The United States Financial Accounting Standards Board (FASB) has ushered in a new era for crypto accounting, aiming to dispel the “poor optics” that have haunted companies holding digital assets, according to Berenberg Capital analysts.

On September 6, FASB gave the green light to fresh regulations regarding cryptocurrency reporting and fair valuation on corporate balance sheets.

Mark Palmer, Berenberg’s senior equity research analyst, emphasized the benefits of these changes, particularly for companies like MicroStrategy.

Now, they can report their digital asset holdings each quarter without being burdened by impairment losses.

“The change should help MicroStrategy and other companies that hold digital assets to eliminate the poor optics that have been created by impairment losses under the rules that the FASB has had in place,” Palmer noted.

MicroStrategy, which started accumulating Bitcoin in August 2020, had incurred a substantial $2.23 billion in cumulative impairment losses.

Over the past three years, its quarterly reports often displayed significant impairment losses on its BTC holdings due to price fluctuations, inviting negative news coverage that inaccurately portrayed a decline in the company’s intrinsic value.

The newly approved rules, slated to become effective in 2025, empower crypto-holding firms to report their assets at fair value.

READ MORE: Ethereum’s Price Stability Under Threat as Bearish Sentiment and Network Metrics Weigh In

Consequently, their quarterly reports will accurately reflect the current values of these assets, allowing for adjustments based on any price rebounds.

This marks a departure from the current scenario, where impairment losses must be recognized and remain unaffected by subsequent price recoveries.

MicroStrategy holds the distinction of being the world’s largest corporate Bitcoin holder, boasting 152,800 BTC as of July 31, valued at approximately $3.9 billion.

The new rules can be applied proactively, and Berenberg predicts that MicroStrategy will do just that, potentially valuing its BTC holdings at $8.8 billion by April 2024.

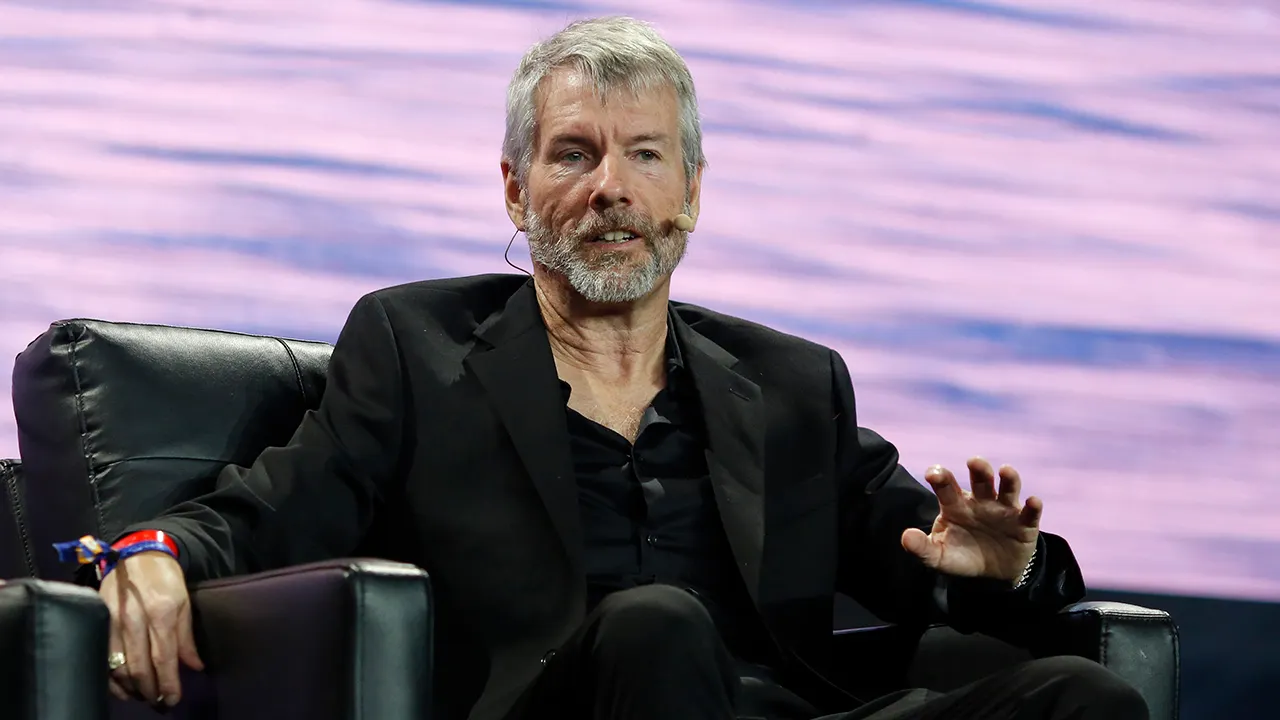

Berenberg’s note highlights MicroStrategy CEO Michael Saylor’s past remarks about the FASB’s “hostile” and “punitive” treatment of crypto, which he believed deterred more companies from embracing a Bitcoin investment strategy. Saylor now sees these accounting changes as a positive catalyst:

“A change in the accounting treatment would be a significant positive catalyst for the price of Bitcoin, as it would spur adoption by tech companies.”

In conclusion, FASB’s new rules promise a brighter and more accurate accounting landscape for companies holding cryptocurrencies, potentially fostering greater adoption within the technology sector.

Other Stories:

Coinbase Launches Institutional Crypto Lending Service Amid Market Turbulence

Bitcoin’s Price Correction to $22,000 Grows Likely as Bearish Signals Emerge in Derivatives

MetaMask Users Targeted in Cryptocurrency Scam Using Government Website URLs