MicroStrategy, a software analytics firm based in the United States, recently acquired more Bitcoin (BTC) holdings, triggering mixed reactions from social media.

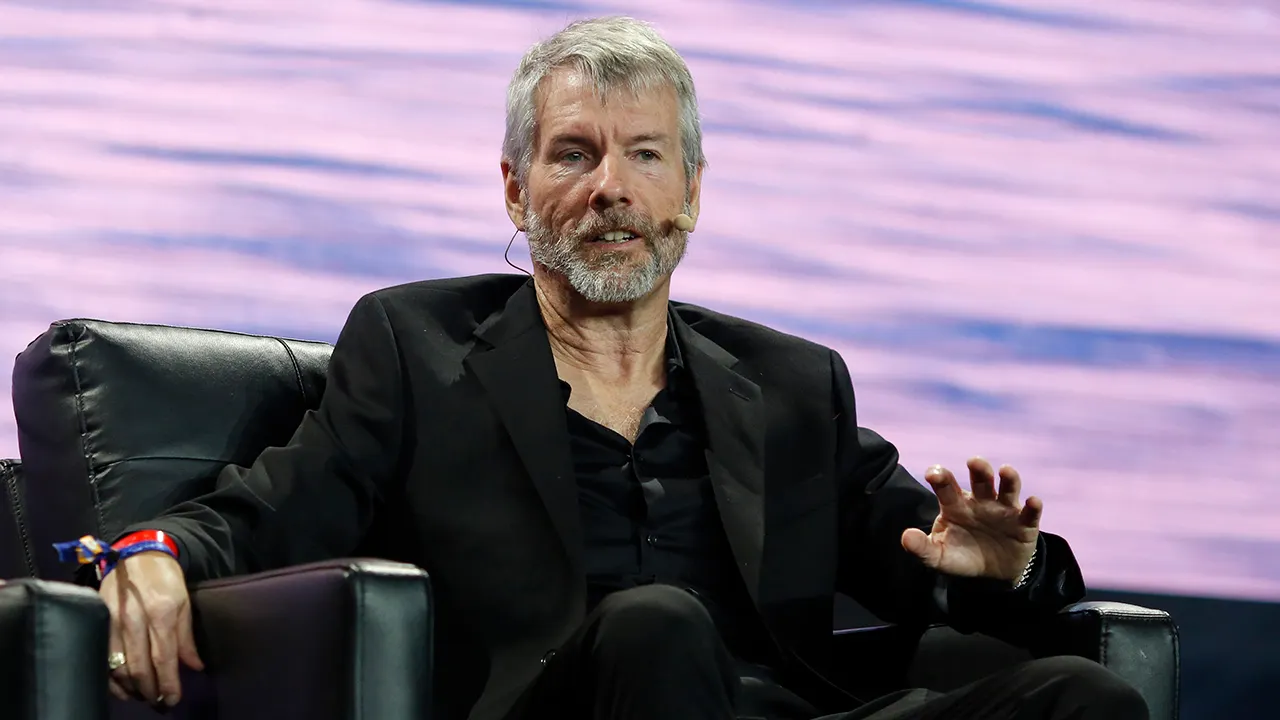

Company executive chairman Michael Saylor tweeted recently that his business had bought more Bitcoin, with its total holdings reaching 132,500 BTC at $4.03 billion at the time of purchase.

Its total holdings plummeted to just $2.1 billion to date, sparking discussions on Twitter.

While some praised him as a “rock star,” others stated Bitcoin backers should not celebrate the extra purchase as it could centralise ownership of the cryptocurrency.

Massive Bitcoin Sale Strategy?

The news comes after a recent sale of its Bitcoin holdings on Thursday, revealing further scrutiny from Bitcoin supporters. In a Yahoo! Finance analysis, the executive cited tax purposes for the sale.

He said at the time: “I think that this is going to be really helpful for Bitcoin because this is an educational moment. And people are realizing the benefits of buying a crypto asset that’s backed by the world’s most powerful computing network and by 10 gigawatts of energy and the difference between that and the 20,000 other cryptos that are, in essence, backed by nothing, and they’re just like other fiat currencies”

According to Yahoo!’s David Hollerith, MicroStrategy had launched a tax loss harvesting strategy by buying Bitcoin and later partially selling it. This allows it to use the losses at the middle selling period to hedge against capital gains taxes for the current fiscal tax year.

Recently, Saylor also stated his firm planned to adopt the Lightning Network in 2023, adding it was searching for software solutions to facilitate the measures.

The Lightning Network is a Layer-2 feature that helps boost Bitcoin capacity and faster transaction rates at scale. Exchanges such as CoinCorner and Bitnob adopted the Lightning Network in mid-December to facilitate cryptocurrency transactions and global remittances for African users.