Robinhood, the popular trading platform, announced its second-quarter results, marking a significant achievement of turning profitable for the first time since going public.

Despite a decline in revenue during the second quarter of 2023, the company managed to report a net income of $25 million and earnings per share (EPS) of $0.03.

This is in stark contrast to the first quarter of the year when they had incurred a net loss of $511 million and an EPS of -$0.57.

The drop in revenue was notable in several transaction-based sources. Revenue from cryptocurrency transactions decreased by 18% to $31 million, while options and equities revenue also witnessed declines of 5% to $127 million and 7% to $25 million, respectively.

Over the past year, the company’s revenue has experienced an overall decrease of 4%, going from $202 million in June of the previous year to $193 million.

Despite the revenue dip, Robinhood managed to improve its total operating expenses, leading to its profitable Q2 results.

The earnings before interest, taxes, depreciation, and amortization (EBITDA) saw a remarkable 31% sequential increase, reaching $151 million, with a corresponding margin gain of five percentage points, reaching 31%.

EBITDA is a crucial metric used by analysts and investors to gauge a company’s operational performance within its industry.

READ MORE: U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

Robinhood’s total assets under custody experienced a 13% growth, reaching $89 billion in the last quarter. The increase was attributed to higher equity valuations and consistent net deposits.

Moreover, the company showed promising progress in its crypto assets under custody, which grew from $8.431 billion in December 2022 to $11.503 billion in June 2023.

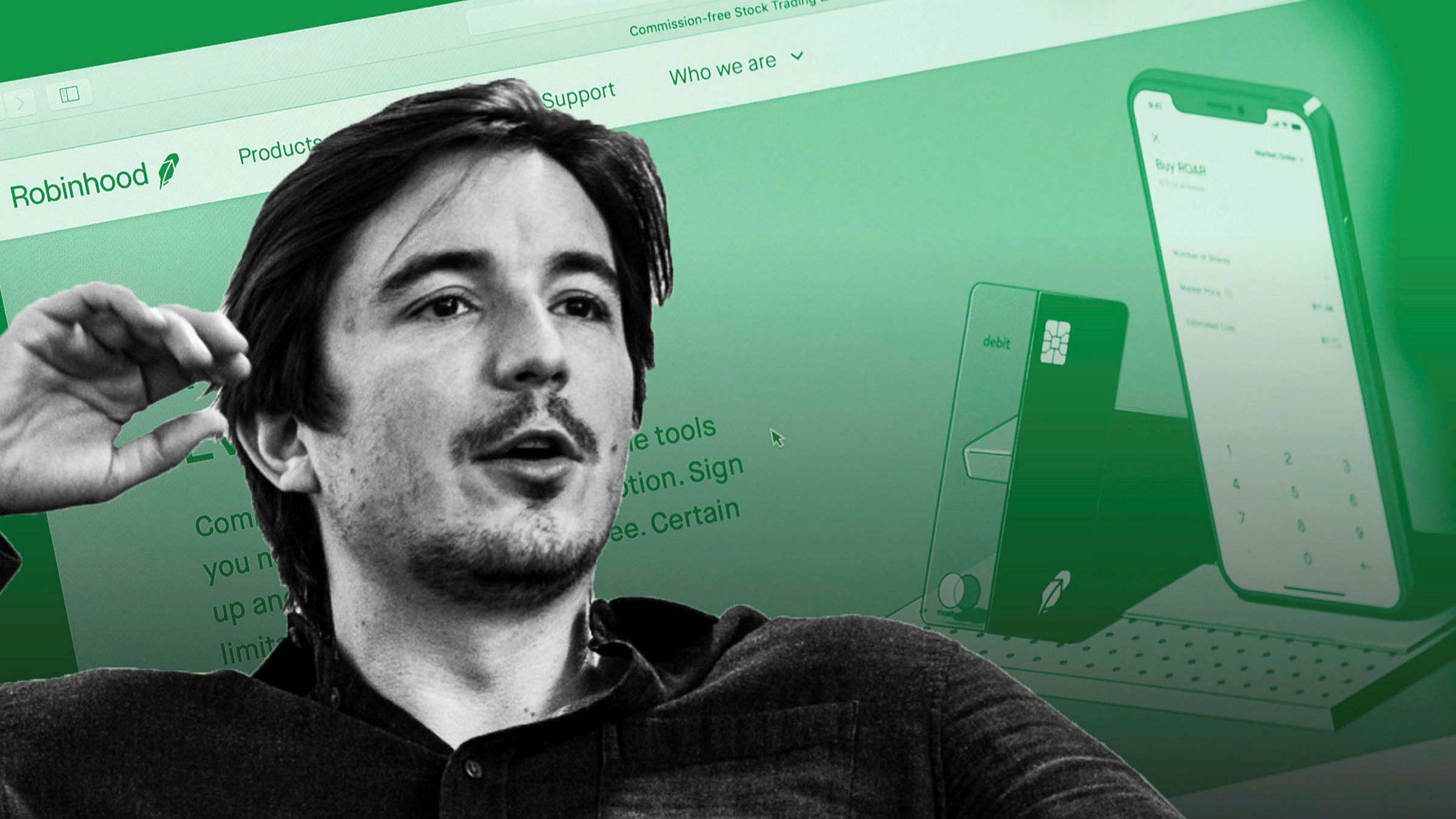

Vlad Tenev, the CEO and co-founder of Robinhood Markets, expressed his satisfaction with the achievement, stating, “In Q2, we reached a significant milestone by achieving GAAP profitability for the first time as a public company.”

GAAP stands for Generally Accepted Accounting Principles, representing standard accounting principles and guidelines used by companies for financial reporting.

The report revealed that Robinhood’s net deposit for the quarter amounted to $4.1 billion, reflecting an annualized growth rate of 21% concerning assets under custody in Q1 2023.

Additionally, the net deposits over the past 12 months amounted to $16.1 billion, indicating a growth rate of 25% over the course of a year.

Overall, despite the drop in revenue from certain transactions, Robinhood’s second-quarter results marked a significant turning point, as they successfully achieved profitability and demonstrated positive growth trends in various aspects of their business operations.

Other Stories:

Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income