Argo Blockchain, a company listed on the London Stock Exchange, issued a warning on Monday it may close its business due to a lack of funds.

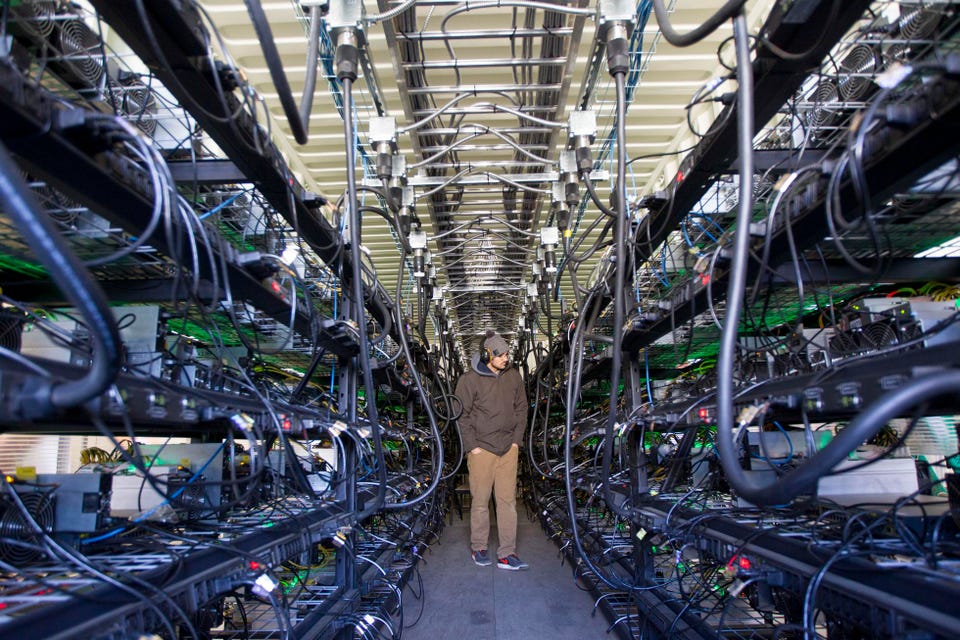

The company mines cryptocurrencies, but has failed to receive substantial capital from investors, leaving it with a major shortage of funds to continue operations, it announced at the time.

New RNS today contains updates on the strategic actions disclosed on 10/7.

— Argo (@ArgoBlockchain) October 31, 2022

We no longer expect to close the equity subscription on the terms disclosed and we’re exploring other financing options.

We also sold 3,843 S19J Pro machines for $5.6m.

Full RNS: https://t.co/KthypzXCAT

In its tweet, the company said it had sold 3,843 S19J Pro coin mining machines for $5.6 million.

Despite seeking fresh financing, there was “no assurance” it would sign any definitive agreements or consummate transactions, it said in its notice.

Explaining further, the company said: “Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations.”

Additionally, it stated it aimed to complete financing transactions to earn enough “working capital sufficient for its present requirements” up to 12 months from the announcement, it explained.

It added it hoped to raise roughly £24 million using a subscription service for ordinary shares. Concluding, it explained: “Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations.”

Crypto Crash and Freeway Diversion

The news comes amid a major Bitcoin crash triggered in June, which saw the leading coin plummet to around $17,000 amid a volatile bear market. Following the incident, Argo sold 637 BTC and 887 BTC in June and July, respectively. It became a major seller of self-mined Bitcoins along with several other firms.

The news comes just a day after cryptocurrency platform Freeway halted several of its services amid rising instability in the current crypto market, forcing it to diversify assets to tackle the ongoing fluctuations.

Freeway later suspended its Supercharger simulation purchases amid its restructurings due to the “unprecedented volatility.”