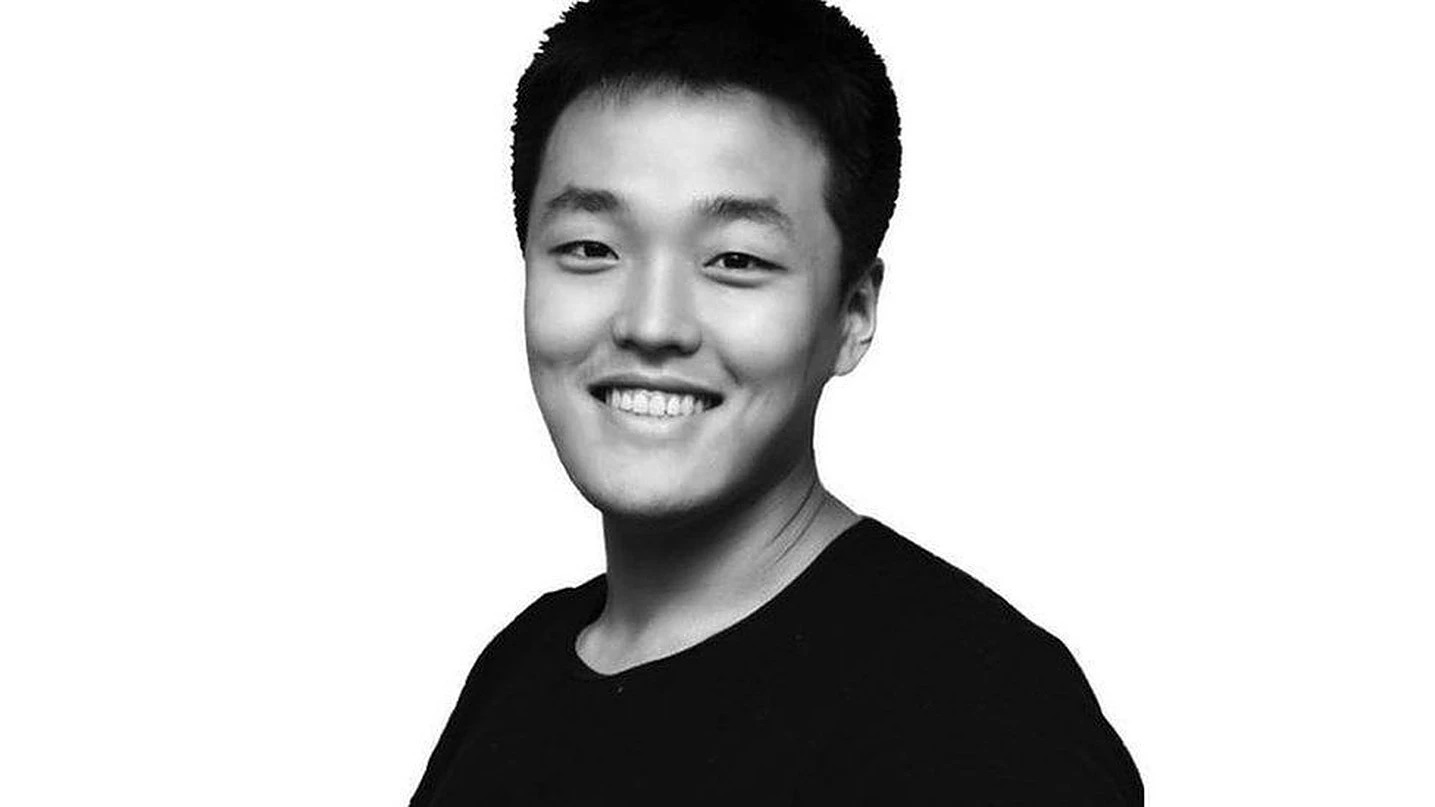

Cryptocurrency entrepreneur Do Kwon, the creator of the failed Terra (UST) stablecoin, appeared in court in Podgorica, Montenegro, facing charges of forging official documents. Meanwhile, a U.S. judge presided over a hearing to determine whether the digital assets produced by Terraform Labs constituted securities. This pivotal question forms the crux of the U.S. Securities and Exchange Commission’s (SEC) fraud case against the company and its founder.

Terraform Labs and Kwon were responsible for two cryptocurrencies that caused significant disruption in global crypto markets last year. They have requested U.S. District Judge Jed Rakoff in Manhattan to dismiss the SEC’s allegations, which assert that they defrauded investors by selling billions of dollars in unregistered securities.

TerraUSD, an algorithmic stablecoin designed to maintain a 1:1 peg to the U.S. dollar, derived its value from another paired token called Luna. Both tokens suffered a substantial loss in value when TerraUSD, also known as UST, fell below its dollar peg in May 2022. Prior to this collapse on May 9, TerraUSD boasted a market capitalization exceeding $18.5 billion, ranking it as the 10th-largest cryptocurrency.

The SEC’s complaint alleges that Terraform Labs and Kwon deceived investors regarding the stability of UST while falsely claiming that their crypto tokens would appreciate in value.

During the hearing, Judge Rakoff raised doubts about whether the offering of Terraform Labs’ Anchor protocol, which promised returns of up to 20% on TerraUSD deposits, should be considered a security. He questioned the nature of this protocol, highlighting that it was exclusive to those who had taken the initial step. Consequently, he pondered why it shouldn’t be regarded as a securities contract.

Terraform Labs and Kwon argue for the dismissal of the case, asserting that their digital assets do not meet the criteria to be classified as securities. Furthermore, they maintain that the SEC lacks the authority to regulate the industry.

The outcome of this legal battle will undoubtedly have significant implications for the cryptocurrency sector, as it could potentially establish important precedents regarding the classification of digital assets as securities. The ruling will shape the future regulatory landscape and provide clarity to market participants and investors alike.

Other Stories:

Tether responds to allegations about its reserves

BlackRock to launch Bitcoin ETF with Coinbase