin Blockchain under 7-weeks ago, and is currently sitting at $24m in market cap, with over $7m daily trading volume.

Using the paradigm-shifting Ordinals protocol, players will store their NFTs on the Bitcoin BRC-20 blockchain, offering a new level of security and reliability when stacked up against competitors Solana and Ethereum.

Press the paws button: Inside the Bitcoin Dogs game

Bitcoin Dogs allows users to raise, trade, and race their pets in a play-to-earn (P2E) environment, drawing heavily on experiences like Tamagotchi or Axie Infinity.

The game invites players to look after their dogs in order to level them up. In-game token BARK powers this process; these can be earned by sharing activity on social media – a mechanism designed to bring new players into the fold.

As dogs reach maturity, they begin to earn $0DOG – the BRC-20 presale token and one that players can ultimately hold, sell, or bet with. Dog owners can battle it out in races to compete for each other’s $0DOG stash, creating a financial incentive for players to climb the leaderboards.

$0DOG tokens can also be staked to maximize rewards: presale stakers will unlock a 75% APR when they lock up their tokens.

Retro gaming graphics bring the Bitcoin Dogs world to life, with dogs stored on the blockchain as 10,000 individual NFTs with varying rarity levels. This ecosystem is given an extra layer of interactivity with NFT owners having the option to buy, sell, and even breed their dogs, creating a vibrant marketplace for dog lovers to interact with one another.

Since these NFTs are minted on the Bitcoin blockchain using the cutting-edge Ordinals protocol, there’s something for multiple cohorts of investors. Bitcoin maximalists get to enjoy NFTs without leaving the BTC ecosystem, and seasoned collectors can become early investors in the NFT market’s newest niche.

The Road Ahead for Bitcoin Dogs

The Bitcoin Dogs ICO is the simplest way to purchase $0DOG tokens. 90% of the 900,000,000 total supply will be available during the presale, with any unsold tokens (stray dogs) being “burned’ to create deflationary pressure.

After the presale, $0DOG will be available in the secondary market for trading Then, in Q2, comes the Bitcoin Dogs NFT collection, as well as the beta version of the Bitcoin Dogs game.

The game will continue to develop, with the addition of new P2E partnerships, and will officially launch to the public in Q3. Competitions and events will bolster the project’s marketing efforts, and the cross-chain bridge will go live too, bringing Bitcoin Dogs to its biggest audience yet.

The timing for $0DOG couldn’t be better

Now is the opportune moment for Bitcoin Dogs to strike since many experts are predicting the NFT craze will return. This is compounded by a range of bull market indicators. Additionally, given the success of first-generation projects like Bitcoin Cats last year, the team hopes that Bitcoin Dogs will excel and have a vibrant community.

Bitcoin itself is enjoying a bright start to 2024 that looks set to continue: Bitcoin ETFs were approved in January, and the next halving in April is coming up. Bitcoin Dogs is looking to ride this wave as the roadmap unravels throughout the year.

As the first ICO on the Bitcoin blockchain, making the ground-breaking union of NFTs, BRC-20 tokens, and cross-chain interoperability, the project and its $0DOG token are a rare leap forward in the crypto space.

About Bitcoin Dogs

Bitcoin Dogs is breaking new ground in the Bitcoin ecosystem. For the first time ever, NFTs, gaming, and new token types come together, to offer the first ICO on the original Bitcoin blockchain. The truly permissionless immutability of Bitcoin is being harnessed to create the $0DOG token, while a play-to-earn (P2E) gaming experience and NFT collection is being developed exclusively for $0DOG holders.

$0DOG tokens will be available to purchase on the BitcoinDogs.club website on February 14th, 2024, at 11:00AM GMT.

Website | Whitepaper | Socials

Bitcoin Dogs is the source of this content. This Press Release is for informational purposes only. The information does not constitute investment advice or an offer to invest. Investing in cryptocurrencies can be volatile and dangerous.

Contact

Bitcoin Dogs

marketing@bitcoindogs.club

As the blockchain environment changes, new, innovative platforms always arise. The Ideal Cooperation Blockchain (ICB) Network has emerged into the spotlight with SertiK support due to its dedication to trustworthiness and transaction integrity. As a low-cost utility network, the ICB Network uses the Proof of Stake (PoS) consensus method to change how validation works and how blocks are made. This huge change will make things safer and give users a unique and smooth experience, setting a new standard for blockchain networks.

Within the ecosystem of the network, stakeholders are very important. They actively validate transactions and create blocks by “staking” tokens, protecting the network’s integrity by ensuring that people who have a stake in it are participating in running it. Further, adding biometric and Know-your-customer (KYC) information to Proof of Stake (PoS) technology strengthens security. This lowers the risk of attacks and builds trust between master nodes and users. Notably, this coming together of cutting-edge technologies makes blockchain networks more efficient and safe and shows how the crypto community works together to move the industry forward as a whole.

Most importantly, ICB Network has formed strategic relationships with top players like Binance Smart Chain, Ethereum, Polygon, and Avalanche. This is a big step towards making the blockchain ecosystem more robust and connected. Using the Ethereum Virtual Machine (EVM) standard, these partnerships allow different blockchain networks to work together without problems.

The Impact of EVM Standards and ICB Network on Blockchain Infrastructure

The adoption of EVM standards catalyzes developers, enabling them to conceive and deploy applications on the ICB blockchain infrastructure rapidly. Using Ethereum’s powerful development tools and EVM-compatible networks, this way not only makes the best use of resources but also lowers transaction costs and speeds up the network.

Utilizing these strengths aids the ecosystem’s growth, encouraging new ideas and creating more chances for developers and users. Also, ICB Network liquidity pools, which include important cryptocurrencies like ICB Coin and stablecoins, make the ecosystem even better by giving users more options, rewarding those who stake, and making it easier to exchange cryptocurrencies.

Moving further, the ICB Network connects different networks and makes it easier for people to trade. This network’s unique method effectively bridges networks for diverse exchange, allowing transactions to go smoothly between ecosystems. Users can get to more assets and markets by connecting these networks, which makes it easier for them to take advantage of chances more quickly and effectively.

The seamless experience of navigating between various networks is simplified by improving liquidity and broadening access across the cryptocurrency landscape. The ICB Network’s facilitation of effortless transitions between networks is pivotal in breaking down barriers and cultivating a more interconnected and efficient ecosystem. With this flexibility, traders can refine their strategies and capitalize on emerging opportunities.

Rise to Prominence

In its second-quarter milestone, the ICB Network emerges as a significant force in decentralized exchange (DEX) transactions, reshaping the narrative by enhancing trade security and reducing susceptibility to market manipulation.

The network’s innovative approach integrates staking methods and native derivatives, revolutionizing NFT trading for greater openness and efficiency. Notably, this alignment with the NFT Talent promotes transparent NFT transactions. Furthermore, the ICB Network catalyzes significant advancements in blockchain gaming through its support for GameFi, providing players with immersive entertainment experiences and lucrative earning opportunities.

The ICB Network is also leading the Native Metaverse effort with strategic partnerships with universities to work on cutting-edge projects exploring ways to earn cryptocurrency in the metaverse. Remarkably, the Metaverse is expected to reach a huge $400 billion valuation for virtual reality (VR) by 2025, and its reach goes beyond standard gaming areas, including social networks and virtual economies.

The ICB Network is positioning itself as a frontrunner in globalizing blockchain using advanced technologies and strategic partnerships. Undoubtedly, the platform’s expansion heralds a transformative era in blockchain technology, unlocking fresh opportunities and fostering widespread adoption across the globe.

Serhii Tron, founder of White Rock Management, one of the largest mining companies in the world, spoke on the current state of the crypto market, and shared his vision of what comes next this year

What are the most valuable lessons we can learn from 2023?

What’s most important – and quite obvious for everybody – is that the crypto winter, the topic that so many people fueled their devastating forecasts with in 2022, is over and done with. A stone-cold fact, which I am not sure why anybody has any reason to question. The market did have to plough through a lot, but last year, the price of bitcoin leapt by 150%, and hit a $44 thousand mark. There were, of course, some corrections and fallbacks, however, the outcome is still very much on the bright side, so there are few people bringing up the $17 thousand indicator from November 2022.

BTC capitalization once again exceeded $816 billion. If you look at the entire market, you can see the capitalization growth of 2023 was a solid 108.1% – from $829 billion to $1.72 trillion, with the annual trade volumes reaching $36 trillion. Doesn’t feel like winter to me.

Were the external factors involved?

Naturally, there were many things at play, for the crypto market does not exist by itself. Back in 2022, world regulators had to handle the aftermath of the COVID-19 pandemic and forced monetary emission (to help businesses stay afloat and keep the wolf of the global crisis at the door) – monetary policies had to tighten in order to keep the global inflation at bay. Very active in this endeavor was the U.S. Federal Reserve, which raised their basic rates. But, by the end of 2023, the Feds softened a bit, with the consumer prices gradually going down.

Two major events took place in the United States: at the year’s start, the state regulator had to interfere and save the banks in distress (Silicon Valley Bank, Signature Bank) by means of its own Bank Term Funding Program (BTFP), which basically means a lot of money (around $400 billion) had to be pumped into the failing institutions; as the monetary policies eased up a little, the said money incrementally spread across the markets. For the loan and stock markets, and crypto market to boot, the money influx worked like a charm. Dollar instruments’ profitability decreased, but it went up in our segment, hence it feels like a natural order of things, all things considered.

Declining unemployment rates across the world and GDP growth were some other positive factors. Geopolitical tensions are still on the rise, though. I’m speaking about not only military actions in Ukraine and Israel, but the attacks on ships in the Red Sea, and bad blood between North/South Korea, and China/Taiwan.

On the bright side, people happened to notice the financial regulators are pretty interested in crypto. I am, of course, talking about the scandals and law suits against several crypto-dealing enterprises after FTX closure, which made a lot of market players really worried. Some even said it was about to bring the eternal winter upon our market. Which did not happen, by the way, as we soldiered on. I believe that, at least in part, it was possible thanks to the settlement that one of the world’s largest platforms Binance agreed to. Even though the company was fined, this solution is widely considered the optimal choice under the very tricky circumstances. The court hearings on another stock market (Coinbase) are still afoot, but we stay hopeful that both sides can also come to an agreement.

Do you think the state authorities will keep on pushing?

Most certainly, yes. Not in a bad way only, though, by imposing even more pressure and limitations. We can see that many regulators remain unmoved, and are dead-set to not accept crypto for what it is. However, it is pretty much common understanding that digital assets are the future. It doesn’t need to be fought; it needs to be reasonably regulated instead.

Yes, the regulations must be reasonable: measures of control need to be in place so that bitcoin and other coins are not used in arms deals and drug trade; the investors need to be protected from scoundrels and thieves. That being said, excessive regulations need to perish, for they only hold back development of the market and some necessary instruments.

Are you now speaking of the 10-year war with the U.S. regulator for BTC ETFs?

I’m now speaking in general. Surely, BTC ETFs implementation in the United States took way longer than it should have, and it definitely should have happened much sooner. However, hats off to the U.S. Securities and Exchange Commission (SEC) for what they did in January 2024. The entire market has been anticipating this move since the summer of 2023, when BlackRock applied for this instrument after the watershed court ruling in the Grayscale Investments case: this one company was the sole most persistent proponent of this instrument, and basically served as a trailblazer for the market as a whole.

I would like to point out, though, that many political figures warmed up to the crypto market last year. Robert Francis Kennedy Jr. (nephew of the legendary 35th U.S. President JFK), Democratic Party member and U.S. presidential candidate, openly supported crypto, and was the one to admit that bitcoin can back up the dollar exchange rate; he also compared BTC to gold. A lot was done in terms of lobbying and legislation by the U.S. Senator (Rep) Cynthia Lummis. Another vocal supporter of crypto is Javier Milei, the new President of Argentina, who’s put his team on a mission of crypto popularization in his home country. There are more politicians in favor of cryptocurrency: Lichtenstein’s Prime Minister, Minister of Finance Daniel Risch, leader of the Polish party “Porozumienie” (previously “Polska Razem”) Jarosław Govin, and many more political figures, who from their high chairs and offices substantiate the importance of digital assets. More importantly, they take real measures for coins integration.

In my home country of Ukraine, the work on legislative regulations has intensified. Before the full-scale invasion, one specialized law was adopted and signed (“The Law on Virtual Assets”), with one more piece of legislation in the works, which touches upon taxation, regulations, and other minor details. Several drafts have been introduced so far, with ongoing debates in full swing – which is always helpful; I expect the authorities to pay attention to the field experts and find common ground. Despite the sad reality of a fully-fledged atrocious war, popularity of BTC and other coins is only rising: Ukraine is No. 5 (preceded by the United States) on the Chainanalysis list of countries embracing crypto assets. According to this list, we beat Brazil, China, and Turkiye. Once we win this war, and once the legislation is sorted out, BTC in Ukraine will skyrocket.

Even under such conditions, Ukrainian crypto business keeps moving forward, including foreign countries. What are the objectives of your company?

My personal goals at the moment are to make White Rock Management one of the world’s top-3 miners, and make our company public. We are prepared to enter new markets and attract capitals. From day one, we designed our business in a way to be very clear and understandable to our investors. We imposed our principle from the very start (Environmental, Social, and Corporate), and we never messed with loans, which many of our colleagues do; thus, they’re up to the neck in debts.

We might fall short in terms of mining volumes, however, we’re not reliant on massive loans. We have zero debts and optimal EBITDA, which can be proven by three consecutive years of successful audits by international experts. I am certain that we’ll attract a lot of interest.

We are actively developing several projects in Canada and South America. Investment-wise, we’re talking about $100+ million. Also, alternative energy sources, green energy in particular, are one of our top priorities, and we have no intention of pulling back on this path.

This is, by the way, one of the reasons why miners face heavy criticism – excessive energy consumption (competing for it with other industries), especially in the middle of winter in regions burdened with all sorts of troubles…

State authorities of many countries have previously attacked the mining community as our industry was maturing, with some even launching full-scale propaganda campaigns against crypto: they claimed we’re parasites that stand in the way of developing economies. However, it was the miners who turned out to be the most prolific investors in alternative energy sources. Therefore, this angle of critique is no longer valid. There still might be some local complaints in specific regions, yet they are few and far in between.

No other field but crypto does as much to keep the green energy sector in motion. When I meet my colleagues, I find out about new projects on alternative energy sources that are being developed non-stop: for example, Bitfarms representatives spoke very engagingly on the use of hydro power in Norway, Finland, and Sweden, while Bit Digital is powered by the Niagara River in the USA (electric power generated by the currents of the Niagara River); some of our colleagues put to use geothermal power in Iceland. Our own White Rock Management is an avid proponent of hydro energy, but we are also very interested in American projects (Texas) in gas flaring, which help reduce CO2 emissions at the same time. We joined another 250 companies in signing the Crypto Climate Accord agreement that stipulates environmentally friendly and safe mining of crypto.

Do you think this subject will remain in demand in 2024? What is your general forecast for this year?

Yes, I am confident that environmentally friendly projects will remain popular among the miners – I know we’ll keep working on them for sure. This is right, and this is profitable, too, if you make your business work correctly.

Speaking of the crypto market as a whole, a lot will revolve around those new instruments and opportunities for the investors. I am, of course, talking about BTC ETFs that had a pretty solid start in the United States despite the Grayscale sale-off (Grayscale Bitcoin Trust), which people saw coming to begin with. The major share of stock exchange spots ended up in the liquidator’s pocket, FTX, which never denied it was after maximizing profits to pay off the creditors. Sooner or later, these sale-offs will come to an end, with more money gradually flowing into other funds.

I am sure the investments will grow, including the numbers from the retail market. Back in late-January, Google posted first ads of BTC ETFs, a move that will most certainly attract attention of general public across the board. New funds will emerge, not in the U.S. alone: not so long ago, a spot application was filed in Hong Kong, and I’ve faith it will come through. Let’s wait and see when Europe kicks this door flying open, for the big party is yet to start around here. Capitalization and trading volumes will grow, make no mistake about that.

Surely, other products will pass various stages of development too. 2023 saw significant interest in AI-generated tokens (AI segment of the crypto market exceeded 11%), GameFi and even meme-coins – something a lot of us managed to forget about entirely. But, speaking of the mass market, I am sure the lion share of attention will be dedicated to BTC ETFs.

Readers are always curious about expected rates of the main cryptocurrency of all…

I’m not keen on putting exact numbers on things, however, I am confident the price of bitcoin will keep on rising. With some fallbacks and profit locking, perhaps, but still on the rise overall. There are objective reasons for the upward dynamics.

I have mentioned the further expansion of BTC ETFs, which will perpetuate the increasing value of the coin. Let us not forget about another major event, the halving, which will most definitely affect the exchange rate fluctuations. Also, willingly or otherwise, the stimulation of the interest in BTC will depend on the world’s financial regulators that are on the path of easing their monetary policies. U.S. Federal Reserve in particular: American regulator kept the basic rates as they were (5.25-5.5% per annum), but might lower them in this coming March, as inflation retreats and employment rates improve. The next thing to happen will be a natural reaction: a decrease in the profitability of dollar instruments, and an easy flow of capital from the credit and stock markets to the cryptocurrency market, which promises more interesting earnings. This wheel will spin itself, and we will see the price of crypto rise.

Many analysts insist that by the end of the year’s first quarter or beginning of the second, bitcoin will comfortably sit around $50-60 thousand apiece. Who knows, though: should the stars align perfectly, this price tag might be even better.

Grand Cayman, Cayman Islands, February 7th, 2024, Chainwire

Ondo’s Sui upcoming integration will bring native access to new tokenized assets such as treasuries, securities, and stablecoins on chain

Sui, the Layer 1 blockchain which has experienced explosive growth since its inception eight months ago, today announced that Ondo Finance is expanding into the Sui ecosystem. The expansion will bring Sui Network’s first native dollar-denominated token (including stablecoins and interest-bearing stablecoin substitutes) in the form of Ondo USD Yield or “USDY” — a US treasury-backed and interest-bearing token issued by Ondo.

Ondo’s expansion to Sui adds to Sui’s blistering DeFi momentum, demonstrating the growth and demand for financial applications and native functionality on chain. Sui’s DeFi volume is up more than 1200% since October and Sui recently broke into the top 10 DeFi ecosystems as measured by TVL.

Ondo Finance is the third-largest platform bringing tokenized derivatives of real-world assets onto public blockchains with $185M in TVL and over $1B worth of its newly-launched governance token trading in its first week in late January. In addition to stablecoins, Ondo’s flagship Treasury-backed tokens, tokenized securities, and real-world assets will create countless new opportunities for teams building on Sui.

Ondo’s expansion into the Sui ecosystem also continues a trend of top projects affirmatively choosing to integrate into Sui. For example, in December 2023, leading Solana lending protocol Solend announced it would launch a lending protocol native to Sui and decentralized derivatives exchange Bluefin likewise shuttered its V1 Arbitrum implementation to focus entirely on Sui.

“The people who interact with our platform want fast and efficient transactions, which should be essential for any blockchain project,” said Ondo’s founder and chief executive officer, Nathan Allman. “Sui’s growth and network performance offer clear confirmation that its network is the perfect fit for Ondo’s ecosystem.”

Tokenized treasury offerings represent tradable tokens backed by real-world assets, and their presence on Sui is a significant step toward growing DeFi in the ecosystem and across the industry.

“Ondo is an amazing addition to the Sui ecosystem, providing a native yield-bearing stablecoin-like asset that will unlock new opportunities for Sui’s builders and developers and essential new functionality for the users of their applications,” said Greg Siourounis, Managing Director of the Sui Foundation. “Sui’s DeFi volume is already growing at a remarkable rate and Ondo’s participation will make that trajectory even stronger. I am excited to see how Sui’s community leverages the real-world assets and innovative financial products Ondo offers.”

Contact

Sui Foundation

media@sui.io

Zug, Switzerland, February 7th, 2024, Chainwire

The Swiss-based platform Skyline Digital empowers underbanked Web3 Businesses, Founders, and DAOs to access third-party fiat payments, OTC trades, tokenized real-world assets, vIBANs, and on/off-ramping.

Web3 Businesses, DAOs, and High Net Worth Individuals find themselves underserved by traditional banks, while custodial and centralized crypto exchanges pose risks and unreliability. Skyline Digital has made it a mission to solve these issues at the core of Web3 business with its non-custodial platform, providing access to TradFi services directly from any wallet.

Switzerland is the crypto-friendly home base of Skyline Digital, from where it operates as a regulated financial intermediary and VASP. From there, Skyline Digital facilitates a variety of financial activities, including third-party payments, OTC trades, vIBANs, on and off-ramping, and tokenized real-world assets such as US treasury bills.

Skyline Digital’s suite of services addresses the needs of Web3 organizations, including business expenses, contractor payments, or service provider transactions. So far, customers have utilized the platform for different types of transactions, including real estate investments, paying legal fees, purchasing a Tesla, and hiring contractors on a global scale.

The platform’s integration with Web3 liquidity providers and traditional finance institutions allows it to act as a payment facilitator, handling the exchange and payment from and to any major stablecoin and fiat currency (EUR, USD, CHF, GBP, SGD). Onboarded customers can directly process transactions from their Metamask, Safe, Ledger, or other wallets, bypassing the intricacies associated with traditional banking intermediaries. Last month, the platform extended the integration to Polygon Mainnet, and now users can choose between that network and Ethereum.

“For Web3 professionals, the boundary between TradFi and DeFi remained practically impenetrable. Bridging on-chain assets to the real world posed significant challenges, especially for Unincorporated DAOs, due to their lack of a legal entity. We can process single and batch transactions directly from our client’s Web3 wallets. The alternative is a cumbersome and costly combination of centralized exchange and bank transactions, which all require custody of your assets and bear substantial fees.” says Sebastião Queiroz e Mello, co-founder and CEO of Skyline Digital.

A distinct feature of Skyline Digital is its accessibility to the traditional investor market. Traditional investors can subscribe to Web3 fundraises through bank transfers without needing a wallet or technical sophistication.

Additionally, for Web3 businesses, Skyline Digital simplifies accounting reconciliation by providing detailed descriptions and tracking of on-chain and fiat payments.

Skyline Digital also offers customers crypto-to-crypto batch payments free of charge, contrasting its competitors, which charge up to 9000 USD annually, coupled with a 0.2% to 0.5% charge applied to each batch payment. Skyline Digital charges 1% and 10 USD per fiat payment without onboarding or monthly fees.

The platform went live in early 2023 and provides its rails also via API, while working with partners to make it accessible through main Web3 infrastructure tools and platforms. This year, Skyline Digital will roll out new TradFi and DeFi features, such as invoicing functionality, cards, and loans. To date, Skyline services some of the industry’s most well-known DAOs and businesses.

About Skyline Digital

Skyline Digital is a non-custodial solution opening the doors of TradFi for Web3 Businesses, Founders and DAOs.

Official Website | Linkedin | Twitter | Telegram

Contact

Cíntia Costa

Skyline Digital AG

cintia.costa@skylinedigital.xyz

Gibraltar, Gibraltar, February 6th, 2024, Chainwire

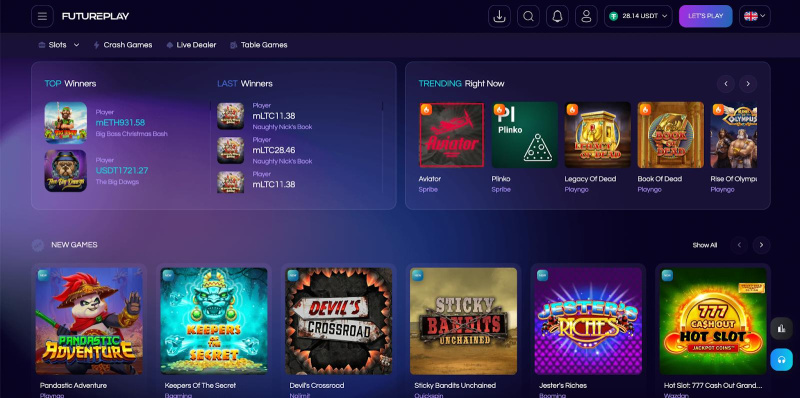

FuturePlay crypto casino has rapidly ascended in the gaming scene since December, forming key partnerships with leading providers like Relax, Spribe, Quickspin, and many others. With over 4,000 titles, FuturePlay offers new users a chance to earn up to 4 BTC + 400 free spins in bonuses.

About FuturePlay

A revolutionary blend of sports, iGaming, and entertainment, FuturePlay casino pioneers a transformative community where crypto bets meet thrilling sports categories and exciting game titles. Accepting Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Dogecoin, Tether, Ripple, and many others. This ensures provably fair games, transparency, and swift payouts.

FuturePlay: Nomination Best Crypto 2024

FuturePlay.com is thrilled to announce its nomination for the prestigious 𝗕𝗘𝗦𝗧 𝗖𝗥𝗬𝗣𝗧𝗢 𝗖𝗔𝗦𝗜𝗡𝗢 𝟮𝟬𝟮𝟰 Award at the upcoming Sigma Eurasia event. As one of the top contenders among the nominees, FuturePlay.com stands out for its innovative approach to crypto gaming. The recognition reflects the platform’s commitment to providing an exceptional and secure gaming experience. Being nominated alongside other leading names in the industry is an honor, and FuturePlay.com eagerly anticipates the event, where winners will be unveiled. This nomination underscores FuturePlay.com’s dedication to excellence and innovation in the ever-evolving world of crypto gaming.

FuturePlay Crypto Casino New Gaming Providers

FuturePlay’s fusion of blockchain and diverse gaming experiences, featuring providers like Relax, Spribe, Quickspin, and more, signals a gaming revolution. Notably, Spribe’s innovative gaming experiences and Relax Gaming’s versatility strengthen FuturePlay’s position.

Players in territories such as the Americas and Oceania will see the biggest improvement in casino games offered.

Spribe ‘Aviator’

Established in 2019, Spribe Gaming has swiftly risen as a prominent provider of online casino games and iGaming products. Recognized for their commitment to innovation, Spribe delivers distinctive gaming experiences that distinguish them in the industry. With a focus on quality, Spribe’s games exemplify excellence, capturing players with their high standards. The strategic and innovative moves by Spribe position them as a provider worth monitoring. The partnership between FuturePlay Casino and Spribe Gaming is a natural synergy, uniting two entities dedicated to pushing the boundaries of online gaming, offering players an unparalleled and forward-thinking gaming experience.

Top Spribe Titles at FuturePlay

Relax Gaming

Founded in 2010 in Malta, Relax Gaming Group embarked on revolutionizing B2B content delivery in the iGaming landscape. A major European supplier, the company’s diverse portfolio spans various verticals, aligning seamlessly with the FuturePlay partnership. Thriving on innovative and engaging games, the collaboration between Relax Gaming and FuturePlay Casino promises to shape the future of online gaming.

Top Relax Gaming Titles at FuturePlay

BetSoft

A gaming powerhouse since 2005, BetSoft crafts state-of-the-art experiences captivating players with cinematic graphics. As a top slot provider, BetSoft’s commitment to creating immersive gaming experiences solidifies it as an industry leader. The FuturePlay and BetSoft partnership, marked by dedication to innovation and excellence, promises to shape the future of gaming, providing cutting-edge entertainment and pushing the boundaries of what’s possible in the online gaming realm.

Top BetSoft Titles at FuturePlay

Feature Releases

FuturePlay introduces flexibility by allowing users to play in their native crypto token or exchange to USD, broadening game provider options. With an impressive start, FuturePlay eyes continuous growth and innovation.

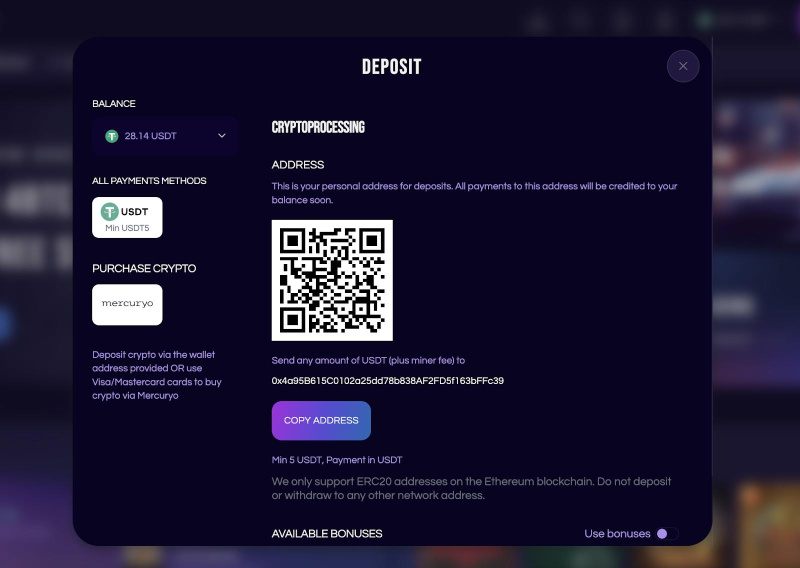

Deposits at FuturePlay

For users looking to transact with Mercuryo on FuturePlay, the process is straightforward and involves the following steps:

- Registration: Users begin by registering an account at www.futureplay.com.

- Deposit Initiation: Post-registration, users click the ‘Deposit’ option, situated in the upper right-hand corner of the FuturePlay interface.

- Mercuryo Selection: Within the deposit area, users select the ‘Mercuryo’ option on the left side.

- Amount Submission: Finally, users click ‘Submit’ and enter the specific amount of cryptocurrency they want to purchase.

Conclusion: A New Era Unveiled at FuturePlay

FuturePlay stands at the forefront of the crypto iGaming revolution, boasting 4,000+ top-tier games and upcoming sportsbook launch. A dynamic gaming landscape awaits, promising an unparalleled and exhilarating crypto gambling experience.

About FuturePlay

Established in 2023, FuturePlay, at the forefront of merging sports, gaming, and digital innovation. With a distinctive approach to iGaming, the company is dedicated to crafting a dynamic platform for the next generation of gamers and sports enthusiasts. www.futureplay.com

Social Media:

Twitter | Facebook Instagram | Telegram | Website (https://futureplay.rocks/jb0fecf8c)

Contact

FuturePlay Team

FuturePlay

affiliate@futureplay.com

Hong Kong, Hong Kong, February 6th, 2024, Chainwire

After a period of tranquility, the Ethereum ecosystem is gradually regaining momentum with the rise of the Restaking. As seasoned DeFi participants, DeSyn has consistently focused on developing the Ethereum network. Previously, DeSyn initiated the launch of the 3x ETH Leveraged ETF based on sharp market insights, aiming to promote diversity in Ethereum network products and assist users in maximizing their returns within the Ethereum ecosystem.

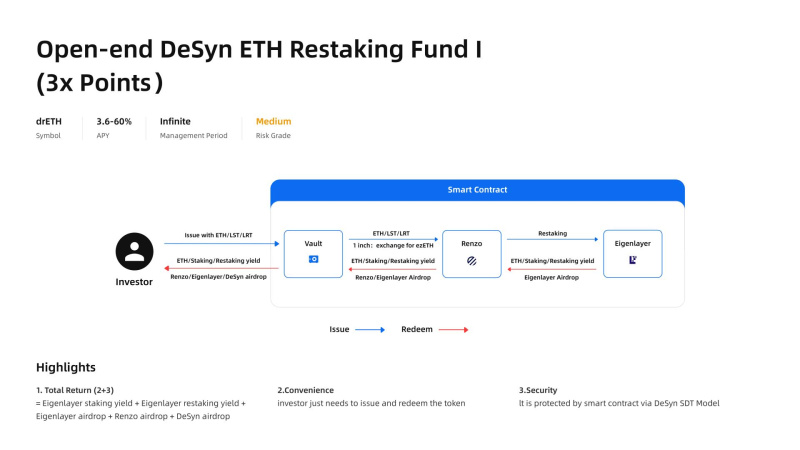

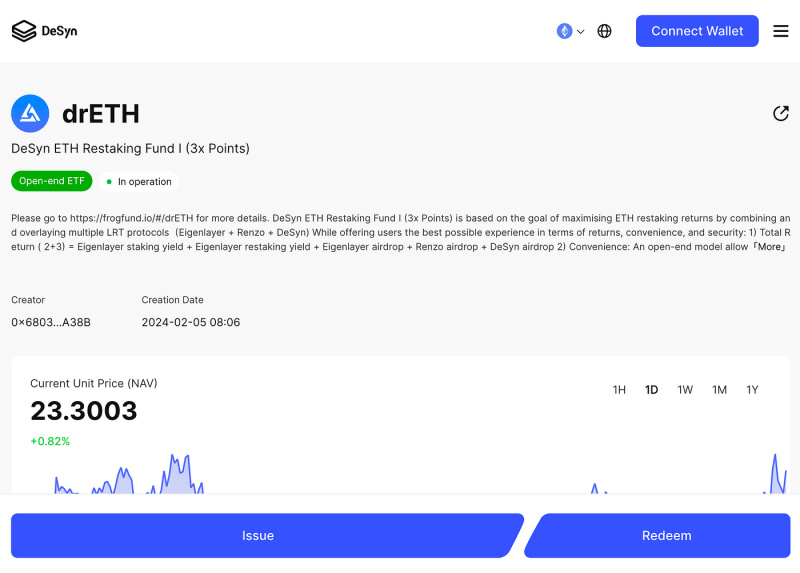

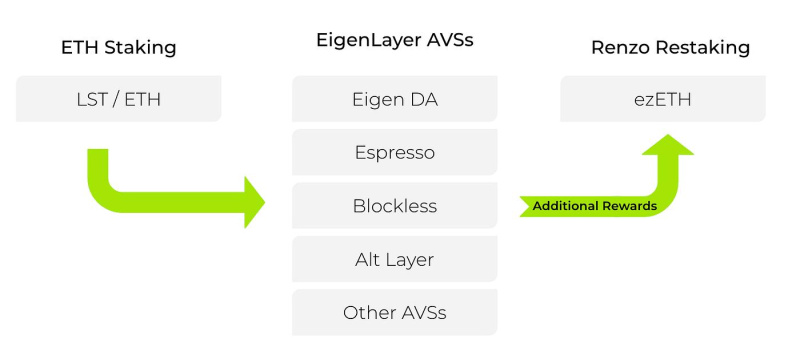

Today, DeSyn announces the launching of the DeSyn ETH Restaking Fund I( 3x Points), dedicated to participating in this industry revolution alongside ecosystems such as Eigenlayer and Renzo, collectively shaping the future of DeFi.

The DeSyn ETH Restaking Fund I( 3x Points), drETH in short, is an open-end fund product introduced by Little Frog, a professional decentralized asset management DAO organization based on the infrastructure of the DeSyn platform. This product integrates DeSyn and other two highly acclaimed restaking platforms, Eigenlayer and Renzo. Users can stake ETH, stETH, wETH, and ezETH through the DeSyn platform. The fund supports on-demand withdrawals and offers the existing APY from LST and LRT and the triple yield expectations from Eigenlayer, Renzo, and DeSyn. Currently, this fund’s APY ranges from 3.6% to 60%. In terms of security, DeSyn solemnly declares that all contract codes have undergone security audits to ensure the safety of user assets.

https://little-frog.gitbook.io/little-frog/products/open-end-desyn-eth-restaking-fund-i-3x-points

How to restake?

Users can navigate to Desyn’s website and select the “restaking” option to access the DeSyn ETH Restaking Fund I (3x Points) issue. Upon selection, users have the opportunity to acquire drETH, associated with the potential of triple returns.

https://www.desyn.io/#/pool/0x8F92265FE1F875d1985cD9D4275dd4Cfec9eb1E7

Enhanced Incentives through Triple-Point Staking with DeSyn

As mentioned earlier, opting for the fund not only grants potentially basic LST and LRT returns but also yields triple points from Eigenlayer, Renzo, and DeSyn.

DeSyn is committed to maximizing incentives for staking users. Starting from February 6, 2024, any user participating in this Fund can earn corresponding points, dependent on the staking amount and duration.

- DeSyn Points Formula: DeSyn points = (Amount of LST) * Number of staked days * 10,000

- Eigenlayer Points Guide can be found here.

- Renzo Points Guide can be found here.

EigenLayer: Elevating Ethereum Security through Restaking

EigenLayer is a protocol built on Ethereum that introduces restaking, a new primitive in crypto-economic security. This primitive enables the reuse of ETH on the consensus layer. Users that stake ETH natively or with a liquid staking token (LST) can opt-in to EigenLayer smart contracts to restake their ETH or LST and extend crypto-economic security to additional applications on the network to earn additional rewards.

Users can learn more by visiting EigenLayer’s official website.

Renzo: Pioneering Restaking on the EigenLayer Mainnet

Renzo is the first native restaking protocol to launch on the EigenLayer mainnet. Although EigenLayer will not begin securing Actively Validated Services (AVSs) I.e. EigenDA until mid-2024, they have been accepting deposits. Deposits for Liquid Staking Tokens (LSTs) are capped; however, native ETH deposits remain uncapped but very difficult for most users to access. They require a user to have 32 ETH and run an Ethereum node that is integrated with EigenLayer to run EigenPods.

Users can learn more by visiting Renzo’s official website.

About DeSyn

DeSyn Protocol is an innovative decentralized asset management infrastructure on Web 3, empowering users to securely and transparently create and manage customized pool-based portfolios with various on-chain assets (tokens, NFTs, derivatives, etc.) via smart contract.

For more information users can visit DeSyn’s: Official Website | Twitter | Telegram | Discord | YouTube

Contact

DeSyn Team

DeSyn Protocol

marketing@desyn.io