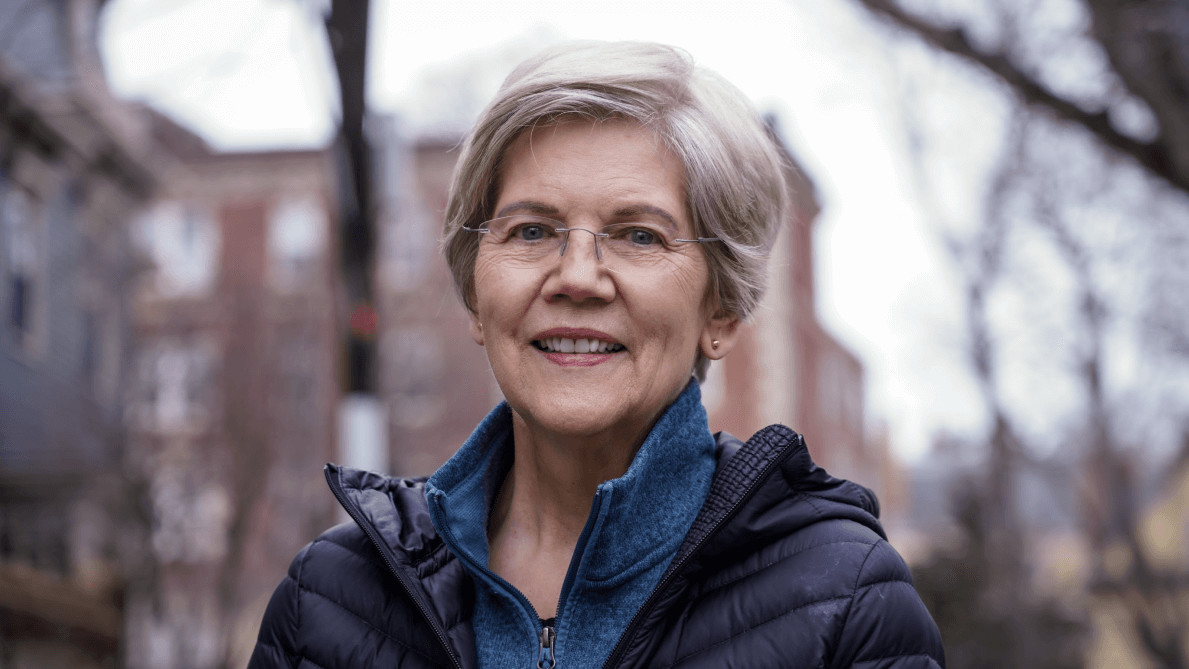

Nine United States Senators have thrown their support behind Senator Elizabeth Warren’s Digital Asset Anti-Money Laundering Act, marking a significant step in the bipartisan fight against illicit cryptocurrency activities, according to a statement from Warren’s office.

Among the notable senators who have joined the coalition supporting the bill are prominent Democratic Party members: Gary Peters, Dick Durbin, Tina Smith, Jeanne Shaheen, Bob Casey, Richard Blumenthal, Michael Bennet, and Catherine Cortez Masto. Independent Senator Angus King has also lent his support to this bipartisan effort.

Notably, Peters chairs the Senate Homeland Security and Governmental Affairs Committee, while Durbin serves as the chair of the Senate Judiciary Committee.

Senator Warren, the driving force behind the bill, expressed her satisfaction with the growing support, affirming that it demonstrates Congress’s readiness to take action.

She highlighted the strength of their bipartisan proposal, which is touted as the most robust solution to combat the illicit use of cryptocurrencies, equipping regulators with essential tools to enforce compliance.

READ MORE: FTX Reopens Secure Customer Claims Portal Following Cyberattack

This legislation has garnered endorsements from various organizations dedicated to combating financial crimes, including Transparency International U.S., Global Financial Integrity, the National District Attorneys Association, the Major County Sheriffs of America, the National Consumer Law Center, and the National Consumers League.

Warren originally introduced the Digital Asset Anti-Money Laundering Act in July 2023, collaborating with Senators Joe Manchin, Roger Marshall, and Lindsey Graham.

The current version of the bill encompasses several key provisions.

Notably, it seeks to crack down on noncustodial digital wallets, expand the responsibilities under the Bank Secrecy Act, and establish a framework for Anti-Money Laundering/Combating the Financing of Terrorism compliance examinations and other legal mechanisms to combat the illicit use of digital currencies.

Senator Warren has underscored the urgency of addressing what she terms as a “$50 billion crypto tax gap.”

She asserts that unless there is a timely update to tax policies, the Internal Revenue Service and the U.S. Treasury could potentially miss out on approximately $1.5 billion in tax revenue for the 2024 financial year.

As such, the Digital Asset Anti-Money Laundering Act represents a critical step in enhancing oversight and regulation in the rapidly evolving cryptocurrency landscape.

Other Stories:

NFL Quarterback Trevor Lawrence and YouTube Influencers Settle FTX Lawsuit

Bitcoin Stabilizes at $26,500 After Hitting September Highs: Eyes on Federal Reserve’s FOMC Meeting

Magic Eden Unveils Solana’s cNFT Support