Blockchain data highlighted by Coinbase director, Conor Grogan, shows that in 2021, Alameda Research redeemed over $38 billion in Tether USDT tokens, even though their assets under management didn’t match this value. At the 2021 crypto market’s peak, the USDT creation by Alameda exceeded its recorded assets.

Grogan also pointed out probable USDT redemptions ordered by FTX were from Alameda’s stash, approximately 3.9 billion USDT. Most of these redemptions coincided with Terra’s algorithmic stablecoin downturn.

In January 2021, Alameda’s former co-CEO, Sam Trabucco, addressed reports about major USDT mints by Tether.

He detailed how Alameda capitalized on arbitrage opportunities due to USDT’s value fluctuations on different exchanges.

He explained that the value at which USDT trades compared to $1 tends to be volatile.

When juxtaposed with BTC/USD trades, Bitcoin-to-USDT trades often show a minor deficit in basis points.

Trabucco emphasized that the BTC/USDT and BTC/USD markets are better indicators of USDT’s trading position than any individual exchange’s USDT/USD market.

READ MORE:Prosecutors Challenge Defense Over FTX Funds in Bankman-Fried’s High-Profile Trial

Unlike USDT, other stablecoins like the USD Coin (USDC) have a steadier premium.

This is attributed to the USDT creation and redemption process.

As only certain firms can directly create and redeem USDT, most traders obtain and trade USDT via the markets, bypassing Tether’s treasury.

Highlighting Alameda’s trading strategies, Trabucco mentioned that when USDT’s value exceeds $1, a well-equipped firm like Alameda would be inclined to sell, and they did so extensively.

With their ability to initiate USDT creations and redemptions, they could place significant bets.

This was a strategic move for Alameda, ensuring both profit for the company and stability for USDT’s value, keeping it close to the $1 mark.

Alameda leveraged these arbitrage chances by creating USDT tokens and cashing in on the premium.

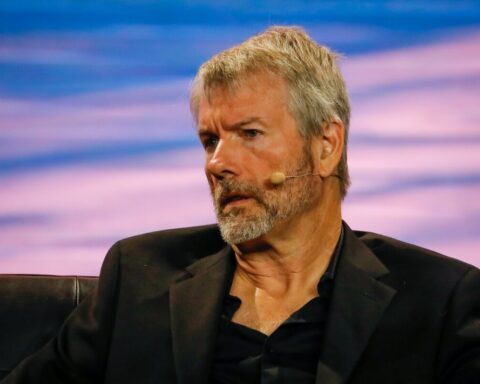

In 2021, Sam Bankman-Fried also mentioned Alameda’s active redemptions of USDT for U.S. dollars.

Cointelegraph is awaiting Tether’s response regarding the exact number of USDT tokens minted upon Alameda’s request.

Other Stories:

Binance and OKX Adjust Operations in Response to U.K.’s New FinProm Regulations

EU Mulls Tighter Regulations on Major AI Systems, Mirroring Digital Services Act Approach

Why Developers Should Seriously Consider Building on EOS EVM with v0.6.0 Release