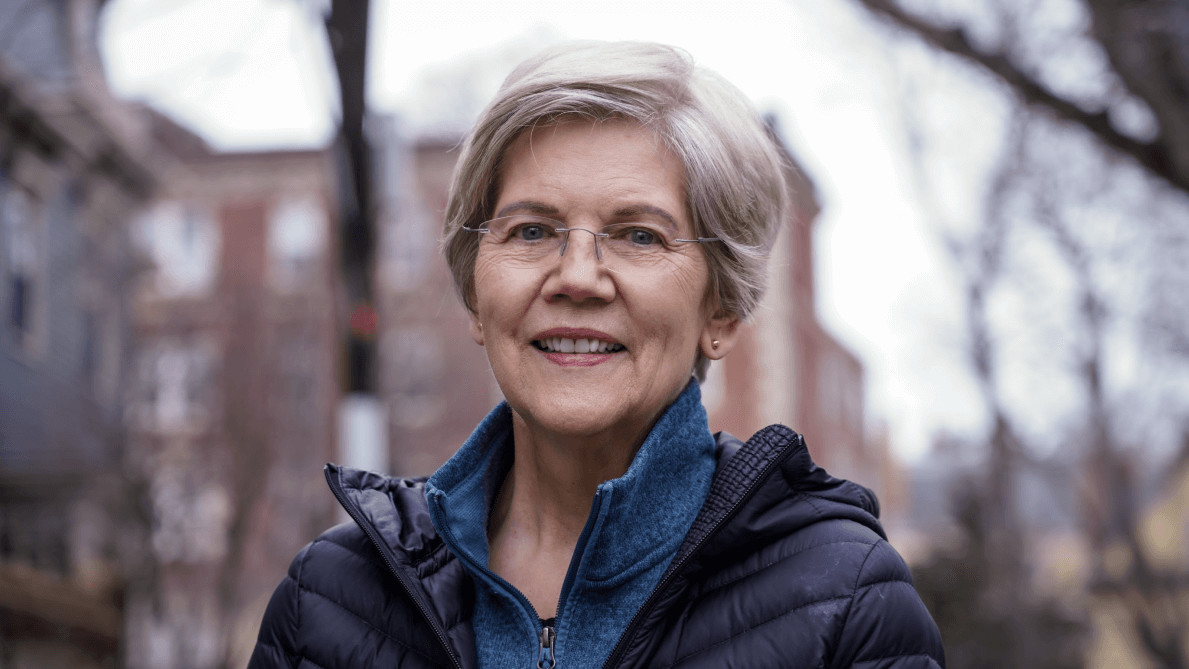

The Bank Policy Institute (BPI), a pro-banking organization in the US, has come out in support of Senator Elizabeth Warren’s efforts to strengthen cryptocurrency regulations.

Senator Warren, along with three other senators, recently reintroduced the Digital Asset Anti-Money Laundering Act, which aims to impose stricter rules to combat money laundering and terrorism financing within the crypto industry.

Despite past criticism from Senator Warren, the BPI expressed its endorsement of the bipartisan legislation.

In a statement, the BPI emphasized the need for the existing anti-money laundering and Bank Secrecy Act framework to encompass digital assets, in order to safeguard the nation’s financial system against illicit finance.

The proposed seven-page bill, if enacted, would require digital asset wallet providers, miners, and blockchain validators to maintain records of customer identities.

Additionally, financial institutions would be prohibited from using digital asset mixers, such as Tornado Cash, which are designed to obscure blockchain data.

Senator Warren and her co-sponsors, Senator Joe Manchin, Senator Roger Marshall, and Senator Lindsey Graham, announced the reintroduction of the bill.

In addition to customer identity tracking, the legislation would prompt relevant government bodies, including the Treasury Department, Securities and Exchange Commission, and Commodity Futures Trading Commission, to establish new examination processes to ensure compliance with anti-money laundering and terrorism financing requirements.

Several organizations, including the Massachusetts Bankers Association, AARP, the National Consumer Law Center, and the National Consumers League, have expressed their support for the bill.

READ MORE: Why Didn’t Bitcoin (BTC) Enter a New Rally?

However, not everyone in the crypto community agrees with the proposed legislation.

Tyler Winklevoss, co-founder of the Gemini crypto exchange, criticized the bill in a tweet, suggesting that those opposing it are making the right decision.

Senator Warren originally introduced the bill in December 2022, arguing that current anti-money laundering laws do not adequately cover the crypto industry.

She has consistently called for cryptocurrencies to be subjected to the same regulations as traditional banking institutions to prevent money laundering and illegal activities.

Gary Gensler, Chairman of the US Securities and Exchange Commission (SEC), has also been vocal about his concerns regarding the crypto market.

He highlighted the prevalence of fraud in the sector and pointed out that many crypto investors do not receive the same level of protection as investors in traditional securities markets.

In conclusion, the Digital Asset Anti-Money Laundering Act seeks to tighten regulations on cryptocurrencies to combat illicit financial activities.

While Senator Warren and the BPI back the bill, some members of the crypto community, including Tyler Winklevoss, have expressed reservations. Gary Gensler, the SEC Chairman, also shares concerns about fraudulent activities in the crypto market and advocates for better investor protection.

Other Stories:

Revealed: The Best Crypto Marketing & PR Agency

3 Best Crypto Projects That Will Boom In 2023 & The Next Bull Run

SEC and Binance Oppose Eeon’s Intervention in Crypto Exchange Lawsuit