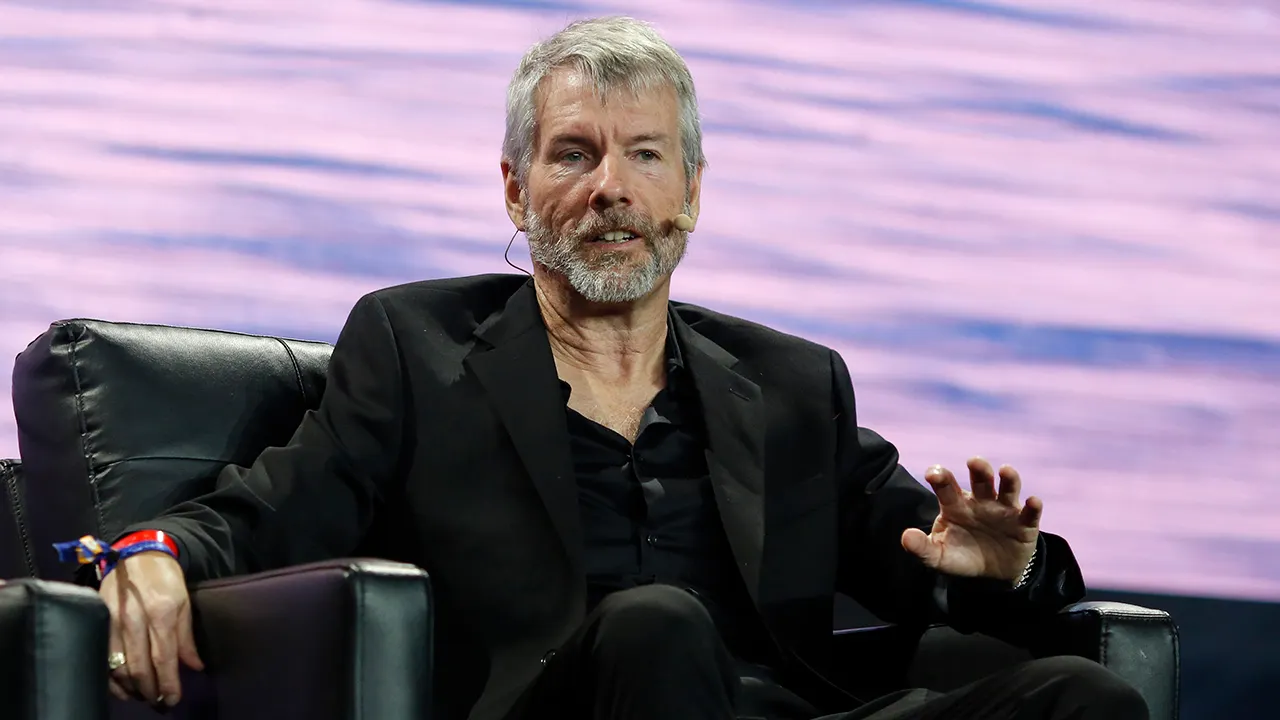

Corporate Bitcoin investor MicroStrategy continued its aggressive Bitcoin buying spree last week, in line with founder Michael Saylor’s pledge to keep accumulating the cryptocurrency at peak prices.

Between December 16 and 22, MicroStrategy acquired 5,262 BTC, investing approximately $561 million, the company announced on December 23.

The firm purchased Bitcoin at an average price of roughly $106,662 per BTC, marking the highest cost it has ever paid for the cryptocurrency.

As of December 22, 2024, MicroStrategy and its subsidiaries held a total of 444,262 BTC, acquired for a cumulative $27.7 billion at an average price of $62,257 per BTC.

The latest purchase is part of a December buying spree, during which the company accumulated 42,162 BTC now valued at $4 billion.

However, the latest acquisition accounts for only about 12% of the company’s total December purchases and represents the smallest amount of BTC bought since mid-2024, when it acquired 169 BTC.

MicroStrategy’s latest Bitcoin purchase is 191% smaller than the acquisition announced on December 16 and 309% smaller than the one disclosed on December 9.

The slowdown in BTC buying coincides with concerns raised by BitMEX co-founder Arthur Hayes about a potential market drop tied to the inauguration of U.S. President-elect Donald Trump.

Hayes’ fund, Maelstrom, plans to clear some positions and re-enter the market later at lower prices.

Additionally, rumors suggest MicroStrategy may enter a blackout period in January 2025, halting its issuance of shares and convertible bonds to fund further Bitcoin purchases.

Despite market uncertainties, Saylor remains committed to Bitcoin.

“I’m sure that I will be buying Bitcoin at $1 million a coin — probably $1 billion dollars a day of Bitcoin at $1 million a coin,” Saylor said in early December.