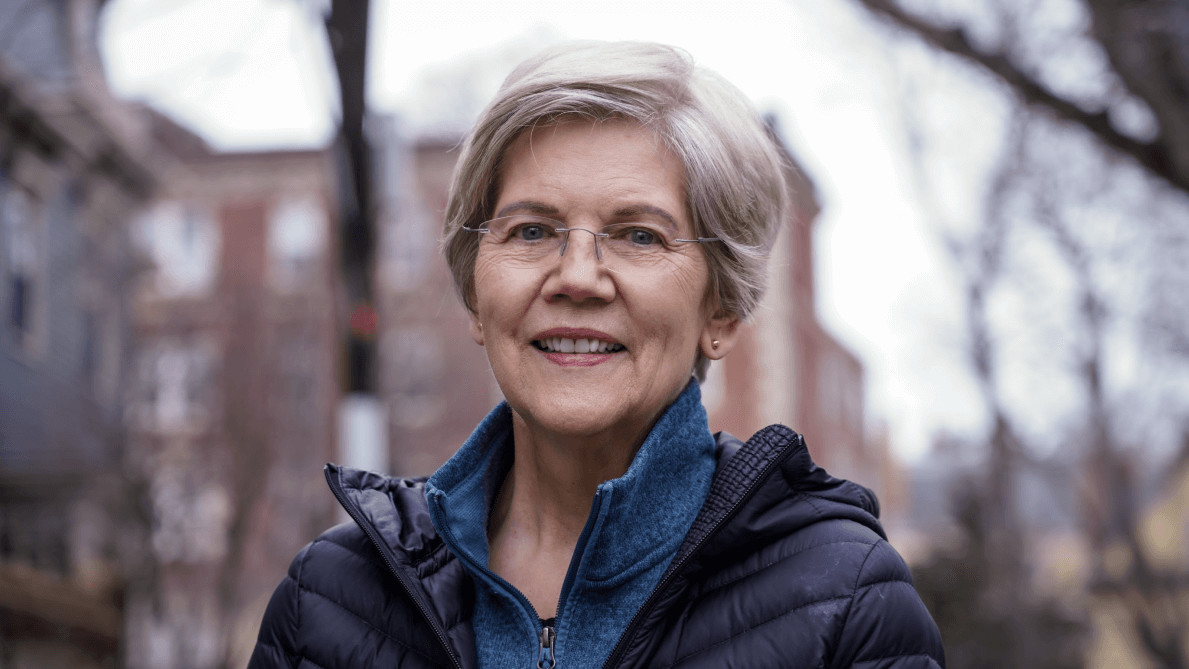

US Senator Elizabeth Warren has raised concerns over Howard Lutnick, President Donald Trump’s nominee for Commerce Secretary, due to his firm’s deep ties with stablecoin issuer Tether. In a letter dated Jan. 27, Warren criticized Lutnick’s involvement with Tether, calling it a “known facilitator of criminal activity” and labeling it the “outlaws’ favorite cryptocurrency.”

Lutnick is the CEO of Cantor Fitzgerald, a financial services firm that holds a 5% stake in Tether and serves as the asset manager for its reserves. While Lutnick has pledged to divest from Cantor Fitzgerald, Warren argues that this does not eliminate the ethical concerns surrounding his personal ties to Tether and its affiliates. As the top Democrat on the Senate Banking Committee, Warren questions whether he can prioritize “the interests of the American people” over personal financial gains if confirmed as Commerce Secretary.

If Lutnick secures confirmation on Jan. 29, Warren warns that he will have “extraordinary access” to Trump and other high-ranking officials responsible for shaping crypto regulations. She suggests that his position could allow him to influence policies affecting Tether and the broader cryptocurrency industry.

Warren has requested that Lutnick provide detailed answers to 13 questions by Feb. 10, covering topics such as his current financial stake in Tether and any discussions he has had with Trump administration officials regarding the company. She also inquired whether Cantor Fitzgerald conducted due diligence to ensure Tether’s compliance with the Bank Secrecy Act, Know Your Customer (KYC) rules, Anti-Money Laundering (AML) regulations, and international sanctions laws.

Although Warren is not part of the Senate Commerce, Science, and Transportation Committee—the body overseeing Lutnick’s confirmation hearing—her concerns highlight growing scrutiny over Tether’s role in the financial system.

Tether’s Role in Crypto and Controversy Surrounding USDT

Tether (USDT) is the world’s largest stablecoin, with a market capitalization exceeding $90 billion. Unlike volatile cryptocurrencies such as Bitcoin and Ethereum, stablecoins like USDT are pegged to the US dollar, providing a digital alternative to fiat currency for traders, investors, and businesses.

USDT plays a crucial role in the crypto ecosystem by facilitating liquidity, enabling cross-border transactions, and serving as a preferred trading pair on major exchanges. However, it has also been accused of being a tool for illicit financial activities.

Critics, including Warren, argue that Tether has been used for money laundering, sanctions evasion, and financing illicit operations, such as North Korea’s nuclear program. Due to its limited transparency regarding its reserves and regulatory compliance, Tether has faced regulatory scrutiny in the U.S. and abroad.

Despite these concerns, Tether has taken steps to collaborate with law enforcement agencies. On Jan. 27, the company worked with blockchain firms Tron and TRM Labs to assist Spanish authorities in freezing $26.4 million in crypto linked to a pan-European money laundering operation. In September 2023, Tether also helped the FBI recover $6 million from crypto scammers targeting U.S. citizens by freezing illicit wallets.

Warren’s Broader Push for Crypto Regulations

Warren, a long-time crypto skeptic, has consistently pushed for stricter regulations on digital assets. She has frequently warned about the potential risks posed by cryptocurrencies, including their use in illicit finance, consumer fraud, and economic destabilization.

In 2022 and 2023, Warren introduced the Digital Asset Anti-Money Laundering Act, which aims to bring the crypto industry under existing AML and Counter-Terrorism Financing (CTF) frameworks. The legislation would require exchanges, wallet providers, and miners to implement strict KYC procedures and financial reporting standards.

However, the bill has faced strong opposition from the crypto industry and policymakers who argue that it could stifle innovation and drive digital asset businesses overseas. The Chamber of Digital Commerce, along with 80 former military and national security officials, criticized the bill, warning that it could have unintended consequences that might hinder law enforcement efforts.

The Future of Stablecoins in U.S. Financial Policy

Stablecoins have become a critical component of the global financial system, with institutions and governments closely monitoring their impact. In the U.S., regulators have debated whether stablecoin issuers should be subject to stricter oversight, including requirements to hold fully audited reserves and register as banks.

Tether, despite facing legal challenges and controversy, remains the dominant stablecoin in the market. While its collaboration with law enforcement suggests an effort to address regulatory concerns, critics like Warren argue that it remains a major risk to financial stability and national security.

As the debate over stablecoins intensifies, Lutnick’s nomination could become a flashpoint in the broader conversation about cryptocurrency regulation. If confirmed, his role in shaping U.S. economic policy could have significant implications for the future of stablecoins, Tether, and the entire digital asset industry.