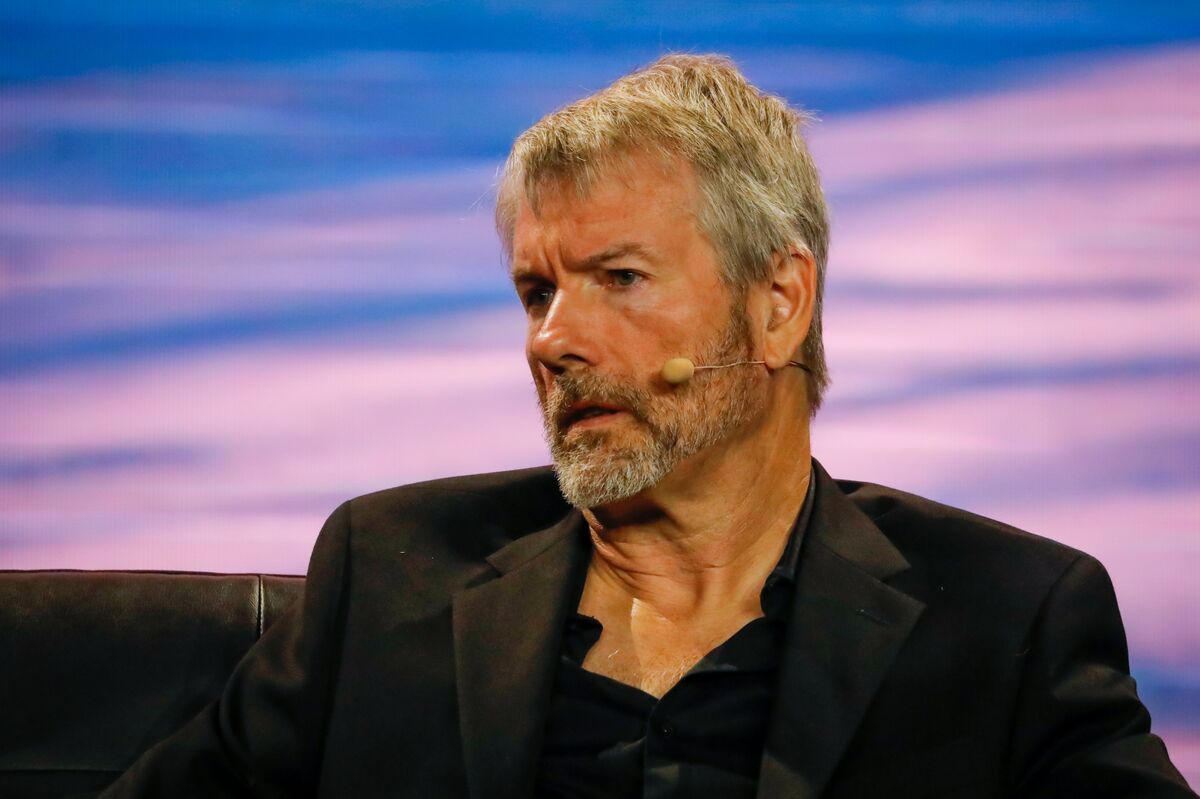

MicroStrategy co-founder, Michael Saylor, is confident that his company will continue to be an attractive option for investors seeking exposure to Bitcoin, irrespective of future exchange-traded fund (ETF) approvals.

As the price of Bitcoin ticks down to $29,223, Saylor reaffirms the firm’s commitment to adding more Bitcoin to its balance sheet, even planning a $750 million share sale to potentially fund further acquisitions.

During an interview with Bloomberg on August 2, Saylor discussed how a spot Bitcoin ETF approval could impact MicroStrategy’s offering.

He expressed assurance that the company would still offer unique advantages that spot Bitcoin ETFs cannot match.

This sentiment echoes his previous remarks during the August 1 earnings call, where he emphasized that MicroStrategy’s Bitcoin operating strategy would set it apart from spot ETFs when they eventually launch.

Since MicroStrategy began its purchasing strategy in August 2020, Bitcoin’s price has surged by 145%. Saylor attributes this success to the company’s use of leveraged investments, generating yields that are shared with shareholders.

Unlike ETFs, MicroStrategy, being an operating company, can access leverage, giving it a distinct advantage in the ecosystem.

Saylor believes that spot Bitcoin ETFs will attract large hedge funds and sovereigns, allowing them to invest billions of dollars in the space.

READ MORE: U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

However, he sees MicroStrategy as a unique instrument, akin to a sports car, while spot ETFs would be more like supertankers.

He envisions spot ETFs serving a different set of customers and contributing to the overall growth of the asset class.

Currently, MicroStrategy boasts more than 470 institutional shareholders and holds a market capitalization of $5.3 billion, according to Fintel.

As analysts raise the chances of spot Bitcoin ETF approval in the United States to 65%, Saylor confirms the company’s goal is to accumulate as much Bitcoin as possible.

Their existing holdings of 152,800 BTC are expected to increase in the coming quarters.

To support their Bitcoin accumulation strategy, MicroStrategy plans to sell up to $750 million in class A common stock, as revealed in a recent SEC filing.

Saylor clarifies that the primary use of these proceeds will be to acquire more Bitcoin, further solidifying the company’s belief in the long-term potential of the digital asset.

Other Stories:

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins