In the run-up to South Korea’s parliamentary elections, major political factions are courting the electorate with proposals aimed at the burgeoning cryptocurrency sector.

Bloomberg reported on April 5 that the Democratic Party, the main opposition, has committed to lifting bans on both domestic and international exchange-traded funds (ETFs) that directly invest in cryptocurrencies, such as U.S.-based spot Bitcoin ETFs.

This pledge comes in the wake of South Korea’s securities watchdog cautioning in January against the local distribution of Bitcoin ETFs, citing potential conflicts with national legislation.

“We’re going to allow the ETFs, whether domestic or overseas,” Hwanseok Choi of the Democratic Party conveyed to Bloomberg, highlighting a key point in the party’s agenda.

Similarly, the ruling People Power Party, led by President Yoon Suk Yeol, is looking to attract the crypto-savvy demographic by proposing a postponement of taxation on digital asset gains, which is currently set to commence in 2025.

Cryptocurrency trading is a significant activity in South Korea, with nearly six million South Koreans, or 10% of the population, engaging in the market through registered platforms in the first half of 2023 alone.

Additionally, 7% of those running for election have disclosed cryptocurrency holdings.

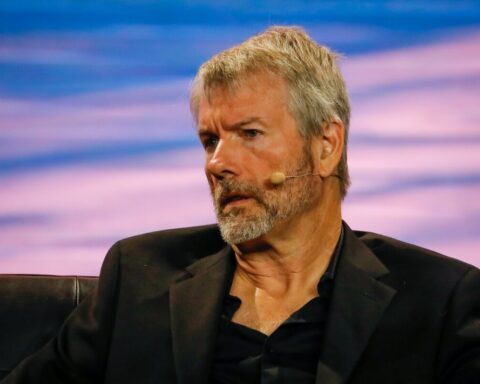

Investment data reveals that South Koreans have poured more than $200 million into shares of MicroStrategy, a U.S.-listed enterprise with substantial Bitcoin assets, leading some to describe it as a de facto Bitcoin ETF.

Despite these electoral enticements, tighter regulatory measures on cryptocurrencies loom on the horizon.

READ MORE: DogWifHood (WIF) Braces for Explosive Price Rally After Binance Tweet Sparks Listing Speculation

The nation’s financial authorities are finalizing new regulations for token listings on centralized exchanges.

These include barring the listing of tokens involved in hacking incidents until an investigation is complete and restricting foreign digital assets to those that provide a white paper or technical guide for local investors.

Furthermore, the forthcoming Virtual Asset Users Protection Act, set to be enacted on July 19, introduces stringent restrictions against undisclosed information, market manipulation, and illegal trades in the crypto sphere.

An update to this act in February has established severe penalties for infringements, including imprisonment for over a year or fines amounting to three to five times the illicit gains.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.