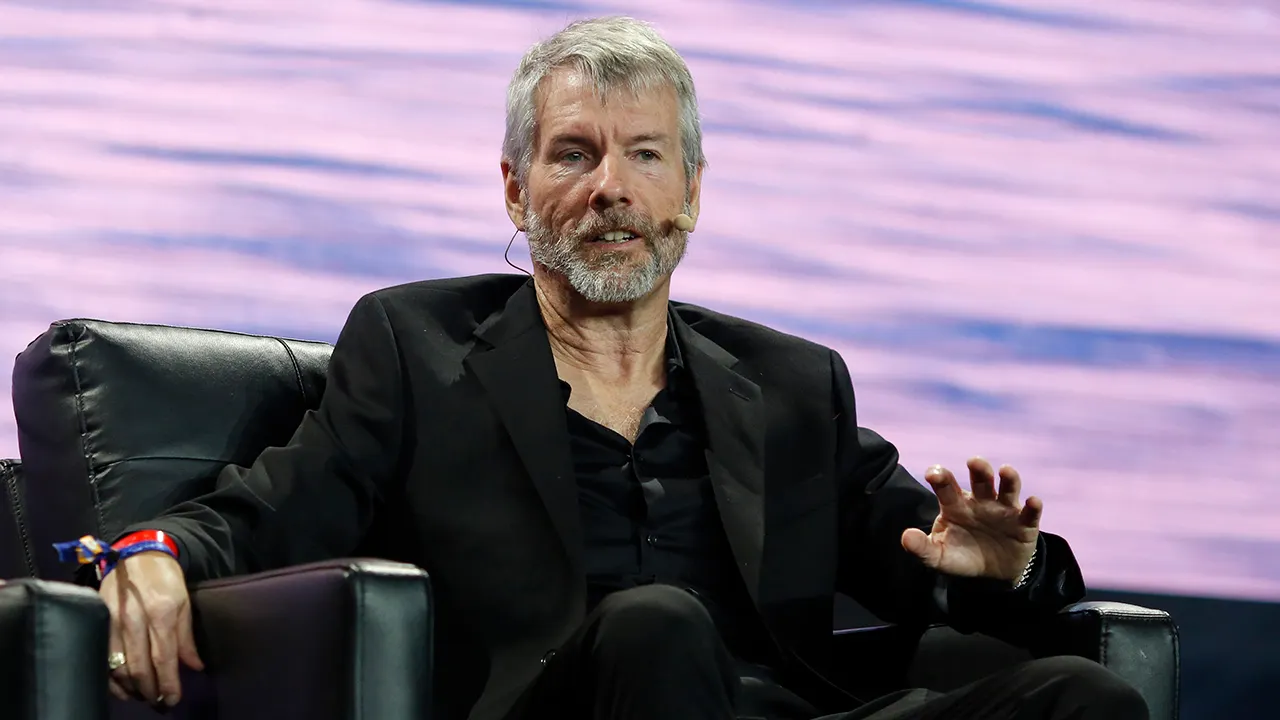

Michael Saylor’s company, Strategy, has continued its aggressive Bitcoin accumulation, announcing the purchase of 3,459 BTC between April 7 and April 13. Acquired at an average price of $82,618 per Bitcoin, this latest investment pushes the firm’s total BTC holdings to an astonishing 531,644 coins—valued at nearly $45 billion based on current market prices.

Funding the Buy with Equity Sales

According to a recent SEC filing, the purchase was funded through the sale of company shares. Strategy sold 959,712 shares of MSTR stock within the same timeframe, generating approximately $286 million in net proceeds. The transaction was part of its ongoing Common ATM equity offering program.

Even after this share sale, Strategy maintains substantial capacity for future funding. The company still holds over $2.08 billion in MSTR shares and approximately $21 billion in STRK shares that can be issued and sold down the line.

Holding Steady Despite Market Turbulence

The purchase comes on the heels of a one-week pause in acquisitions, during which the firm disclosed an unrealized loss of nearly $6 billion due to Bitcoin’s price drop. However, Saylor has shown no signs of changing course. On Sunday, he posted the company’s portfolio tracker on X (formerly Twitter)—a move that has historically signaled a pending buy.

Despite the recent volatility, Strategy’s Bitcoin stash still shows approximately $9 billion in unrealized profits, with Bitcoin trading above $84,500 at the time of the announcement.

Leading the Corporate Bitcoin Charge

Strategy remains the largest corporate holder of Bitcoin, owning around 2.5% of the total circulating supply. Other firms such as MARA Holdings, Riot Platforms, and Galaxy Digital Holdings trail behind.

Saylor’s firm continues to be a driving force in corporate Bitcoin adoption, frequently making large-scale purchases that reflect his unwavering belief in the cryptocurrency as a long-term store of value.

Metaplanet Ramps Up Bitcoin Investment

Meanwhile, in Asia, another Bitcoin-centric company is following a similar path. Metaplanet, often dubbed “Asia’s Strategy,” revealed its latest Bitcoin purchase on Monday. The Tokyo-based investment firm acquired $26 million worth of BTC, bringing its total to 4,525 coins.

Despite the price swings triggered by political developments—including proposed tariff policies from former President Donald Trump—Metaplanet remains committed to reaching its goal of holding 10,000 BTC by the end of 2025. It currently ranks as the ninth-largest public company globally in terms of Bitcoin holdings and holds the top spot in Asia.