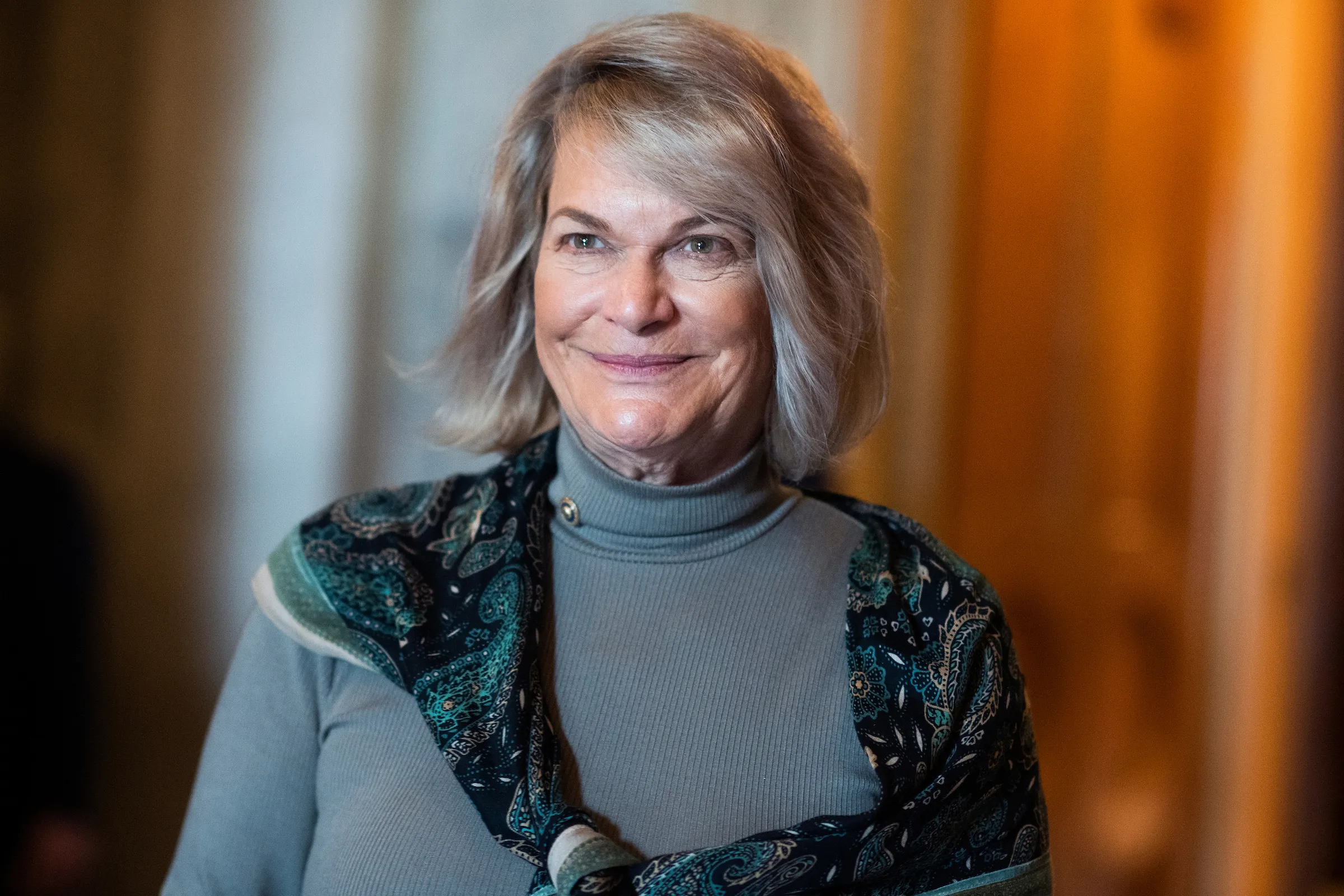

United States Senator Cynthia Lummis, a well-known advocate for cryptocurrency, has lodged an amicus brief in support of Coinbase’s bid to have the U.S. Securities and Exchange Commission (SEC) lawsuit against the company dismissed.

An amicus brief is a legal document submitted to a court by a third party that isn’t directly involved in the case.

Its purpose is to provide additional arguments and perspectives in favor of one side of the legal dispute, often highlighting the wider implications of the case.

According to the filing on August 11 in the U.S. District Court for the Southern District of New York, Lummis underscored that the SEC’s action against Coinbase is far from an ordinary enforcement case.

She contended that the SEC’s lawsuit, alleging securities violations by Coinbase, seeks to establish significant control over the cryptocurrency sector, precisely when discussions about regulation and related matters are ongoing both in Congress and various governmental bodies.

Lummis emphasized that the authority to legislate in matters of such economic and political importance lies with Congress, not the SEC.

She criticized the SEC’s effort to exert extensive influence over crypto asset markets, particularly at odds with legislative proposals that propose distributing such authority to other agencies.

Lummis accused the SEC of trying to sidestep the political process and seize such power for itself.

Coinbase had filed its motion to dismiss on August 4, asserting that the SEC had acted against due process and deviated from its previous interpretations of securities laws by asserting jurisdiction over the exchange.

Lummis’s court submission further argued that the SEC has exceeded its boundaries by attempting to categorize nearly all crypto assets as securities.

READ MORE: FTX Debtors Clash with Creditors Over Asset Control Amidst Restructuring Plan

She questioned the agency’s regulatory approach, likening it to trying to make laws through enforcement actions, which she deemed beyond the SEC’s powers.

Lummis isn’t alone in supporting Coinbase through an amicus brief. Various crypto advocacy groups, such as the Blockchain Association, Crypto Council for Innovation, Chamber of Progress, and Consumer Tech Association, filed a collective brief on August 11.

These groups, in line with Lummis, stressed that the SEC’s authority is restricted to what Congress has granted it, expressing concerns over the potential misapplication of regulatory measures.

Marisa Tashman, senior counsel at the Blockchain Association, concurred with Lummis’s stance, highlighting that the SEC’s interpretation risks classifying non-security assets as such, potentially deviating from Congress’s intended scope of the SEC’s regulatory authority.

She refuted the SEC’s claim that most digital assets on the secondary market are investment contracts under securities laws, asserting that these transactions lack ongoing contractual obligations, making the SEC’s position untenable.

Other Stories:

California Updates Campaign Manuals with Detailed Rules for Cryptocurrency Contributions

US Bank’s Crypto Holdings Surge to Nearly $170 Million Amid Regulatory Scrutiny

Hong Kong’s HKVAX Granted Preliminary Approval for Virtual Asset Trading Platform by SFC